An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Verification of an Account

Description

How to fill out Verification Of An Account?

If you need to total, down load, or printing lawful record themes, use US Legal Forms, the biggest variety of lawful varieties, that can be found on the Internet. Take advantage of the site`s simple and practical research to discover the files you require. Different themes for enterprise and individual functions are categorized by categories and suggests, or keywords. Use US Legal Forms to discover the West Virginia Verification of an Account in a few clicks.

In case you are presently a US Legal Forms customer, log in in your accounts and click on the Obtain switch to obtain the West Virginia Verification of an Account. You can also gain access to varieties you in the past saved inside the My Forms tab of your accounts.

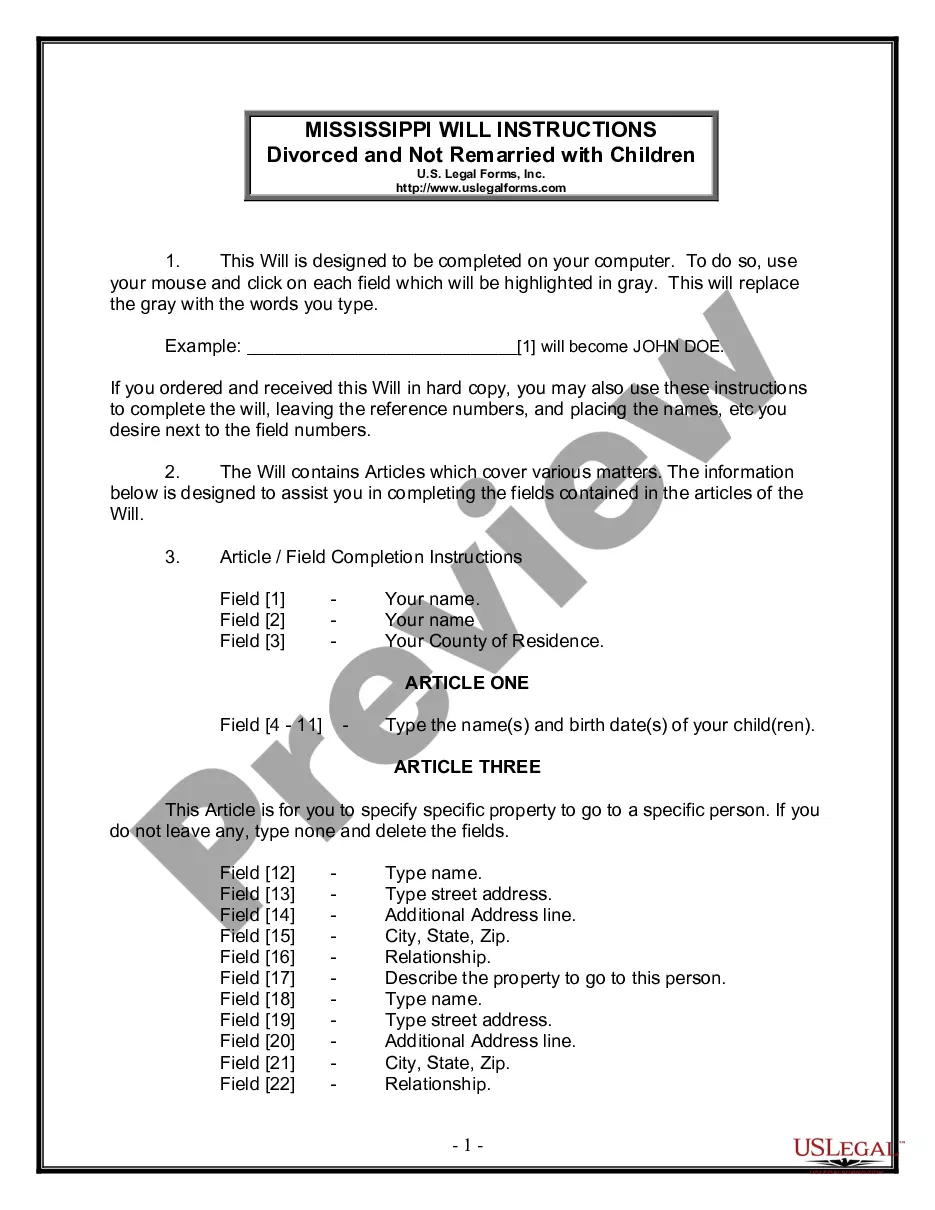

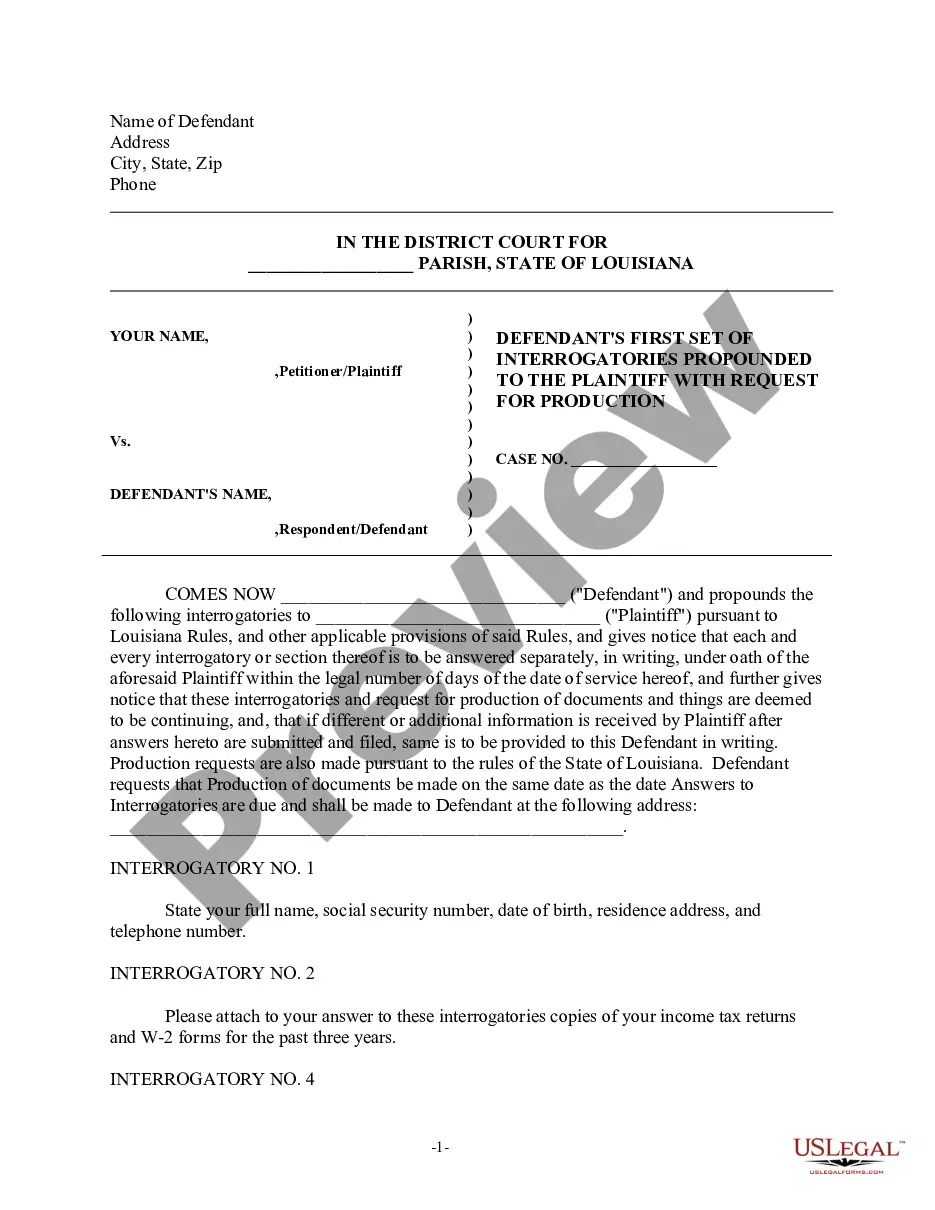

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the proper city/land.

- Step 2. Make use of the Preview solution to look over the form`s content material. Don`t forget to read the description.

- Step 3. In case you are unhappy with the form, use the Research discipline on top of the display screen to locate other types of your lawful form format.

- Step 4. Once you have located the shape you require, select the Purchase now switch. Opt for the prices strategy you choose and add your credentials to register on an accounts.

- Step 5. Approach the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Pick the format of your lawful form and down load it on the gadget.

- Step 7. Comprehensive, revise and printing or indication the West Virginia Verification of an Account.

Each and every lawful record format you get is the one you have permanently. You may have acces to every form you saved in your acccount. Select the My Forms segment and select a form to printing or down load yet again.

Be competitive and down load, and printing the West Virginia Verification of an Account with US Legal Forms. There are thousands of skilled and status-certain varieties you can utilize for the enterprise or individual demands.

Form popularity

FAQ

As with all states, once a CPA candidate passes their first CPA exam section, they will only have 18 months to pass the remaining three CPA exam sections to complete the Uniform CPA Examination. Once a CPA candidate has passed the Uniform CPA Examination, their scores never expire in Virginia.

The public is encouraged to visit the VBOA licensee search and verify if a CPA holds an Active license. Other resources on CPAs include the Virginia Society of Certified Public Accountants and the Better Business Bureau.

To inquire about the license status of a CPA, contact the West Virginia Board of Accountancy at 1-304-558-3557 or visit The West Board of Accountancy Licensure Verification Page.

CPAverify.org is the public facing version of NASBA's Accountancy Licensee Database (ALD). The site is a free service that is available to the public so that anyone can quickly determine whether a person or firm is licensed to practice public accounting.

Active CPAs must complete the required 120 CPE hours over a rolling three-year period, with a minimum of 20 hours annually. The CPE requirement also includes completing a two-hour VBOA-approved ethics course annually and eight hours of A&A courses, if applicable.

We protect the citizens of the Commonwealth through a regulatory program of licensure and compliance of CPAs and CPA firms.