West Virginia Independent Sales Representative Agreement - Software and Computer Systems

Description

How to fill out Independent Sales Representative Agreement - Software And Computer Systems?

If you need to compile, obtain, or create legal document templates, utilize US Legal Forms, the primary collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to find the documents you require. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to locate the West Virginia Independent Sales Representative Agreement - Software and Computer Systems in just a few clicks.

Every legal document template you obtain is yours permanently. You have access to each form you acquired in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the West Virginia Independent Sales Representative Agreement - Software and Computer Systems with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the West Virginia Independent Sales Representative Agreement - Software and Computer Systems.

- You can also access forms you previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

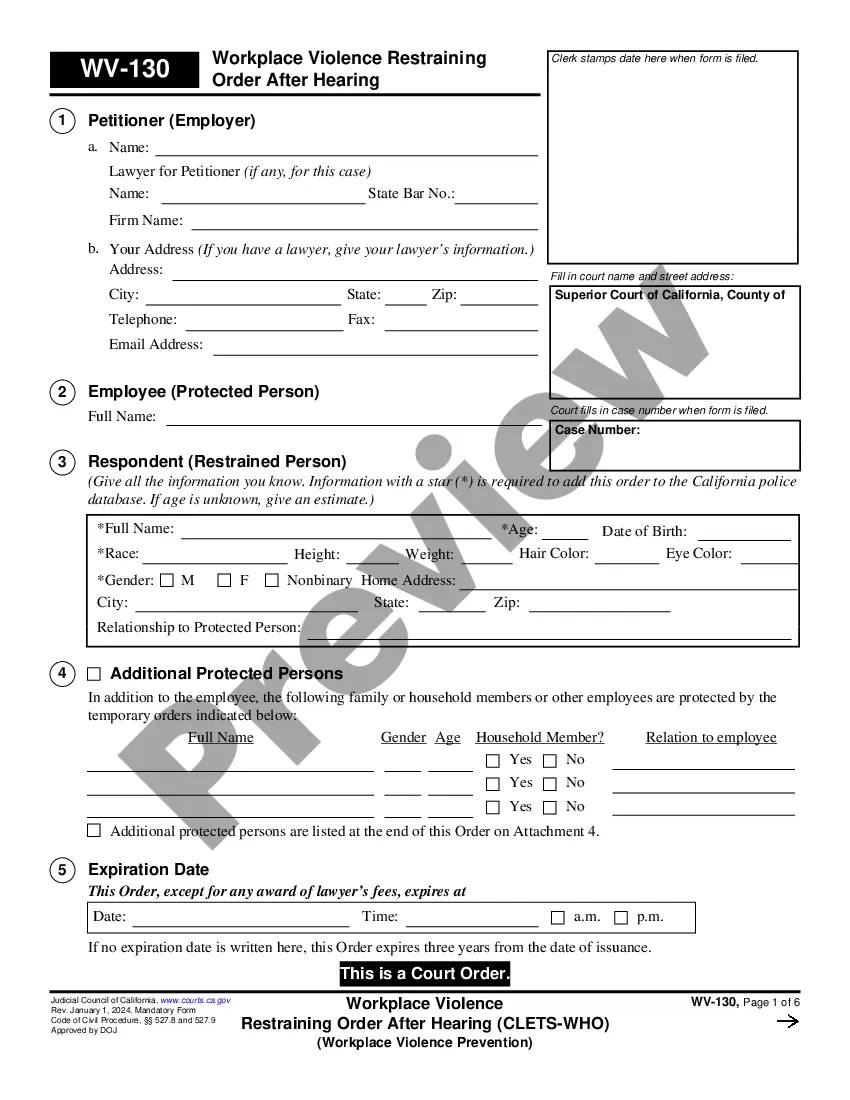

- Step 2. Use the Preview option to review the form's details. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the West Virginia Independent Sales Representative Agreement - Software and Computer Systems.

Form popularity

FAQ

The agreement between a company and a sales agent details the terms under which the agent will sell the company's products or services. This includes the commission structure, territory, and duration of the agreement. By utilizing a West Virginia Independent Sales Representative Agreement - Software and Computer Systems, businesses can effectively manage their sales force while ensuring that both the company and the sales agent are aligned in their goals. Such agreements promote transparency and can lead to more successful sales outcomes.

A sales representative agreement is a legal document that outlines the relationship between a company and its sales representatives. This agreement specifies the duties, compensation, and terms of the sales activities. For those in West Virginia, having a West Virginia Independent Sales Representative Agreement - Software and Computer Systems ensures compliance with local laws while protecting both parties. This agreement helps to clarify expectations and responsibilities, fostering a more efficient sales process.

In Virginia, the taxability of software depends on its delivery method. If the software is provided as a service, it may be exempt from sales tax. However, packaged software typically incurs tax. For businesses operating in both states, a West Virginia Independent Sales Representative Agreement - Software and Computer Systems can clarify tax obligations and ensure compliance.

In West Virginia, several items are exempt from sales tax, including certain food products, prescription medications, and some types of services. Software delivered as a service may also qualify for exemption. To fully understand the exemptions applicable to your business, especially when dealing with software, refer to the West Virginia Independent Sales Representative Agreement - Software and Computer Systems.

Yes, certain types of software are taxable in West Virginia. If you sell software as a tangible product, it is generally subject to sales tax. However, software sold as a service may be exempt. Clarifying your sales structure with a West Virginia Independent Sales Representative Agreement - Software and Computer Systems can help you navigate these tax considerations.

To register a remote vendor in West Virginia, you need to complete the online registration process through the West Virginia State Tax Department. This process includes providing your business information and details about your products or services. If you plan to sell software, understanding the West Virginia Independent Sales Representative Agreement - Software and Computer Systems can help streamline your operations.

West Virginia has reciprocity agreements with several states, allowing for smoother business transactions across state lines. States like Ohio and Pennsylvania have such agreements, which can benefit businesses operating under a West Virginia Independent Sales Representative Agreement - Software and Computer Systems. Being informed of these relationships can streamline operations and reduce tax liabilities.

Certain items and services are exempt from sales tax in West Virginia, including specific food items and prescription medications. Additionally, some services may also qualify for exemptions. To fully understand these exemptions, businesses should refer to the West Virginia Independent Sales Representative Agreement - Software and Computer Systems for guidance.

The sales tax rate for Software as a Service (SaaS) in West Virginia is typically set at the state’s standard rate. At present, this rate is 6%. Understanding how this tax applies within the context of the West Virginia Independent Sales Representative Agreement - Software and Computer Systems is crucial for effective financial planning.

Yes, Software as a Service (SaaS) is generally considered taxable in West Virginia. This means businesses providing SaaS must be aware of their tax obligations. Utilizing a well-crafted West Virginia Independent Sales Representative Agreement - Software and Computer Systems can help clarify these obligations and ensure compliance.