Alabama Basic Debt Instrument Workform

Description

How to fill out Basic Debt Instrument Workform?

Are you currently in a location where you require paperwork for either business or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is challenging.

US Legal Forms offers thousands of template forms, including the Alabama Basic Debt Instrument Workform, which can be customized to meet federal and state requirements.

When you locate the correct form, simply click Buy now.

Select the pricing plan you desire, fill in the necessary details to create your account, and pay for the transaction using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alabama Basic Debt Instrument Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your appropriate city/state.

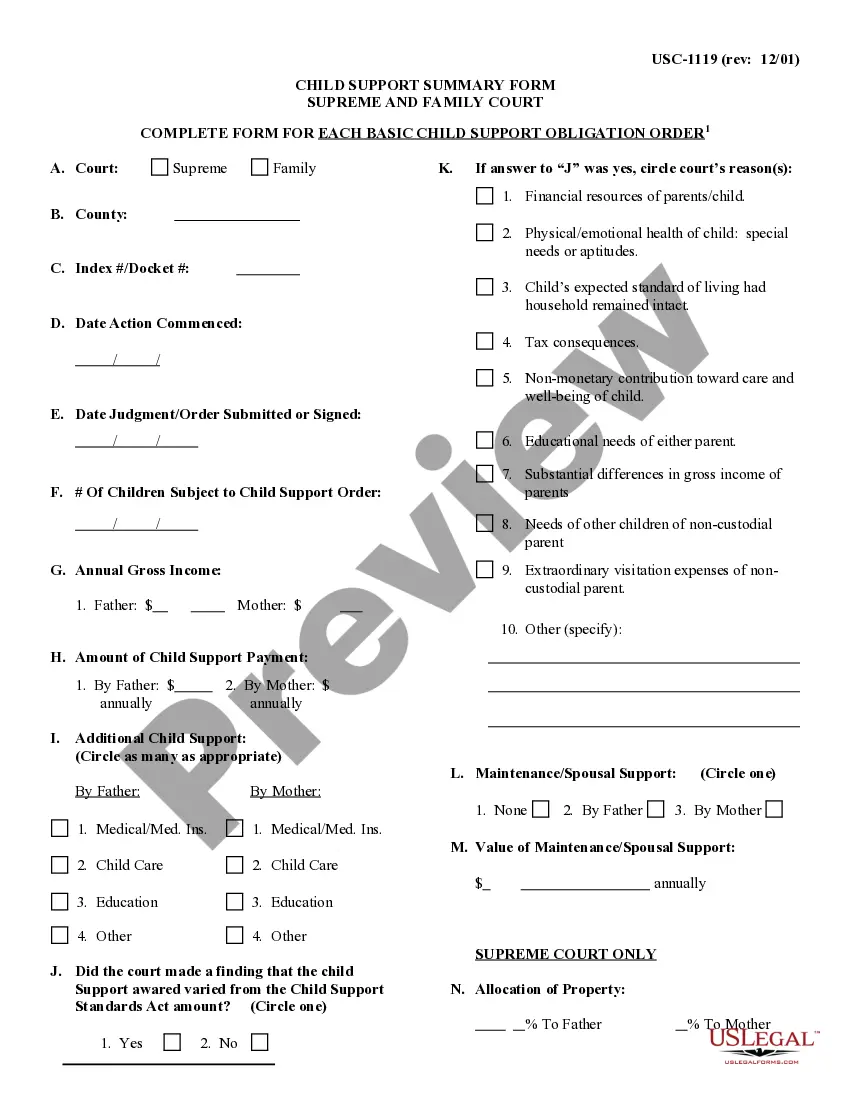

- Utilize the Review button to examine the form.

- Check the description to ensure that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Time barred debt in Alabama refers to debts that can no longer be legally enforced due to the passage of time. Generally, creditors must file lawsuits within a specific period, usually six years for most debts. Understanding the concept of time barred debt is crucial when using financial tools like the Alabama Basic Debt Instrument Workform.

A debt instrument is a fixed income asset that allows the lender (or giver) to earn a fixed interest on it besides getting the principal back while the issuer (or taker) can use it to raise funds at a cost.

Colloquially, OID occurs when a debt instrument is issued for less than its face amount. E.g., our bond was issued for $82 but its face amount is $100. But it's more complicated: OID = the excess (if any) of (A) the stated redemption price at maturity (SRPM), over (B) the issue price (IP).

THE SHORT ANSWER:Cash Interest per Year = $100 10% = $10 (based on Face Value Coupon Rate)OID Amortization = $10 / 5 = $2 (based on Original Issue Discount / Maturity)

Original Issue Discount (OID) is a type of interest that is not payable as it accrues. OID is normally created when a debt, usually a bond, is issued at a discount. In effect, selling a bond at a discount converts stated principal into a return on investment, or interest.

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

An original issue discount (OID) is the discount in price from a bond's face value at the time a bond or other debt instrument is first issued. Bonds can be issued at a price lower than their face valueknown as a discount.

A debt instrument is an asset that individuals, companies, and governments use to raise capital or to generate investment income. Investors provide fixed-income asset issuers with a lump-sum in exchange for interest payments at regular intervals.

There are different types of Debt Instruments available in India such as;Bonds.Certificates of Deposit.Commercial Papers.Debentures.Fixed Deposit (FD)G - Secs (Government Securities)National savings Certificate (NSC)

2.2 The four basic categories of debt instruments are simple loans, discount bonds, coupon bonds, and fixed-payment loans.