Wyoming Escrow Check Receipt Form

Description

How to fill out Escrow Check Receipt Form?

It is feasible to dedicate multiple hours online trying to discover the authentic document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of authentic forms that are vetted by professionals.

You can easily download or print the Wyoming Escrow Check Receipt Form from our services.

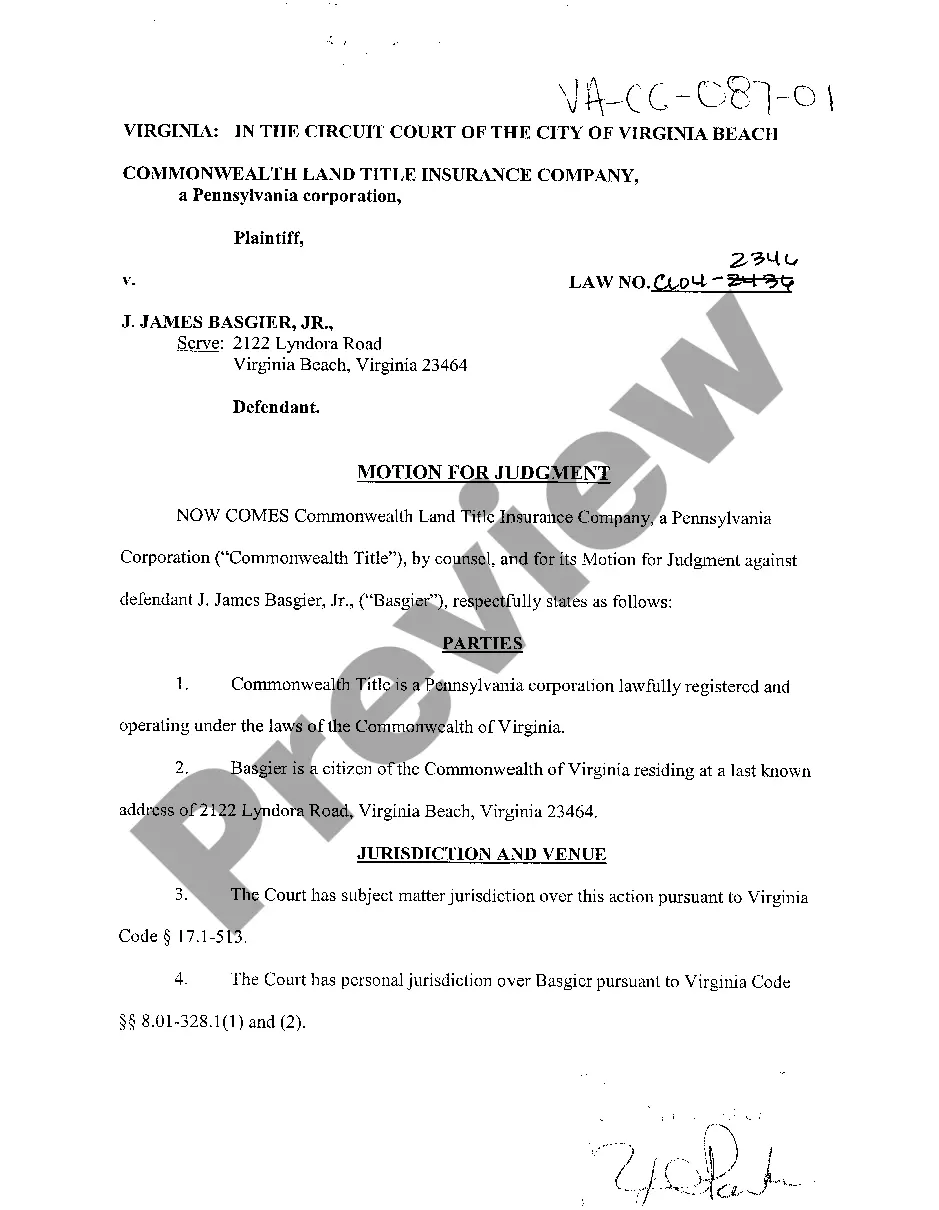

If available, use the Review option to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Acquire option.

- Next, you can fill out, modify, print, or sign the Wyoming Escrow Check Receipt Form.

- Every authentic document template you acquire is yours forever.

- To obtain another copy of the purchased form, go to the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/area of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

Several states offer property tax breaks to seniors, with specifics varying widely. States such as Florida, Texas, and New York provide varying levels of relief for senior homeowners. If you are looking into eligibility for property tax breaks, the Wyoming Escrow Check Receipt Form can help simplify your documentation process, whether you're in Wyoming or exploring options in other states.

Yes, Wyoming offers a property tax exemption for seniors, allowing them to reduce their property tax liability. This exemption is designed to support older adults, making it easier for them to remain in their homes. To apply for this benefit, seniors can utilize the Wyoming Escrow Check Receipt Form to ensure they document their application correctly.

Generally, a property tax refund in Wyoming is not considered taxable income. However, specific circumstances may change this, so it is advisable to consult a tax professional for personalized guidance. When filing taxes, keeping your Wyoming Escrow Check Receipt Form handy can assist you in maintaining accurate records of any refunds received.

In Wyoming, there is no specific age at which you stop paying property taxes. However, those who are 65 and older may qualify for certain exemptions that reduce their property tax burden. Using the Wyoming Escrow Check Receipt Form can help seniors navigate the application process and ensure they receive all available benefits.

Wyoming property tax is calculated based on the assessed value of your property, which is a percentage set by local governments. Taxes fund essential services such as education, public safety, and infrastructure. Understanding the nuances of property tax in Wyoming is crucial, and using the Wyoming Escrow Check Receipt Form can ensure you manage payments effectively to avoid any complications.

If you are waiting for a refund in Wyoming, it's essential to track your claim. You can check the status of your refund by contacting the local assessor's office or visiting their website for updates. Additionally, using the Wyoming Escrow Check Receipt Form can help you keep your records organized, making it easier to follow up on your refund status.

When you receive your escrow refund check, first review the accompanying documentation to confirm the amount. Next, store the check in a safe place until you decide how to utilize the funds. You might want to deposit the check into your bank account or allocate it towards future expenses. Remember that the Wyoming Escrow Check Receipt Form can help track this transaction effectively.

You can locate your refund using the Mississippi Department of Revenue's refund tracker on their website. You'll need to provide your Social Security number along with some other identifying information. To ensure all your documentation is in order, especially if it involves the Wyoming Escrow Check Receipt Form, maintain good records of your financial transactions.

To obtain a Wyoming sales tax ID, you should apply online through the Wyoming Department of Revenue’s website. This process requires some basic business information and can often be completed quickly. If you're filling out the Wyoming Escrow Check Receipt Form for your business transactions, having your sales tax ID will be essential for compliance and verification.

To find out the status of your Wisconsin tax refund, visit the Wisconsin Department of Revenue website. They offer a simple tracking tool that requires your Social Security number and the exact refund amount. If you’re using the Wyoming Escrow Check Receipt Form, keeping track of your financial documents will help streamline your inquiries.