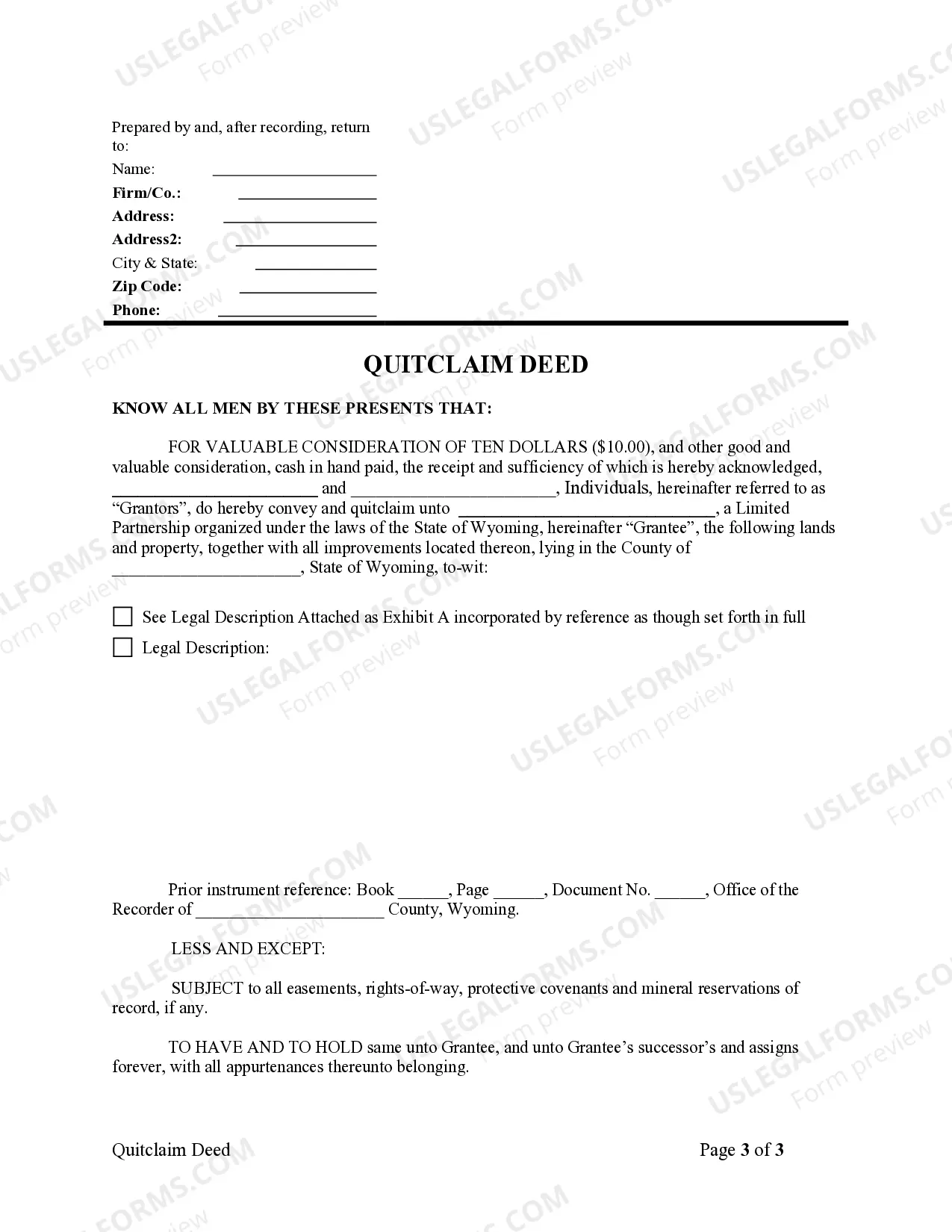

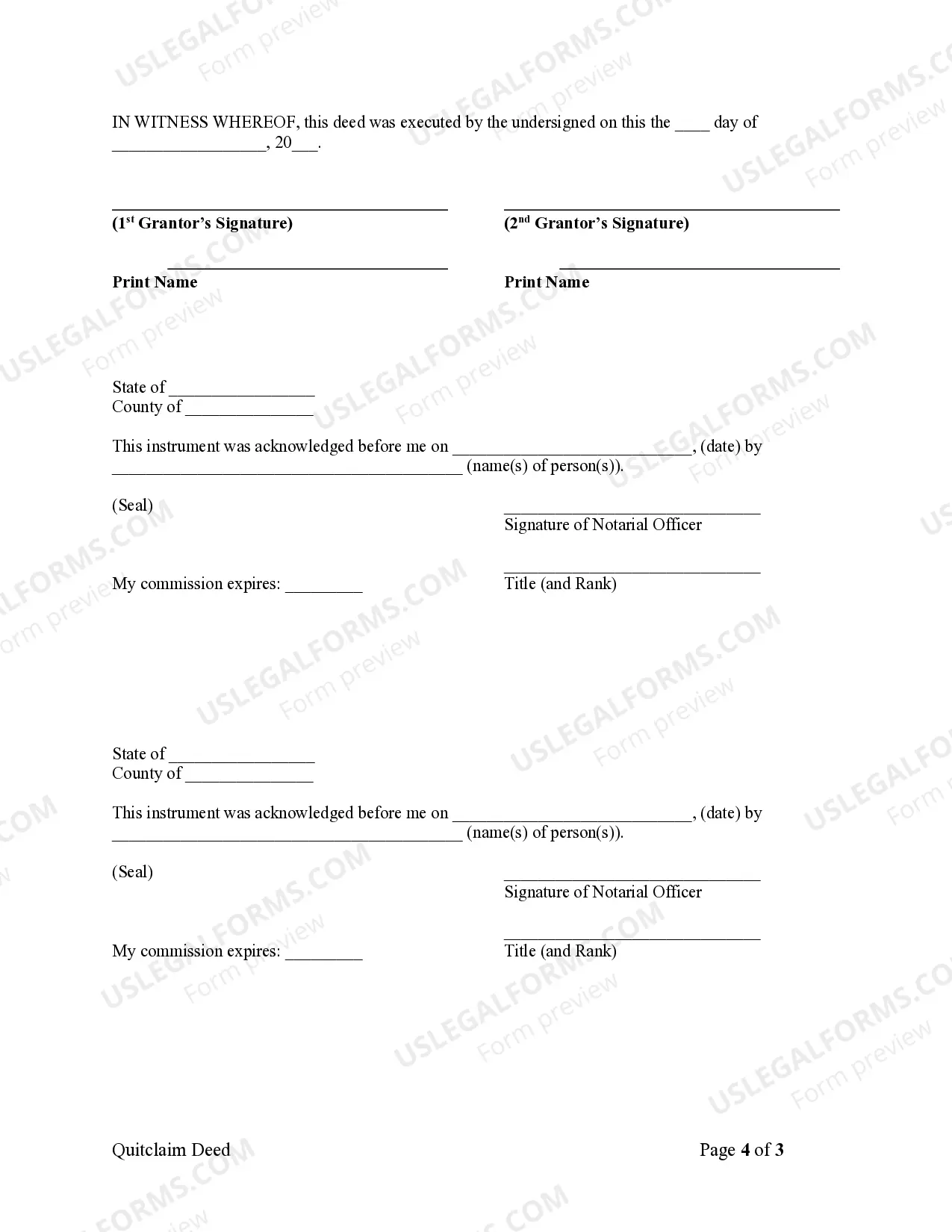

This form is a Quitclaim Deed where the grantors are husband and wife, or two individuals, and the grantee is a limited partnership. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Wyoming Quitclaim Deed - Two Individuals or Husband and Wife to Limited Partnership

Description

How to fill out Wyoming Quitclaim Deed - Two Individuals Or Husband And Wife To Limited Partnership?

Out of the large number of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before buying them. Its extensive library of 85,000 templates is categorized by state and use for efficiency. All of the forms available on the platform have been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, click Download and access your Form name from the My Forms; the My Forms tab keeps all of your saved forms.

Keep to the guidelines below to obtain the form:

- Once you see a Form name, ensure it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new template using the Search engine in case the one you’ve already found is not correct.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

After you have downloaded your Form name, it is possible to edit it, fill it out and sign it in an online editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service provides fast and easy access to templates that fit both attorneys and their clients.

Form popularity

FAQ

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.