Massachusetts Insurer Notification of Payment for Workers' Compensation

Description

How to fill out Massachusetts Insurer Notification Of Payment For Workers' Compensation?

Greetings to the most important legal documents repository, US Legal Forms.

Here you can obtain any sample such as Massachusetts Insurer Notification of Payment for Workers' Compensation forms and store them (as many as you need).

Prepare official paperwork in just a few hours, instead of days or weeks, without paying a fortune to a lawyer.

To create your account, choose a subscription plan. Use a credit card or PayPal account to sign up. Download the document in your preferred format (Word or PDF). Print the document and fill it out with your own or your business’s details. Once you’ve finished the Massachusetts Insurer Notification of Payment for Workers' Compensation, present it to your attorney for verification. It's an additional step, but a crucial one to ensure you’re completely protected. Join US Legal Forms today and gain access to numerous reusable templates.

- Acquire the state-specific form with just a few clicks and have peace of mind knowing it was prepared by our qualified attorneys.

- If you are already a registered user, simply sign in to your account and then click Download next to the Massachusetts Insurer Notification of Payment for Workers' Compensation you need.

- Since US Legal Forms is an online service, you will always have access to your saved documents, no matter what device you are using.

- Find them in the My documents section.

- If you do not have an account yet, what are you waiting for? Follow the instructions below to get started.

- If this is a state-specific document, verify its relevance in your state.

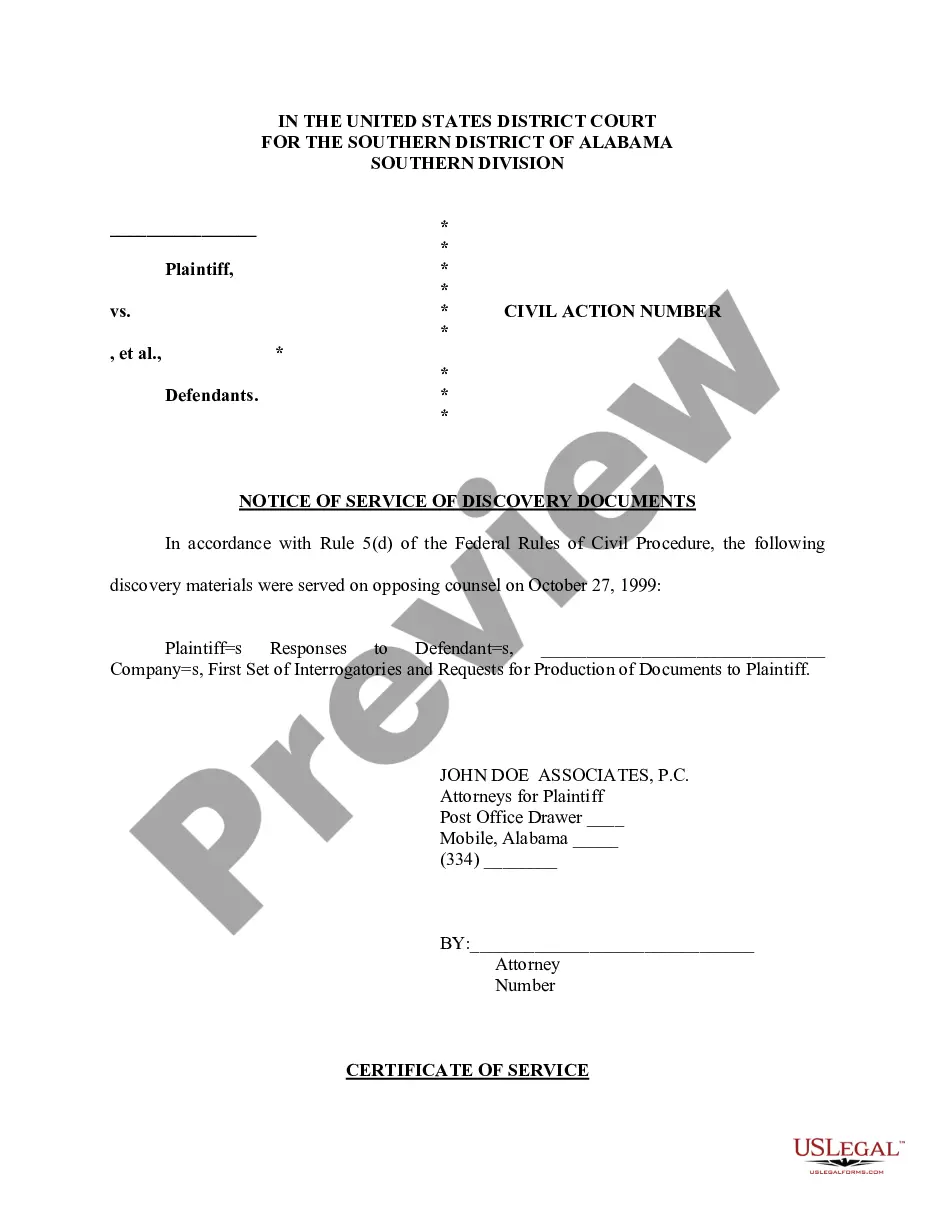

- Read the description (if available) to determine if it’s the correct template.

- Use the Preview feature to see additional content.

- If the example satisfies all your requirements, click Buy Now.

Form popularity

FAQ

In NSW, a worker for workers compensation purposes is 'a person who has entered into or works under a contract of service or a training contract with an employer2026'.If you are a small employer, your premium will not be impacted by the costs of your workers compensation claims.

The amount you will receive is a percentage of your wages at the date of injury. In many states, the percentage is 66 2/3%. Some states include in your wages the amount your employer contributes to your employee benefits.Time loss compensation benefits are paid on a periodic basis usually twice per month.

Yes. A portion of the benefits must usually be repaid.This right of the workers' compensation insurance carrier to be repaid a portion of its benefits is called subrogation. On the other hand, the workers' compensation insurance carrier must usually pay its share of attorneys' fees and expenses in the lawsuit.

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

Regardless of the state you're in, employers pay for workers' compensation insurance.Unlike health insurance, there are no employee payroll deductions for workers' compensation insurance. Workers' compensation provides benefits to your employees if they get sick from their work or injured on the job.

After a workers' comp claim is filed and processed, an injured or sick employee can be paid if the employer and insurance carrier agrees the injuries or illness is work-related. Claims can be disputed if an employer does not believe the injury or illness was caused by their work.

Workers' Comp Payroll DefinitionWages or salaries including retroactive wages or salaries.Payment by an employer of amounts otherwise required by law to be paid by employees to statutory insurance or pension plans, such as the Federal Social Security Act.

The state workers' comp system provides lost wage reimbursement, within limits, for employees who have to miss work because of an occupational injury or illness. You may also qualify for additional wage restitution through a personal injury claim, depending on the details of your case.

Lawyers.com reports that 73% of workers were awarded a their workers comp claim, with the the typical settlement totaling $18,000 if they didn't work with a lawyer. However, when the claim turned into a lawsuit, their average aware rose to $23,500, and it generally required much higher legal costs to resolve.