West Virginia Sale or Return

Description

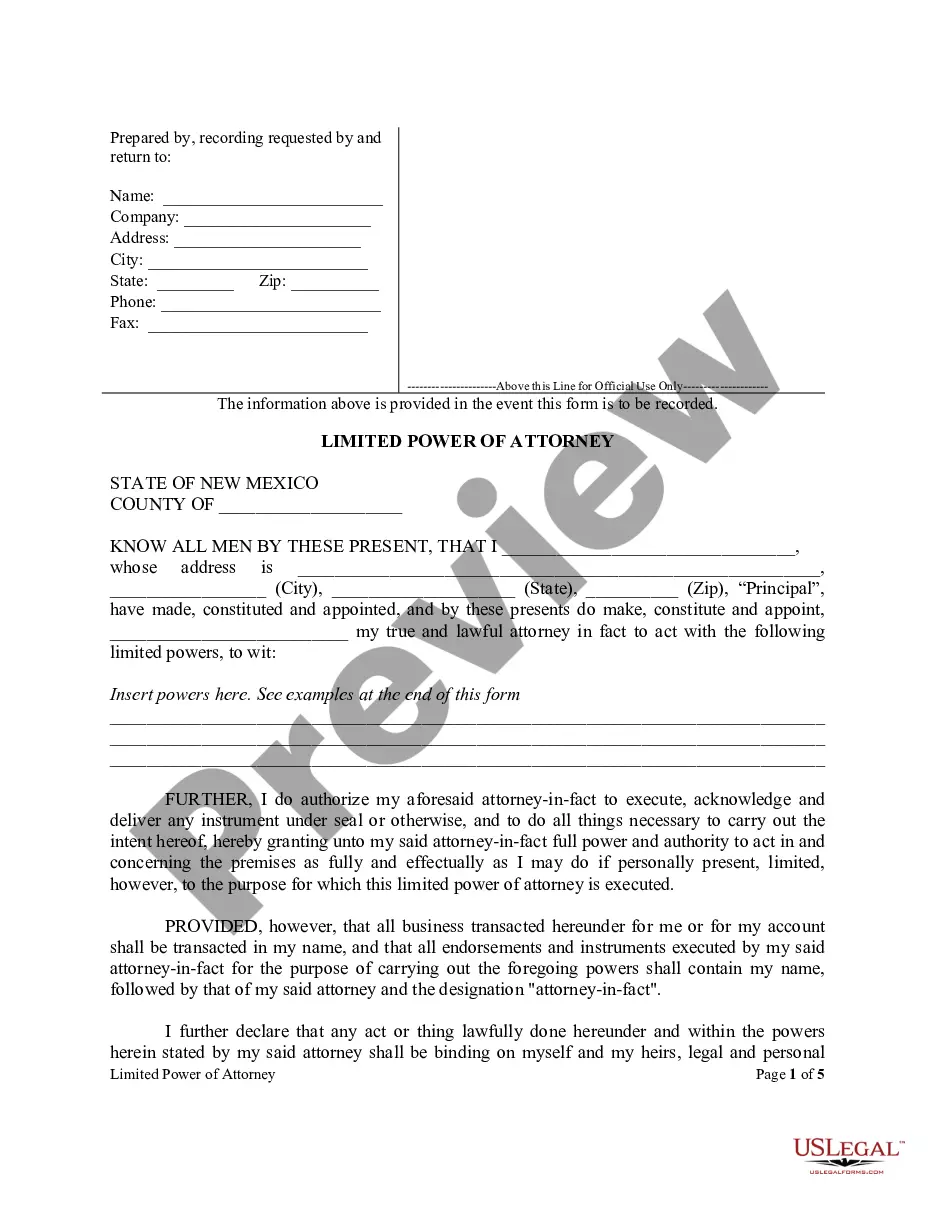

How to fill out Sale Or Return?

US Legal Forms - among the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the site, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You will find the latest editions of documents such as the West Virginia Sale or Return in moments.

If you have an existing subscription, Log In and download the West Virginia Sale or Return from your US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved templates from the My documents tab in your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the format and download the document onto your system. Edit. Complete, modify, and print and sign the saved West Virginia Sale or Return. Every template you added to your account does not have an expiration date and is yours indefinitely. So, if you need to download or print another copy, just navigate to the My documents section and click on the document you need. Access the West Virginia Sale or Return with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct document for your area/region.

- Click on the Review button to view the document's content.

- Check the document description to confirm that you have chosen the appropriate template.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you want and provide your credentials to register for an account.

Form popularity

FAQ

Yes, West Virginia sales tax exemption certificates can expire. Typically, these certificates remain valid as long as the purchaser continues to qualify for tax-exempt status. It is essential to keep track of expiration dates to avoid complications during your West Virginia Sale or Return activities.

To close your West Virginia sales tax account, you need to submit a request to the West Virginia State Tax Department, stating your intention to close the account. Ensure all tax filings are up to date and any outstanding balances are settled. This step is crucial for a smooth transition during your West Virginia Sale or Return journey.

The small seller exception in West Virginia allows businesses that sell below a certain threshold to be exempt from collecting sales tax. This provision helps small businesses focus on growth without the added burden of tax compliance. If you fall under this exception, it can significantly impact your approach to the West Virginia Sale or Return process.

To obtain a West Virginia resale certificate, you need to apply through the West Virginia State Tax Department. You will typically need to complete an application that verifies your business's legitimacy and intent to resell purchased goods. Once issued, your certificate will simplify your transactions aligned with the West Virginia Sale or Return regulations.

To cancel your sales tax ID in West Virginia, you must submit a completed form to the West Virginia State Tax Department. This form usually requires your tax ID number and some basic business details. Once processed, your sales tax ID will be canceled, allowing you to focus on other aspects of your business, such as understanding the West Virginia Sale or Return requirements.

To contact West Virginia sales and use tax, you can visit the West Virginia State Tax Department's website for the latest information. You can also reach out to them directly via phone or email listed on their site. They are available to assist you with inquiries related to the West Virginia Sale or Return process, ensuring you have the support you need.

In West Virginia, specific exemptions from sales tax apply to various sectors, including non-profit organizations and government entities. Notable exemptions include food for home consumption and certain manufacturing supplies. Staying well-informed about these exemptions can significantly impact your budget. Utilize the West Virginia Sale or Return on the US Legal Forms platform for comprehensive insights and resources.

Purchases for use in West Virginia typically refer to items intended for consumption or use within the state. This includes goods that are not intended for resale, such as personal items and supplies for businesses. Understanding these terms will help you navigate tax implications effectively. For more information and assistance on your purchases, refer to the West Virginia Sale or Return feature on US Legal Forms.

In West Virginia, property tax exemptions can apply to seniors over the age of 65. Once you reach this age, you may be eligible for significant tax benefits that help ease the financial burden. It's essential to apply for these exemptions appropriately to ensure you receive the relief available. Explore resources like the West Virginia Sale or Return on our US Legal Forms platform to streamline the process.

West Virginia does impose capital gains tax on profits made from the sale of certain assets. It is important to consider this tax when planning a West Virginia Sale or Return, as it could affect your overall financial outcome. Consulting with professionals can help clarify how these taxes apply to your specific situation.