Wyoming Sample Letter Informing Client of Settlement of Cases

Description

How to fill out Sample Letter Informing Client Of Settlement Of Cases?

Are you presently inside a position the place you require papers for both organization or person uses just about every day? There are tons of legitimate papers templates accessible on the Internet, but finding ones you can trust isn`t easy. US Legal Forms gives thousands of type templates, much like the Wyoming Sample Letter Informing Client of Settlement of Cases, which are composed in order to meet federal and state requirements.

If you are already familiar with US Legal Forms web site and also have a free account, simply log in. Afterward, you may obtain the Wyoming Sample Letter Informing Client of Settlement of Cases design.

If you do not offer an profile and would like to start using US Legal Forms, abide by these steps:

- Get the type you require and ensure it is for your proper city/area.

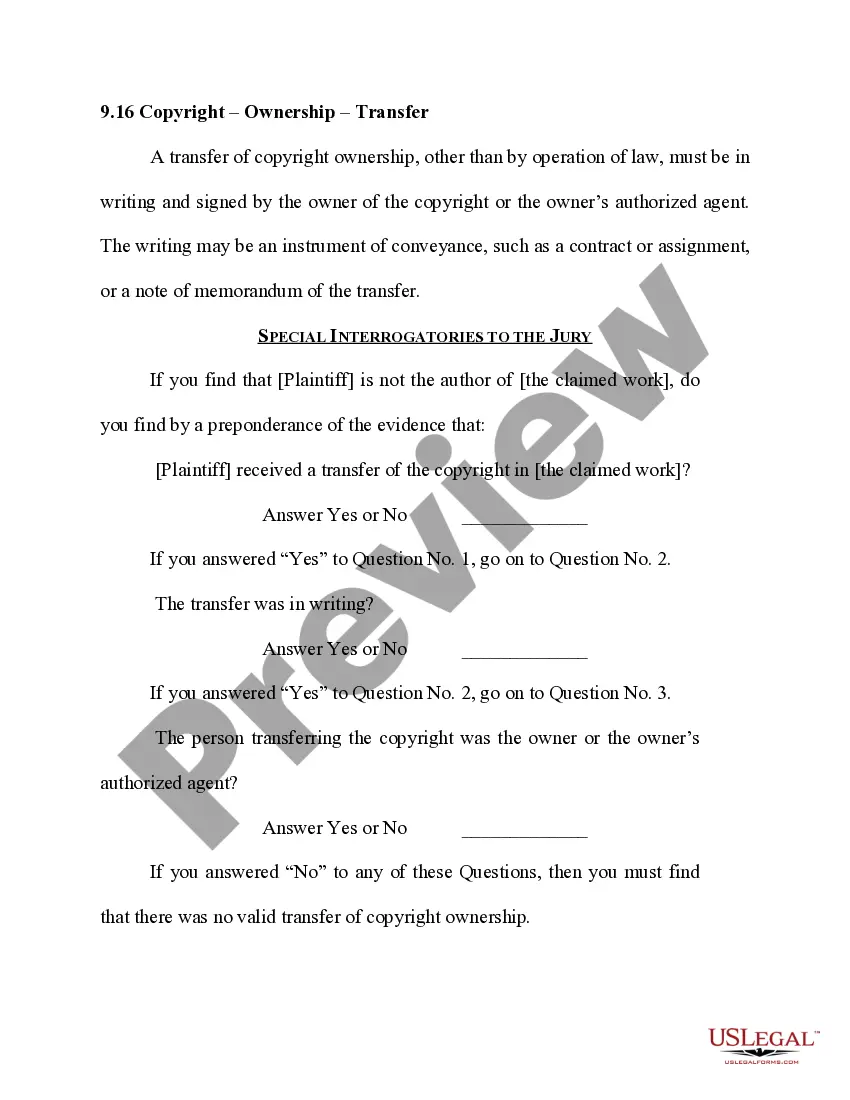

- Utilize the Review switch to examine the shape.

- Read the outline to ensure that you have selected the correct type.

- When the type isn`t what you are searching for, utilize the Lookup area to discover the type that meets your requirements and requirements.

- Once you find the proper type, just click Get now.

- Pick the costs plan you would like, submit the specified details to generate your money, and pay for the order utilizing your PayPal or bank card.

- Select a handy paper file format and obtain your backup.

Discover each of the papers templates you might have purchased in the My Forms menus. You can aquire a more backup of Wyoming Sample Letter Informing Client of Settlement of Cases any time, if needed. Just click the needed type to obtain or produce the papers design.

Use US Legal Forms, one of the most considerable variety of legitimate forms, in order to save time as well as avoid errors. The support gives expertly created legitimate papers templates that you can use for an array of uses. Generate a free account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

I am writing about the money which you are claiming I owe on the above account. I can confirm that I am unable to offer to pay in full what I owe. and I want to offer this as an ex-gratia payment in full and final settlement of the account.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report.

A settlement demand letter is a written offer addressed to a claimant in a dispute. Typically, the claimant has previously sent a demand letter requesting payment for injury or other damages. In the Settlement Demand Letter, a counteroffer is made to try to induce settlement before the matter ends up in court.

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.

What A Settlement Letter Should Include Key facts about the incident: date, time, location, parties involved, etc. Injuries sustained. Medical treatment received. Cost of medical treatment and supplies. Other expenses. Non-economic damages you suffered (pain and suffering, emotional distress, loss of companionship, etc.)

Settlement Advice/Opinions means the advice or opinions, satisfactory to the Trustee, of one or more persons or entities retained by the Trustee to advise it on the adequacy and reasonableness of the Settlement that, either singly or taken together, advise or opine that the Settlement terms set forth in this Agreement ...

Include a paragraph explaining your circumstances and details of your financial situation that you want the creditor to take into account. Enter the amount which you can afford to pay. and I want to offer this as full and final settlement of the account.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

A letter of advice to be sent to an employee client, containing commentary on Standard document, Settlement agreement: employment (long form). The letter should be adapted to reflect any specific instructions given by the client.

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.