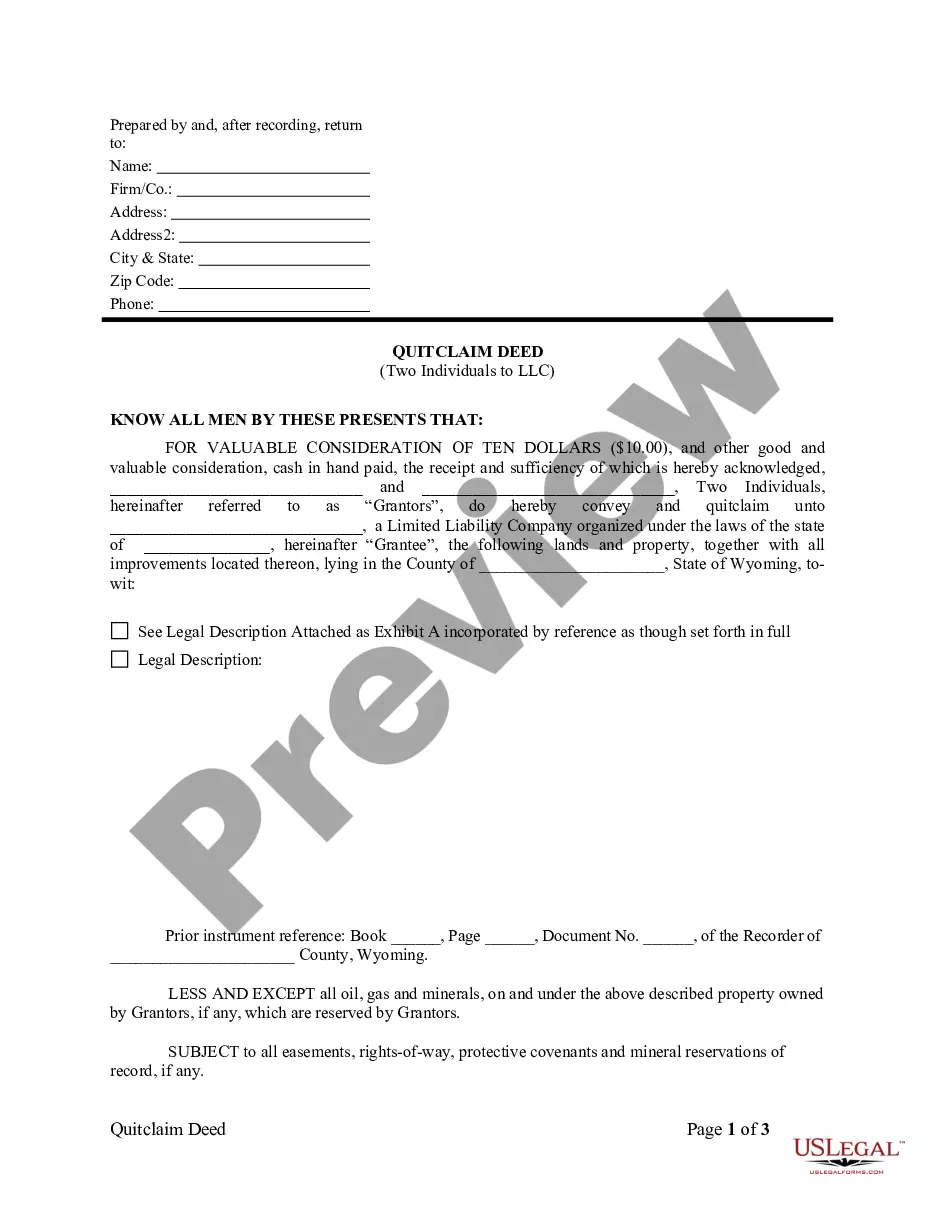

Wyoming Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Wyoming Quitclaim Deed By Two Individuals To LLC?

Out of the large number of services that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing templates prior to buying them. Its complete catalogue of 85,000 templates is grouped by state and use for simplicity. All of the forms available on the platform have already been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the form, hit Download and gain access to your Form name from the My Forms; the My Forms tab holds your saved documents.

Stick to the tips below to obtain the form:

- Once you find a Form name, ensure it is the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the template.

- Search for a new sample using the Search engine if the one you have already found isn’t appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

When you’ve downloaded your Form name, you may edit it, fill it out and sign it in an online editor of your choice. Any form you add to your My Forms tab might be reused many times, or for as long as it remains the most up-to-date version in your state. Our platform offers fast and easy access to templates that suit both lawyers as well as their clients.

Form popularity

FAQ

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Gift Tax. If you transfer property without consideration, you are effectively making a gift, regardless of whether you use a quitclaim deed or a gift deed. The Internal Revenue Service imposes federal gift tax rules to gift transactions.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

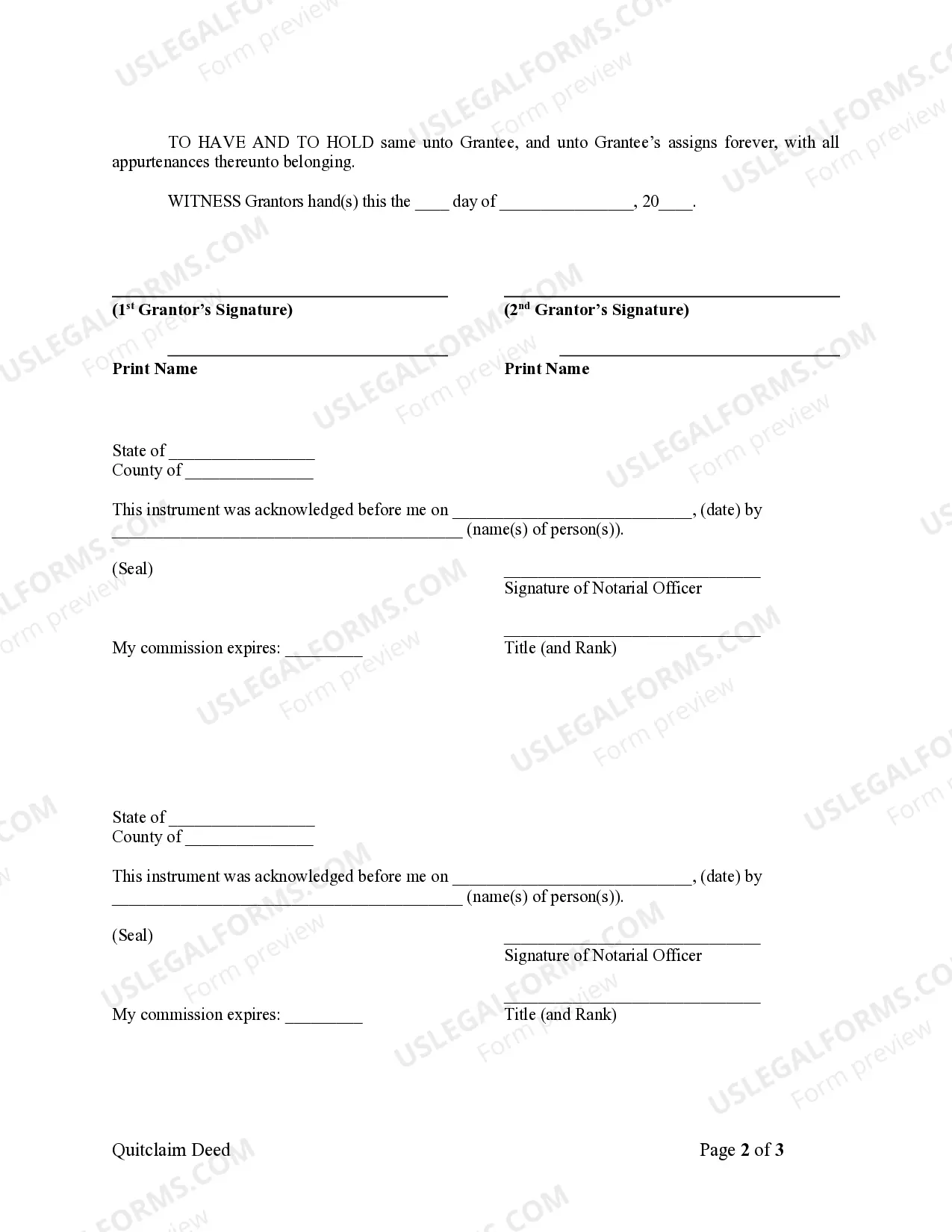

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.