West Virginia Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

Are you currently in the place that you need to have papers for both business or individual reasons just about every day time? There are tons of authorized record layouts available on the Internet, but getting versions you can rely on is not straightforward. US Legal Forms delivers thousands of develop layouts, just like the West Virginia Notice of Violation of Fair Debt Act - Improper Document Appearance, which are written to satisfy state and federal needs.

If you are already acquainted with US Legal Forms web site and have an account, simply log in. Following that, it is possible to acquire the West Virginia Notice of Violation of Fair Debt Act - Improper Document Appearance format.

If you do not come with an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the develop you need and ensure it is for that proper city/area.

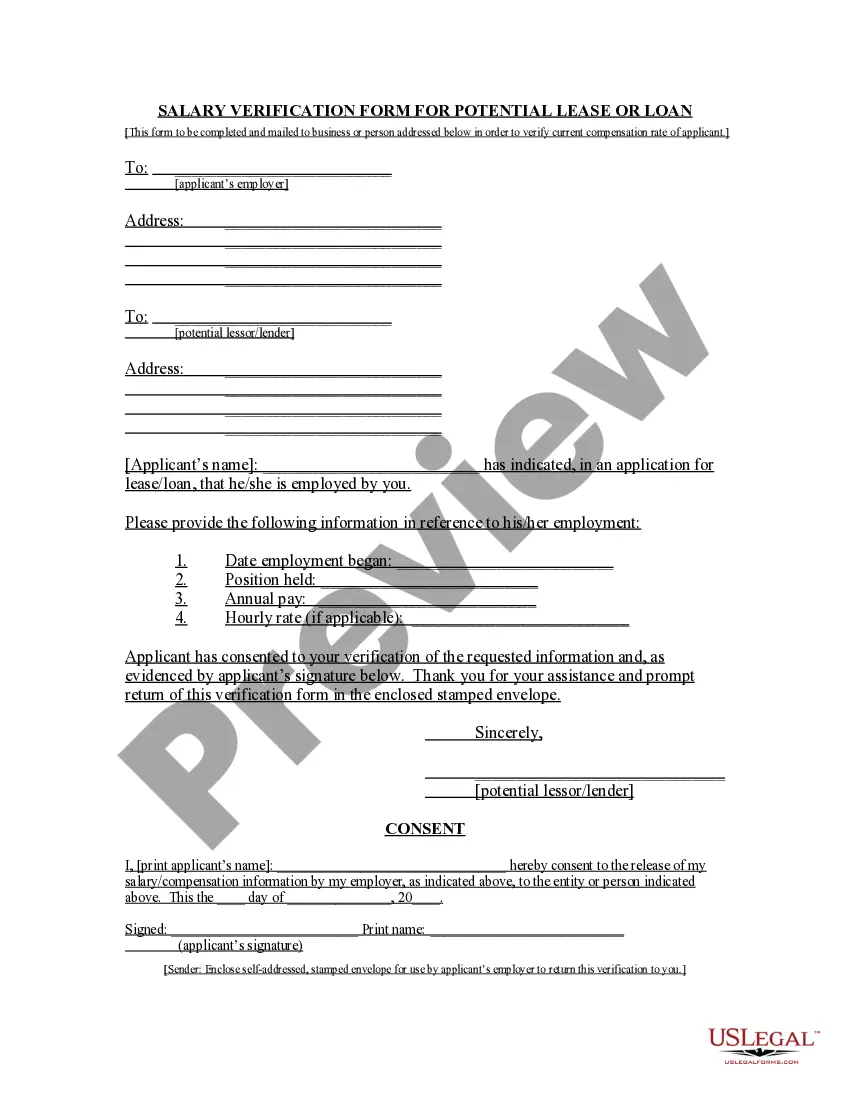

- Utilize the Review button to check the shape.

- Browse the description to actually have chosen the correct develop.

- When the develop is not what you`re searching for, utilize the Look for discipline to find the develop that suits you and needs.

- Once you discover the proper develop, click Purchase now.

- Opt for the costs program you would like, submit the desired information and facts to produce your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Choose a practical file formatting and acquire your version.

Find all of the record layouts you may have purchased in the My Forms food list. You can obtain a further version of West Virginia Notice of Violation of Fair Debt Act - Improper Document Appearance anytime, if required. Just click the essential develop to acquire or produce the record format.

Use US Legal Forms, the most substantial collection of authorized types, to conserve time as well as stay away from blunders. The service delivers expertly manufactured authorized record layouts which you can use for a variety of reasons. Create an account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

If a debt collector breaks the law, you have one year from that date to sue that collector in a state or federal court.

To dispute collections, send a letter to the debt collector within 30 days requesting proof of the debt and asking not to report it to the credit agency until the dispute is resolved. Keep a copy of the letter and any correspondence. Seek legal help if needed.

If you think a debt collector has violated the FDCPA, you can sue them for damages. If you prove a violation occurred, you may be awarded $1,000 in damages, plus additional compensation for any actual harm they caused. If you win, the collector may also be responsible for paying your lawyer fees and costs.

The terms of the FDCPA allow consumers to recover damages up to $1,000 from a debt collector. This amount is above and beyond other forms of damages that a consumer may be entitled to. To obtain this amount, a consumer merely has to prove that the collector violated the FDCPA.

A debt collector who fails to comply with any provision of the FDCPA or Regulation F is liable for: Any actual damages sustained as a result of that failure.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.