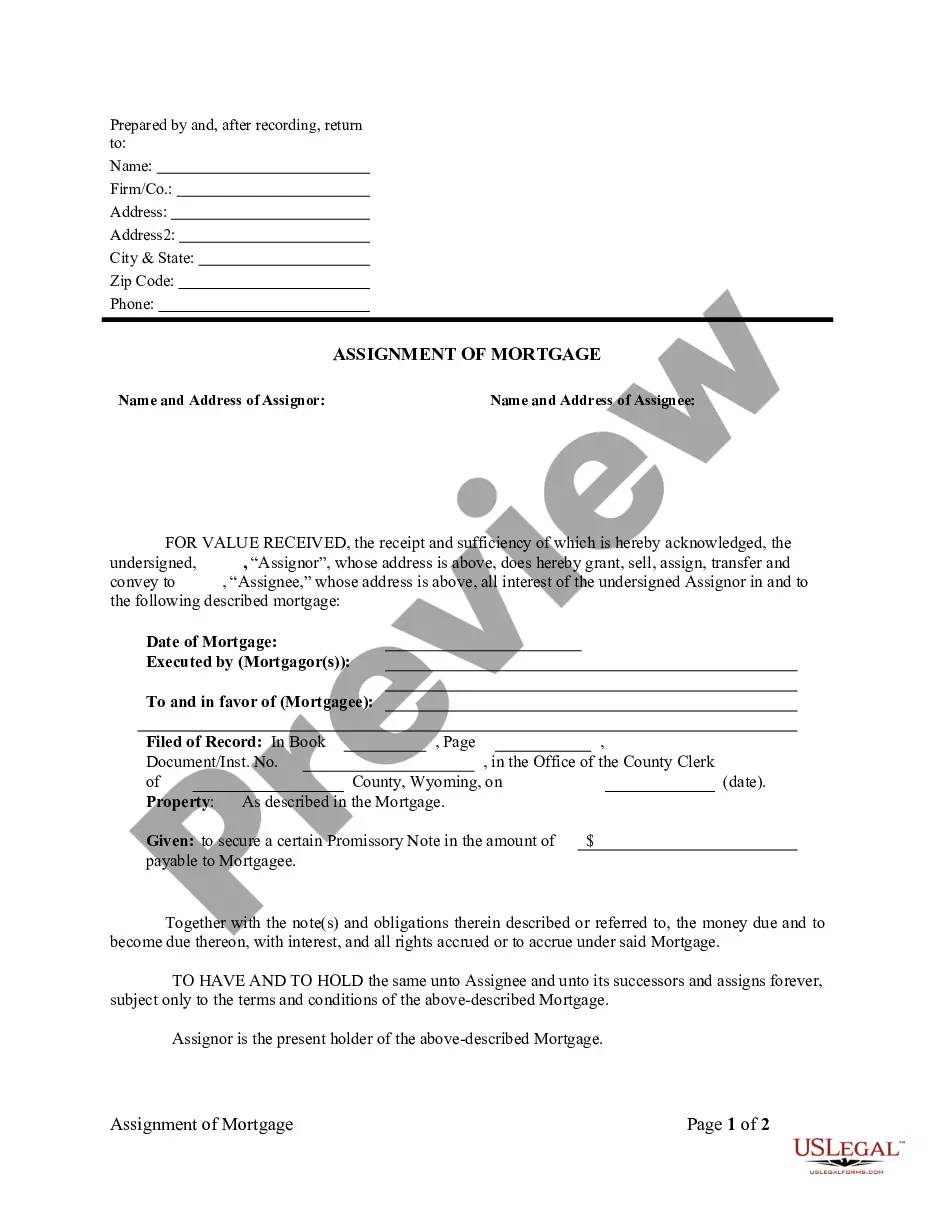

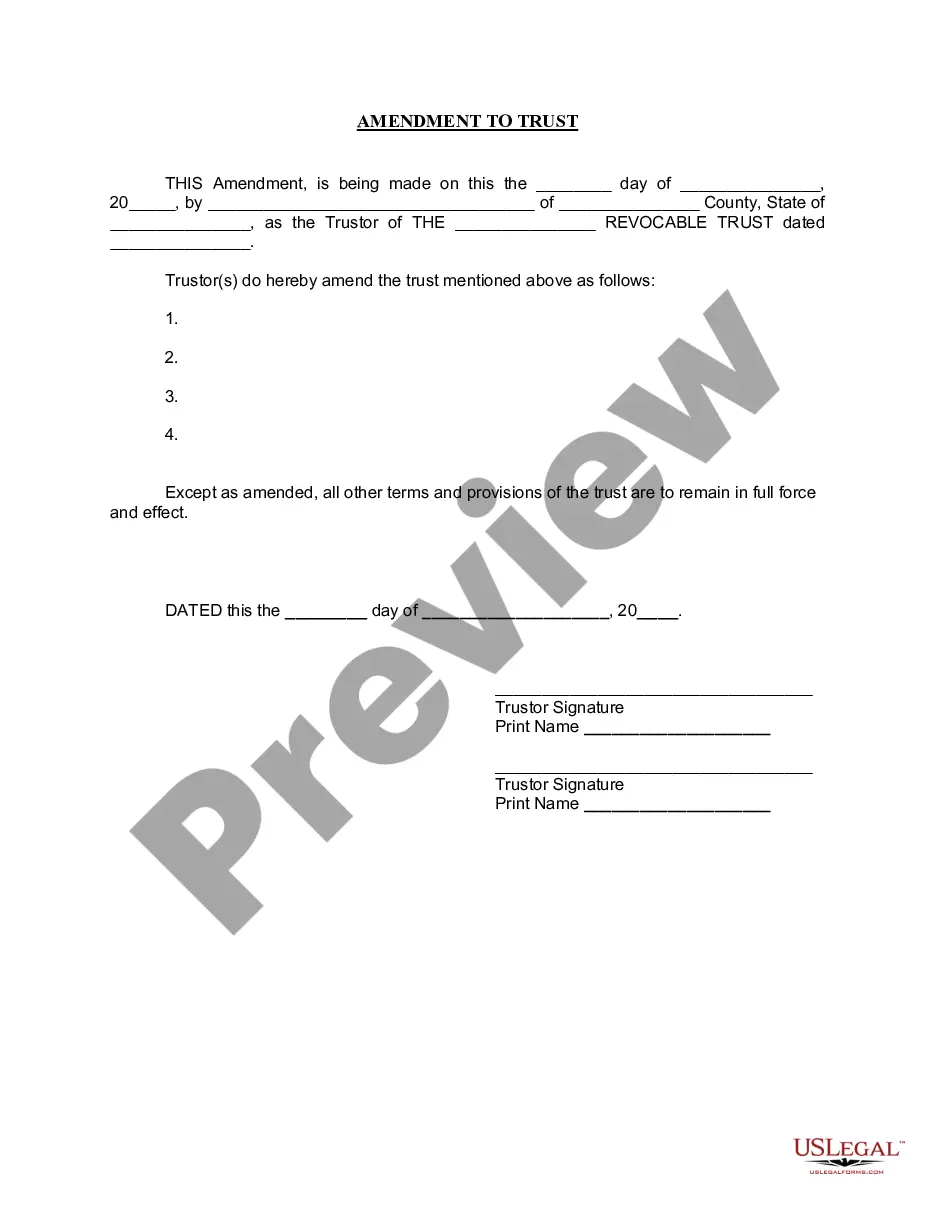

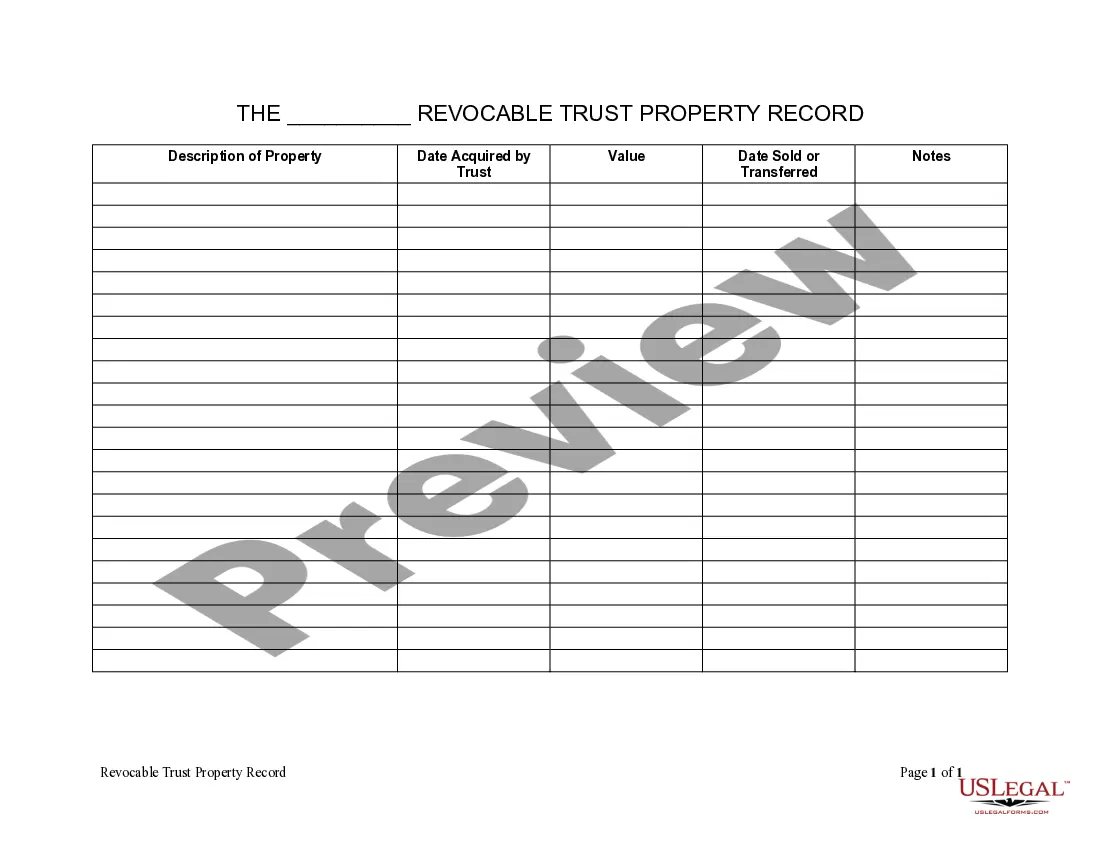

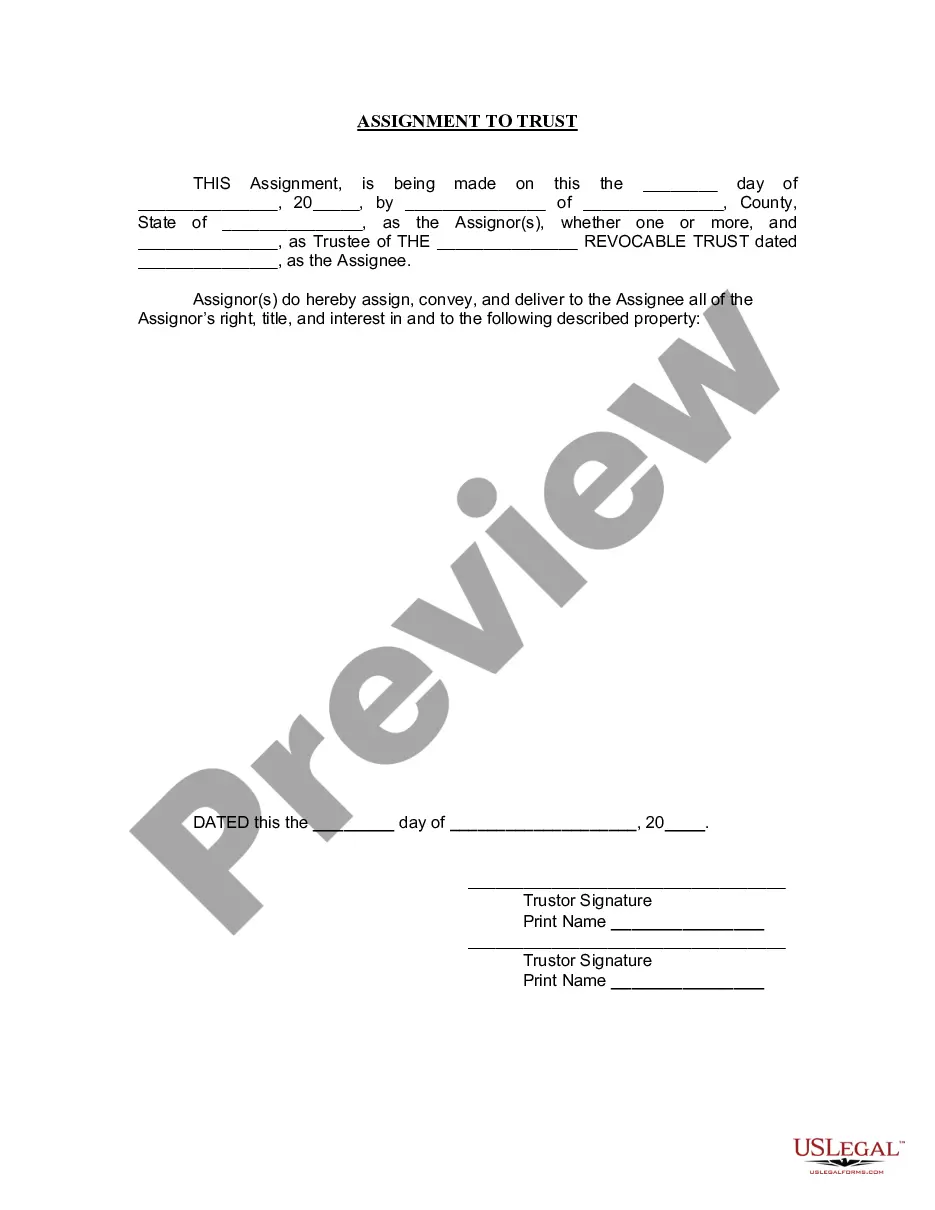

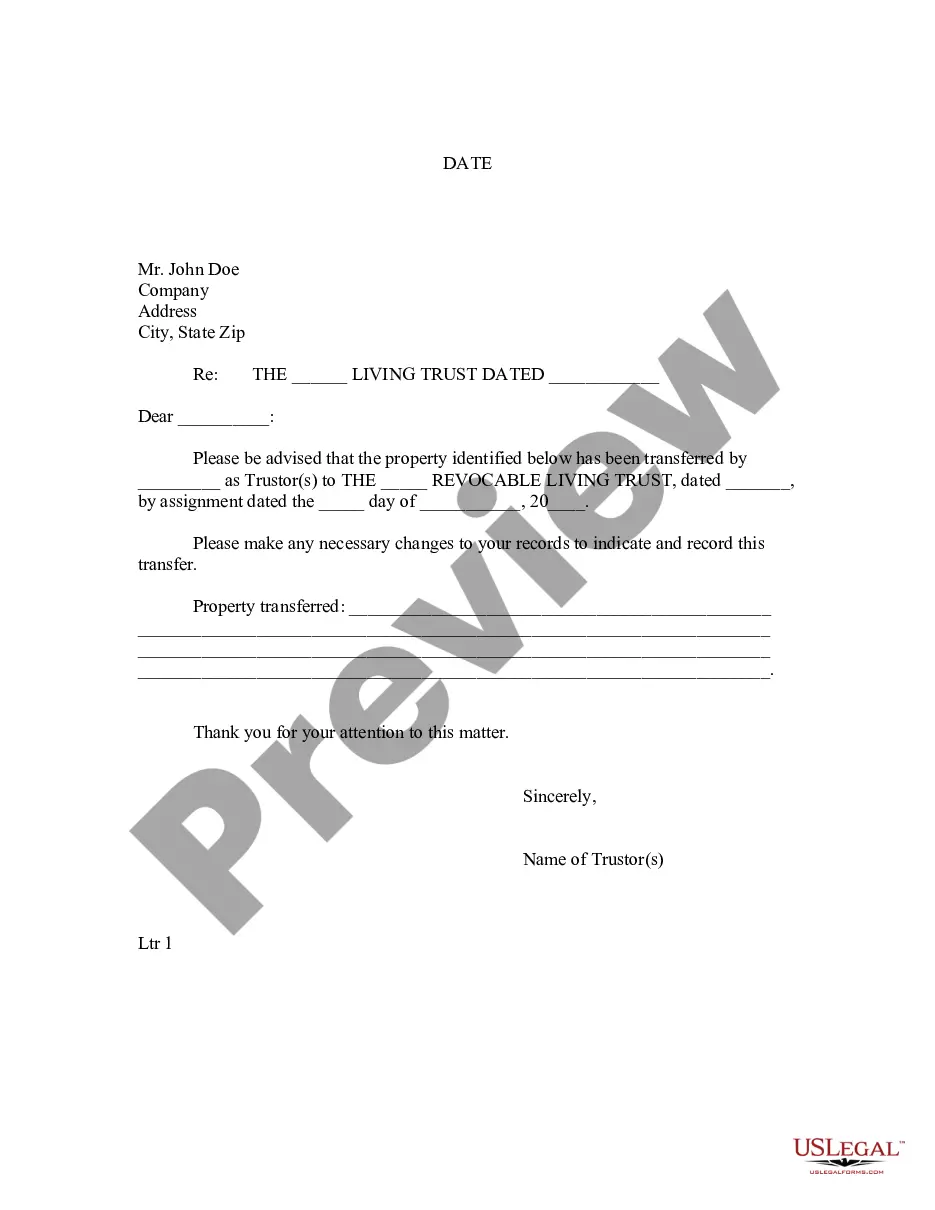

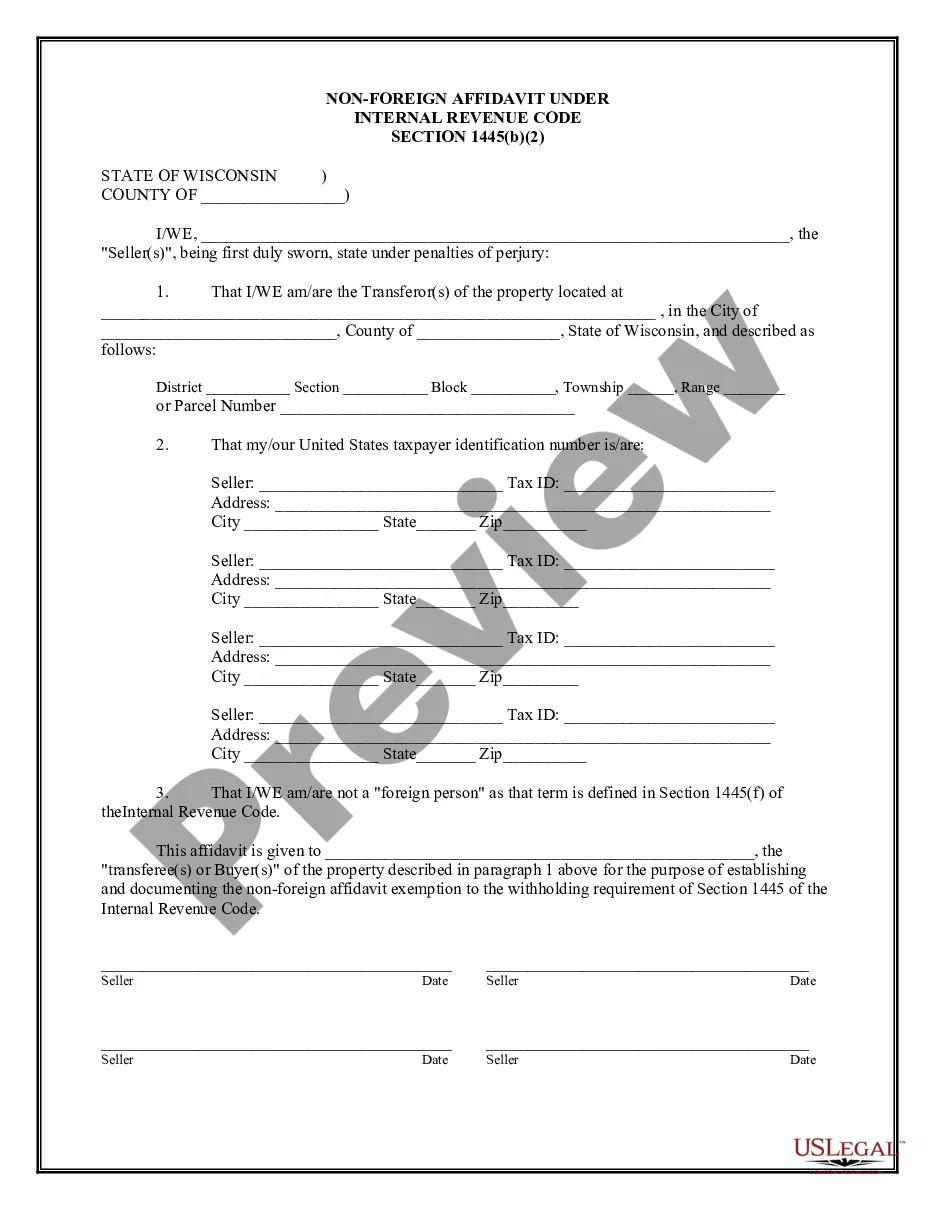

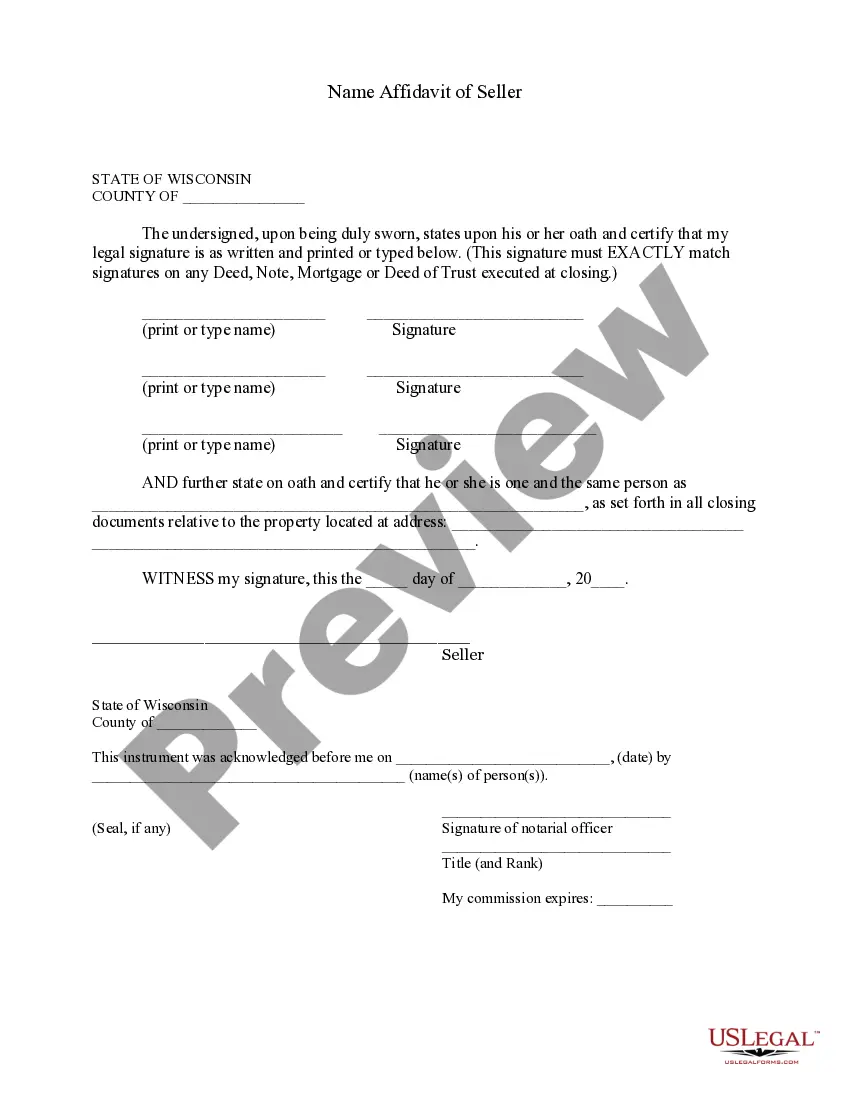

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Wyoming Notice of Assignment to Living Trust

Description

How to fill out Wyoming Notice Of Assignment To Living Trust?

Use US Legal Forms to obtain a printable Wyoming Notice of Assignment to Living Trust. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms catalogue online and offers cost-effective and accurate templates for consumers and legal professionals, and SMBs. The templates are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For those who do not have a subscription, follow the tips below to easily find and download Wyoming Notice of Assignment to Living Trust:

- Check to make sure you get the right template with regards to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Click Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Wyoming Notice of Assignment to Living Trust. More than three million users have utilized our service successfully. Choose your subscription plan and get high-quality documents in a few clicks.

Form popularity

FAQ

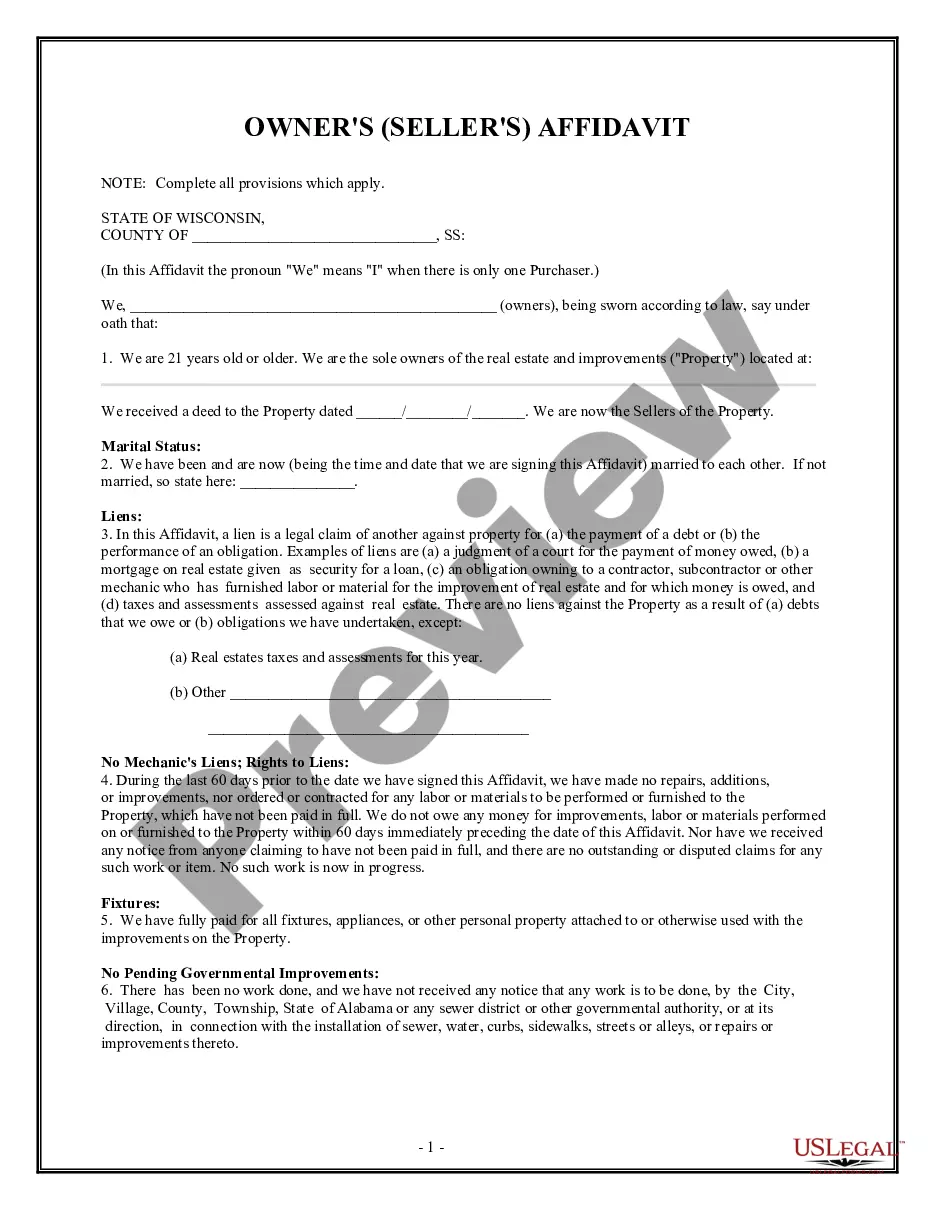

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

The trust in no way protects your assets, so that reasoning is simply false. You should put your vehicles into your trust in order to avoid probate. Only those assets held by the trust will avoid probate.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.