Alabama General Form of Assignment as Collateral for Note

Description

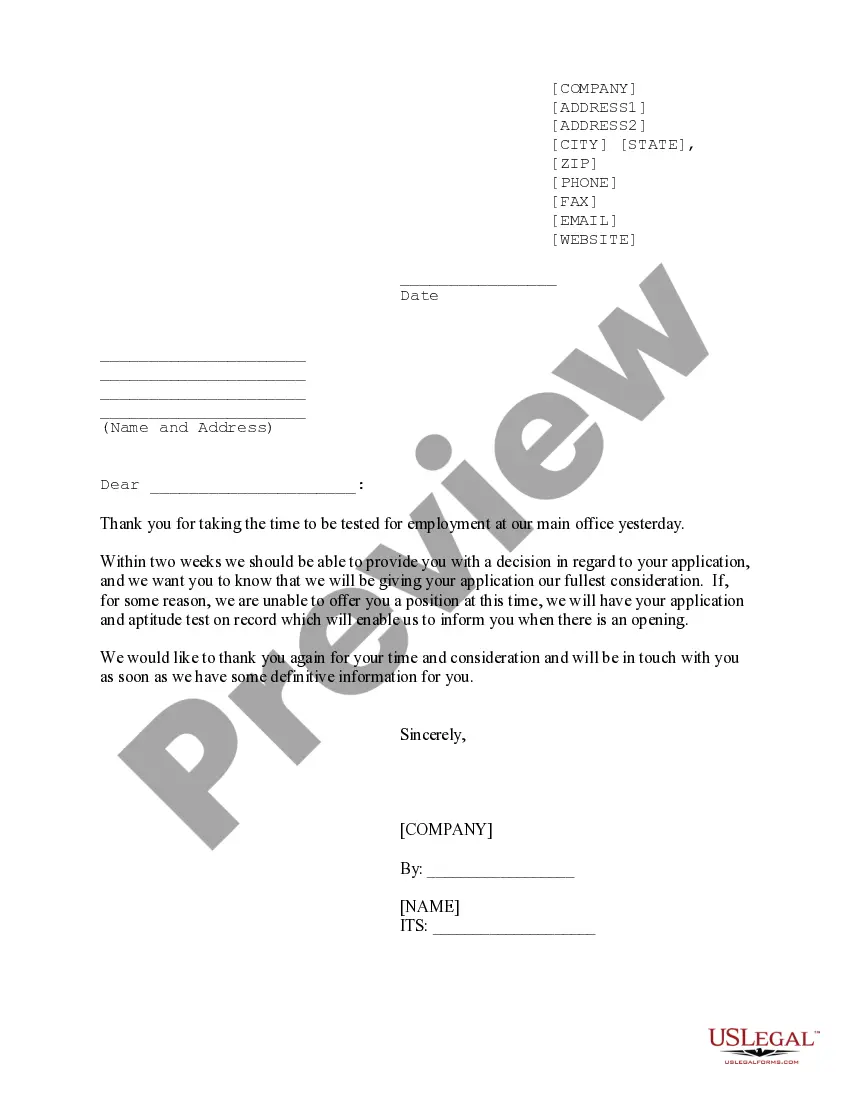

How to fill out General Form Of Assignment As Collateral For Note?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

Using the website, you can find thousands of documents for business and personal purposes, categorized by type, state, or keywords. You can access the latest versions of documents such as the Alabama General Form of Assignment as Collateral for Note in just a matter of minutes.

If you have a monthly subscription, Log In and download the Alabama General Form of Assignment as Collateral for Note from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Alabama General Form of Assignment as Collateral for Note. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Alabama General Form of Assignment as Collateral for Note with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your location/state.

- Click the View option to review the form’s content.

- Check the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

A collateral assignment of a deed of trust secures a borrower's obligations to a lender by assigning rights in the deed of trust as collateral. This legal instrument gives the lender a claim to the property if the borrower fails to fulfill their obligations. Using the Alabama General Form of Assignment as Collateral for Note simplifies this process, ensuring all necessary legal elements are addressed. By employing this form, borrowers and lenders can navigate the complexities of real estate financing with confidence.

A collateral assignment form is a legal document used to pledge an asset as security for a debt. Specifically, the Alabama General Form of Assignment as Collateral for Note outlines the terms under which an asset serves as collateral. This form ensures that if the borrower defaults, the lender can claim the asset to recover the owed amount. You can easily find this form on platforms like US Legal Forms, simplifying the process of securing your loans.

A collateral note is a type of promissory note secured by collateral, which serves as a safety net for the lender. If the borrower defaults, the lender can claim the collateral specified in the agreement. This arrangement can ease the borrowing process for many individuals and businesses, as it provides a layer of security. To create a well-structured collateral note, consider using our tools for crafting the Alabama General Form of Assignment as Collateral for Note.

Collateral assignment refers to the process whereby an asset is designated as security for a debt or obligation. In this case, if the borrower does not fulfill their payment obligations, the lender has the right to take ownership of the assigned asset. Understanding collateral assignment is vital for borrowers and lenders alike. For guidance on this process, explore our resources on the Alabama General Form of Assignment as Collateral for Note.

To file articles of incorporation in Alabama, you must submit them to the Secretary of State. You can usually do this online, through mail, or in person. Make sure to check local regulations as well, as filing requirements may vary by county. Once filed, ensure that your Alabama General Form of Assignment as Collateral for Note is prepared according to state guidelines.

The collateral assignment method involves designating an asset as security for a debt or obligation. With an Alabama General Form of Assignment as Collateral for Note, borrowers can formalize the process, making it clear what asset secures what debt. This approach is beneficial because it clarifies responsibilities and rights for all parties involved. By using this method, you can enhance your financial dealings with more transparency and security.

Collateral Assignment of Mortgage means the collateral assignment of mortgage made by the Borrower in favor of the Administrative Agent which encumbers the Borrower's right, title and interest in the Interim Mortgage.

Written or oral agreement associated as a second, or side contract made between the original parties, or between a third party and an original party. This typically occurs before or at the same time of the first or main contract is made. This collateral contract is independent and separate from the primary contract.

Collateral Assignment means the Collateral Assignment of Mortgages, Loan Documents and Security Agreements executed by the Eligible CDFI for the benefit of the Qualified Issuer dated as of CLOSING DATE, as may be amended, modified, supplemented or restated from time to time.

How To Create a Collateral Contract YourselfNames, contact information, and addresses of all parties.Terms and conditions of the collateral contract.Indication of a promissory note.Duties and responsibilities assigned to each party.The effective date of the agreement.More items...