Wyoming Personnel Payroll Associate Checklist

Description

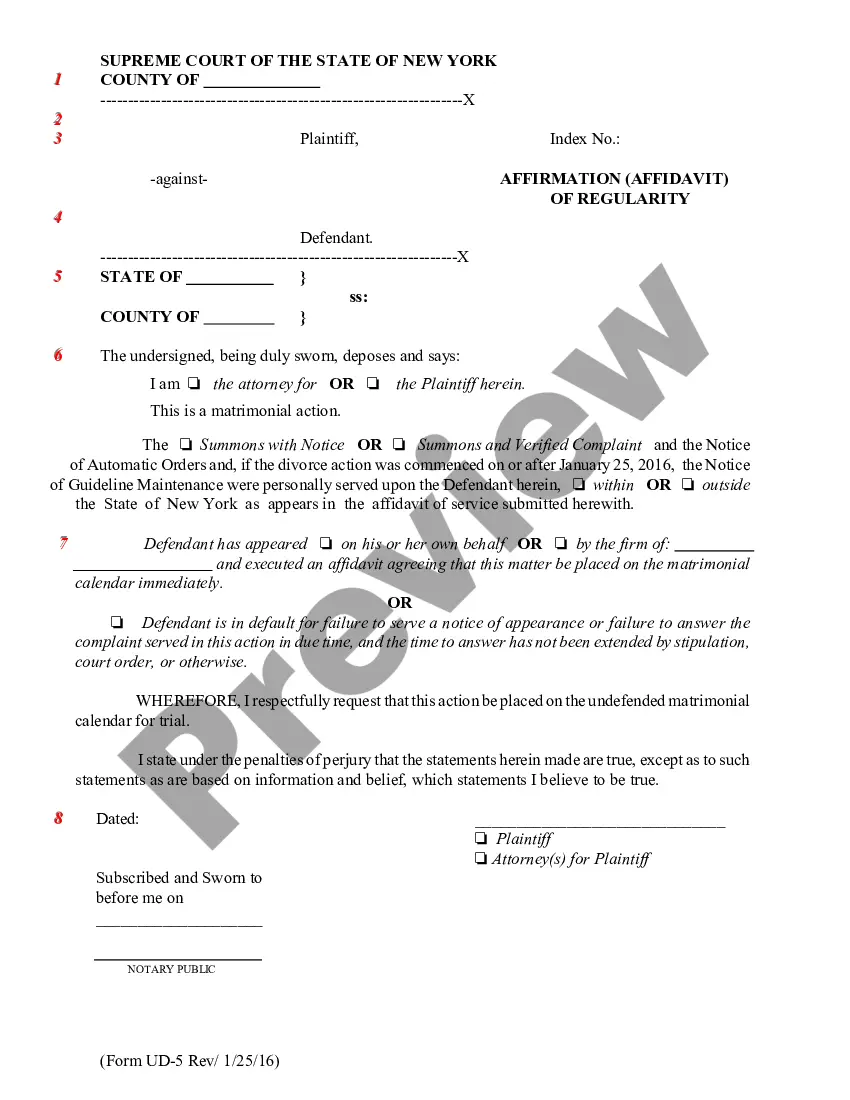

How to fill out Personnel Payroll Associate Checklist?

US Legal Forms - one of the largest collections of legal documents in the U.S. - offers a diverse selection of legal form templates that you can download or create.

By using the website, you can discover thousands of forms for both business and personal purposes, sorted by categories, states, or keywords. You can find the most recent versions of forms like the Wyoming Employee Payroll Associate Checklist in moments.

If you already have an account, Log In and download the Wyoming Employee Payroll Associate Checklist from the US Legal Forms catalog. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Once you are satisfied with the form, confirm your choice by clicking on the Get now button. Then, select your preferred pricing plan and provide your information to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the transaction. Retrieve the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Wyoming Employee Payroll Associate Checklist. Every format you add to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, just visit the My documents section and click on the form you desire.

Gain access to the Wyoming Employee Payroll Associate Checklist through US Legal Forms, one of the most extensive catalogs of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- If you want to use US Legal Forms for the first time, here are simple steps to get you started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to inspect the form's content.

- Read the form description to ensure you have picked the correct form.

- If the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

Form popularity

FAQ

Employer Identification Number (EIN)State/Local Tax ID Number.State Unemployment ID Number.Employee Addresses and SSNs.I-9.W-4.State Withholding Allowance Certificate.Department of Labor (DOL) Records.More items...?

Wyoming workers will still pay FICA taxes and federal income taxes. FICA (Federal Insurance Contributions Act) taxes are Social Security and Medicare taxes. For the Social Security tax, your employer will deduct a flat rate of 6.2% from your paycheck.

Federal Law The Electronic Fund Transfer Act (EFTA), also known as federal Regulation E, permits employers to make direct deposit mandatory, as long as the employee is able to choose the bank that his or her wages will be deposited into.

Some states require agreement in writing before enrolling in direct deposit; some do not:Alaska.California.Connecticut.Colorado.Delaware.Florida.Idaho.Illinois.More items...?

How to manually calculate payroll for your small businessStep 1: Prepare your business to process payroll.Step 2: Calculate gross wages.Step 3: Subtract pre-tax deductions.Step 4: Calculate employee payroll taxes.Step 5: Subtract post-tax deductions and calculate net pay.Step 6: Calculate employer payroll taxes.More items...?

Can employees be required to accept direct deposit of their paychecks? No. However, there is nothing prohibiting an employer of depositing wages due in an account in any financial institution authorized by the United States or any state if the employee has voluntarily authorized such request.

Step-by-Step Guide to Running Payroll in WyomingStep 1: Set up your business as an employer.Step 2: Register your business with the State of Wyoming.Step 3: Create your payroll process.Step 4: Have employees fill out relevant forms.Step 5: Review and approve timesheets.More items...?

Thus employers wanting to pay employees by direct deposit should require new employees to participate in payroll direct deposit as a condition of their employment, obtaining written consent from the employee where required.

How to process payroll yourselfStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

How to process payroll yourselfStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.