Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

Are you currently in a position where you require documents for business or personal purposes nearly every day.

There are a multitude of legal document templates available online, but locating reliable ones is challenging.

US Legal Forms offers a vast collection of form templates, including the Wyoming Agreement to Terminate and Conclude Partnership with Settlement and Lump Sum Payment, designed to comply with federal and state regulations.

Once you have identified the correct form, click on Purchase now.

Choose the pricing plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Wyoming Agreement to Terminate and Conclude Partnership with Settlement and Lump Sum Payment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

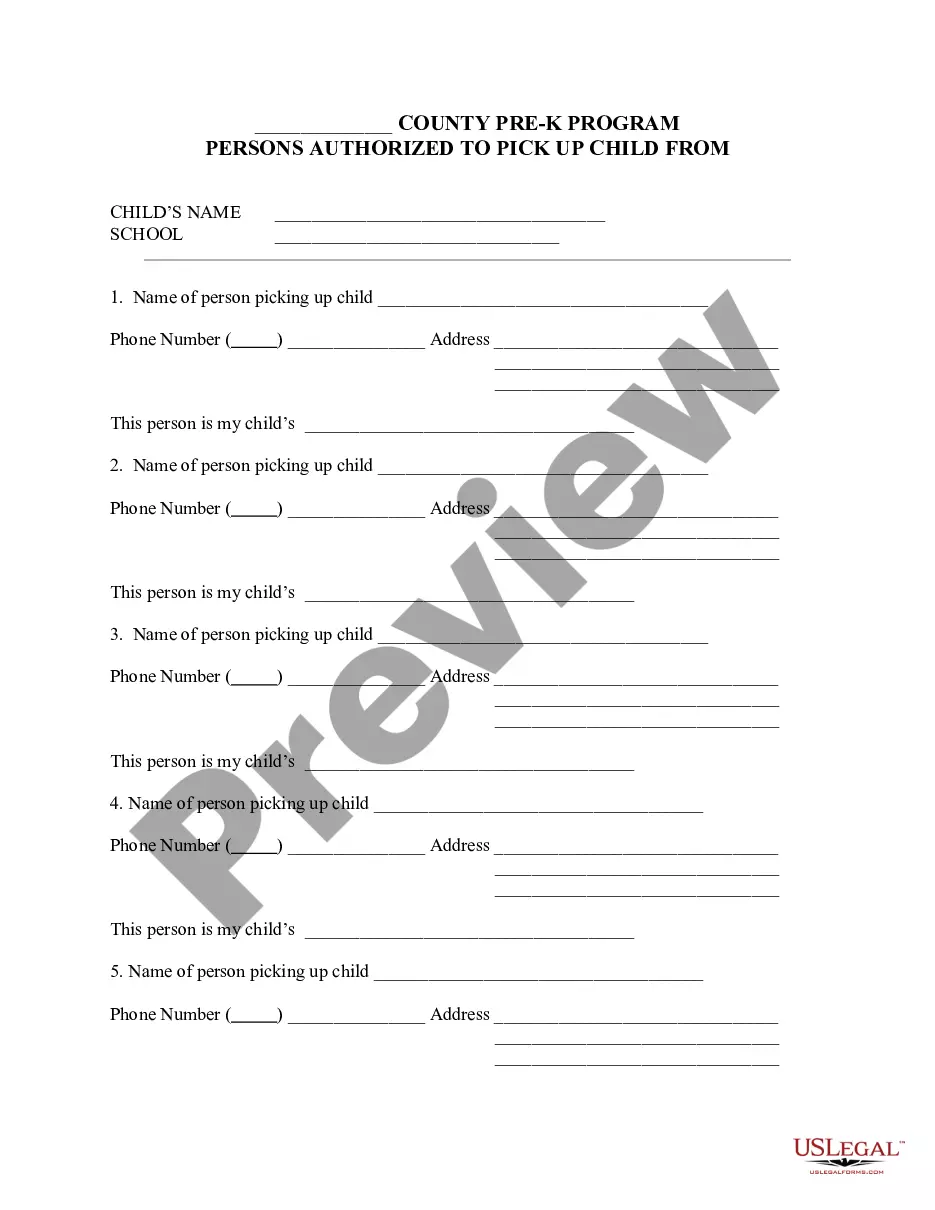

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find a form that meets your needs and criteria.

Form popularity

FAQ

In Wyoming, an entity is considered 'administratively dissolved' when it fails to comply with state regulations, such as not filing annual reports or paying necessary fees. This status affects the entity's ability to conduct business legally. To resolve this, businesses may need to submit a Wyoming Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment to ensure a compliant and orderly wind-up process.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

The proceeds from the sale of assets along with the contribution of the partners at the time of dissolution of the firm are first used up to pay off the external liabilities, i.e., the creditors, bank loans, bank overdrafts, bills payable etc.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Dissolution of a limited partnership is the first step toward termination (but termination does not necessarily follow dissolution). The limited partners have no power to dissolve the firm except on court order, and the death or bankruptcy of a limited partner does not dissolve the firm.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

The liabilities of the partnership shall rank in order of payment, as follows:Those owing to creditors other than partners,Those owing to partners other than for capital and profits,Those owing to partners in respect of capital,Those owing to partners in respect of profits.