Wyoming Retirement Cash Flow

Description

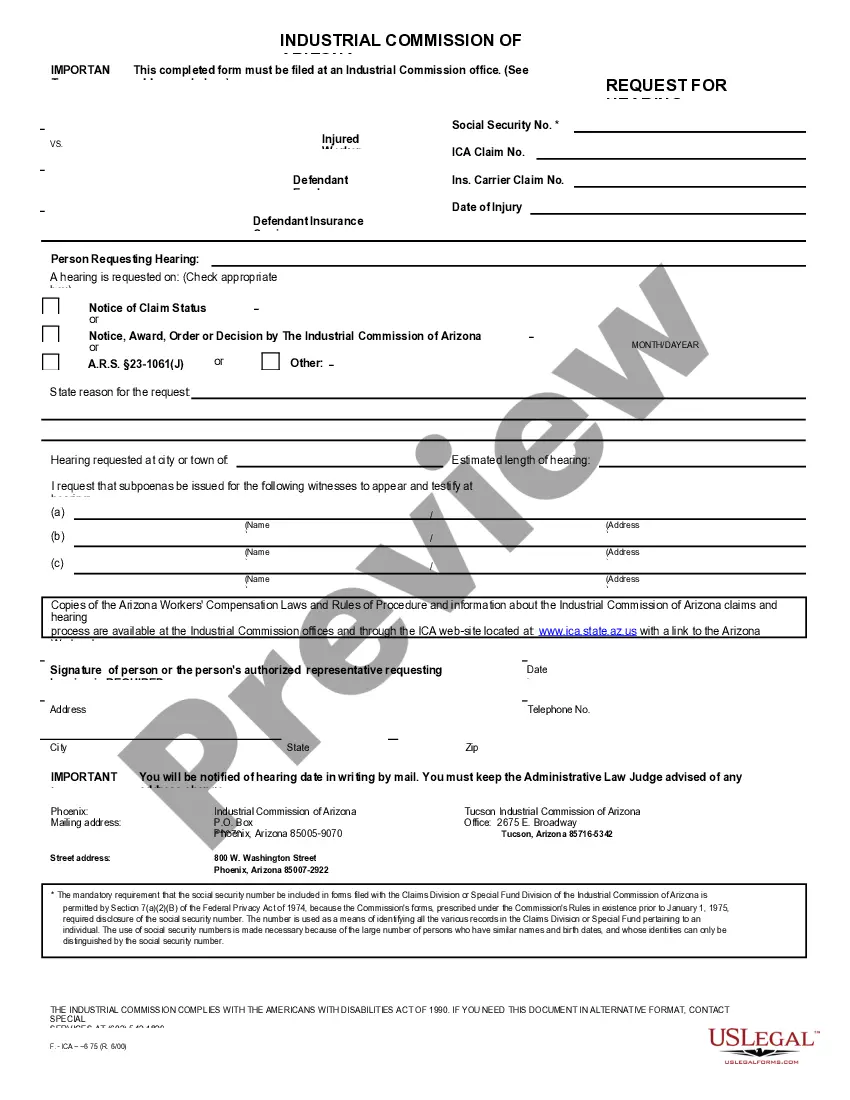

How to fill out Retirement Cash Flow?

If you require complete, fetch, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal categories, available online.

Employ the site’s straightforward and effective search tool to obtain the documents you require.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred pricing plan and input your credentials to create your account.

Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the Wyoming Retirement Cash Flow with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and then click the Download button to fetch the Wyoming Retirement Cash Flow.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the details of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to locate other versions of the legal form template.

Form popularity

FAQ

Wyoming has no state income tax, no state gift tax, no inheritance or estate tax, and no capital gains tax. Consider this comparison of a sale of stock by a Wyoming resident vs a resident of a state with a 10% capital gains tax rate.

Retirement BenefitsOfficers who have served for 10 years and are at least 57 years of age (55-56 years of age under certain conditions) are eligible to retire with a reduced annuity. Retirement at 65 years of age is mandatory.

Currently, the Wyoming Constitution requires Wyoming Supreme Court justices and district court judges to retire upon reaching the age of seventy (70).

Wyoming. Wyoming is the best state to retire in, according to a list from Bankrate. The group ranked all 50 states based on weather, cost of living, crime, quality of health care, state and local taxes, and general well-being. Wyoming is at the top largely because it has the lowest tax rate in the country.

Wyoming is very tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are not taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

Wyoming. Retirement Income: Wyoming is very taxpayer-friendly when it comes your retirement incomeno taxes on payments from 401(k) plans, IRAs or pensions. Why? The Cowboy State doesn't have an income tax.

To calculate the rule of 85, companies take your age and add it to your years of service. If those numbers add up to 85, you are eligible for early retirement. For example, a 55-year-old with 30 years of service would meet the standards of the rule of 85, because her age plus her years of service equals 85.

Wyoming is very tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are not taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

You'll become eligible to receive benefits once you reach age 60 and have at least five years of service. Once you retire, you'll receive $16 per month per year of service for the first 10 years of service and $19 per month per year of service for each year above ten years of service.