West Virginia Sample Letter for Erroneous Information on Credit Report

Description

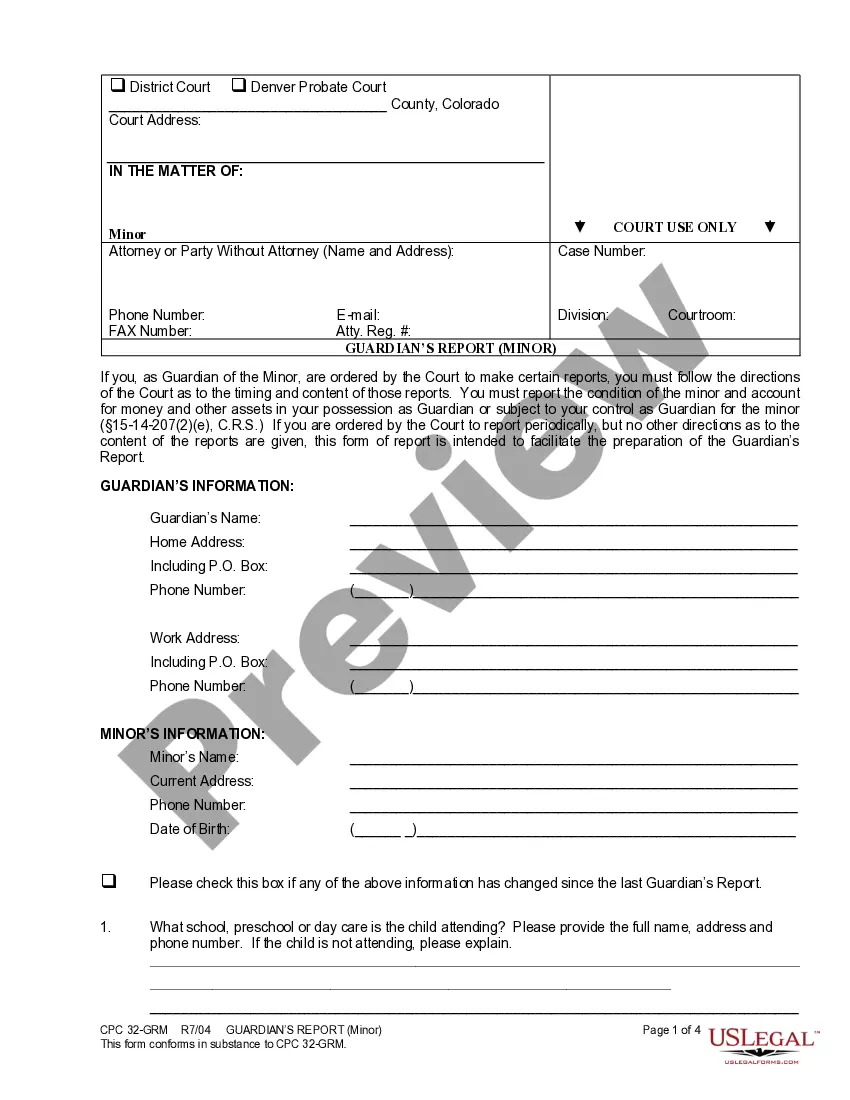

How to fill out Sample Letter For Erroneous Information On Credit Report?

Are you presently in a scenario where you need documents for potential business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones isn’t straightforward.

US Legal Forms provides a vast array of form templates, including the West Virginia Sample Letter for Incorrect Information on Credit Report, designed to fulfill federal and state requirements.

Once you obtain the correct form, simply click Acquire now.

Select the pricing plan you want, provide the necessary details to create your account, and complete your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Sample Letter for Incorrect Information on Credit Report template.

- If you do not possess an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview option to review the form.

- Examine the description to ensure you have selected the correct form.

- If the form isn’t what you're searching for, utilize the Research section to locate the form that meets your requirements and needs.

Form popularity

FAQ

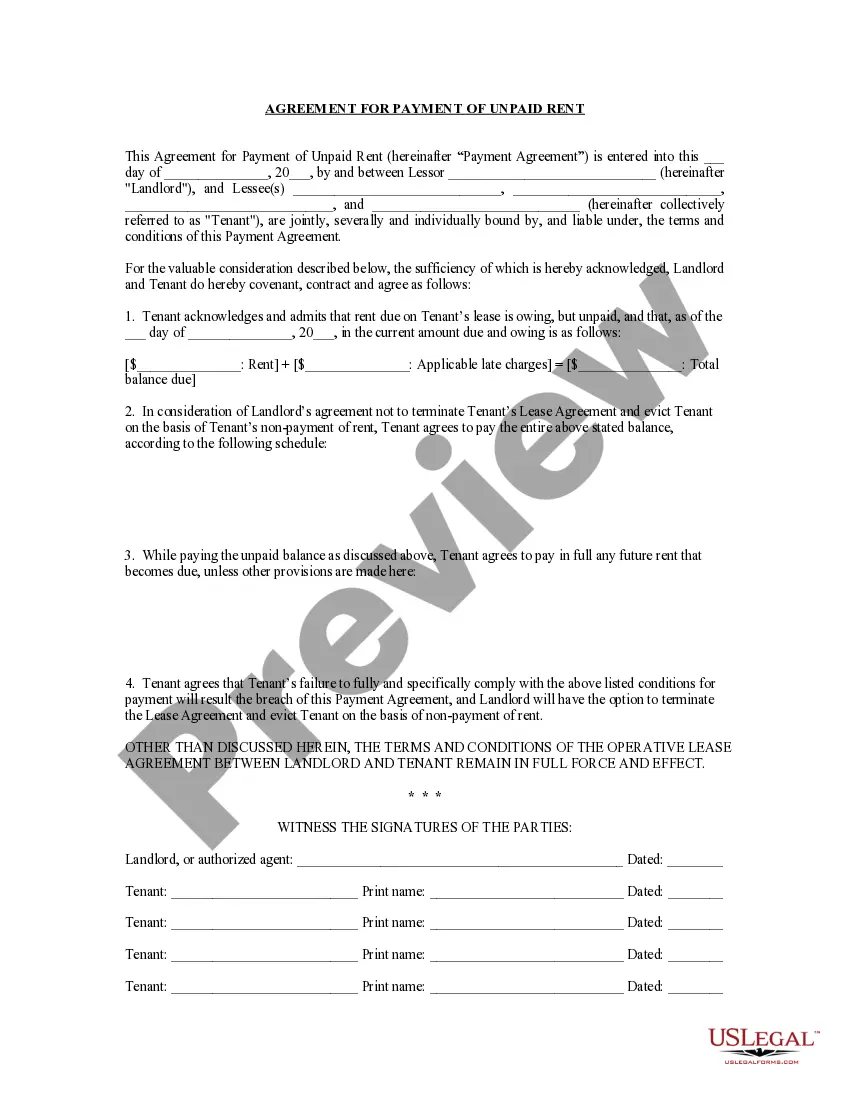

A 623 letter is a formal notification to a creditor regarding inaccuracies on your credit report. In this letter, you reference the specific information you dispute and request verification. Utilizing a West Virginia Sample Letter for Erroneous Information on Credit Report can help guide you in composing a clear and effective letter. Ensure that your letter is concise and includes all necessary details to support your dispute.

Writing a 609 credit dispute letter involves citing your legal rights to challenge inaccuracies in your credit report. Start with your personal information and mention specific errors in your report. Including a reference to a West Virginia Sample Letter for Erroneous Information on Credit Report can provide a solid framework for your letter. Remember to ask for verification of the inaccuracies and send copies of any supporting documents.

Getting incorrect information removed from your credit report involves reviewing your report for mistakes first. Once identified, draft a dispute letter outlining the inaccuracies. A West Virginia Sample Letter for Erroneous Information on Credit Report can streamline this process and ensure clarity in your communication. Once submitted, wait for the credit bureau to investigate and resolve the issue.

To remove erroneous information from your credit report, start by collecting evidence that proves the information is incorrect. Write a formal dispute letter, perhaps utilizing a West Virginia Sample Letter for Erroneous Information on Credit Report, to clearly state your reasons for the dispute. After sending your letter to the credit reporting agency, monitor your credit report for updates on the status of your dispute.

Correcting erroneous information in your credit file requires a systematic approach. First, verify the inaccuracies against your documents. Then, draft a detailed dispute letter; using a West Virginia Sample Letter for Erroneous Information on Credit Report can be very helpful in clearly stating your case. Submit your letter to the credit bureau and ensure you receive confirmation of their investigation.

To remove an incorrect collection from your credit report, start by reviewing your credit report for inaccuracies. Once you identify the incorrect entry, gather all related documentation. You can then send a dispute letter, such as a West Virginia Sample Letter for Erroneous Information on Credit Report, to the credit bureau. This step is crucial to ensure that your report reflects only accurate information.

If you discover false information on your credit report, take immediate action to address it. First, verify the details and gather relevant documents to support your case. Next, use the West Virginia Sample Letter for Erroneous Information on Credit Report to send a clear and concise dispute to the credit bureau. By doing so, you initiate a process that can lead to the removal of the incorrect information, improving your credit score and financial health.

Reporting false information on your credit report involves filing a dispute with the credit bureau that issued the report. Begin by collecting evidence that proves the information is inaccurate. Utilize the West Virginia Sample Letter for Erroneous Information on Credit Report to formally submit your dispute and attach any supporting documents. This process allows you to clearly articulate the false information and request a correction.

To correct a mistake on your credit report, start by obtaining a copy of your report from all major credit bureaus. Identify the incorrect information and gather any necessary documentation that supports your claim. You can then use the West Virginia Sample Letter for Erroneous Information on Credit Report to notify the credit bureau of the error. This letter serves as an effective tool to communicate your request and ensures that the bureau investigates the issue promptly.

A dispute letter for a debt is a formal communication you send to a creditor or credit reporting agency regarding a debt that you believe is incorrect. In your West Virginia Sample Letter for Erroneous Information on Credit Report, you should clearly outline the reasons for your dispute, providing any supporting documents. This letter serves as a crucial step in ensuring your credit report reflects accurate information, protecting your credit score and financial reputation. Platforms like USLegalForms can help you create and customize such letters with ease.