A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

West Virginia Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

Selecting the optimal legal document template can be quite a challenge. Certainly, there are numerous formats accessible online, but how do you find the legal form you require.

Use the US Legal Forms website. The service offers a vast array of templates, including the West Virginia Articles of Incorporation for Non-Profit Organization with Tax Provisions, suitable for both business and personal needs.

All the forms are reviewed by experts and comply with state and federal regulations.

US Legal Forms houses the largest collection of legal templates where you can find various document formats. Use the service to obtain professionally crafted documents that meet state guidelines.

- If you are already registered, Log In to your account and click the Download button to obtain the West Virginia Articles of Incorporation for Non-Profit Organization with Tax Provisions.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

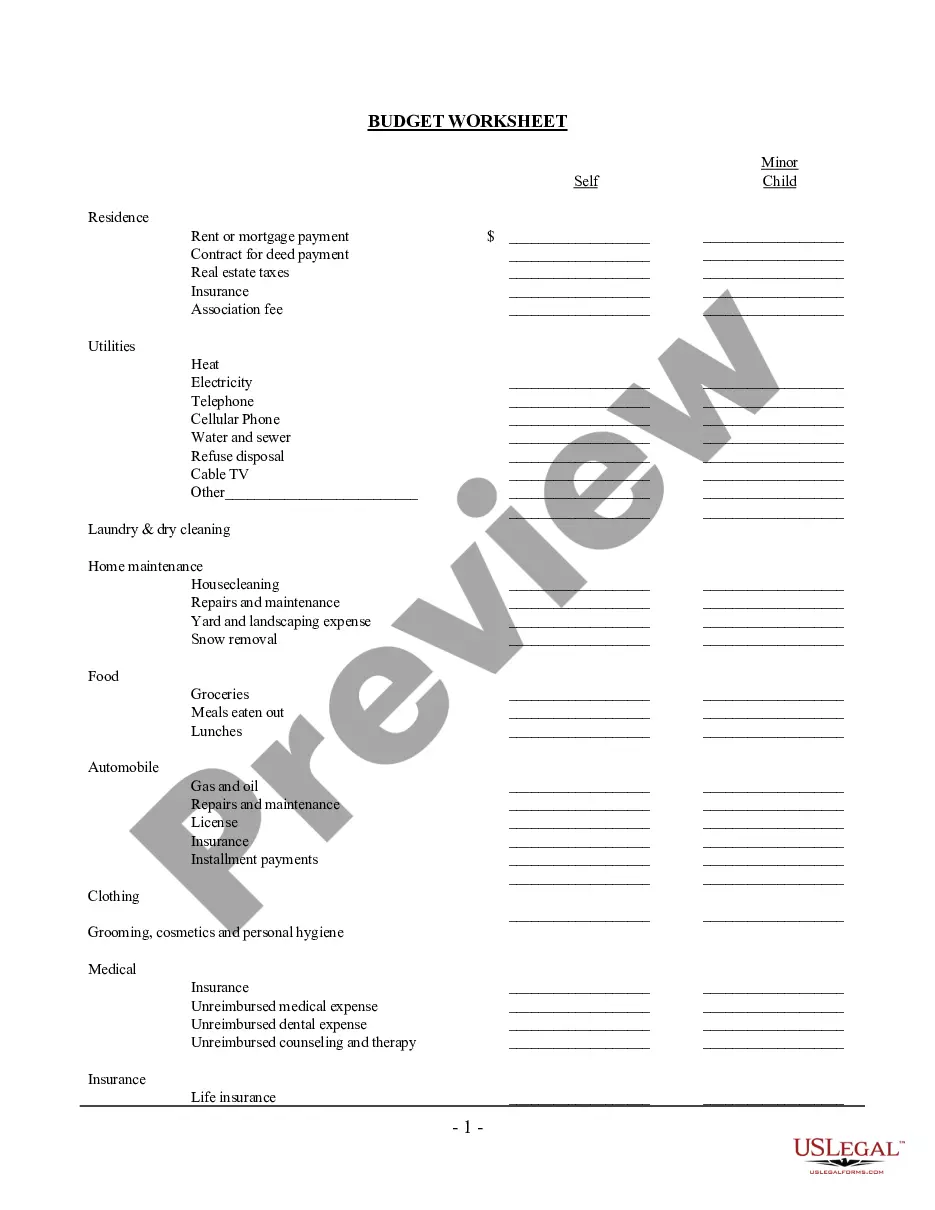

- Firstly, ensure you have selected the appropriate form for your city/state. You can review the document using the Preview button and check the form details to confirm it is suitable for you.

- If the form does not fulfill your needs, utilize the Search field to locate the correct form.

- Once you are certain that the form is fit, click the Get Now button to acquire the form.

- Choose the pricing plan you prefer and input the required details.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template for your device.

- Complete, modify, print, and sign the obtained West Virginia Articles of Incorporation for Non-Profit Organization with Tax Provisions.

Form popularity

FAQ

No, articles of incorporation and 501(c)(3) status are not the same. The articles of incorporation are the foundational documents that establish your non-profit in West Virginia, while 501(c)(3) status grants tax exemption from the IRS. To achieve this status, you must first incorporate and then apply for recognition with the IRS. Using our resources, you can efficiently navigate both processes with ease.

Yes, a 501(c)(3) should be incorporated to gain limited liability and tax-exempt status. Incorporating your organization in West Virginia allows you to file the West Virginia Articles of Incorporation for Non-Profit Organization, with Tax Provisions, ensuring legal recognition. This incorporation helps secure donor confidence and may also provide access to grants. Incorporation creates a strong foundation for your nonprofit's future.

To start a nonprofit organization in West Virginia, begin by forming a board of directors. Together, you'll craft the West Virginia Articles of Incorporation for Non-Profit Organization, with Tax Provisions, and file them with the Secretary of State. After that, apply for tax-exempt status at both the federal and state levels to ensure you can operate effectively. Uslegalforms can guide you through each step, ensuring compliance and efficiency.

Writing articles of incorporation for a non-profit requires a clear understanding of your organization’s mission. Begin by including your organization’s name, purpose, and principal office address in the document. Additionally, outline the structure of your board and governance policies. Use resources from uslegalforms to access templates tailored for West Virginia Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

To start a non-profit in West Virginia, first choose a unique name for your organization. Next, draft your West Virginia Articles of Incorporation for Non-Profit Organization, with Tax Provisions. After that, file these documents with the West Virginia Secretary of State and obtain any necessary federal or state tax exemptions. Lastly, establish your board of directors and begin your fundraising efforts.

To start a 501c3 in West Virginia, you must first file your West Virginia Articles of Incorporation for a Non-Profit Organization, with Tax Provisions. This includes specific language mandated by the IRS for tax-exempt status. Next, ensure you obtain an Employer Identification Number (EIN) and apply for tax exemption with the IRS. Uslegalforms can assist you with resources and templates to simplify each step.

Yes, you can write your own West Virginia Articles of Incorporation for a Non-Profit Organization, with Tax Provisions. However, it’s crucial to ensure that your document meets all legal requirements to avoid potential issues. Using uslegalforms can streamline the process. Their easy-to-follow templates help you create a compliant and effective article of incorporation.

An example of West Virginia Articles of Incorporation for a Non-Profit Organization, with Tax Provisions includes a statement of the organization’s purpose, such as promoting education or charitable activities. This document should also outline the governing structure, which often includes a board of directors. Uslegalforms offers customizable examples to help you create a professional document that meets your specific goals.

Writing West Virginia Articles of Incorporation for a Non-Profit Organization, with Tax Provisions begins with gathering essential information about your organization. You'll need to include the name of the organization, its purpose, and details about your board members. It's important to follow state guidelines to ensure compliance. For assistance, consider using uslegalforms, which provides templates tailored to non-profit needs.

To obtain articles of organization in West Virginia, you can download the necessary forms from the West Virginia Secretary of State’s website. Alternatively, platforms like uslegalforms can provide customizable templates to simplify the process. Completing and submitting the West Virginia Articles of Incorporation for Non-Profit Organization, with Tax Provisions will help you formally establish your nonprofit.