West Virginia Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

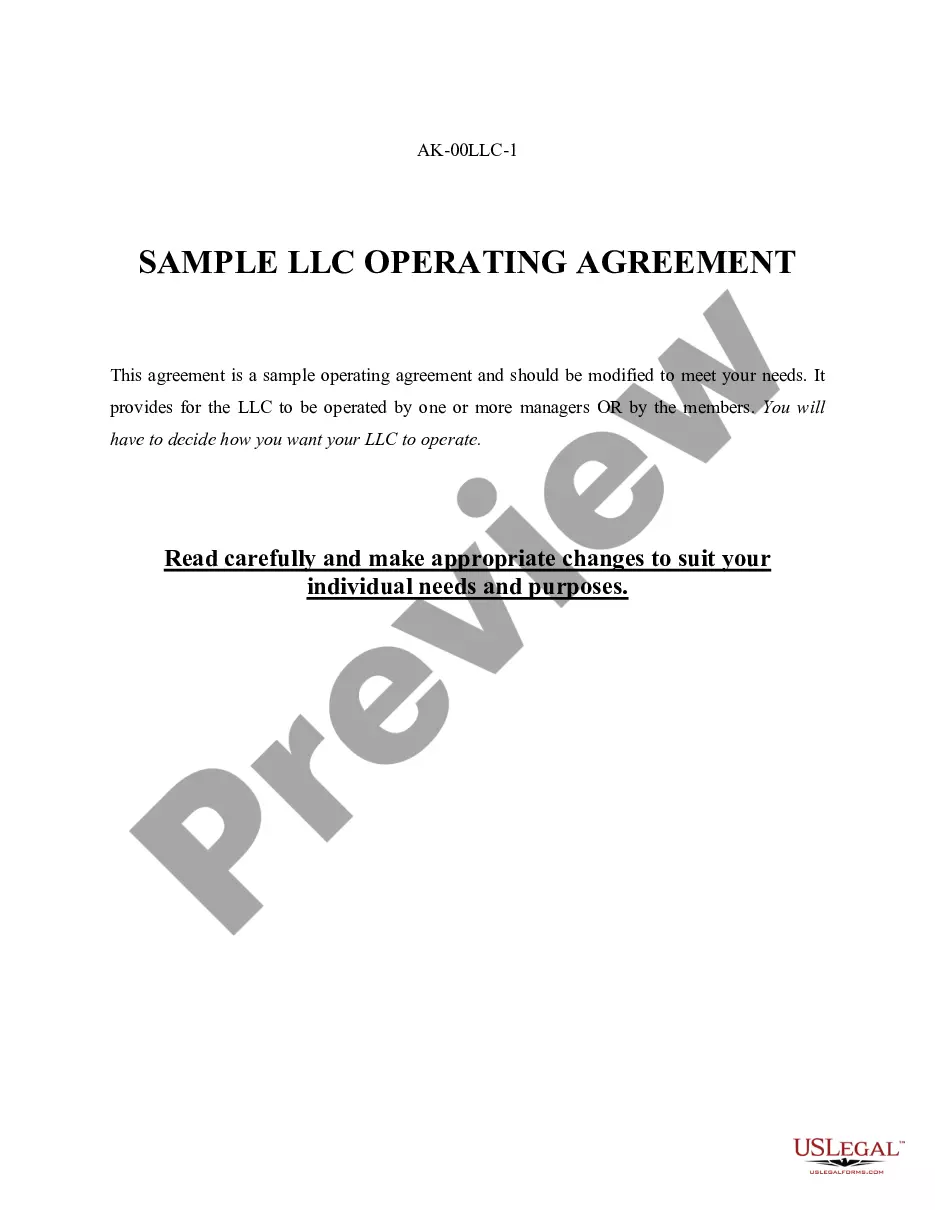

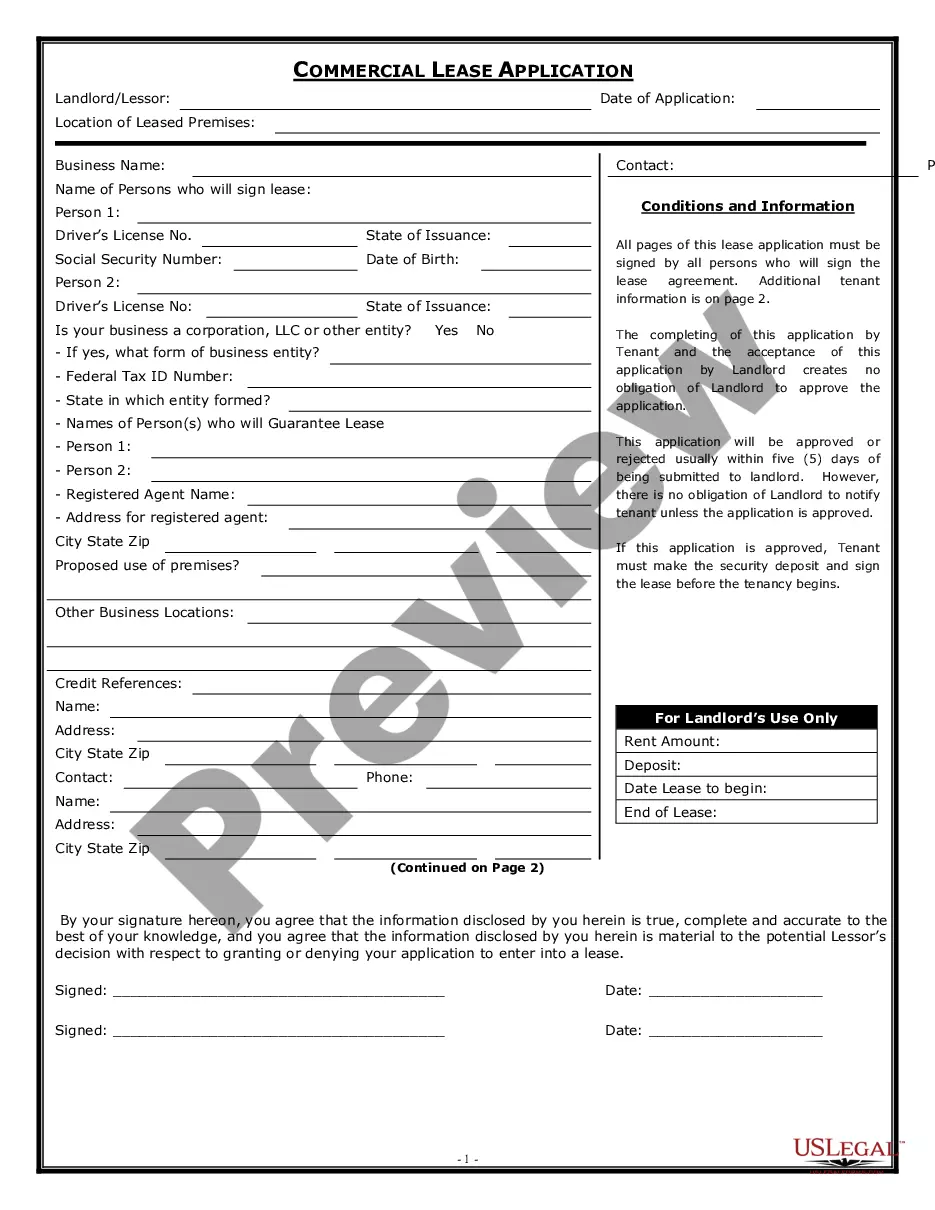

It is feasible to spend time online trying to locate the legal document format that fulfills the federal and state requirements you necessitate.

US Legal Forms provides a vast array of legal forms that are reviewed by specialists.

You can easily download or print the West Virginia Pay in Lieu of Notice Guidelines from the service.

If available, use the Preview button to review the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the West Virginia Pay in Lieu of Notice Guidelines.

- Every legal document format you obtain is yours to keep indefinitely.

- To acquire another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document format for the area/city you select.

- Check the form details to make sure you have selected the appropriate type.

Form popularity

FAQ

In West Virginia, you may be denied unemployment benefits for several reasons. If you quit your job without a valid cause, or if you were discharged for misconduct, your application may be denied. Additionally, failing to actively seek work or not meeting the state’s eligibility requirements can also lead to a denial. Understanding the West Virginia Pay in Lieu of Notice Guidelines can help you navigate these issues, ensuring you are aware of your rights and responsibilities.

West Virginia follows an at-will employment policy, allowing employers to terminate employees without cause as long as it doesn't violate any employment contracts or anti-discrimination laws. However, if an employer chooses to terminate an employee, they may opt to provide pay in lieu of notice, adhering to the West Virginia Pay in Lieu of Notice Guidelines. It's crucial for both employees and employers to stay informed about these laws to ensure fair practices. For those seeking more detailed information, US Legal Forms offers resources tailored to navigate West Virginia's termination laws effectively.

Payment in lieu of leave occurs when an employer compensates an employee for unused leave time instead of granting them the time off. This practice is often outlined in the West Virginia Pay in Lieu of Notice Guidelines, ensuring employees understand their benefits during termination. For clarity and ease, resources on platforms such as ulegalforms can assist in handling these situations and ensuring that employees receive their rightful payments.

In West Virginia, several circumstances can disqualify an individual from receiving unemployment benefits. Common disqualifications include voluntary resignation, misconduct at work, or refusal to accept suitable job offers. Understanding these conditions is vital for employees to navigate their unemployment options effectively, especially in light of the West Virginia Pay in Lieu of Notice Guidelines that may influence their eligibility.

To process payment in lieu of notice, an employer must calculate the amount owed based on the employee's normal wages and the notice period they would have received. The West Virginia Pay in Lieu of Notice Guidelines recommend that employers communicate this process clearly to employees to prevent misunderstandings. Utilizing tools available on platforms like ulegalforms can streamline documentation and ensure all legal requirements are met during this process.

Payment in lieu of notice refers to a compensation that an employer provides when they terminate an employee without prior notice. According to the West Virginia Pay in Lieu of Notice Guidelines, this payment helps cover the employee’s needs until they secure new employment. It is essential for employees to understand their rights and the terms of this payment, as it can significantly affect their financial stability during a job transition.

When an employee is paid money that he or she would have earned through working during the contracted period because he or she is being terminated without notice, it is called wages in lieu of notice. A contractual period for notice may be included as a term in an implied or express contract.

California: Final check must be given immediately if you were fired, and within 72 hours you quit (or immediately if you have given more than 72 hours' notice)

Are employers required to provide vacation and sick leave benefits to their employees? No, state law does not require employers to provide any type of employee fringe benefits such as holiday pay, PTO, vacation pay, sick leave, etc. to their employees.

When is the final paycheck due when an employee is fired under West Virginia law? As per W. Va. Code § 21-5-4, when an employee is fired, the employer must give a final paycheck to him or her within seventy-two (72) hours.