Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

You might spend several hours online searching for the suitable legal document template that meets both state and federal requirements you will need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can quickly download or print the Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner from their service.

If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Next, you may complete, modify, print, or sign the Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

- Each legal document template you purchase is yours permanently.

- To get another copy of the acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for the area/city of your choice.

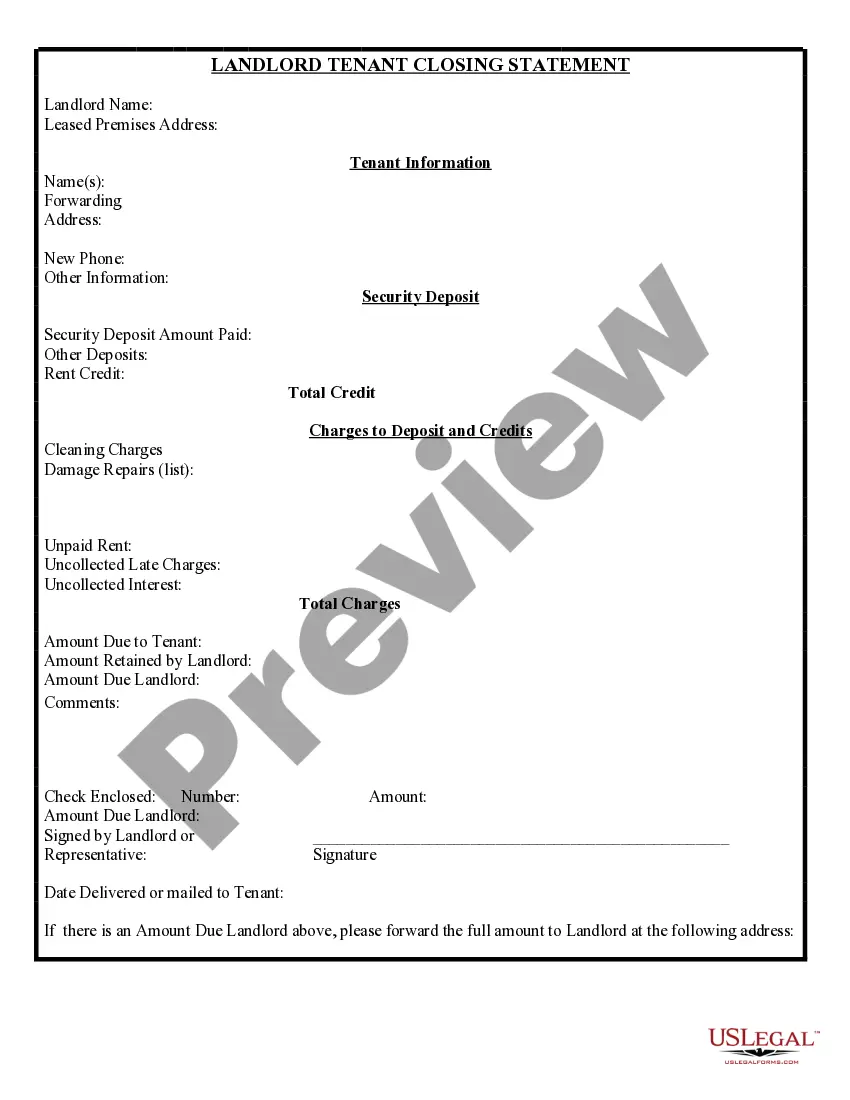

- Check the form details to ensure you have chosen the correct template. If available, make use of the Review button to review the document template as well.

Form popularity

FAQ

The winding up process of a partnership involves settling the partnership's debts and distributing its assets among the partners according to the partnership agreement. This process typically follows the dissolution of the partnership and requires detailed accounting. For partners involved in a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, understanding this process ensures a smooth conclusion of business affairs.

Wyoming is often considered the best state to form an LLC due to its business-friendly laws, no state income tax, and low filing fees. The state also offers strong asset protection and privacy for LLC owners. For those looking to establish a partnership that may lead to a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, Wyoming provides an ideal environment to start fresh.

Forming a limited partnership in Wyoming involves submitting a Certificate of Limited Partnership to the Secretary of State along with the necessary filing fees. Ensure your partnership agreement is comprehensive, detailing each partner's rights and responsibilities. Furthermore, keep in mind that filing for a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can be initiated once agreements between partners are in place.

Section 17-29-1011 of the Wyoming statutes pertains to the winding up of limited partnerships. This section outlines the procedures and requirements for concluding a partnership's activities and settling its affairs. Understanding this section is crucial for any partner considering a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. It ensures you follow proper legal protocols during dissolution.

Setting up an LLC in Wyoming involves several steps. First, choose a unique name that complies with state guidelines and file Articles of Organization with the Wyoming Secretary of State. Following this, create an Operating Agreement to outline the management structure. If you plan to form a partnership and later consider a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, having your LLC established correctly is key.

To set up a limited partnership in Wyoming, start by drafting a partnership agreement that outlines the roles of general and limited partners. Next, you must file a Certificate of Limited Partnership with the Wyoming Secretary of State. After registration, maintain compliance with state regulations, including annual reports. For partners considering a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, understanding the setup process is essential.

Yes, Wyoming does require partnerships to file a tax return. However, Wyoming does not impose a state income tax on businesses, which can simplify your tax obligations. Partnerships typically fill out Form 1065 at the federal level, while Wyoming businesses must comply with any required local taxes. When dealing with a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, understanding your tax responsibilities is crucial.

While Wyoming does not impose a state income tax on LLCs, the entity may still need to file federal tax returns, depending on the structure and income. If your LLC is dissolving, it's crucial to address any outstanding tax obligations. A Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can facilitate this process, ensuring all legal and tax matters are properly handled during the winding-up phase.

Yes, Wyoming requires partnerships to file an informational return, often referred to as a partnership return. This allows the state to keep track of partnership income and distributions. If you're involved in a partnership winding down, utilizing a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can clarify obligations while ensuring compliance with filing requirements.

To shut down a Wyoming LLC, you need to follow specific steps, including filing the necessary paperwork with the state. First, you should finalize any outstanding business matters and debts. Then, you can submit a Wyoming Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to ensure the dissolution process complies with state law and protects your interests.