An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Verification of an Account for Services and Supplies to a Public Entity

Description

How to fill out Verification Of An Account For Services And Supplies To A Public Entity?

Are you currently in the situation in which you need to have papers for possibly company or personal uses virtually every working day? There are plenty of authorized file themes accessible on the Internet, but locating types you can trust isn`t effortless. US Legal Forms delivers a large number of form themes, like the West Virginia Verification of an Account for Services and Supplies to a Public Entity, which can be written in order to meet federal and state demands.

If you are previously acquainted with US Legal Forms web site and also have an account, basically log in. Following that, you can download the West Virginia Verification of an Account for Services and Supplies to a Public Entity format.

Unless you provide an accounts and wish to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for the right metropolis/region.

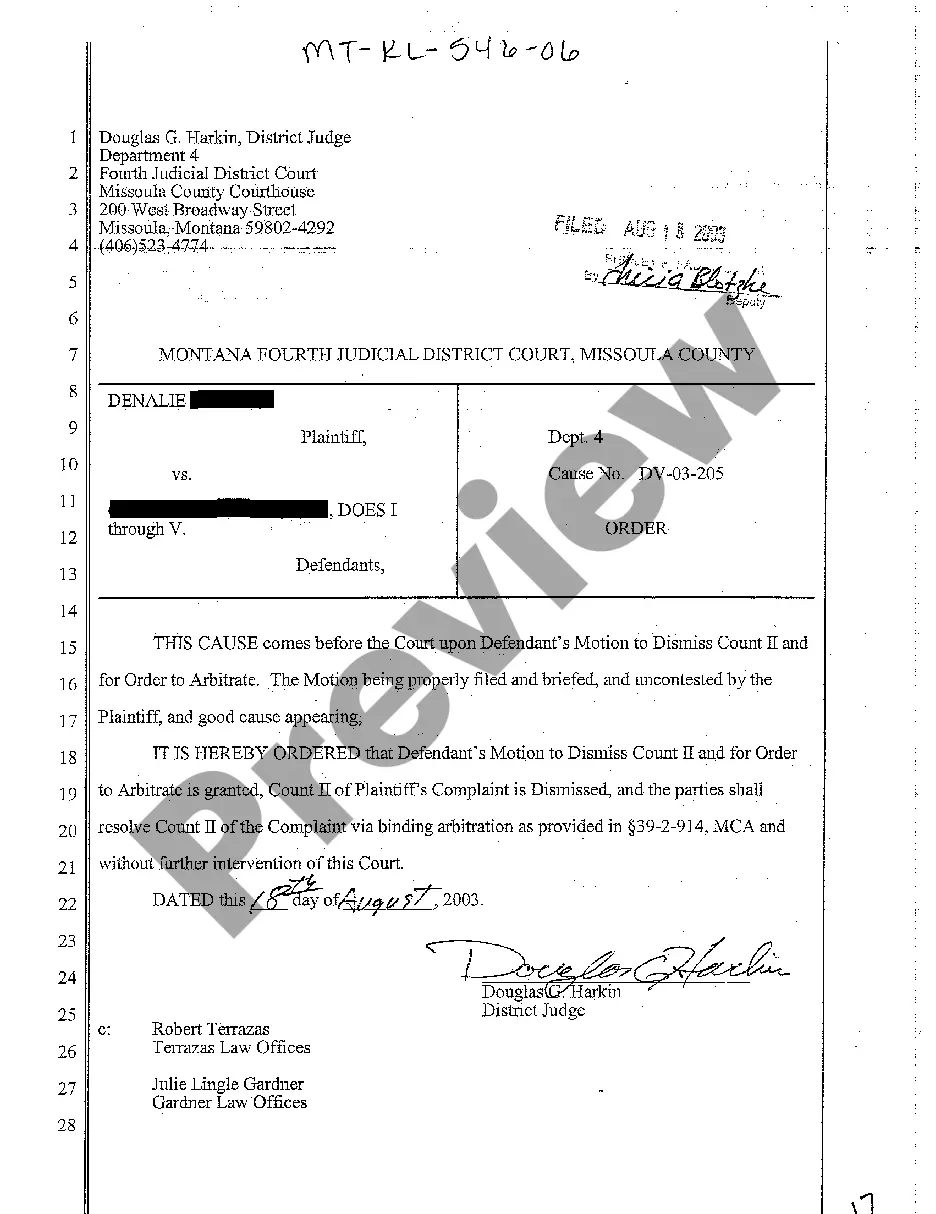

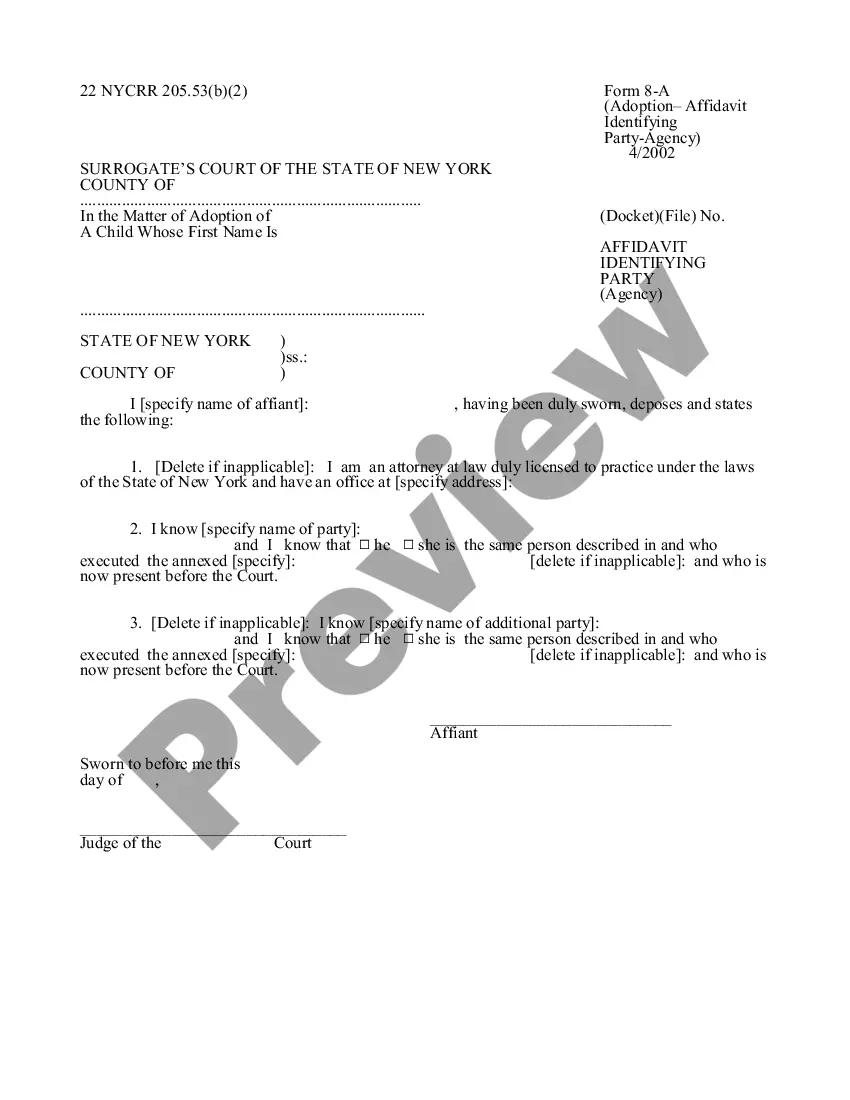

- Take advantage of the Review option to review the form.

- Read the explanation to actually have chosen the right form.

- If the form isn`t what you`re looking for, make use of the Lookup discipline to find the form that meets your needs and demands.

- Once you obtain the right form, just click Acquire now.

- Pick the pricing program you need, fill in the specified info to make your bank account, and pay money for the order utilizing your PayPal or charge card.

- Select a practical data file structure and download your version.

Locate every one of the file themes you might have purchased in the My Forms food selection. You can get a additional version of West Virginia Verification of an Account for Services and Supplies to a Public Entity whenever, if needed. Just click the essential form to download or print out the file format.

Use US Legal Forms, one of the most considerable selection of authorized forms, in order to save efforts and prevent blunders. The service delivers professionally made authorized file themes that you can use for a range of uses. Produce an account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

Code, §§ 40-1-9, 39-1-2) ? A property's deed must be filed in the County Court Clerk's Office in the jurisdiction where the real estate is located. Signing (W. Va. Code, § 39-1-2) ? All deeds are required to be signed with two (2) witnesses or a Notary Public present.

A Certificate of Existence is a document issued by the West Virginia Secretary of State (SOS). This document verifies the existence of a registered company and its authorization to conduct business within the state.

What Is a West Virginia Quitclaim Deed? West Virginia real estate owners can transfer ownership by signing and recording a deed. 1. A quitclaim deed is a specific deed form that transfers whatever claim or interest the signer has in the property without guaranteeing the property's title is clear or valid.

§11-22-6. Duties of clerk; declaration of consideration or value; filing of sales listing form for Tax Commissioner; disposition and use of proceeds.

Declaration of Consideration of Value (This is the monetary amount for which the property is sold. If the property is being transferred without monetary value, it must state in the declaration paragraph 'why' it is exempt from transfer tax.)

The Transfer Tax Fee is $5.50 for every $1,000.00 of the purchase price, or value of the property when the purchase price is not listed on the Deed. All Deeds recorded in West Virginia are subject to an Excise Tax (Transfer Tax Fee).

West Virginia requires all business entities and individuals to obtain a business registration certificate from the State Tax Department before doing business in the state. This certificate (sometimes referred to as a ?business license?) is needed for each business location.

To inquire about the license status of a CPA, contact the West Virginia Board of Accountancy at 1-304-558-3557 or visit The West Board of Accountancy Licensure Verification Page.