Wyoming Schedule J: Your Expenses (Individuals) is a document used by taxpayers in the state of Wyoming to report their expenses. It is a form used to calculate the amount of itemized deductions allowed on the Wyoming individual income tax return. This form is divided into two parts: Part I is used to reporting expenses related to medical care, taxes, contributions, interest, and miscellaneous expenses; Part II is used to report expenses related to home mortgage interest, charitable contributions, casualty and theft losses, and other expenses. There are two types of Wyoming Schedule J: Your Expenses (Individuals): Form WY-J, which is used for returns with itemized deductions, and Form WY-J-NR, which is used for returns with no itemized deductions.

Wyoming Schedule J: Your Expenses (individuals)

Description

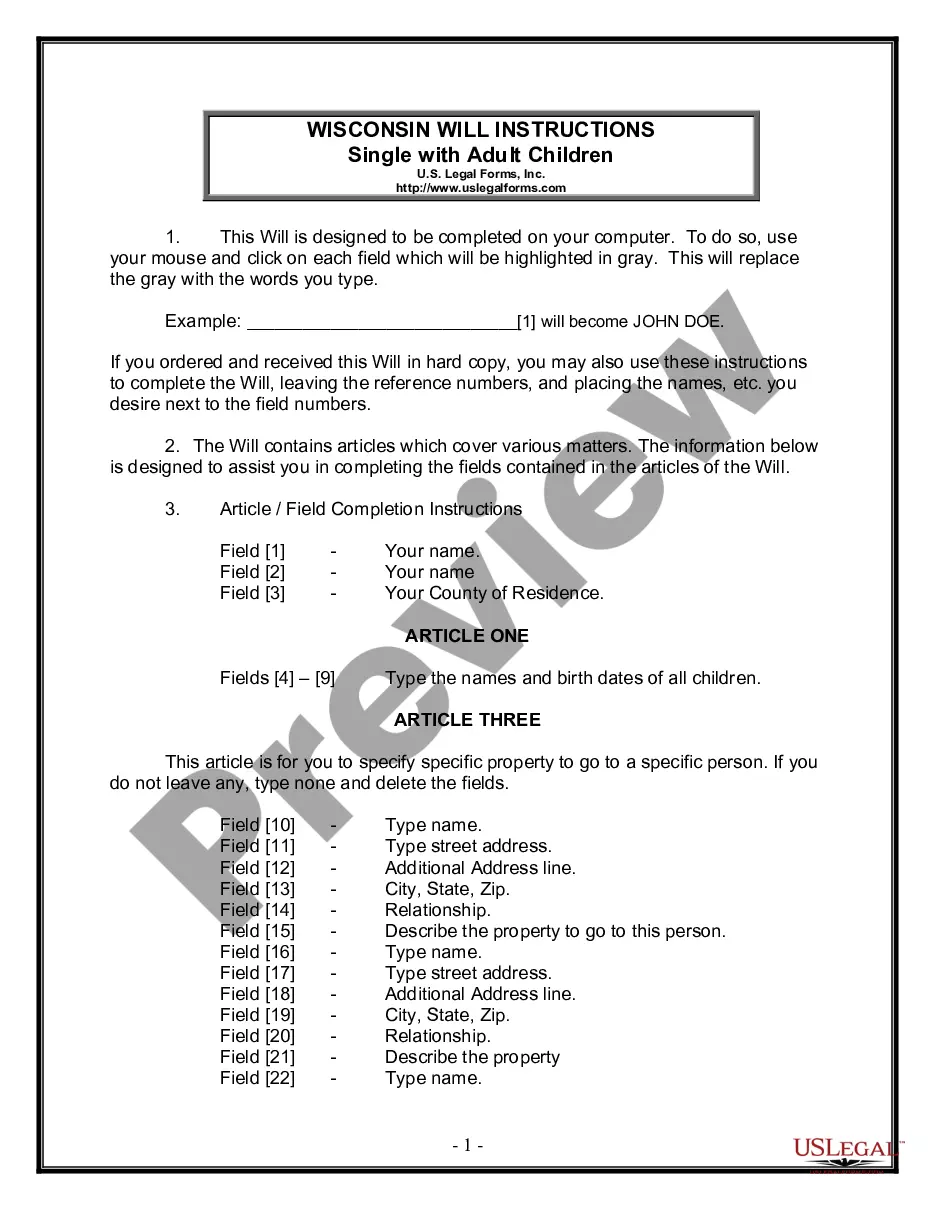

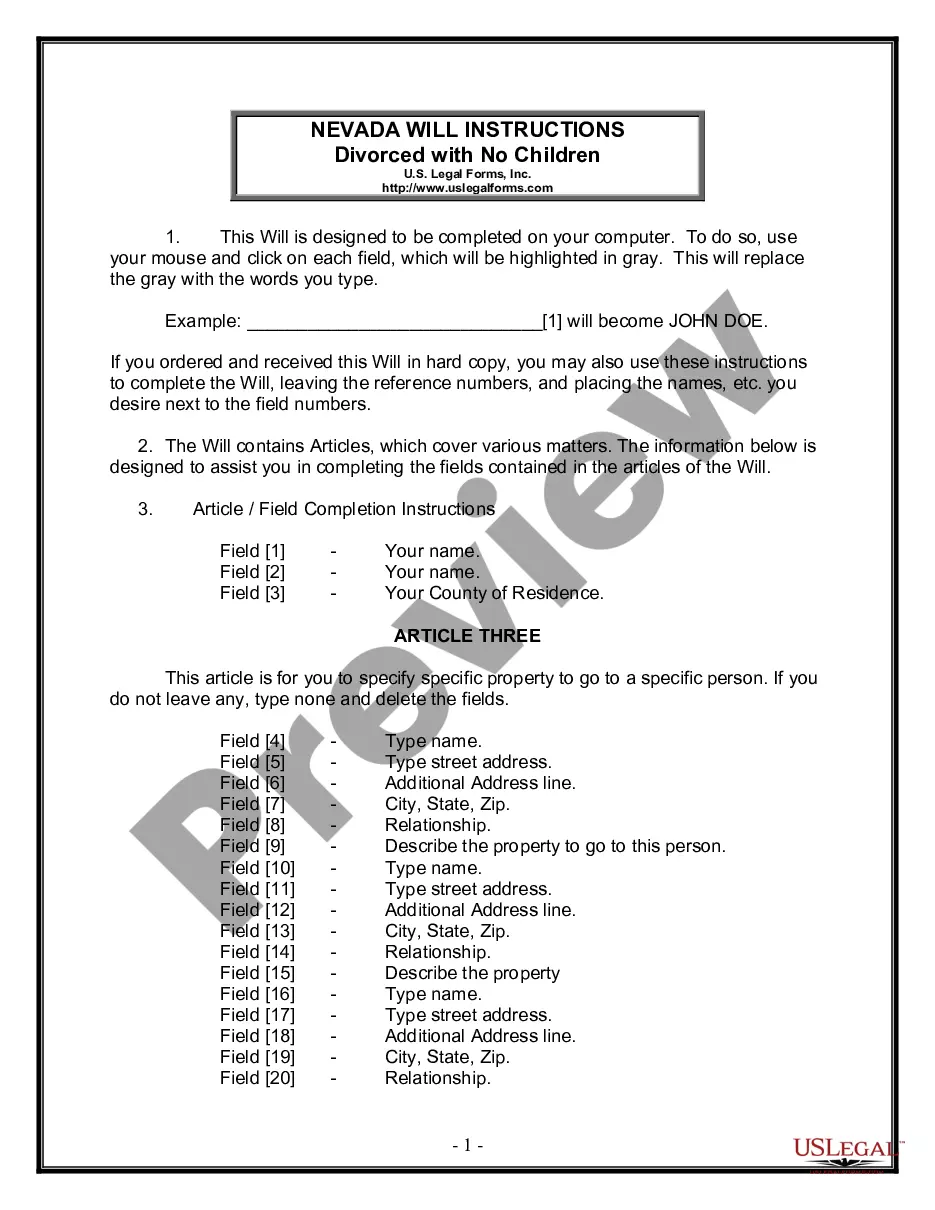

How to fill out Wyoming Schedule J: Your Expenses (individuals)?

How much time and resources do you usually spend on drafting formal documentation? There’s a better opportunity to get such forms than hiring legal specialists or spending hours searching the web for an appropriate template. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Wyoming Schedule J: Your Expenses (individuals).

To get and complete a suitable Wyoming Schedule J: Your Expenses (individuals) template, adhere to these easy steps:

- Look through the form content to ensure it meets your state regulations. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Wyoming Schedule J: Your Expenses (individuals). Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Wyoming Schedule J: Your Expenses (individuals) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth. Ideally, a company should have more assets than liabilities.

Completing Schedule J: Your Expenses Schedule J is where you list your current monthly expenses and all of your dependents, whether living in your household or not.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information.

Some of the monthly expenses that are listed on your Schedule J include your rent or mortgage payments, upkeep expenses on your home, utilities, food, gas, telephone, water, car maintenance, childcare, clothing, laundry, and vehicle maintenance.

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. Assets are reported on a company's balance sheet. They are bought or created to increase a firm's value or benefit the firm's operations.

Form Number: B 106I. Category: Individual Debtors. Effective onDecember 1, 2015. This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Services & Forms Forms. Schedule J-2: Expenses for Separate Household of Debtor 2 (individuals)