Wyoming Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Wyoming Approval for Relocation Expenses and Allowances, suitable for both business and personal use.

All forms are reviewed by experts and comply with state and federal regulations.

Once you are confident the form is correct, click the Purchase now button to obtain the form. Choose the pricing plan you need and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Wyoming Approval for Relocation Expenses and Allowances. US Legal Forms is the largest library of legal forms where you can find various document templates. Take advantage of the service to acquire professionally drafted documents that adhere to state requirements.

- If you are already registered, sign in to your account and click the Download button to retrieve the Wyoming Approval for Relocation Expenses and Allowances.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

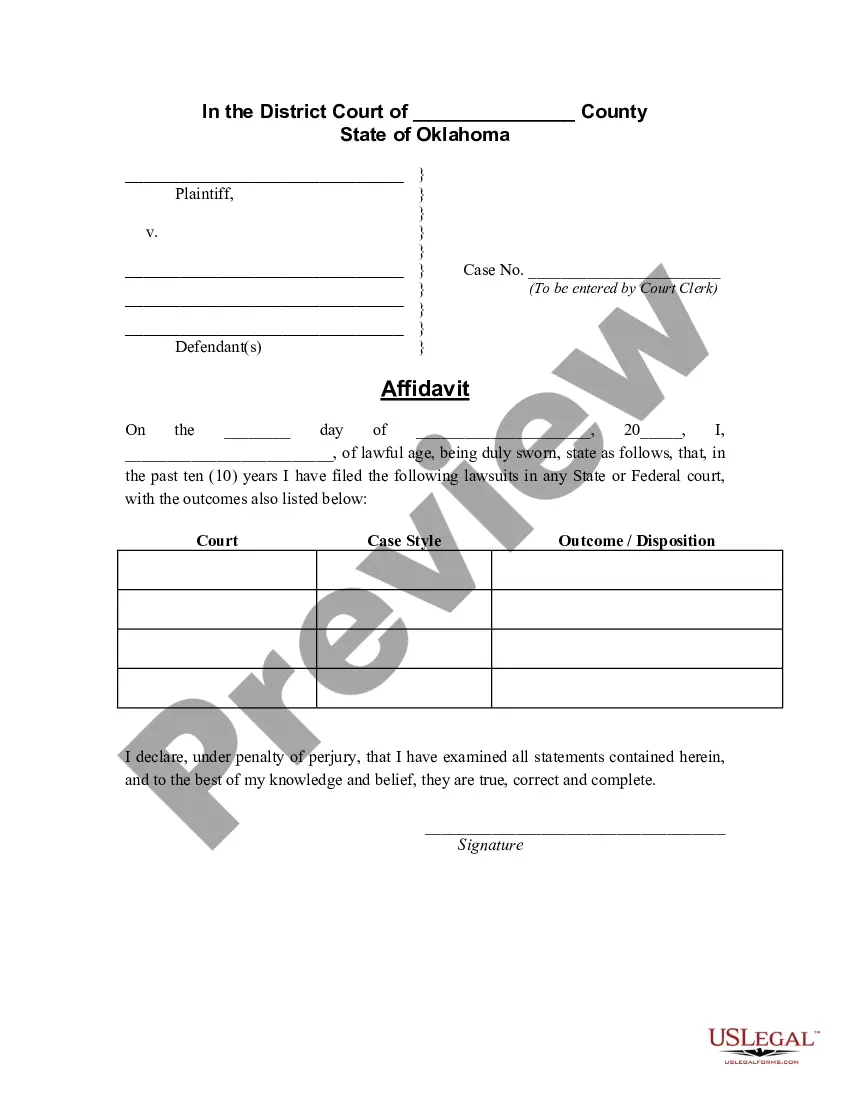

- First, ensure you have selected the correct form for your region/county. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

Relocation assistance may cover many areas , including packing and unpacking services, transportation and moving costs, temporary lodging, disposition of a residence, acquisition of a new residence, mortgage assistance, cultural training and language training.

Moving expense reimbursements. P.L. 115-97, Tax Cuts and Jobs Act, suspends the exclusion for qualified moving expense reimbursements from your employee's income for tax years beginning after 2017 and before 2026.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

If you have moving expenses that are greater than the amount of reimbursement shown in box 12 of Form 1040, or your reimbursement was reported as wages in box 1, then you can file Form 3903 with your tax return to report moving expenses and reimbursements to the IRS.

In order to be eligible for relocation as described in this handbook, your relocation must meet the IRS 50-mile distance test. The distance between your former residence and your new job site must be at least 50 miles greater than the distance between your former residence and your former job site.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expense tax deduction. For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

"Relocation offered" generally refers to an employer being willing to consider paying moving expenses and providing other considerations to enable a new hire to move there. It usually does not include things related to those not already eligible to work in the country in question.

Due to the Tax Cuts and Jobs Act (TCJA) passed in 2017, most people can no longer deduct moving expenses on their federal taxes. This aspect of the tax code is pretty straightforward: If you moved in 2020 and you are not an active-duty military member, your moving expenses aren't deductible.