Wyoming Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Means Test Calculation For Use In Chapter 7 - Post 2005?

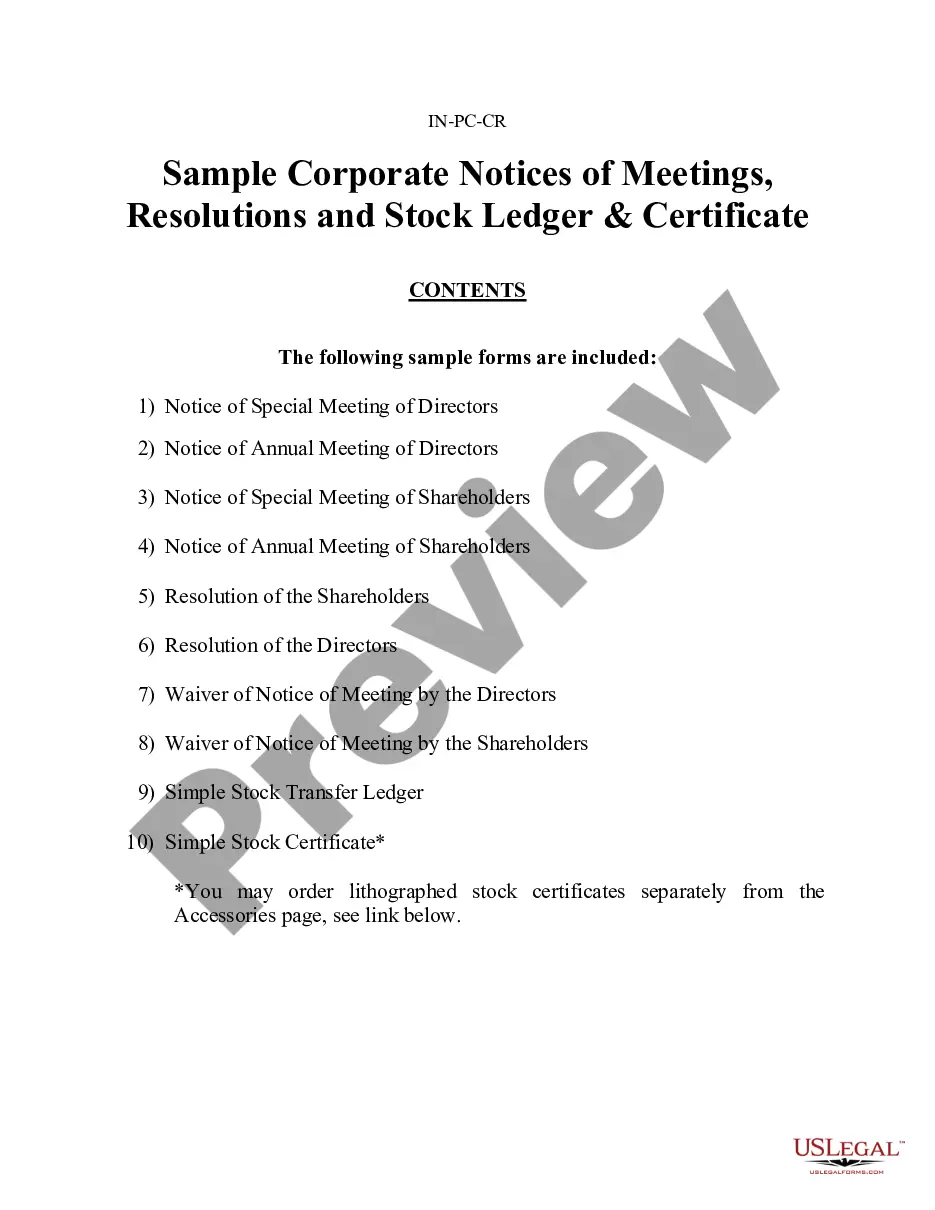

Are you currently in the situation the place you will need papers for sometimes enterprise or individual functions almost every working day? There are tons of legitimate document templates available on the net, but discovering versions you can rely is not straightforward. US Legal Forms offers thousands of develop templates, just like the Wyoming Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005, which can be written to fulfill state and federal specifications.

When you are presently acquainted with US Legal Forms web site and also have your account, basically log in. After that, you may down load the Wyoming Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 format.

Unless you come with an profile and want to begin to use US Legal Forms, adopt these measures:

- Find the develop you want and ensure it is to the proper town/county.

- Use the Review switch to examine the shape.

- Browse the information to ensure that you have selected the correct develop.

- If the develop is not what you are seeking, utilize the Lookup industry to find the develop that fits your needs and specifications.

- When you get the proper develop, click on Purchase now.

- Opt for the rates prepare you need, submit the necessary details to produce your bank account, and buy an order making use of your PayPal or charge card.

- Decide on a convenient document structure and down load your backup.

Discover all of the document templates you might have bought in the My Forms food list. You can get a additional backup of Wyoming Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 anytime, if possible. Just go through the necessary develop to down load or print out the document format.

Use US Legal Forms, probably the most comprehensive selection of legitimate kinds, to conserve time as well as steer clear of blunders. The support offers expertly created legitimate document templates which you can use for a selection of functions. Produce your account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

The income statement presents revenue, expenses, and net income. The components of the income statement include: revenue; cost of sales; sales, general, and administrative expenses; other operating expenses; non-operating income and expenses; gains and losses; non-recurring items; net income; and EPS.

Creditors use the income statement to check whether the company has enough cash flow to pay off its loans or take out a new loan. Competitors use them to get details about the success parameters of a business and get to know about areas where the business is spending an extra bit, for example, R&D spends.

The basic formula for an income statement is Revenues ? Expenses = Net Income. This simple equation shows whether the company is profitable. If revenues are greater than expenses, the business is profitable.

That means both taxed and untaxed income, including wages, salary, tips, bonuses, interest, dividends, royalties, retirement income, unemployment and workers' compensation, and others.

A classified income statement has four major sections - operating revenues, cost of goods sold, operating expenses, and nonoperating revenues and expenses. Operating revenues are the revenues generated by the major activities of the business - usually the sale of products or services or both.

If a filer qualifies for an exception to the means test, they will file Form 122A-1Supp. You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person.

Form 122A-1. This form is called the ?Chapter 7 Statement of Your Current Monthly Income.? This document simply helps you determine whether your income is below the median income of your state. If it is below the median, you have passed the means test. That means the other two forms in this list will not apply to you.

To calculate your six-month average gross income, you first need to add up your wages, salaries, and tips for the past six months. Then, divide that number by six to get your average monthly income. If you receive any income from sources other than employment, you'll need to factor that in as well.