In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm

Description

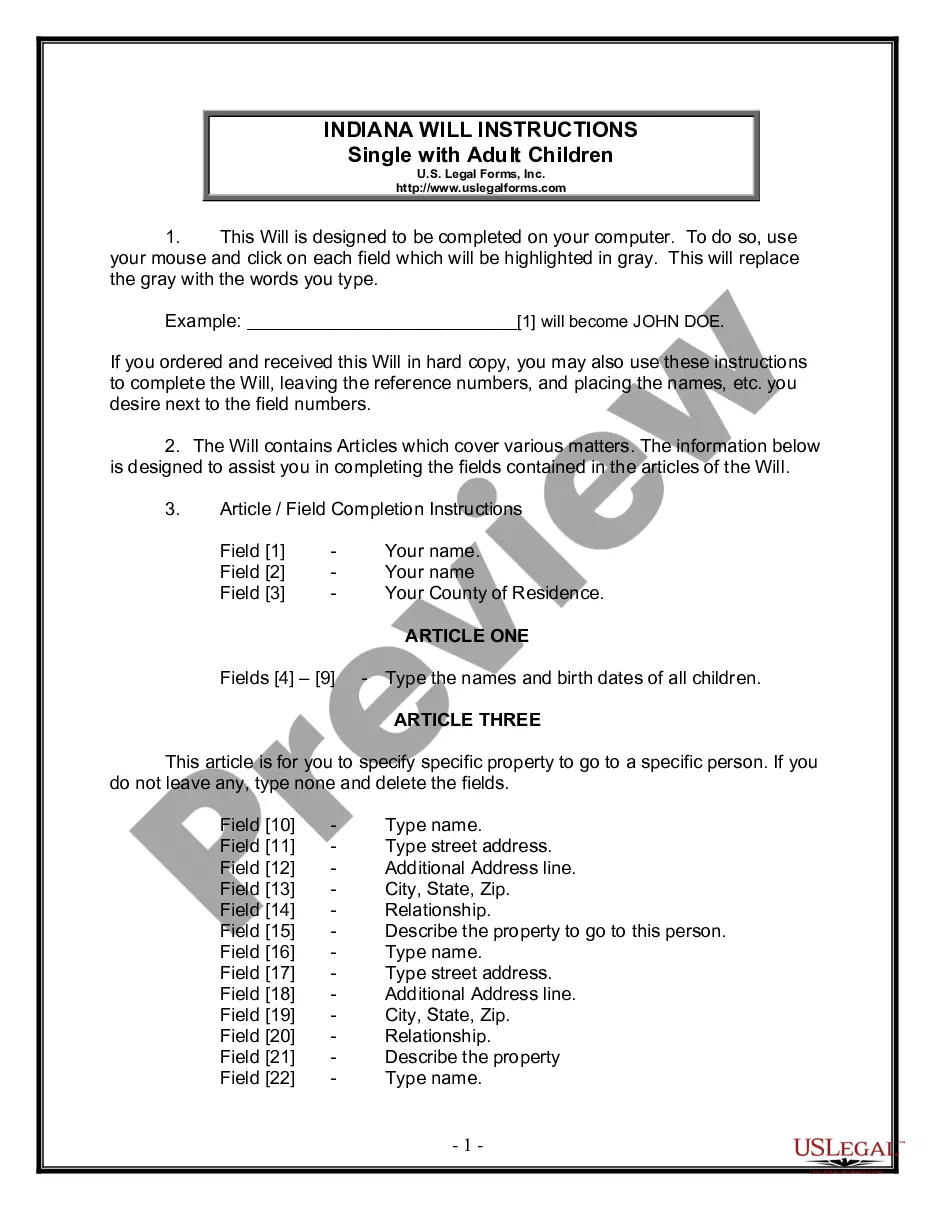

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

Are you situated in a location where you frequently require documentation for business or particular uses almost every day.

There are numerous authentic document templates accessible online, but locating versions you can trust isn’t straightforward.

US Legal Forms offers a vast selection of form templates, including the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm, designed to fulfill state and federal regulations.

Once you obtain the right form, click on Purchase now.

Select the pricing plan you wish, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to evaluate the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

The duration of a financial statement review can vary, but it typically takes a few weeks to complete. Factors that influence this timeline include the complexity of the financial data, availability of documents, and the responsiveness of management. Utilizing services like the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm can streamline this process, making it efficient and satisfactory for all parties involved.

To write a compilation report, you need to gather the financial statements, summarize the financial data, and provide a statement indicating the lack of assurance. The West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm serves as a template that outlines how to present the information. Engaging a professional accounting firm can simplify this process, ensuring that the report meets the required standards.

The process of reviewing financial statements typically includes understanding the company's operations and internal controls, performing analytical procedures, and obtaining management representation. Each step is crucial for the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm. This thorough process aims to provide a clear picture of the financial health while reducing the risk of errors.

In West Virginia, all corporations, limited liability companies, and partnerships must file an annual report with their state government. These reports are essential for maintaining good standing with the state and ensuring compliance with state laws. The West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm serves as a valuable tool for businesses to understand their financial health and fulfill their reporting obligations efficiently.

Typically, a licensed accountant or an accounting firm is responsible for reviewing your financial statements. They use their expertise to ensure that the documents represent your financial position accurately. If you're seeking a comprehensive evaluation, the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm can guide you through this process. By relying on professionals, you can enhance trust in your financial reporting.

A financial statement review involves a systematic evaluation of your financial documents, where an accounting firm assesses the statements for accuracy and compliance. In contrast, a compilation provides a summarized version of your financial data without the same level of scrutiny. The West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm provides insights tailored to your specific needs. Understanding these differences helps you choose the right service for your financial health.

Yes, licensed CPAs can both prepare and review financial statements. While they compile the information from your records, a review involves analyzing and questioning the data. For businesses in West Virginia, utilizing the insights from the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm can enhance understanding and transparency.

No, a compilation is not the same as a review. A compilation provides no assurance about the financial statements, while a review offers limited assurance based on analytical assessments. This distinction is crucial for businesses looking to understand their financial standing, as detailed in the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm.

Compiled financial statements offer no assurance, as they simply compile financial data provided by the business. In contrast, reviewed financial statements include some level of assurance through inquiries and analytical procedures. Understanding these differences is vital for informed decision-making, which you can find detailed in the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm.

The main difference lies in the level of assurance provided. A compilation involves presenting financial data without offering any assurance, while a review includes analytical procedures and inquiries, giving limited assurance. If you need clarity on your financial statements, the West Virginia Report from Review of Financial Statements and Compilation by Accounting Firm can help clarify these distinctions.