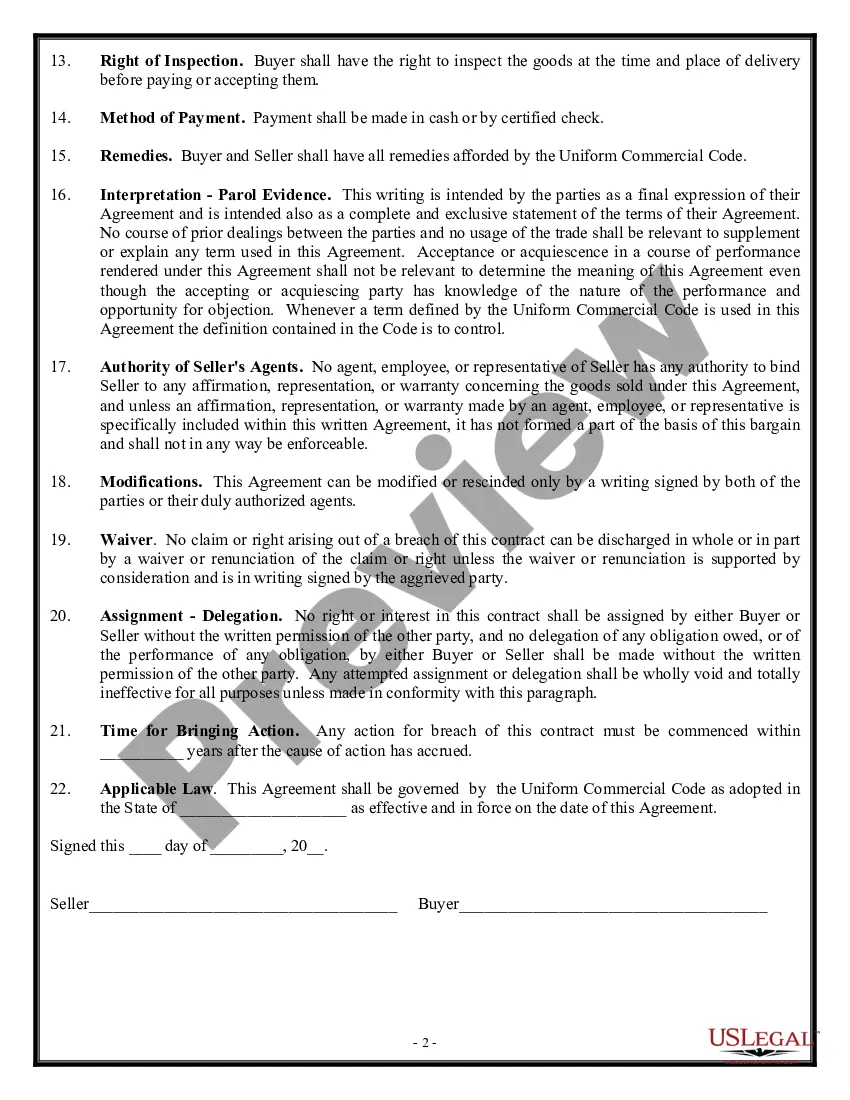

West Virginia Contract - Sale of Goods

Description

How to fill out Contract - Sale Of Goods?

Finding the correct legal document format can be challenging.

Certainly, there are numerous templates available online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The service provides a vast selection of templates, such as the West Virginia Contract - Sale of Goods, which can be used for both business and personal needs. All forms are reviewed by experts and comply with federal and state requirements.

If the form does not fulfill your requirements, utilize the Search field to find the correct form. Once you are confident the form is suitable, click the Purchase now button to acquire the form. Choose your preferred payment plan and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained West Virginia Contract - Sale of Goods. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download properly crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the West Virginia Contract - Sale of Goods.

- Use your account to view the legal forms you've purchased previously.

- Visit the My documents tab of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are the simple steps you can follow.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Review button and read the form description to confirm it meets your needs.

Form popularity

FAQ

An example of a sale and agreement to sell involves a situation where a seller offers a car for $10,000, and the buyer accepts this offer. This transaction represents a sale, as payment and transfer of ownership occur immediately. In contrast, an agreement to sell might take place when a seller agrees to provide goods at a future date, allowing for a detailed arrangement. Understanding the distinctions between these concepts can be vital for drafting a West Virginia Contract - Sale of Goods.

Yes, West Virginia employs a single sales factor for tax purposes, simplifying the taxation process for many businesses. This approach specifically benefits those engaged in a West Virginia Contract - Sale of Goods by concentrating on sales within the state. Leveraging this method can enhance your business efficiency and tax outcomes.

West Virginia ranks 41st in size among the U.S. states, providing a unique geographic landscape for businesses. This ranking may influence market reach and logistics for those entering into a West Virginia Contract - Sale of Goods. Understanding the state's size can help businesses strategize their growth plans.

The small seller exception allows certain small businesses to opt-out of collecting sales tax if their sales are below a specified limit. This exception can be beneficial when considering a West Virginia Contract - Sale of Goods, as it can alleviate some tax burdens for qualifying sellers. Understanding your eligibility can be key to optimizing your business operations.

In West Virginia, the sales tax threshold is defined by the total sales amount a seller makes before needing to collect sales tax. For most sellers, this threshold can be crucial when establishing a West Virginia Contract - Sale of Goods. Knowledge of this threshold can influence your operations and tax strategies effectively.

Yes, businesses selling goods in West Virginia typically require a seller's permit. This permit is essential to legally collect sales tax on transactions involving a West Virginia Contract - Sale of Goods. Obtaining this permit ensures compliance with state tax laws and enables smooth operations.

Yes, West Virginia uses market-based sourcing for determining the taxation of income for a West Virginia Contract - Sale of Goods. This means that income is allocated based on where the product is sold rather than where the production occurs. By focusing on the market, businesses can gain clarity and ease in navigating tax obligations.

A single sales factor is a method used to determine a business's tax liability in West Virginia for a West Virginia Contract - Sale of Goods. Under this approach, the state's tax calculation focuses solely on the sales generated within West Virginia, simplifying the process for businesses. This method can lead to more favorable outcomes for sellers engaged in the sale of goods.

In West Virginia, a debt usually becomes uncollectible after the statute of limitations expires, which is generally five years for most debts. After this period, creditors can no longer sue you to collect the debt. However, some debts may have different limitations, so it's essential to know the specifics of your situation. If you're unsure, our resources can help clarify these regulations.

In West Virginia, you can only claim a breach of contract within the statute of limitations period, which is typically five years. This window starts from the date you discover the breach, rather than the date of the contract. If you suspect a breach, take action quickly to preserve your rights. Utilizing legal forms and resources can guide you through the process of filing your claim effectively.