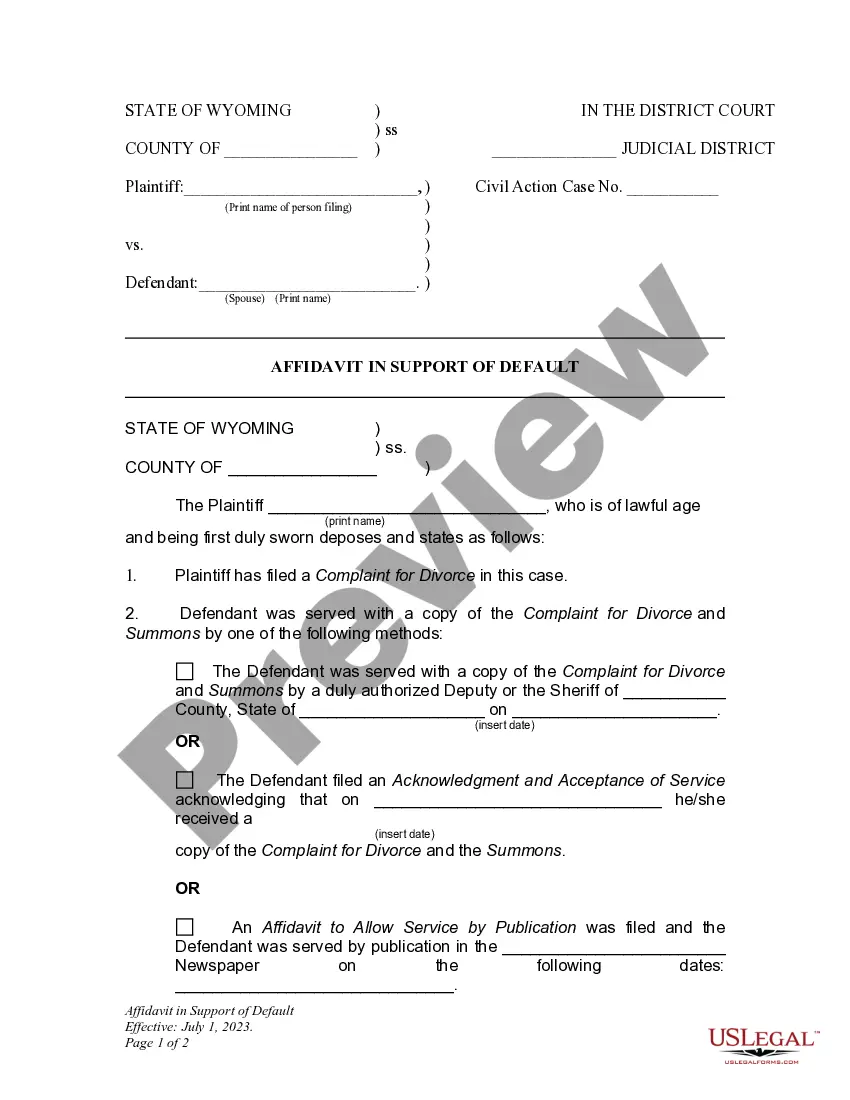

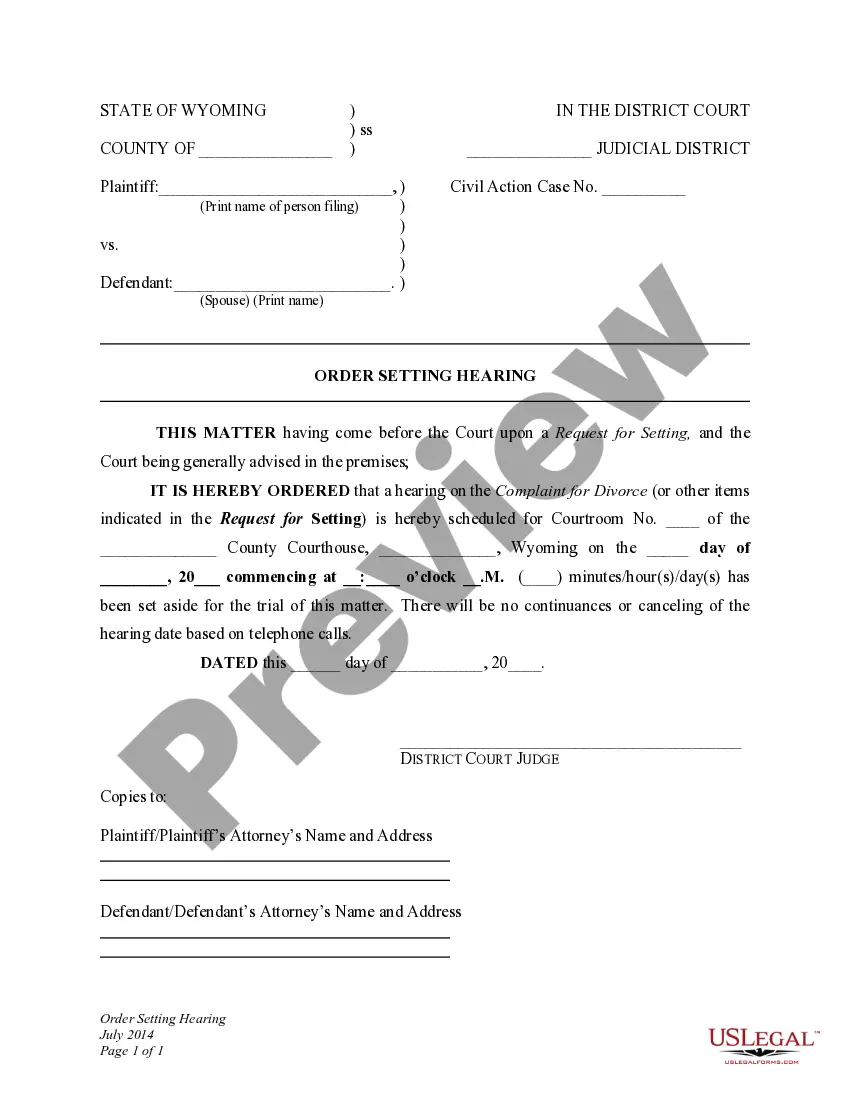

This is an official form from the Judicial Branch of Wyoming which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Wyoming statutes and law.

Wyoming DWCP 13. Affidavit of Imputed Income

Description

How to fill out Wyoming DWCP 13. Affidavit Of Imputed Income?

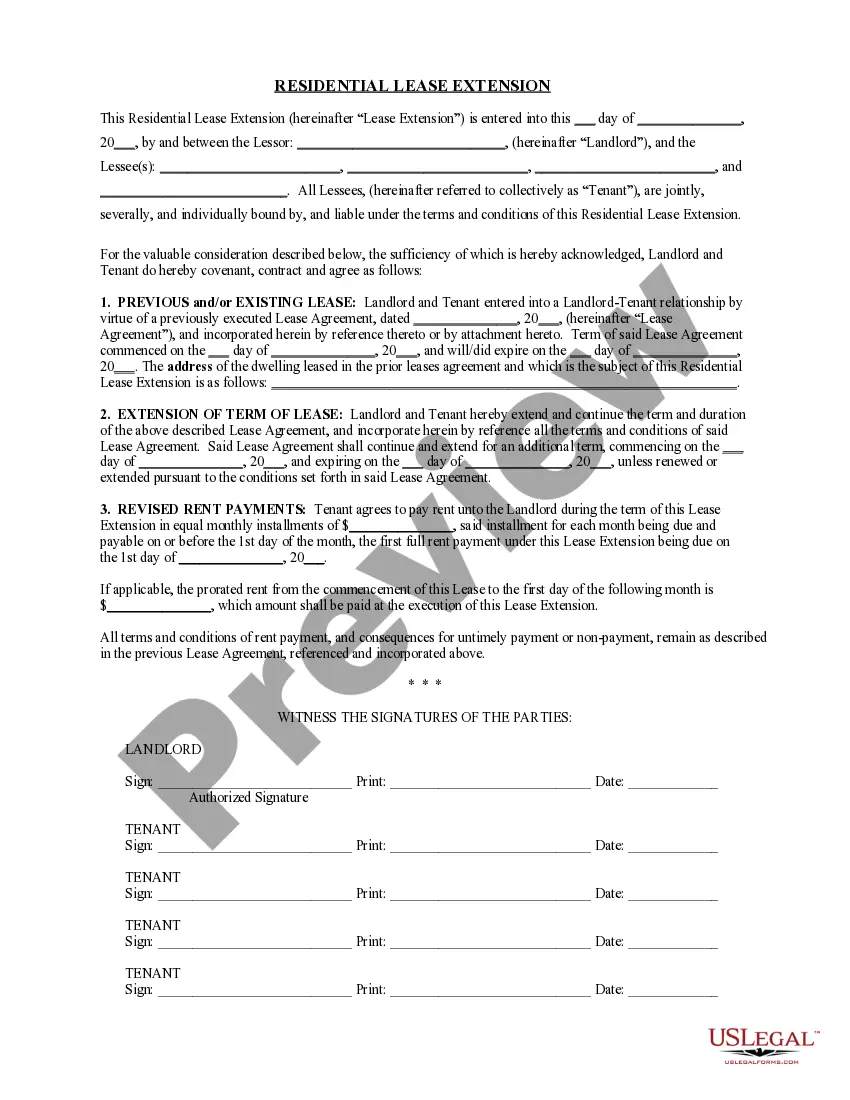

Use US Legal Forms to get a printable Wyoming Affidavit of Imputed Income. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue on the web and offers affordable and accurate samples for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and a few of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to easily find and download Wyoming Affidavit of Imputed Income:

- Check out to ensure that you get the correct template in relation to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Hit Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Wyoming Affidavit of Imputed Income. Above three million users already have utilized our service successfully. Choose your subscription plan and get high-quality documents in a few clicks.

Form popularity

FAQ

This answer is correct. The imputed income could also affect your partner's net paycheck, depending on what tax withholding elections are in effect (W-4). Imputed income would go away if/when you get married. Imputed income is the money you will save by not having to buy insurance.

One simple way to do the calculation is to determine the difference between your company's cost of an employee-only monthly premium and the cost of an employee-plus-one monthly premium. Multiply that number by 12 and you will get your total.

Unless specifically exempt, imputed income is added to the employee's gross (taxable) income.But it is treated as income so employers need to include it in the employee's form W-2 for tax purposes. Imputed income is subject to Social Security and Medicare tax but typically not federal income tax.

Unless specifically exempt, imputed income is added to the employee's gross (taxable) income.But it is treated as income so employers need to include it in the employee's form W-2 for tax purposes. Imputed income is subject to Social Security and Medicare tax but typically not federal income tax.

Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. This income is added to an employee's gross wages so employment taxes can be withheld.

Imputed income is adding value to cash or non-cash employee compensation to accurately withhold employment and income taxes. Basically, imputed income is the value of any benefits or services provided to an employee.Employers must add imputed income to an employee's gross wages to accurately withhold employment taxes.

The imputed income is reported on Form W-2 as taxable wages . In this example, $2 . 66 per pay would be added to the employee's W-2 wages . Assuming a 20% tax rate, this employee would have an annual impact of $13 .