West Virginia Mineral Exploration License - Option to Lease

Description

How to fill out Mineral Exploration License - Option To Lease?

Have you ever found yourself needing paperwork for both business or personal matters almost all the time.

There is a range of legal document templates accessible online, but locating reliable ones is challenging.

US Legal Forms provides a vast collection of document templates, including the West Virginia Mineral Exploration License - Option to Lease, designed to meet both state and federal regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the order with your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents list. You can download or print the document template again at any time if desired. Utilize US Legal Forms, the largest collection of legal documents, to save time and prevent mistakes. This service offers well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the West Virginia Mineral Exploration License - Option to Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for your appropriate city/state.

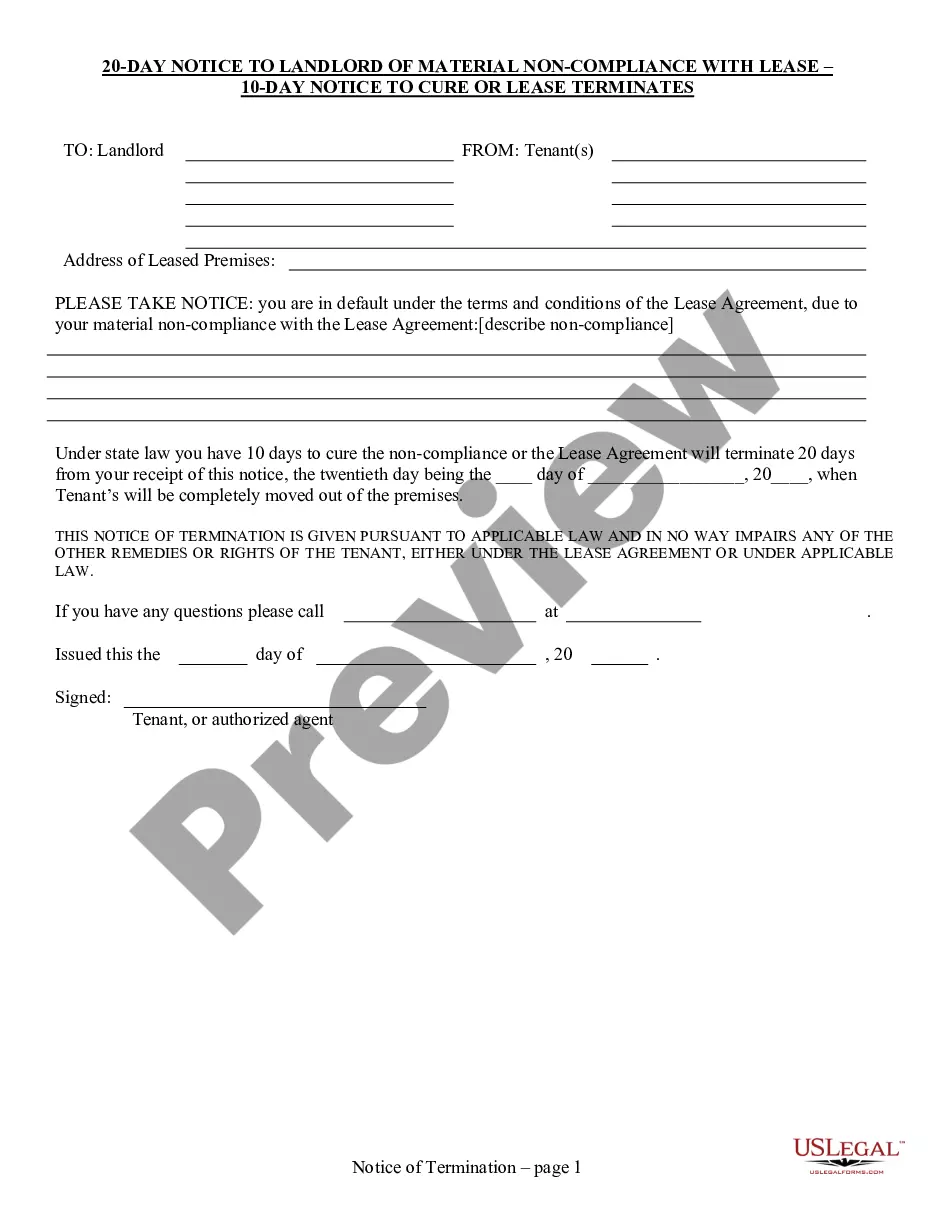

- Use the Preview button to examine the form.

- Read the description to ensure that you have selected the correct document.

- If the form is not what you are looking for, use the Lookup field to find a form that meets your needs.

Form popularity

FAQ

Mineral rights can be split among family members or multiple companies going on for generations. A person (or company) may end up owning 1/100th of a share in the rights. Every mineral rights owner is liable to the tax man in WV, and if you don't pay taxes on ityou can lose the rights at a tax sale.

Investing your money earned from your mineral rights can be endlessly rewarding. When done correctly, the investment will often pay itself off and can provide you another source of income, be used to pay off a mortgage, or be used to start a college fund for your children or grandchildren.

If you have a property that does not currently produce royalty income and you do not have an active lease, the value is nearly always under $1,000/acre. The average price per acre for mineral rights that are not leased is between $0 and $250/acre.

Mineral rights can be an excellent investment for you and it will become endlessly rewarding provided that it is done in a correct manner. It will be a supplemental source of income that enables you to earn a royalty lifelong by selling your mineral rights.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

Minerals are taxed at a minimum value until production begins. Mineral Assessed Value is 60% of the appraised value of the property. WV appraisal values for minerals are based on the start date of drilling and production income.

Mineral rights give ownership, for a specified time, of the underground minerals that do not include sand, limestone, gravel, or subsurface water. If the mineral rights to your property have been sold before you acquired the land, that means you own only the surface rights and cannot use the minerals.

Buyers will pay an average of your monthly royalty checks multiplied by 50. Unleased acreage can be below $500 an acre to $3,000 an acre depending on location. Acreage leased but not in production can be anywhere from $500 to $5,000 an acre based on activity in your area and production nearby.

If you have mineral rights, you have several options available to help you profit from them. These include: 1) leasing the minerals; 2) selling all or a portion of the minerals; and 3) participating in development of the minerals.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).