Wyoming Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

How to fill out Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

You are able to commit hours on the web looking for the authorized papers design that fits the federal and state requirements you want. US Legal Forms supplies thousands of authorized types that are analyzed by experts. It is simple to download or produce the Wyoming Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth from my services.

If you already possess a US Legal Forms accounts, you may log in and then click the Download switch. Next, you may full, modify, produce, or signal the Wyoming Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth. Each and every authorized papers design you acquire is your own eternally. To get an additional duplicate for any obtained type, go to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site the first time, adhere to the simple instructions under:

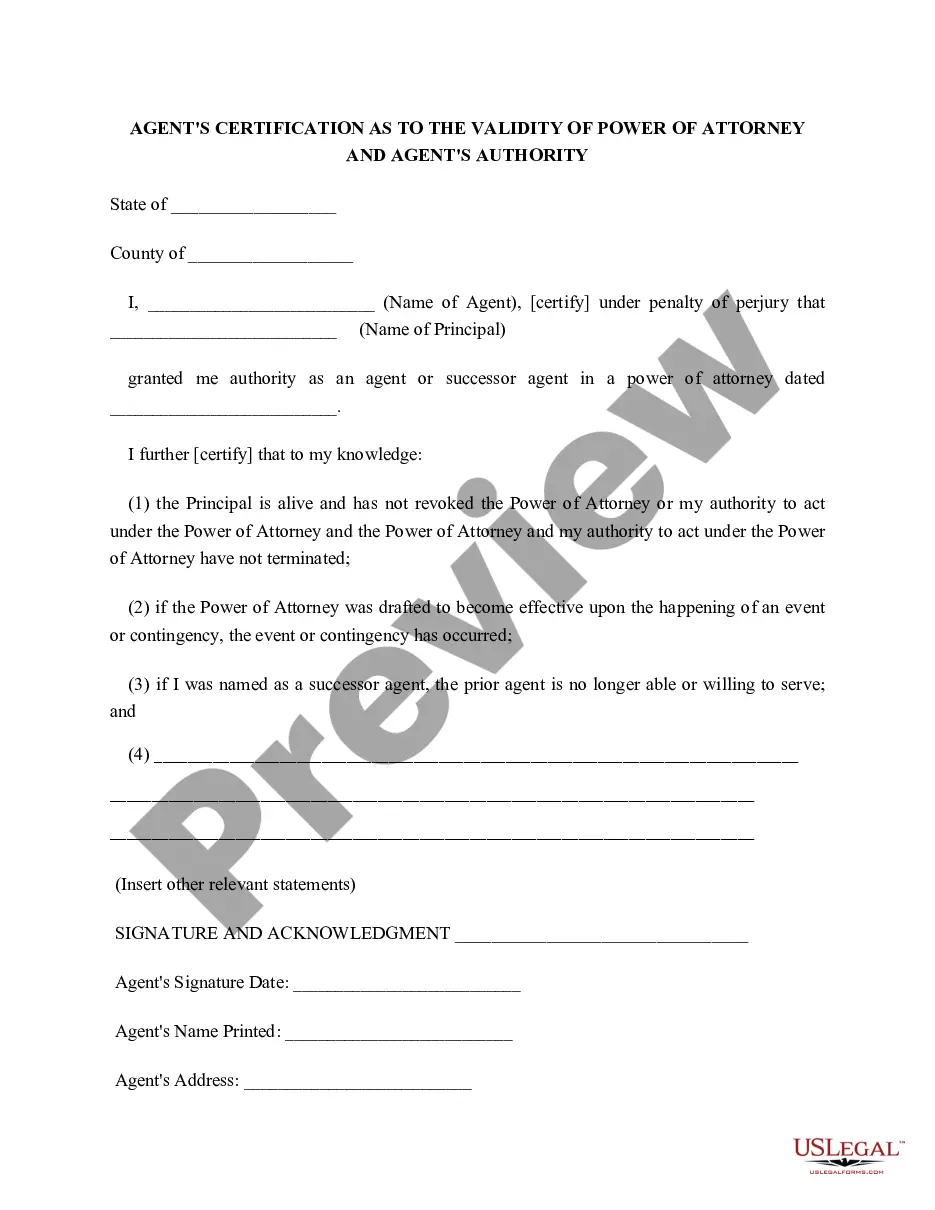

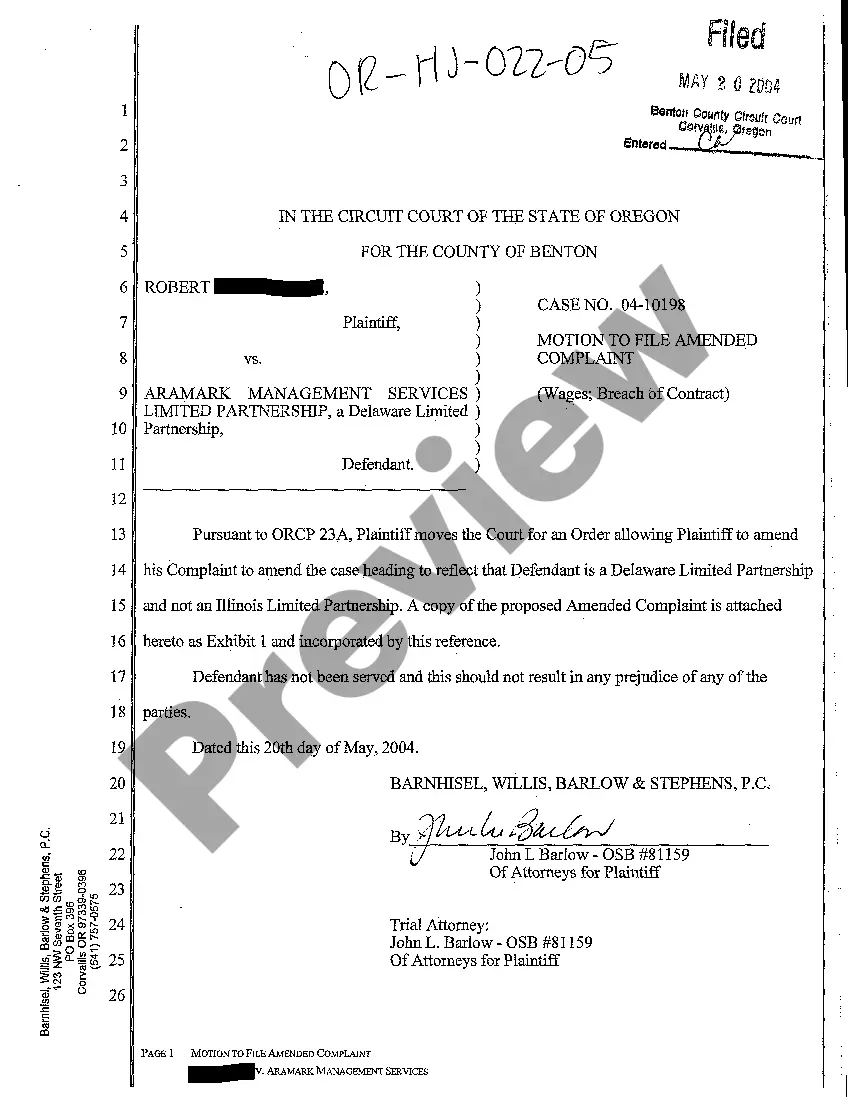

- Initial, make sure that you have selected the correct papers design for your region/area that you pick. Read the type information to ensure you have selected the proper type. If accessible, use the Preview switch to look throughout the papers design as well.

- If you want to discover an additional variation of the type, use the Search field to get the design that fits your needs and requirements.

- When you have identified the design you want, click on Get now to proceed.

- Choose the pricing plan you want, enter your credentials, and register for an account on US Legal Forms.

- Complete the purchase. You should use your charge card or PayPal accounts to cover the authorized type.

- Choose the format of the papers and download it for your gadget.

- Make adjustments for your papers if needed. You are able to full, modify and signal and produce Wyoming Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth.

Download and produce thousands of papers themes making use of the US Legal Forms site, which offers the biggest assortment of authorized types. Use specialist and express-distinct themes to deal with your company or specific requires.