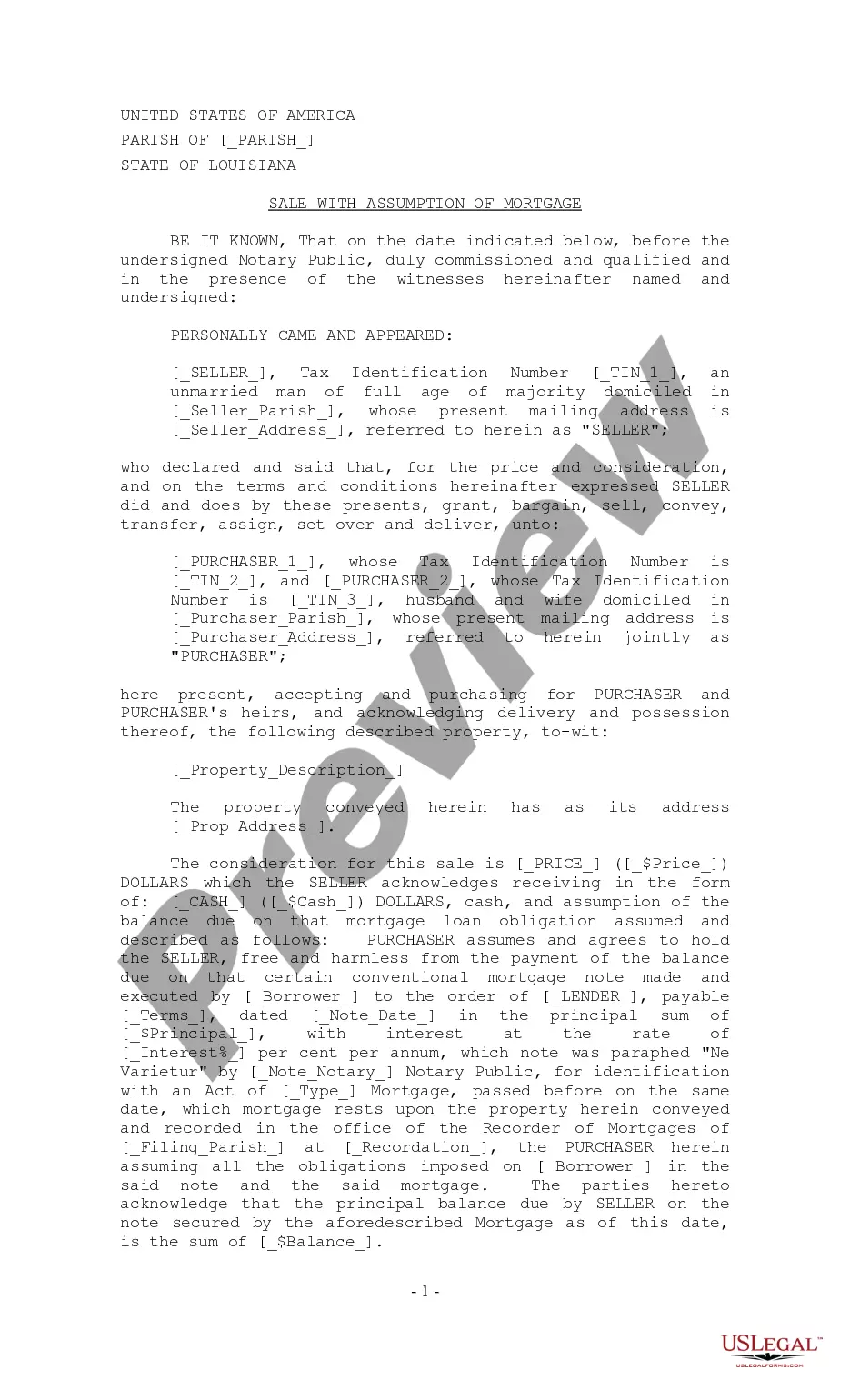

Wyoming Schedule I: Your Income (individuals) is an itemized form used by Wyoming residents to report their income to the state. It covers all types of income, including wages, salaries, tips, interest, dividends, capital gains, and other income sources. Wyoming Schedule I have three different versions depending on the taxpayer's filing status: Single, Head of Household, and Married Filing Separately. The form is used to calculate the taxpayer's Adjusted Gross Income (AGI) and to report any deductions that might apply. It is then used to calculate the taxpayer's Wyoming taxable income and any applicable tax credits.

Wyoming Schedule I: Your Income (individuals)

Description

How to fill out Wyoming Schedule I: Your Income (individuals)?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are examined by our specialists. So if you need to prepare Wyoming Schedule I: Your Income (individuals), our service is the perfect place to download it.

Obtaining your Wyoming Schedule I: Your Income (individuals) from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the correct template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Wyoming Schedule I: Your Income (individuals) and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

One easy way to calculate how much income per month is to total the payments earned in a year, then divide by 12 to get a monthly figure. For example, if you are paid seasonally, you would simply divide the amount you expect to earn in a year by 12 to get the monthly amount.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information.

Form Number: B 106I. Category: Individual Debtors. Effective onDecember 1, 2015. This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. Assets are reported on a company's balance sheet. They are bought or created to increase a firm's value or benefit the firm's operations.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth. Ideally, a company should have more assets than liabilities.