West Virginia Contribution Agreement Form

Description

How to fill out Contribution Agreement Form?

US Legal Forms - one of many greatest libraries of authorized types in America - delivers an array of authorized papers templates it is possible to obtain or produce. Using the website, you can find a large number of types for business and person uses, sorted by classes, claims, or keywords and phrases.You will discover the most recent variations of types just like the West Virginia Contribution Agreement Form in seconds.

If you already possess a membership, log in and obtain West Virginia Contribution Agreement Form from your US Legal Forms catalogue. The Acquire option will appear on every type you perspective. You gain access to all earlier delivered electronically types in the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, allow me to share easy directions to get you started:

- Ensure you have chosen the proper type for the area/state. Click on the Preview option to analyze the form`s articles. See the type explanation to ensure that you have selected the proper type.

- In the event the type does not fit your requirements, take advantage of the Search discipline near the top of the display to find the one that does.

- When you are pleased with the shape, validate your decision by clicking the Purchase now option. Then, choose the rates prepare you prefer and offer your credentials to register to have an accounts.

- Method the deal. Make use of Visa or Mastercard or PayPal accounts to complete the deal.

- Choose the structure and obtain the shape on your gadget.

- Make modifications. Complete, modify and produce and signal the delivered electronically West Virginia Contribution Agreement Form.

Each template you added to your money lacks an expiry date and is your own property eternally. So, if you want to obtain or produce yet another copy, just go to the My Forms section and click around the type you will need.

Get access to the West Virginia Contribution Agreement Form with US Legal Forms, probably the most extensive catalogue of authorized papers templates. Use a large number of specialist and condition-certain templates that meet your business or person requirements and requirements.

Form popularity

FAQ

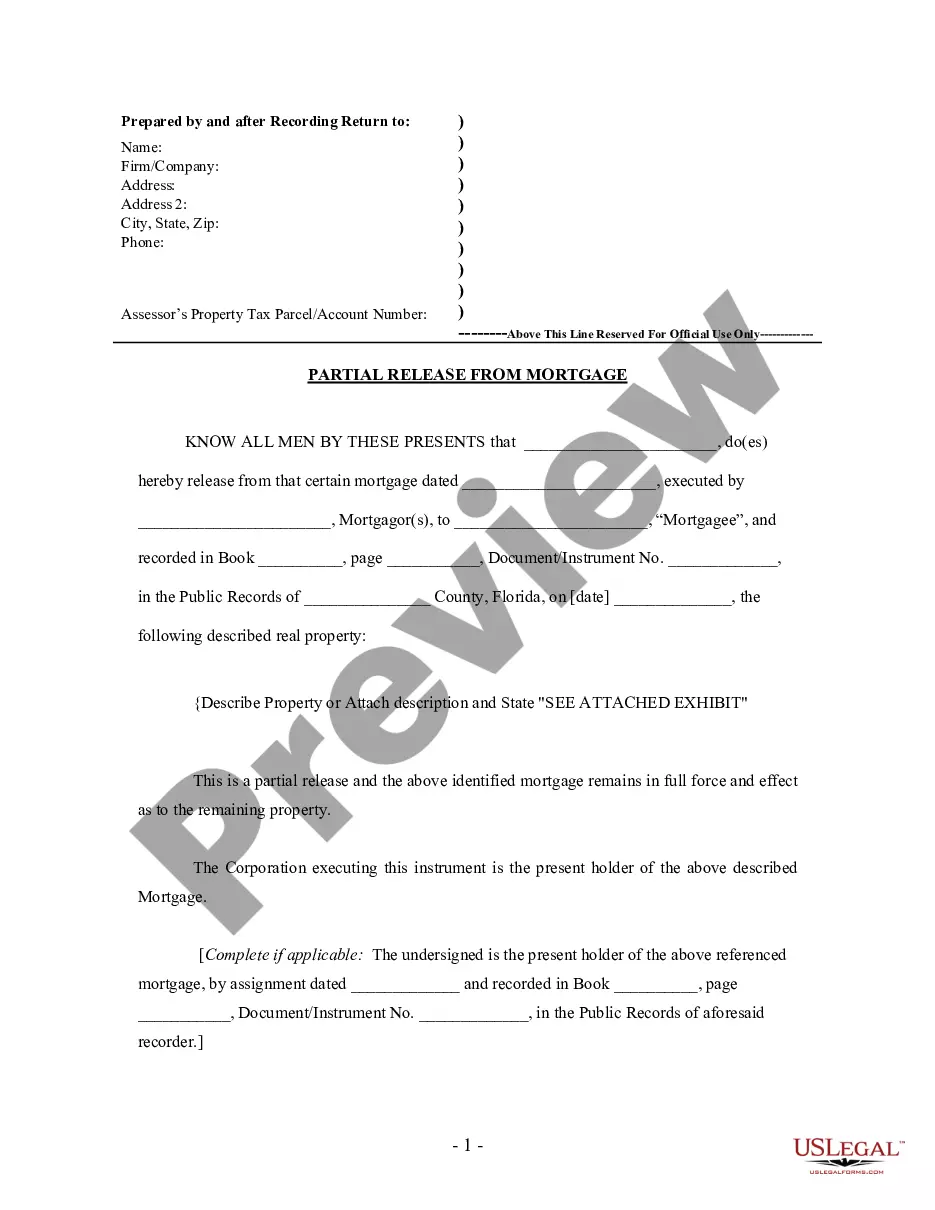

Declaration of consideration or value. The declaration states the property's value or the payment, called consideration, made for the property. The current owner, new owner, or another responsible party must sign the declaration. The West Virginia Code suggests language for a declaration of consideration or value.

PA and WV have a reciprocal agreement that you pay state taxes on your income only where you live and not where you work. What is happening for you depends on what is shown on your W-2.

Declaration of Consideration of Value (This is the monetary amount for which the property is sold. If the property is being transferred without monetary value, it must state in the declaration paragraph 'why' it is exempt from transfer tax.)

-- Every employer maintaining an office or transacting business within this state and making payment of any wage taxable under this article to a resident or nonresident individual shall deduct and withhold from such wages for each payroll period a tax computed in such manner as to result, so far as practicable, in ...

The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt. Household goods and personal effects not used for commercial purposes.

West Virginia Code §11-22-1, provides for exemptions to paying the Transfer Tax Fee. Deeds must specifically state the reason for exemption, otherwise, the Transfer Tax Fee will be charged. Every Deed recorded requires a completed Sales Listing Form to be attached. The Sales Listing Form can be found here.

The Transfer Tax Fee is $5.50 for every $1,000.00 of the purchase price, or value of the property when the purchase price is not listed on the Deed. All Deeds recorded in West Virginia are subject to an Excise Tax (Transfer Tax Fee).

The followings are exempt from the transfer tax: (1) wills; (2) testamentary or inter vivos trusts; (3) deeds of partition; (4) deeds made pursuant to mergers of corporations, limited liability companies, partnerships, and limited partnerships; (5) deeds made pursuant to conversions to limited liability companies; (6) ...

(a) A parent is barred from inheriting from or through a child of the parent if: (1) The parent's parental rights were terminated by court order and the parent-child relationship has not been judicially reestablished; or (2) the child died before reaching 18 years of age and there is clear and convincing evidence that ...

What Is a West Virginia Quitclaim Deed? West Virginia real estate owners can transfer ownership by signing and recording a deed. 1. A quitclaim deed is a specific deed form that transfers whatever claim or interest the signer has in the property without guaranteeing the property's title is clear or valid.