West Virginia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity

Definition and meaning

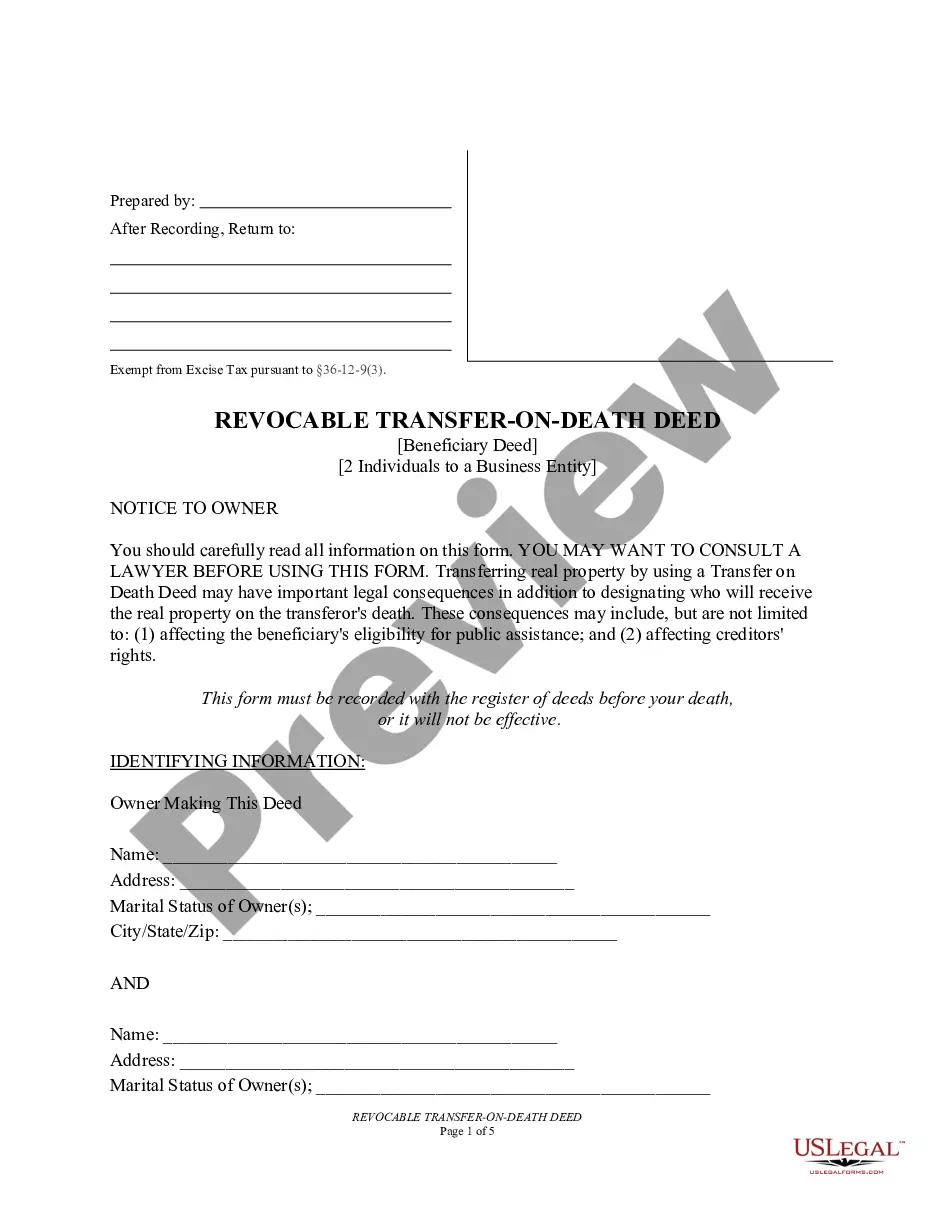

A West Virginia Transfer on Death Deed, commonly known as a TOD or Beneficiary Deed, allows individuals to transfer real property to specified beneficiaries upon their death. This deed is particularly useful for individuals in a marital relationship who wish to designate a business entity as a beneficiary. Upon the death of the property owner, the deed ensures that the property does not go through probate, simplifying the transfer process and providing clarity regarding ownership.

How to complete a form

To complete the West Virginia Transfer on Death Deed, follow these steps:

- Provide the names and addresses of the owners making the deed.

- Indicate the marital status of the owners.

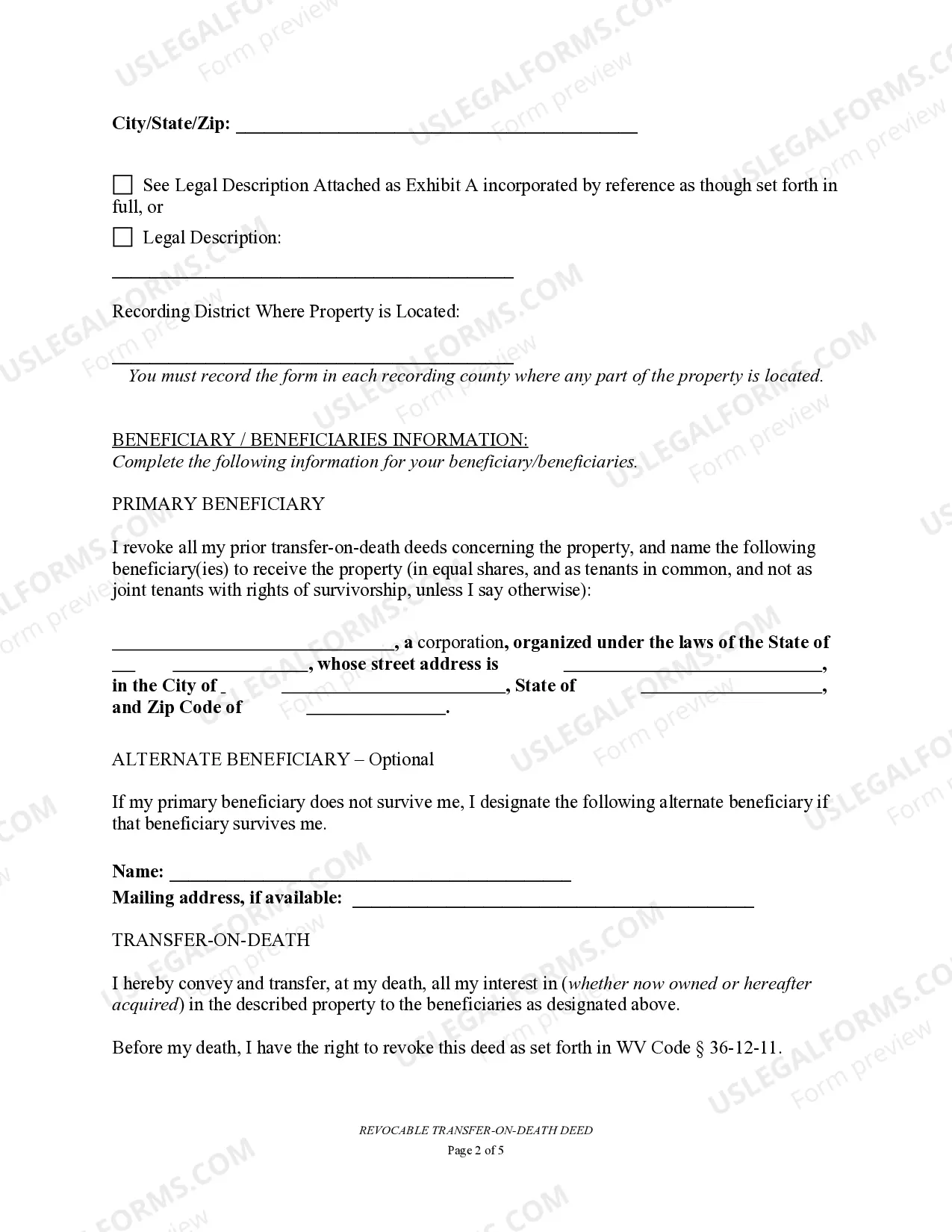

- Include a legal description of the property being transferred.

- Specify the names and addresses of the primary and alternate beneficiaries.

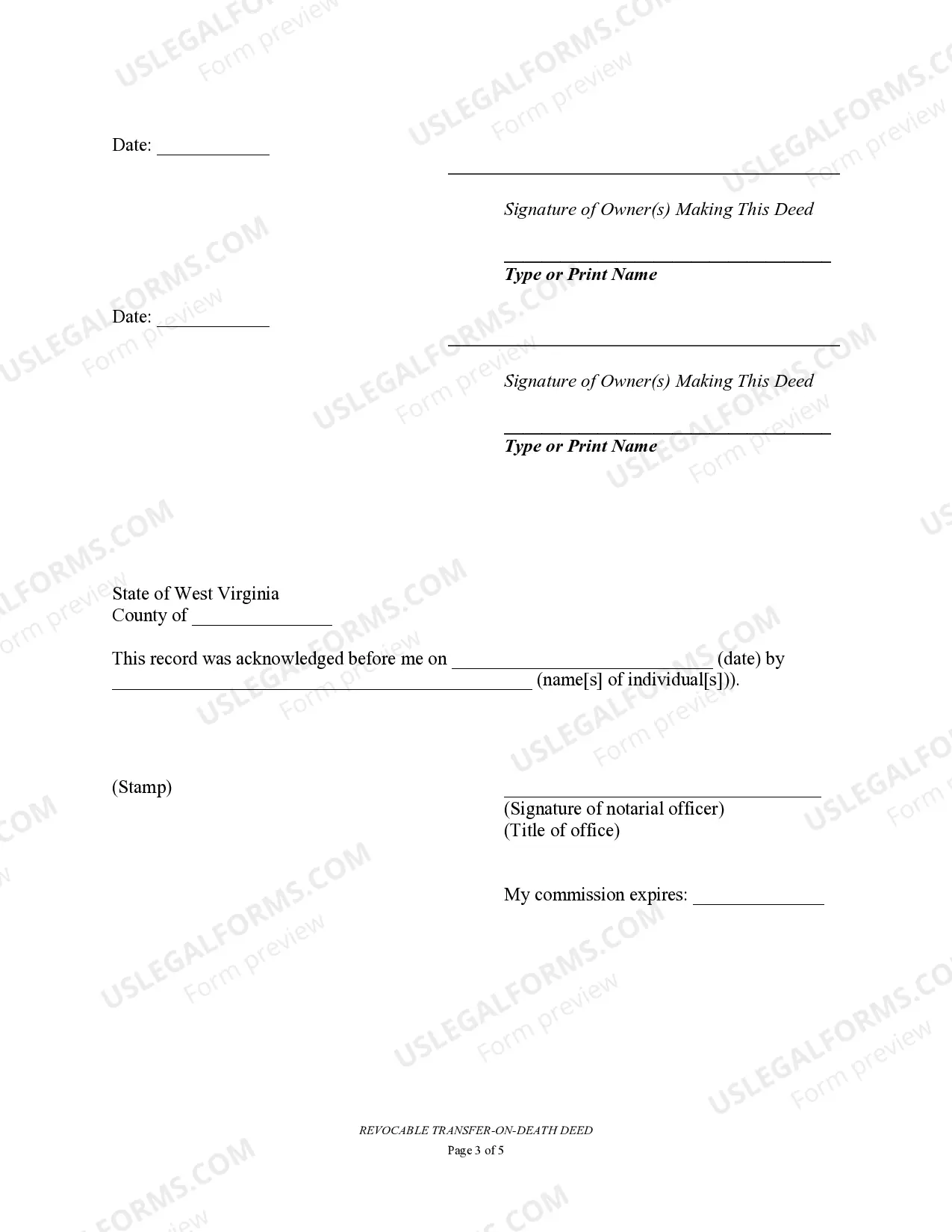

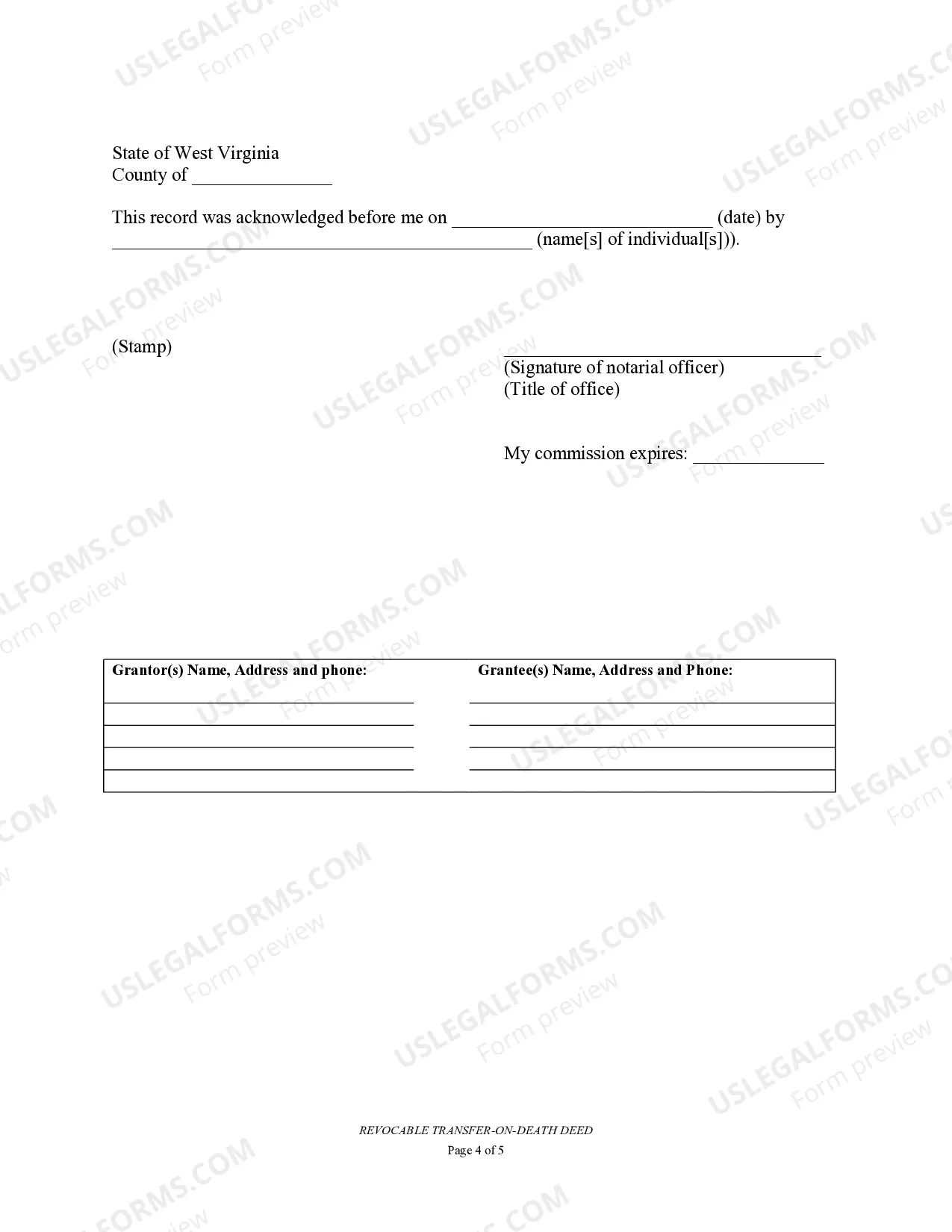

- Sign and date the document in the presence of a notary public.

- Record the completed deed with the local county register of deeds office.

Who should use this form

This form is ideal for couples who own property together and want to ensure a smooth transfer of their property to a business entity after their death. Individuals considering estate planning, especially those wanting to minimize probate complications, should also consider using this deed. It is a practical option for those who have a clear understanding of their beneficiaries and wish to make their intentions known legally.

State-specific requirements

In West Virginia, specific regulations govern the use of Transfer on Death Deeds. The form must be executed as per West Virginia Code § 36-12-11. It is necessary that the deed is recorded with the appropriate county register of deeds before the death of the property owner for it to be valid. Additionally, the deed must clearly state the name and address of the business entity designated as the beneficiary.

Common mistakes to avoid when using this form

When utilizing the West Virginia Transfer on Death Deed, avoid the following mistakes:

- Failing to provide complete information for all parties involved.

- Not recording the deed before the death of the property owner.

- Incorrectly describing the property, leading to potential legal disputes.

- Neglecting to have the deed notarized, which can invalidate the document.