Arkansas General Form of Assignment as Collateral for Note

Description

How to fill out General Form Of Assignment As Collateral For Note?

Locating the appropriate legitimate document template can be quite challenging. Clearly, there are numerous templates accessible online, but how do you locate the specific type you need.

Utilize the US Legal Forms website. The platform provides a vast selection of templates, such as the Arkansas General Form of Assignment as Collateral for Note, which can be utilized for both business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and then click the Download button to retrieve the Arkansas General Form of Assignment as Collateral for Note. Use your account to search for the legal documents you have previously purchased. Visit the My documents tab of your account and obtain another copy of the file you desire.

Select the file format and download the legitimate document template to your device. Complete, modify, print, and sign the received Arkansas General Form of Assignment as Collateral for Note. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to acquire professionally-created documents that comply with state requirements.

- First, ensure you have selected the appropriate form for your area/region.

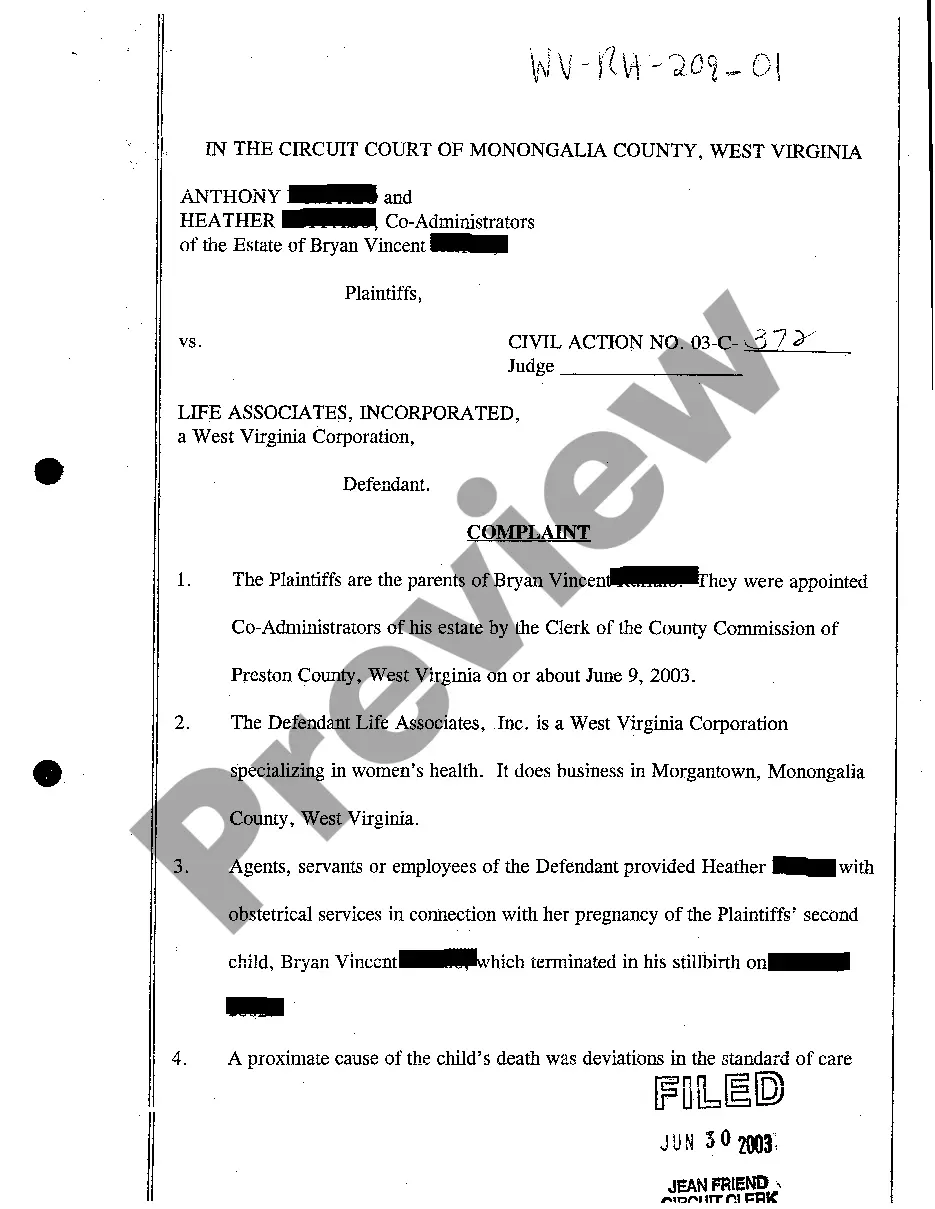

- You may review the form using the Preview button and examine the form outline to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the correct form.

- Once you are confident that the form is suitable, click on the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and input the necessary information.

- Create your account and finalize your purchase using your PayPal account or credit card.

Form popularity

FAQ

A collateral assignment of a note involves transferring the rights to receive payment from a note as security for a debt. This is commonly used in transactions involving the Arkansas General Form of Assignment as Collateral for Note. It allows lenders to claim the payment from the note if the borrower fails to fulfill their obligations. By understanding and using this tool, you can enhance your financial strategies while ensuring security in lending practices.

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

Collateral Assignment of Deeds of Trust means that agreement executed by Borrower in favor of Lender in which Borrower collaterally assigns to Lender all of the Borrower's rights, title and interest in and to those deeds of trust which secure repayment of the Pledged Accounts.

Collateral Assignment of Mortgage means the collateral assignment of mortgage made by the Borrower in favor of the Administrative Agent which encumbers the Borrower's right, title and interest in the Interim Mortgage.

Definition and Examples of Collateral Assignment Collateral is any asset that your lender can take if you default on the loan. For example, you might apply for a $25,000 loan to start a business. But your lender is unwilling to approve the loan without sufficient collateral.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.

How To Create a Collateral Contract YourselfNames, contact information, and addresses of all parties.Terms and conditions of the collateral contract.Indication of a promissory note.Duties and responsibilities assigned to each party.The effective date of the agreement.More items...

Collateral Assignment means the Collateral Assignment of Mortgages, Loan Documents and Security Agreements executed by the Eligible CDFI for the benefit of the Qualified Issuer dated as of CLOSING DATE, as may be amended, modified, supplemented or restated from time to time.

Collateral Assignment of Contracts means the assignment of representations, warranties, covenants, indemnities and rights to the Agent, in respect of the Loan Parties' rights under that certain Escrow Agreement executed in connection with the Riverstone Acquisition delivered on the Original Closing Date.