Wyoming Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

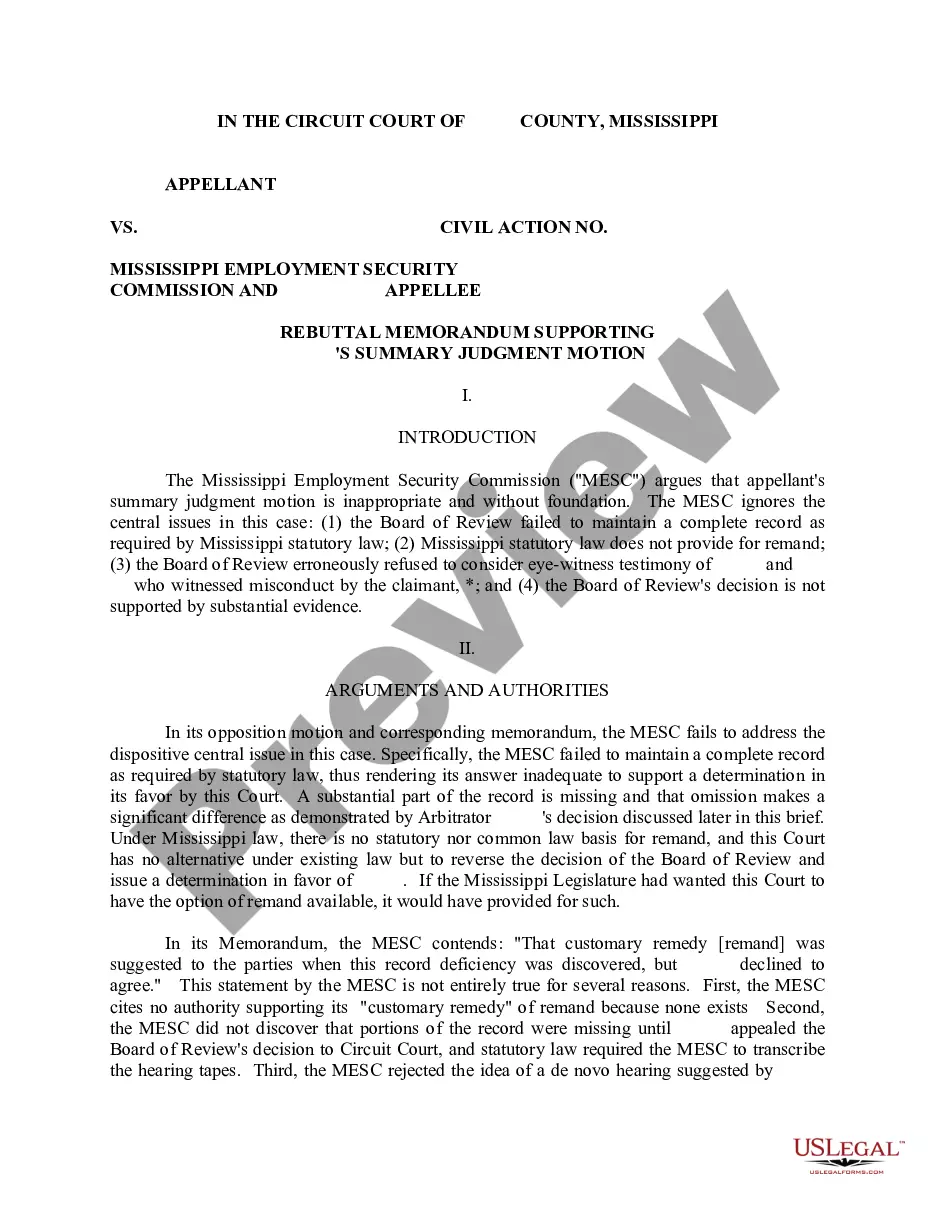

Finding the right lawful record format might be a struggle. Of course, there are plenty of layouts accessible on the Internet, but how will you discover the lawful develop you need? Take advantage of the US Legal Forms web site. The assistance gives thousands of layouts, like the Wyoming Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares, that you can use for enterprise and personal requirements. All the forms are checked out by specialists and meet federal and state requirements.

Should you be already registered, log in to the account and click the Acquire button to obtain the Wyoming Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares. Utilize your account to look through the lawful forms you possess bought in the past. Visit the My Forms tab of your respective account and get yet another copy from the record you need.

Should you be a brand new user of US Legal Forms, allow me to share basic directions that you can follow:

- Initially, make sure you have selected the correct develop for your city/state. You may check out the form using the Preview button and study the form information to ensure it is the right one for you.

- When the develop will not meet your requirements, use the Seach discipline to get the proper develop.

- When you are certain the form is acceptable, click the Get now button to obtain the develop.

- Select the pricing strategy you desire and enter the required information. Make your account and pay for the transaction using your PayPal account or Visa or Mastercard.

- Choose the file file format and acquire the lawful record format to the device.

- Total, change and produce and indication the acquired Wyoming Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares.

US Legal Forms may be the biggest library of lawful forms that you will find different record layouts. Take advantage of the service to acquire professionally-made files that follow condition requirements.

Form popularity

FAQ

In general, restricted securities are acquired in a nonpublic transaction (private placement). Such securities are unregistered, can only be resold under certain conditions and usually bear a legend to that effect.

Only a transfer agent can complete the task of removing a restrictive stock legend. The transfer agent will require an opinion letter from the issuer's counsel or from his or her own lawyer plus 144 papers completed by a broker?stating that the restricted legend can be removed.

Rule 144 is a set of regulations that outline the conditions in which the sale of unregistered or restricted stock shares can be sold. Typically, criteria must be met before a sale is allowed, including a minimum period in which the stock should be held, which can be up to one year.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

In order to have the legend on a stock certificate removed, investors should contact the company's shareholder relations department to find out the details of the removal process. Following that, the company will send a confirmation authorizing its transfer agent to remove the legend.

You may not sell, assign, pledge, encumber, or otherwise transfer any interest in the Restricted Shares until the dates set forth in the Vesting Schedule set forth below, at which point the Restricted Shares will be referred to as ?Vested.? A Restricted Share shall not be subject to execution, attachment or similar ...