Wyoming Agreement for Auditing Services between Accounting Firm and Municipality

Description

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

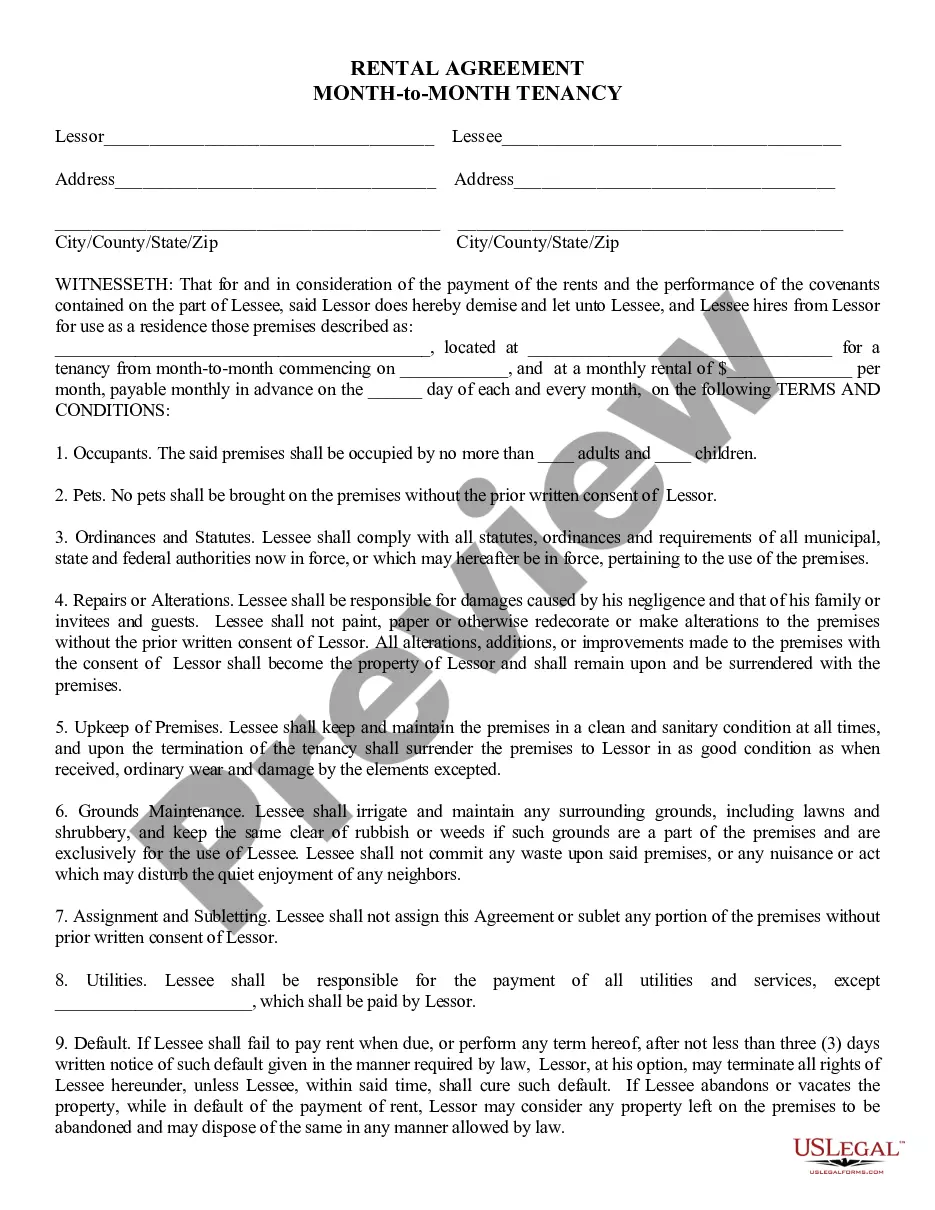

Are you within a placement in which you will need paperwork for either enterprise or specific purposes just about every day? There are plenty of legitimate papers themes accessible on the Internet, but getting types you can depend on is not effortless. US Legal Forms provides 1000s of type themes, such as the Wyoming Agreement for Auditing Services between Accounting Firm and Municipality, which are composed to meet federal and state requirements.

Should you be already informed about US Legal Forms internet site and possess a free account, just log in. After that, you can obtain the Wyoming Agreement for Auditing Services between Accounting Firm and Municipality format.

If you do not offer an bank account and want to start using US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is for your correct town/state.

- Make use of the Review switch to analyze the form.

- Look at the information to actually have chosen the right type.

- In case the type is not what you`re trying to find, make use of the Lookup industry to obtain the type that fits your needs and requirements.

- When you get the correct type, click on Buy now.

- Opt for the prices prepare you need, submit the desired information and facts to make your money, and pay for your order with your PayPal or credit card.

- Select a handy paper format and obtain your copy.

Discover all of the papers themes you possess purchased in the My Forms menus. You may get a additional copy of Wyoming Agreement for Auditing Services between Accounting Firm and Municipality at any time, if necessary. Just select the needed type to obtain or produce the papers format.

Use US Legal Forms, by far the most extensive variety of legitimate forms, in order to save time as well as steer clear of errors. The service provides expertly created legitimate papers themes which you can use for a selection of purposes. Create a free account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Whether seeking an audit committee's permission to provide permissible tax services or other non-audit services to a public company audit client or when preparing to take a public company on as a new audit client, three important steps are: Describe, discuss, and document. Request, explain, and record.

The Public Company Accounting Oversight Board (PCAOB) is a non-profit organization that regulates audits of publicly traded companies to minimize audit risk. The PCAOB was established at the same time as the Sarbanes-Oxley Act of 2002 to address the accounting scandals of the late 1990s.

In addition, the following companies must have an audit: a public company (unless it's dormant) a subsidiary company (unless it qualifies for an exemption) an authorised insurance company. those carrying out insurance market activity. those involved in banking. an issuer of electronic money (e-money)

Private companies and small nonprofits don't have a legal obligation to conduct an annual external audit. Despite this, many still choose to conduct a voluntary external audit.

Every private limited company must compulsorily get their annual accounts audited each financial year as per the Act and the Companies (Accounts) Rules, 2014.

A company (other than a small proprietary company), registered scheme (managed investment scheme) or disclosing entity (a body that holds enhanced disclosure securities) must have its annual financial report audited and obtain an auditor's report.

Steps for conducting a financial audit Understand your goals. ... Decide what to include in your audit. ... Gather and organise your materials. ... Begin data analysis. ... Consider financial security. ... Examine tax reporting status. ... Compile a report.

Every private limited company must compulsorily get their annual accounts audited each financial year as per the Act and the Companies (Accounts) Rules, 2014.