Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Relocation Agreement Between Employer And Employee Regarding Moving Expenses?

Have you found yourself in a circumstance where you require documentation for potential business or individual purposes nearly every day.

There are numerous legal document templates accessible online, but discovering reliable options isn’t straightforward.

US Legal Forms provides an extensive array of form templates, such as the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses, which are designed to comply with state and federal regulations.

Choose the payment plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Obtain the form you need and make sure it is for your specific area/region.

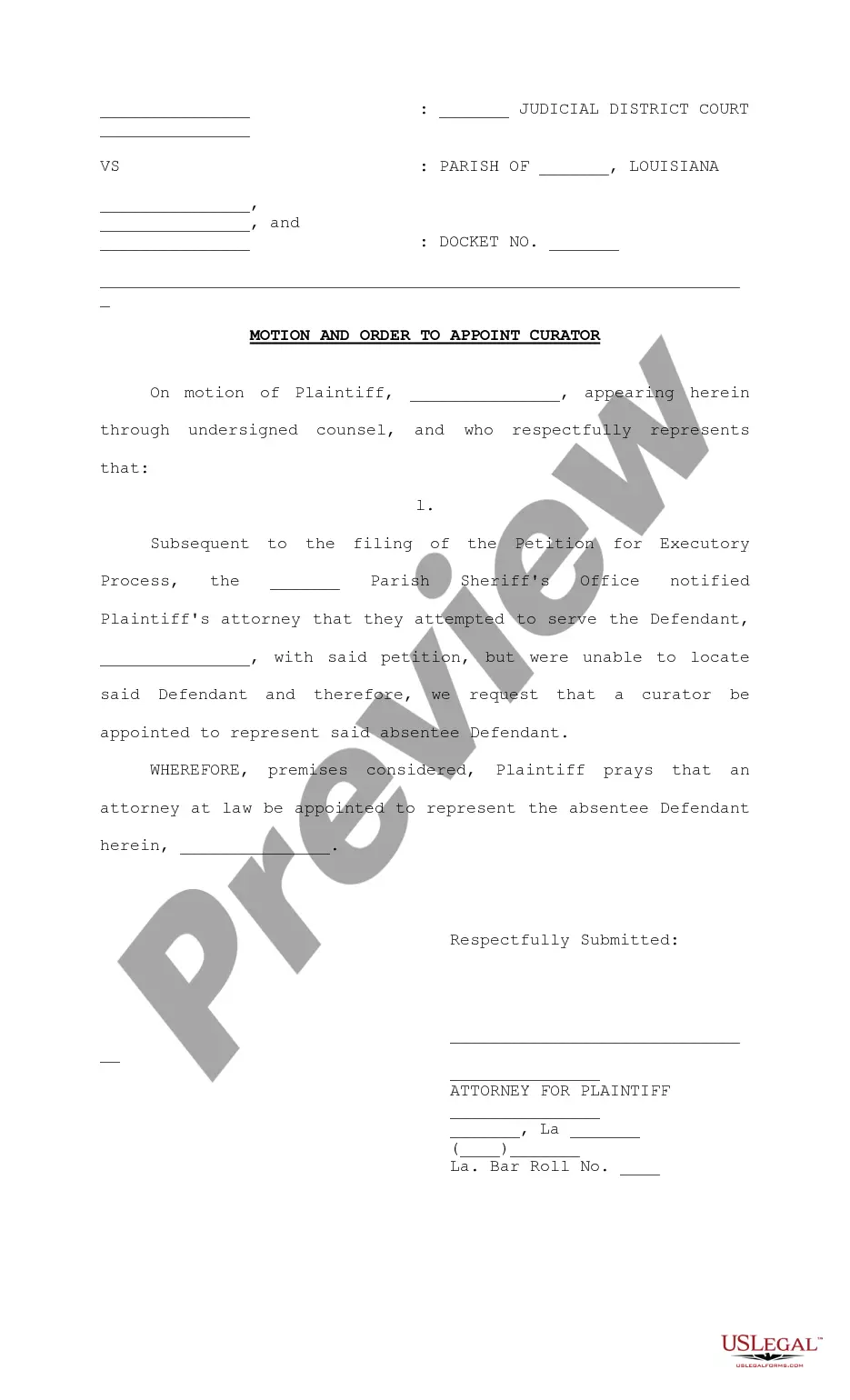

- Utilize the Review button to examine the document.

- Read the description to confirm that you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

- Once you find the right form, click Purchase now.

Form popularity

FAQ

Claiming moving expenses on your taxes may be worthwhile, especially if your employer does not cover all moving costs. While individual circumstances vary, the benefits can reduce your taxable income, leading to potential savings. Review your Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses to determine if your situation qualifies for deductions, and consult a tax advisor for clarity.

To account for relocation expenses on your taxes, gather all receipts and invoices related to your move. If you qualify according to the IRS guidelines or receive reimbursements under the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses, report these amounts on your tax return. Consider utilizing tax preparation software or consulting with a tax professional to ensure accurate reporting.

Yes, relocation expenses can be reportable on a 1099 form if they qualify as taxable income. The Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses outlines which reimbursements may fall under this category. If you receive a lump sum payment instead of direct reimbursements, your employer may issue a 1099 to report this income to the IRS.

The IRS has specific guidelines for moving expenses that were impacted by changes in tax laws. Generally, only active-duty members of the Armed Forces can deduct moving expenses. However, if your employer reimburses you, then it may be considered taxable income per the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses. It’s advisable to consult a tax professional for personalized advice.

Relocation reimbursement often occurs when an employer compensates an employee for moving expenses outlined in the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses. Employers may offer a flat rate, or reimburse specific expenses like transportation, packing, or storage. It’s essential to review your agreement to understand what costs qualify for reimbursement.

To report relocation expenses, you should keep detailed documentation of all moving costs. This includes invoices and receipts categorized under the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses. You will typically report these expenses on your tax return using Form 3903. Ensure that you follow IRS guidelines for proper reporting.

A valid reason for relocation includes job advancement, changes in job responsibilities, or moving to support a business initiative. Often, employers consider relocation requests more favorably when they align with corporate goals. The Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses can provide you with the necessary framework to justify your need to relocate effectively.

To request a relocation allowance, begin by preparing a formal letter or email addressed to the appropriate department in your organization. Outline the specifics of your move and refer to the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses for context. Ensure you explain why the allowance is necessary and how it fits with your relocation.

Requesting relocation expenses involves submitting a detailed expense report to your employer or HR department. Be clear about the costs you incurred related to moving, and refer to the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses to guide your submission. Clear documentation will help streamline the approval process.

To request relocation, start by reviewing your company’s policy on moving expenses and allowances. You can then prepare a formal request that outlines your reasons for relocating, along with any expected costs. Utilizing the Wyoming Relocation Agreement between Employer and Employee Regarding Moving Expenses can strengthen your case, ensuring you're aligned with company policies.