Wyoming Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

You can spend time on-line attempting to find the legitimate papers format that meets the federal and state needs you will need. US Legal Forms provides 1000s of legitimate types which can be analyzed by experts. You can actually down load or printing the Wyoming Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 from your support.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Download key. Next, it is possible to complete, edit, printing, or indication the Wyoming Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Every single legitimate papers format you get is your own forever. To get another version of any purchased type, check out the My Forms tab and click on the related key.

If you use the US Legal Forms web site the very first time, adhere to the easy directions beneath:

- Initially, be sure that you have selected the proper papers format for the state/city of your liking. See the type description to make sure you have chosen the correct type. If accessible, make use of the Review key to check from the papers format as well.

- If you want to get another version from the type, make use of the Look for field to get the format that suits you and needs.

- When you have found the format you want, click Buy now to continue.

- Find the costs program you want, enter your references, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal accounts to purchase the legitimate type.

- Find the structure from the papers and down load it for your product.

- Make changes for your papers if required. You can complete, edit and indication and printing Wyoming Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Download and printing 1000s of papers themes making use of the US Legal Forms site, that offers the greatest assortment of legitimate types. Use expert and condition-distinct themes to tackle your small business or person requirements.

Form popularity

FAQ

Chapter 13 cases can be filed for no money down because the attorney fees and court costs can be rolled into a 3-5 year repayment plan. While you're at it, you can also wipe away all of your other unsecured debt (credit cards, medical bills, payday loans, old collections, etc.).

Getting a Refund After Dismissal As you make payments under your repayment plan, the money goes to your bankruptcy trustee, who then distributes it to your creditors. If your case is dismissed, you are entitled to a refund of any money that is still in the trustee's possession.

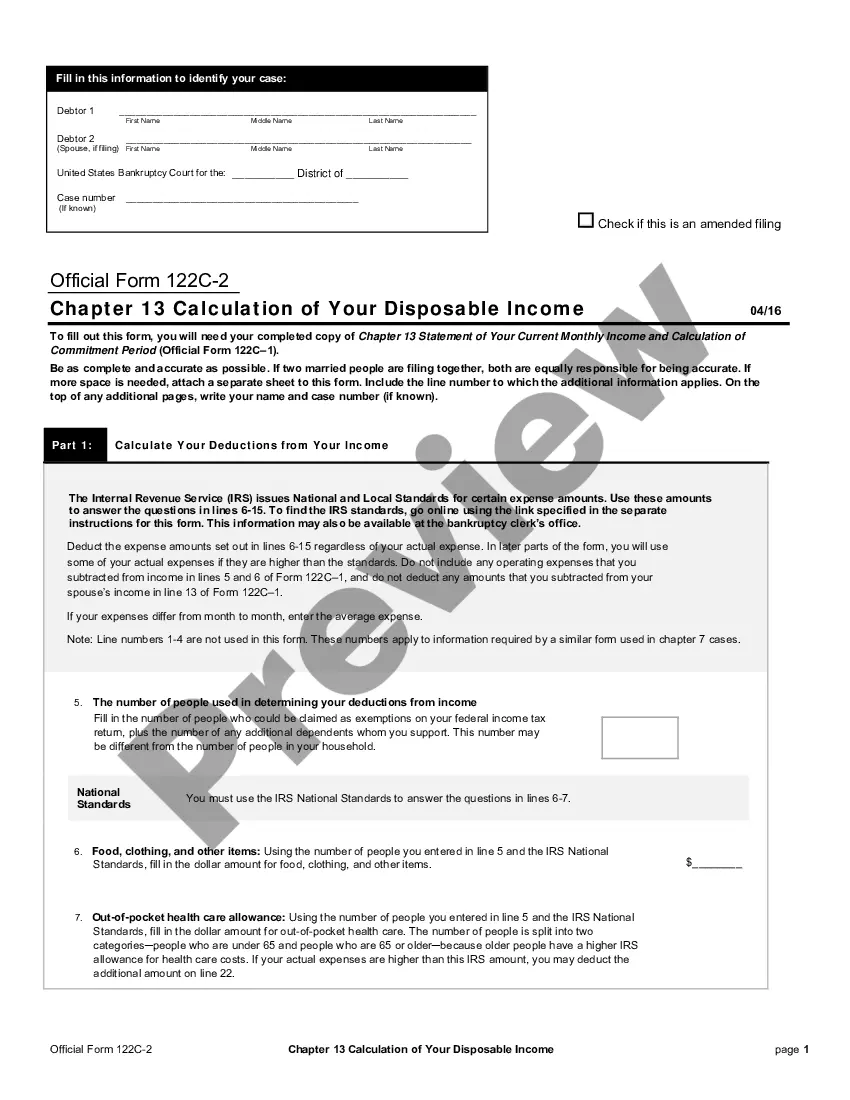

The disposable income calculation starts with your gross income. You must also be a wage earner in order to file a Chapter 13. Then, certain expenses are deducted based on an IRS deduction. The deduction is based upon a national average, taking into consideration the metropolitan area you live.

The documents in your repayment plan include income information on monthly expenses, assets, and debts. The trustee confirms those figures by using your tax returns, paycheck stubs, bank statements, etc. It's not expressly the job of the trustee to keep checking your pay stubs or direct deposits for wage increases.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

How Is Disposable Income Calculated? Your last six months of income divided by six to get average monthly income. If you own a business or work for yourself, you must calculate average monthly income. Any money you get from rent on an asset you own, interests, dividends or royalties.

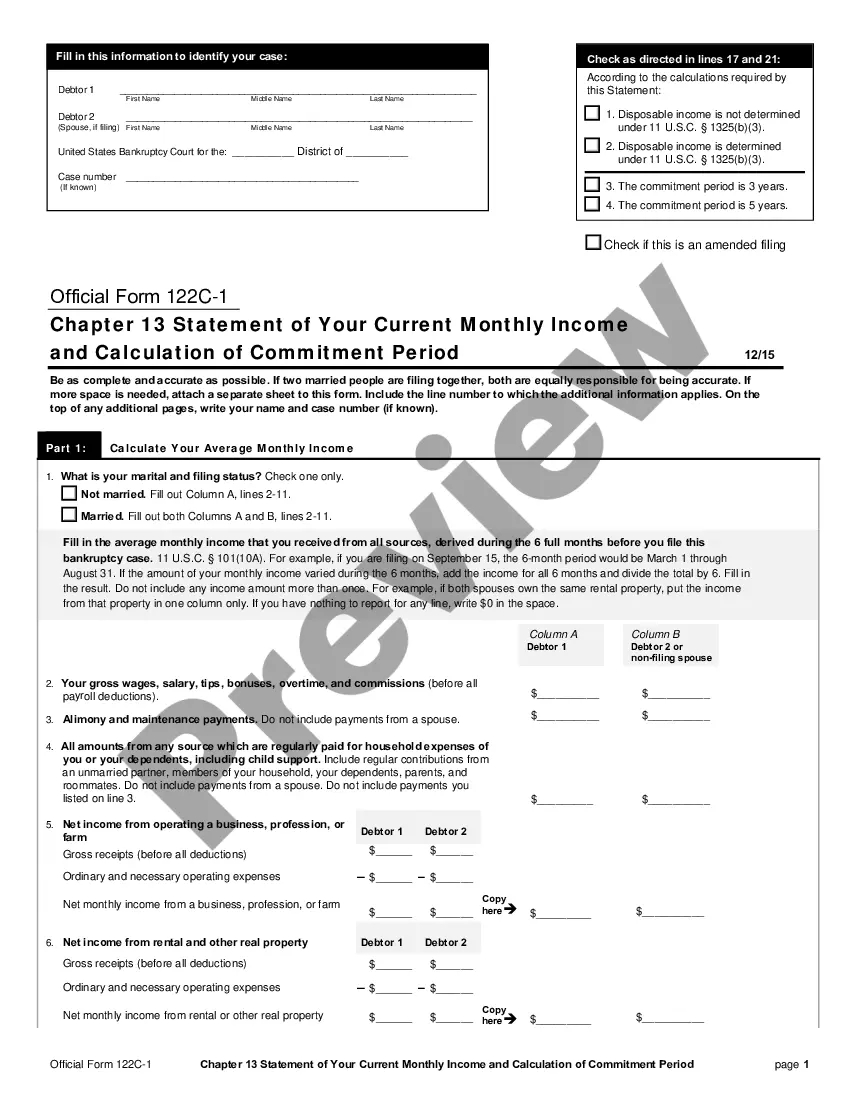

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

You can't pay more than your disposable income in Chapter 13, because your disposable income represents all earnings that remain after paying required debts. However, there is another step in the Chapter 13 payment calculation, and if you don't meet the criteria, the judge won't approve your plan.