Florida Partial Release of Property From Mortgage for Corporation

Description

How to fill out Florida Partial Release Of Property From Mortgage For Corporation?

Access one of the most comprehensive collections of legal documents.

US Legal Forms is a service where you can discover any state-specific file within moments, such as Florida Partial Release of Property From Mortgage for Corporation forms.

There's no need to waste countless hours searching for a court-approved sample.

Then, download the sample to your device by clicking on the Download button. That’s it! You should complete the Florida Partial Release of Property From Mortgage for Corporation template and review it. To ensure accuracy, consult with your local legal advisor for assistance. Sign up and effortlessly explore over 85,000 valuable templates.

- Our certified professionals guarantee you obtain current samples consistently.

- To benefit from the forms library, choose a subscription and create an account.

- If you have registered, simply Log In and select the Download button.

- The Florida Partial Release of Property From Mortgage for Corporation form will be instantly saved in the My documents section (a section for every document you store on US Legal Forms).

- To establish a new account, follow the straightforward instructions below.

- If you plan to use a state-specific template, ensure you select the correct state.

- If possible, examine the description to grasp all the specifics of the form.

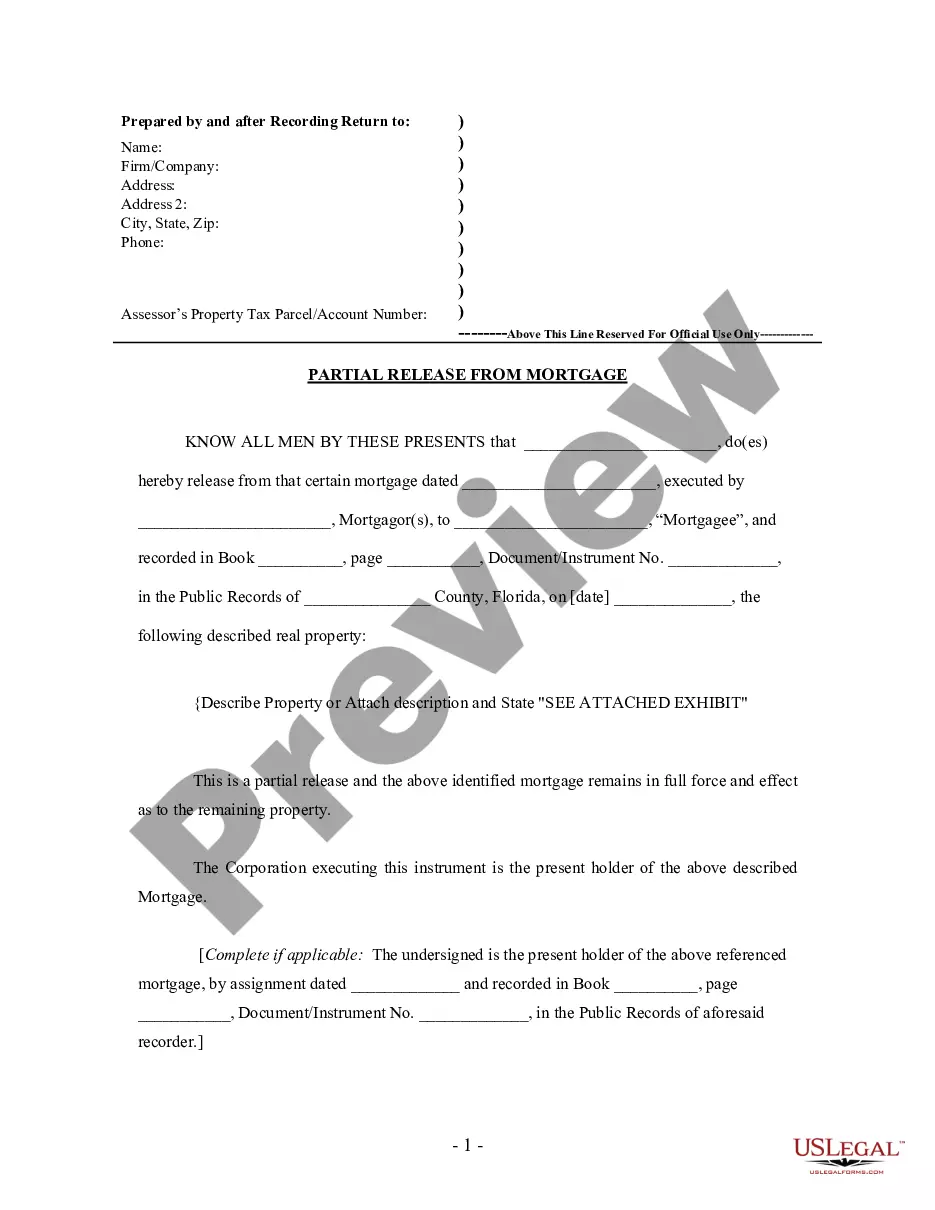

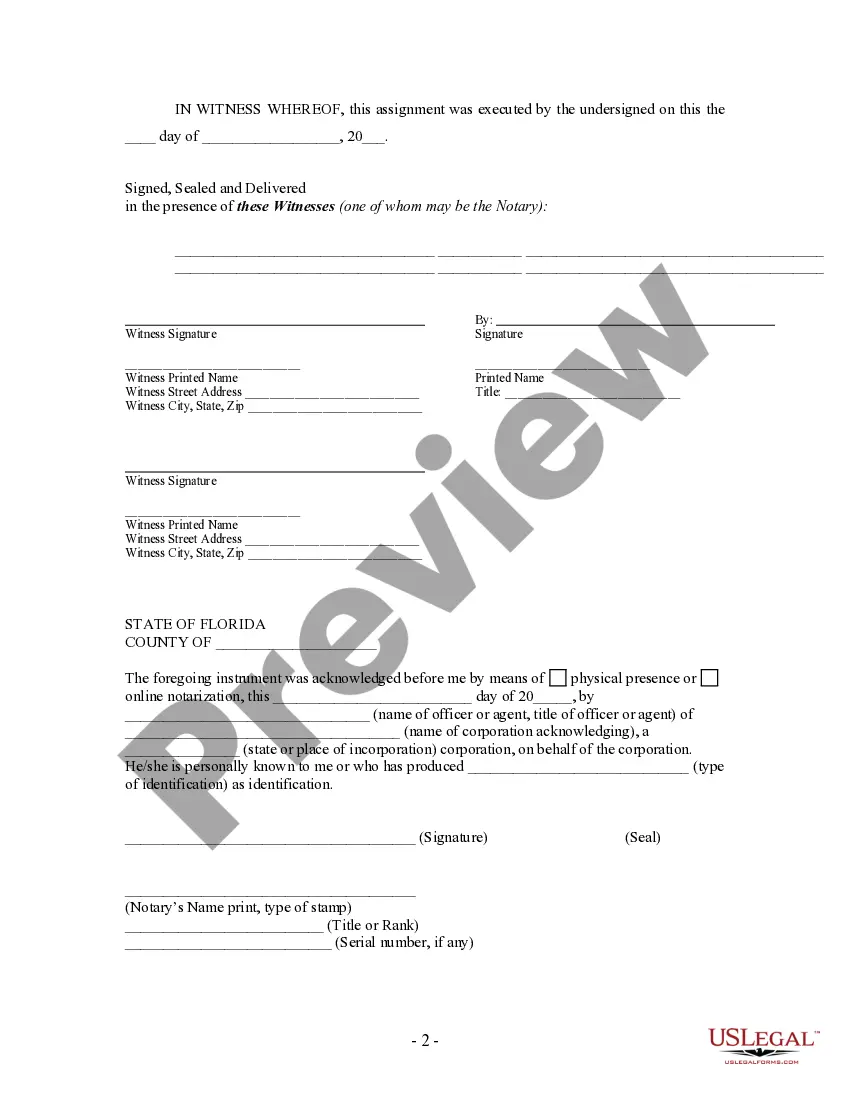

- Utilize the Preview feature if it's available to view the document details.

- If everything appears accurate, click the Buy Now button.

- After choosing a pricing option, set up an account.

- Make the payment using credit card or PayPal.

Form popularity

FAQ

To release your mortgage in Florida, you need to file a Florida Partial Release of Property From Mortgage for Corporation with the local county clerk's office. First, gather your mortgage documents and any additional paperwork required by your lender. Next, ensure you follow any specific instructions provided by your lender for a smooth process. Using our platform, USLegalForms, you can find templates and guidance to simplify the preparation of these documents, ensuring accuracy and compliance.

The partial release clause in Florida outlines the conditions under which a lender agrees to release a portion of the property secured by a mortgage or deed of trust. This clause is particularly beneficial for corporations looking to optimize their property holdings without incurring penalties or losing their entire property investment. Knowing how to leverage this clause is essential for businesses in Florida. USLegalForms provides the necessary resources and templates to help navigate these regulations confidently.

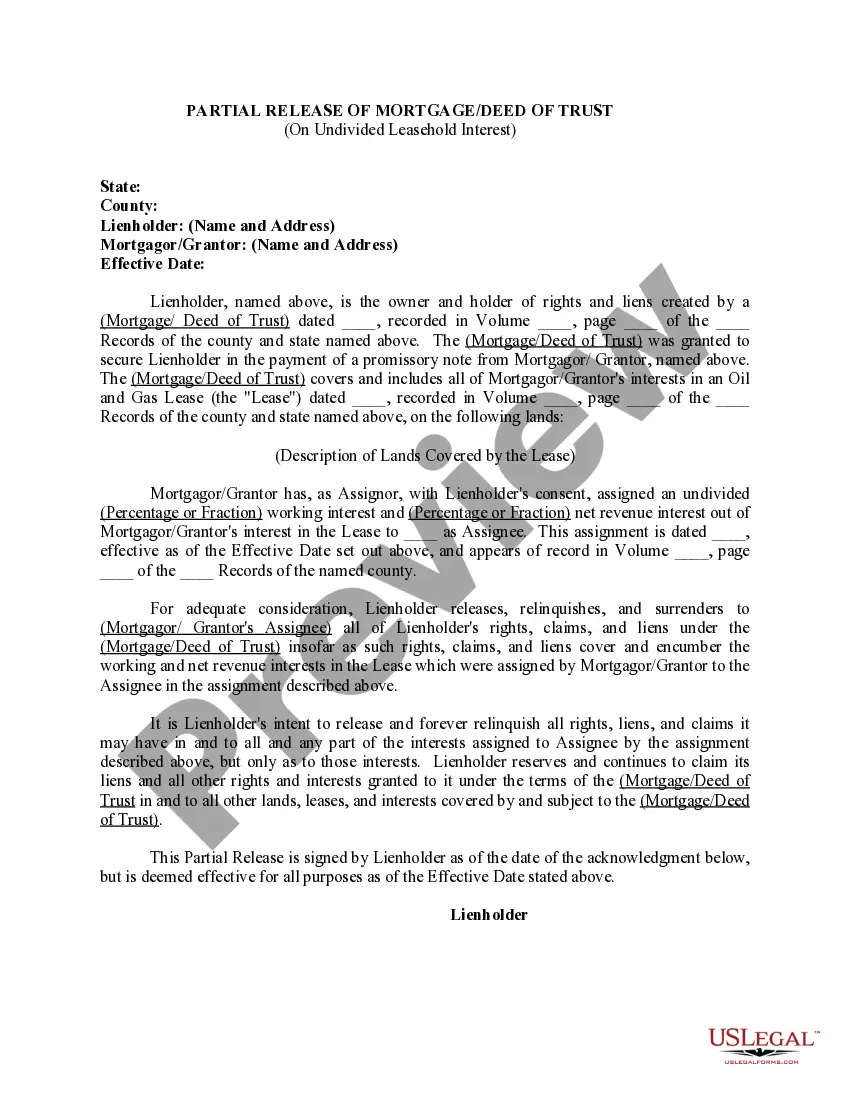

A partial release of a deed of trust operates similarly to a partial release of lien. This legal process allows part of the secured property to be released while maintaining the integrity of the trust on the remaining property. It is commonly used by corporations to manage their assets more effectively without paying off the entire debt. When considering this process, it is crucial for organizations in Florida to be aware of their rights and responsibilities regarding the Florida Partial Release of Property From Mortgage for Corporation.

Obtaining a partial release of a mortgage involves a few straightforward steps. First, you need to negotiate with your lender about the specific property you want to release. After securing agreement, you'll need to provide documentation proving the property’s value and that the mortgage will be honored by the remaining secured property. Utilizing platforms like USLegalForms can simplify this process, ensuring you have the necessary forms and guidance tailored for the Florida Partial Release of Property From Mortgage for Corporation.

A partial release of lien allows a portion of the property secured by the mortgage to be freed from the lien while keeping the rest of the property under the mortgage. This process is essential for corporations looking to sell or refinance part of their property without affecting the entire mortgage. It ensures that the remaining property continues to secure the mortgage, providing financial flexibility. Understanding this aspect is vital for corporations operating in Florida.

The partial release of a mortgage involves a formal request to the lender to release a specific property from the mortgage. Once the lender approves the request, they will issue a document that outlines the release. This process allows corporations to manage their assets better and is an essential part of strategically using a Florida Partial Release of Property From Mortgage for Corporation, especially in real estate development.

A partial discharge of a mortgage occurs when a lender agrees to release a portion of the property from the mortgage agreement. This usually applies to specific parcels of land or properties while keeping the rest of the mortgage intact. Such a process can facilitate the sale or development of part of a property, and it’s essential for corporations to know about Florida Partial Release of Property From Mortgage for Corporation to maximize their investment strategies.

In Florida, when there is a mortgage, the property owner typically retains ownership, while the lender holds a security interest in the property. This means that you, as the property owner, can use and enjoy the property, but the lender has the right to reclaim it if you fail to meet your mortgage obligations. Understanding the nuances of ownership can help you navigate the process more effectively, especially if you consider a Florida Partial Release of Property From Mortgage for Corporation.

To secure a Florida Partial Release of Property From Mortgage for Corporation, you typically need to provide a request form, proof of ownership, and sometimes a valuation of the property to the lender. Additionally, payment of applicable fees and any necessary documentation about the remaining mortgage will be required. Each lender may have specific requirements based on their policies, making it wise to familiarize yourself with these provisions. Leveraging tools from uslegalforms can help you organize and understand what you need to prepare.

A partial release is a legal process that allows part of a mortgaged property to be freed from the mortgage obligation. This means that the remaining property still has the mortgage tied to it, but specific portions are released to facilitate sale or modification without fully dissolving the mortgage. For a corporation, this can add flexibility in managing assets and liabilities while maintaining operational stability. Platforms like uslegalforms can provide valuable tools to navigate these legal processes.