Wyoming Direct Deposit Form for Chase

Description

How to fill out Direct Deposit Form For Chase?

Are you presently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding versions you can depend on isn't straightforward.

US Legal Forms provides a vast array of form templates, including the Wyoming Direct Deposit Form for Chase, that are crafted to comply with federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legitimate documents, to save time and reduce errors.

The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wyoming Direct Deposit Form for Chase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and make sure it is for the correct location/category.

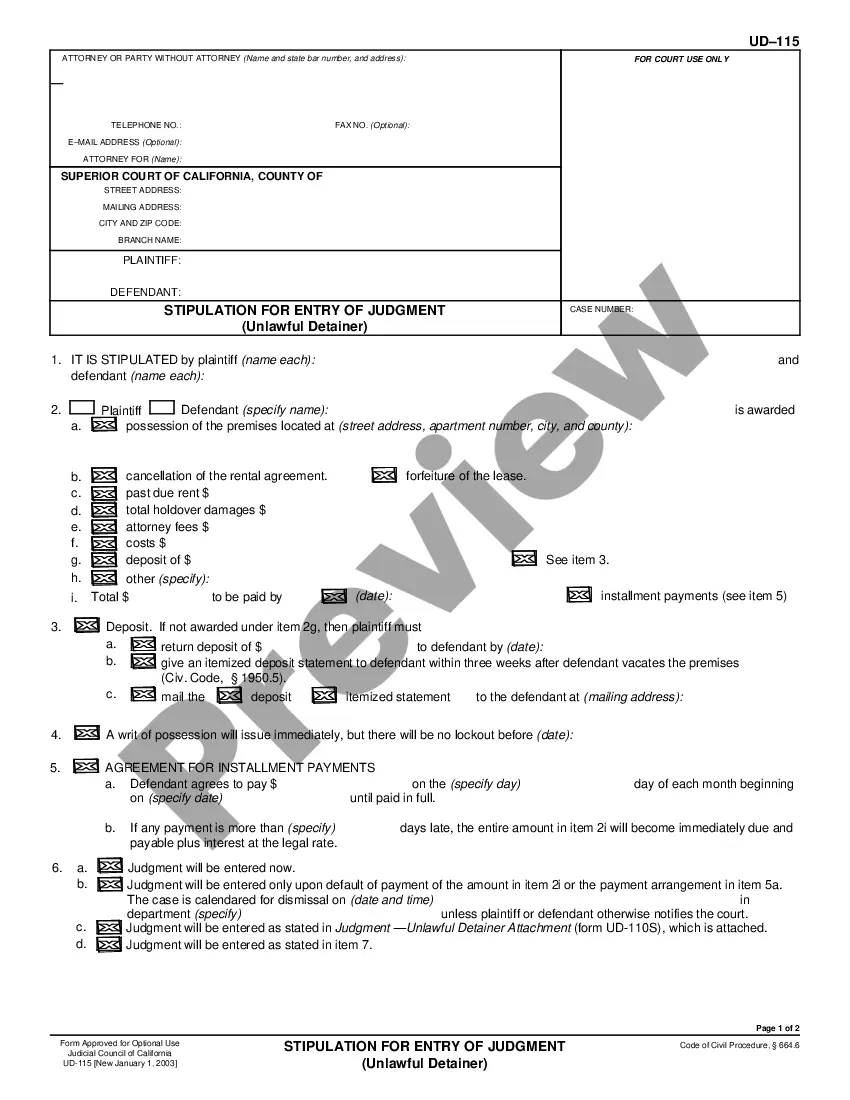

- Use the Preview button to review the document.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you are looking for, utilize the Search section to find the form that fits your needs and requirements.

- Once you find the correct form, click Purchase now.

- Choose the payment plan you prefer, enter the required details to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- Select a suitable document format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

- You can download an additional copy of the Wyoming Direct Deposit Form for Chase at any time if needed. Just open the relevant form to download or print the document template.

Form popularity

FAQ

To get a direct deposit authorization form from Chase, begin by visiting the official Chase website. Look for the banking resources section, where you can download or print the appropriate Wyoming Direct Deposit Form for Chase. Alternatively, if you prefer hands-on assistance, visiting a Chase branch or calling their customer support can provide you with the necessary guidance and resources.

Getting a direct deposit authorization form from Chase is a straightforward process. You can visit the Chase website or go to a local branch for assistance. Customer service representatives can guide you in filling out the Wyoming Direct Deposit Form for Chase correctly, ensuring a smooth setup for your direct deposits.

To obtain a direct deposit authorization form, you typically need to contact your employer's payroll department or access your company's human resources portal. Many employers provide this form online or in employee handbooks. You can also find the Wyoming Direct Deposit Form for Chase on financial websites, ensuring it's the correct version for your use.

You can get the Chase direct deposit form from various sources. The most convenient option is to check the Chase online banking portal or mobile app. Alternatively, the Wyoming Direct Deposit Form for Chase is readily available on the US Legal Forms platform, where you can find standardized forms to simplify your banking procedures.

To get a Chase direct deposit form, visit your local Chase branch or access the Chase website. They provide a downloadable version of the Wyoming Direct Deposit Form for Chase for your convenience. Furthermore, the US Legal Forms platform also offers an easy way to access this form, ensuring that you can complete your direct deposit setup efficiently.

You can obtain a Wyoming Direct Deposit Form for Chase directly from your employer. Many employers provide this form to new employees as part of the onboarding process. Additionally, you can find this form on the Chase website or through the US Legal Forms platform, which offers a variety of legal document templates, including direct deposit forms.

To list direct deposit with Chase, you need to fill out the Wyoming Direct Deposit Form for Chase accurately. After gathering all necessary information, such as your personal and bank details, submit the form to your employer or relevant payment processor. This method ensures that future payments are deposited directly into your Chase account without delay.

To complete the Wyoming Direct Deposit Form for Chase, you must provide your full name, address, account number, and the bank's routing number. It’s important to ensure all information matches the details registered with Chase. Once you have reviewed the form for accuracy, submit it to your payroll department or the organization responsible for your payments.

Filling out an authorization form for your Wyoming Direct Deposit Form for Chase requires you to provide details like your personal information and financial institution details. Make sure to include your signature, which grants authorization for direct deposits. Once completed, send the form to your employer or the financial entity managing your deposits.

When completing the Wyoming Direct Deposit Form for Chase, you will need to provide essential information such as your name, address, account number, and routing number. Additionally, include your employer's information or the source of your deposits. This ensures that the bank can process your deposits accurately and promptly.