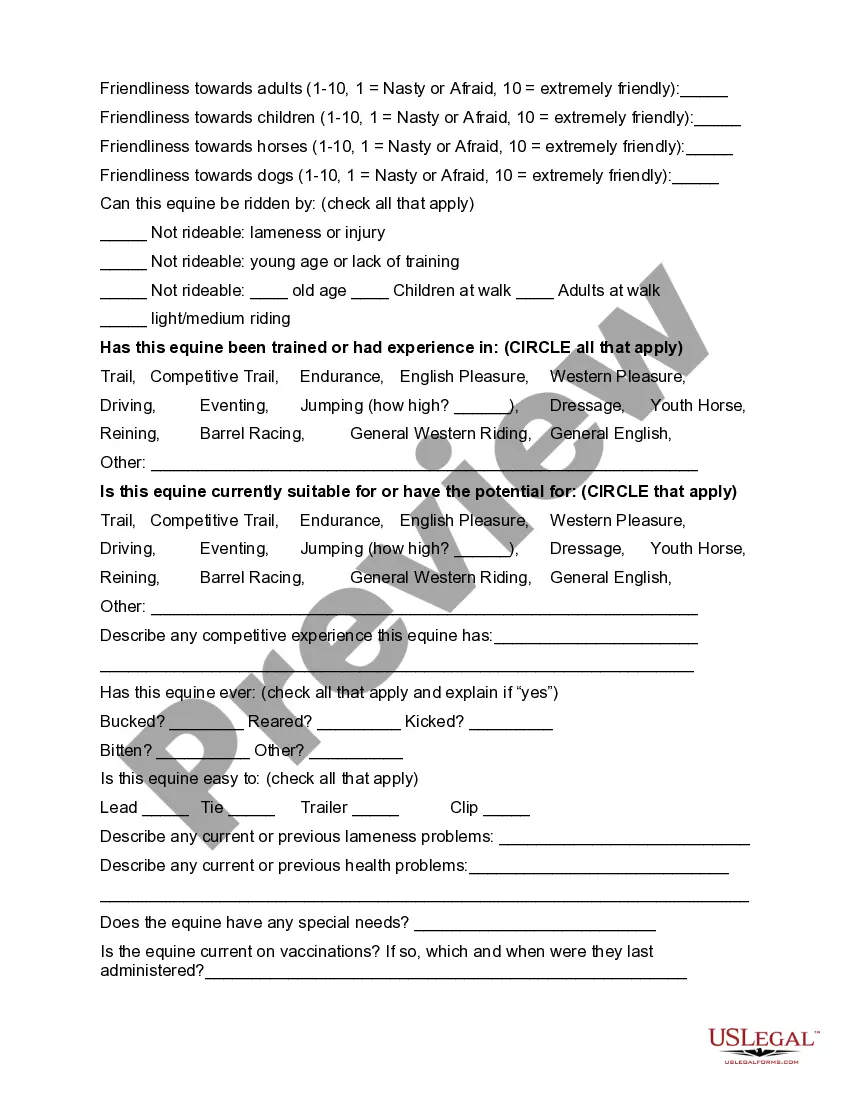

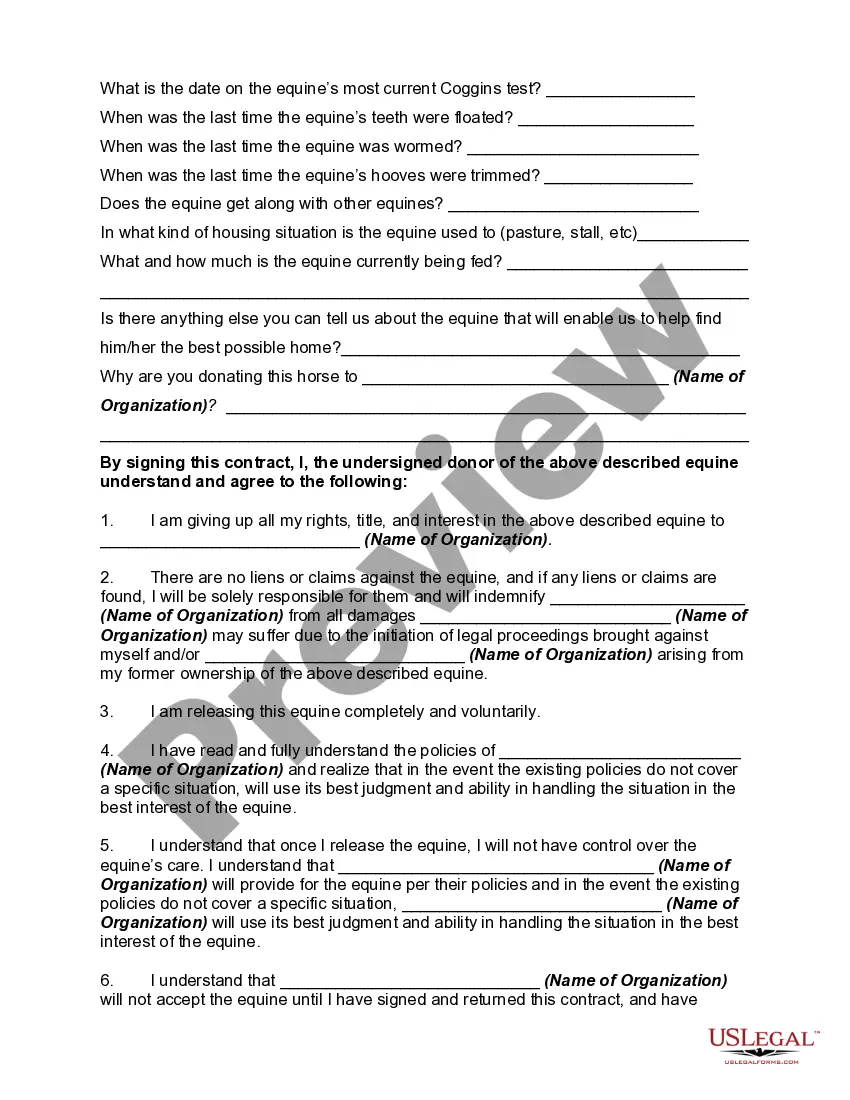

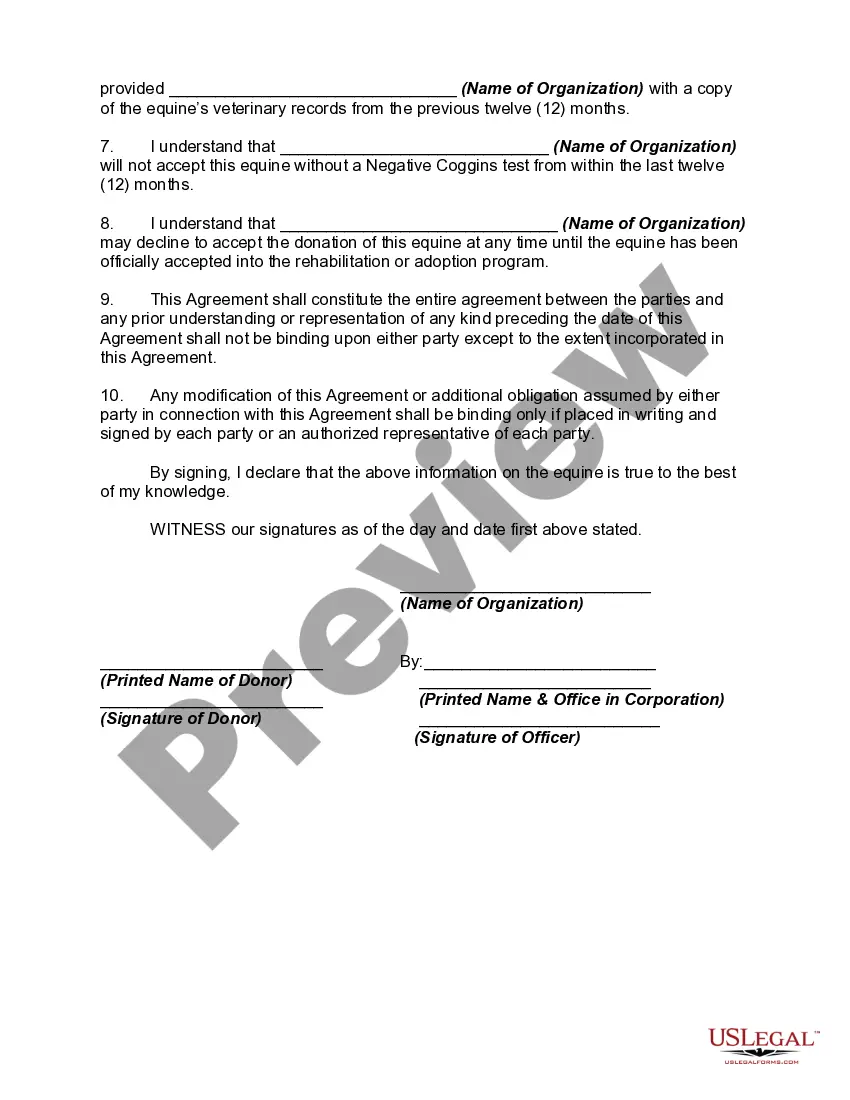

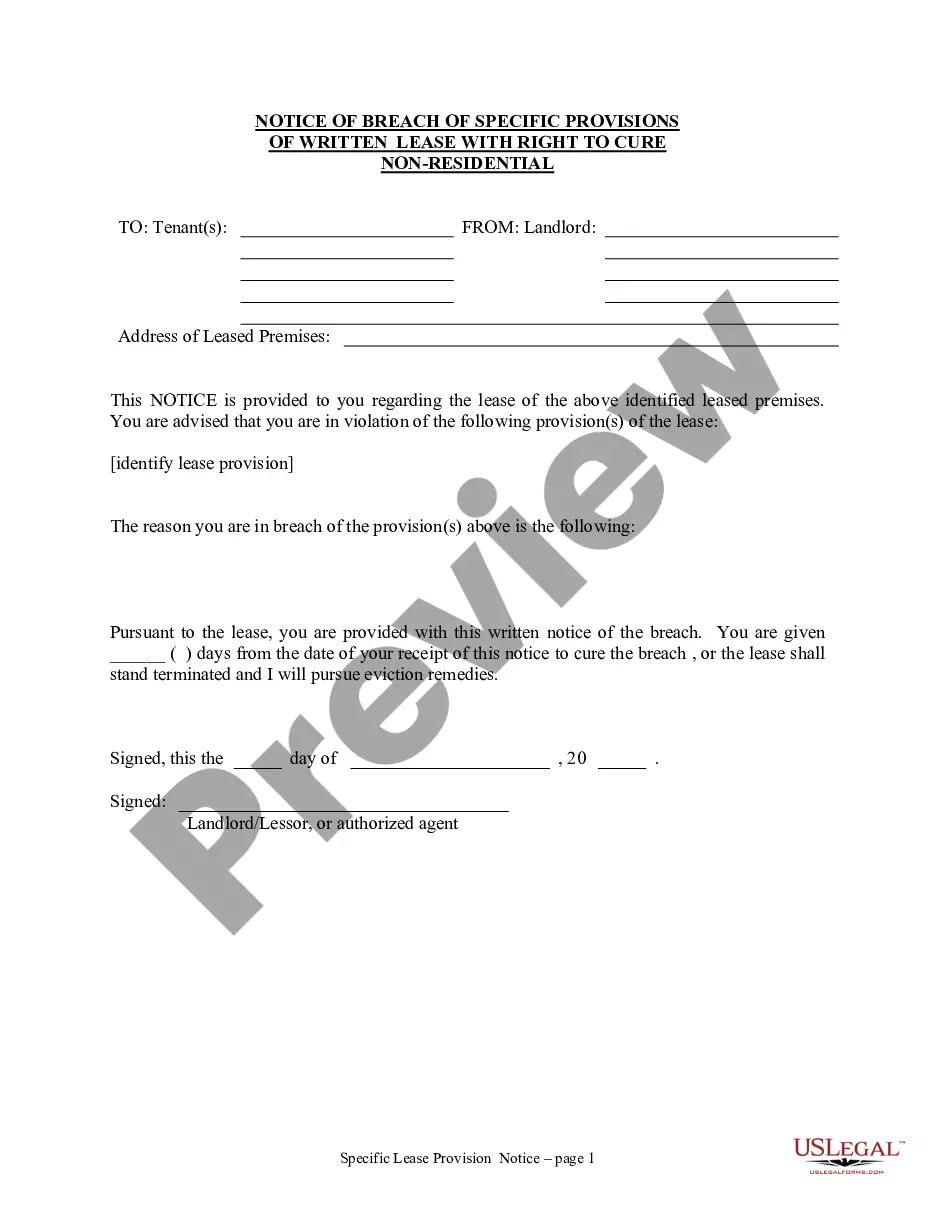

This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

It is feasible to dedicate multiple hours online searching for the legal template that meets the federal and state requirements you desire.

US Legal Forms offers thousands of legal documents that are vetted by experts.

You can download or print the West Virginia Equine or Horse Donation Agreement from our platform.

If available, use the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can fill out, modify, print, or sign the West Virginia Equine or Horse Donation Agreement.

- Every legal document template you receive is yours permanently.

- To get another copy of the acquired form, go to the My documents section and click the corresponding option.

- If you are utilizing the US Legal Forms website for the first time, follow the straightforward steps below.

- First, ensure that you have chosen the right document template for the region/city of your choice.

- Review the document details to confirm you have selected the correct one.

Form popularity

FAQ

To get a rescue horse, start by researching local equine rescue organizations in your area. Contact them to learn about their adoption process and available horses. Typically, you will need to fill out an application, attend an interview, and sometimes, even meet the horses before making a decision. Utilizing a West Virginia Equine or Horse Donation Contract can simplify the adoption process, ensuring clear agreements and understanding between you and the rescue organization.

Yes, you can write off a horse donation if you donate to a qualified charitable organization. A West Virginia Equine or Horse Donation Contract will help solidify your claim by providing a record of the donation. To ensure compliance and maximize your tax benefits, keep all related documentation handy and seek guidance from a tax expert.

To write horses off on taxes, you must donate them to an approved charity and obtain a proper acknowledgment, such as a West Virginia Equine or Horse Donation Contract. The IRS requires that you maintain accurate records of the donation, including the horse's fair market value, to support your deduction. Consulting with a tax professional can help ensure you follow all necessary steps.

A buy back contract allows the seller to reclaim the horse under certain conditions. This agreement is often used when the seller wants assurance that the horse can return if circumstances change. Including terms in a West Virginia Equine or Horse Donation Contract can clarify expectations for both parties.

You can write off animals on taxes if they are donated to an eligible charity. This typically includes horses, provided you have proper documentation like a West Virginia Equine or Horse Donation Contract. It's important to verify the charity's status to confirm its eligibility for tax deductions.

Identifying the best horse charity often depends on your personal values and the causes you wish to support. Research local and national organizations dedicated to equine welfare. Using a West Virginia Equine or Horse Donation Contract when donating ensures that your contribution is properly recorded and can maximize your potential tax benefits.

Yes, donating a horse can lead to a tax write-off, provided you use a formal agreement like a West Virginia Equine or Horse Donation Contract. This contract is essential for establishing the donation's legitimacy, which can help you prove your eligibility for a tax deduction. Always consult a tax advisor to navigate your specific situation effectively.

When you donate a horse or any other property, you can usually deduct its fair market value from your taxable income. With a West Virginia Equine or Horse Donation Contract, you ensure this deduction aligns with IRS requirements. Keep in mind, the amount you can write off may depend on factors like the horse's condition and appraised value.

If you have unwanted horses, there are several responsible options available. You can consider donating through a West Virginia Equine or Horse Donation Contract, which helps place the horse in a caring environment. Alternatively, you may seek reputable adoption programs or equine rescue organizations that specialize in finding new homes for horses. Approaching local charities and experts can provide guidance to help you make the best choice.

To qualify for a tax write-off on your donation, you typically need to contribute to a qualified nonprofit organization. The IRS requires documentation, so if you are donating a horse under a West Virginia Equine or Horse Donation Contract, ensure you receive a receipt acknowledging the donation's value. Generally, donations over a specific amount, such as $250, are eligible for tax deductions, but it is wise to consult with a tax professional for personalized advice.