West Virginia Certificate of Trust for Mortgage

Description

How to fill out Certificate Of Trust For Mortgage?

Are you inside a situation in which you require documents for sometimes enterprise or specific reasons nearly every day time? There are a variety of authorized record themes available online, but finding kinds you can rely is not straightforward. US Legal Forms gives a large number of develop themes, such as the West Virginia Certificate of Trust for Mortgage, that happen to be published in order to meet federal and state demands.

If you are previously familiar with US Legal Forms website and also have a free account, basically log in. Next, you may acquire the West Virginia Certificate of Trust for Mortgage design.

Unless you have an accounts and want to begin using US Legal Forms, follow these steps:

- Obtain the develop you want and make sure it is to the appropriate metropolis/county.

- Make use of the Review switch to examine the shape.

- See the explanation to actually have selected the appropriate develop.

- If the develop is not what you`re seeking, take advantage of the Search area to obtain the develop that meets your needs and demands.

- If you get the appropriate develop, just click Get now.

- Choose the costs strategy you would like, submit the specified info to generate your bank account, and pay for an order with your PayPal or charge card.

- Pick a handy file structure and acquire your backup.

Find all of the record themes you have bought in the My Forms menus. You can obtain a additional backup of West Virginia Certificate of Trust for Mortgage anytime, if required. Just click on the required develop to acquire or produce the record design.

Use US Legal Forms, probably the most substantial selection of authorized types, to conserve time as well as steer clear of faults. The services gives appropriately created authorized record themes that can be used for an array of reasons. Produce a free account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

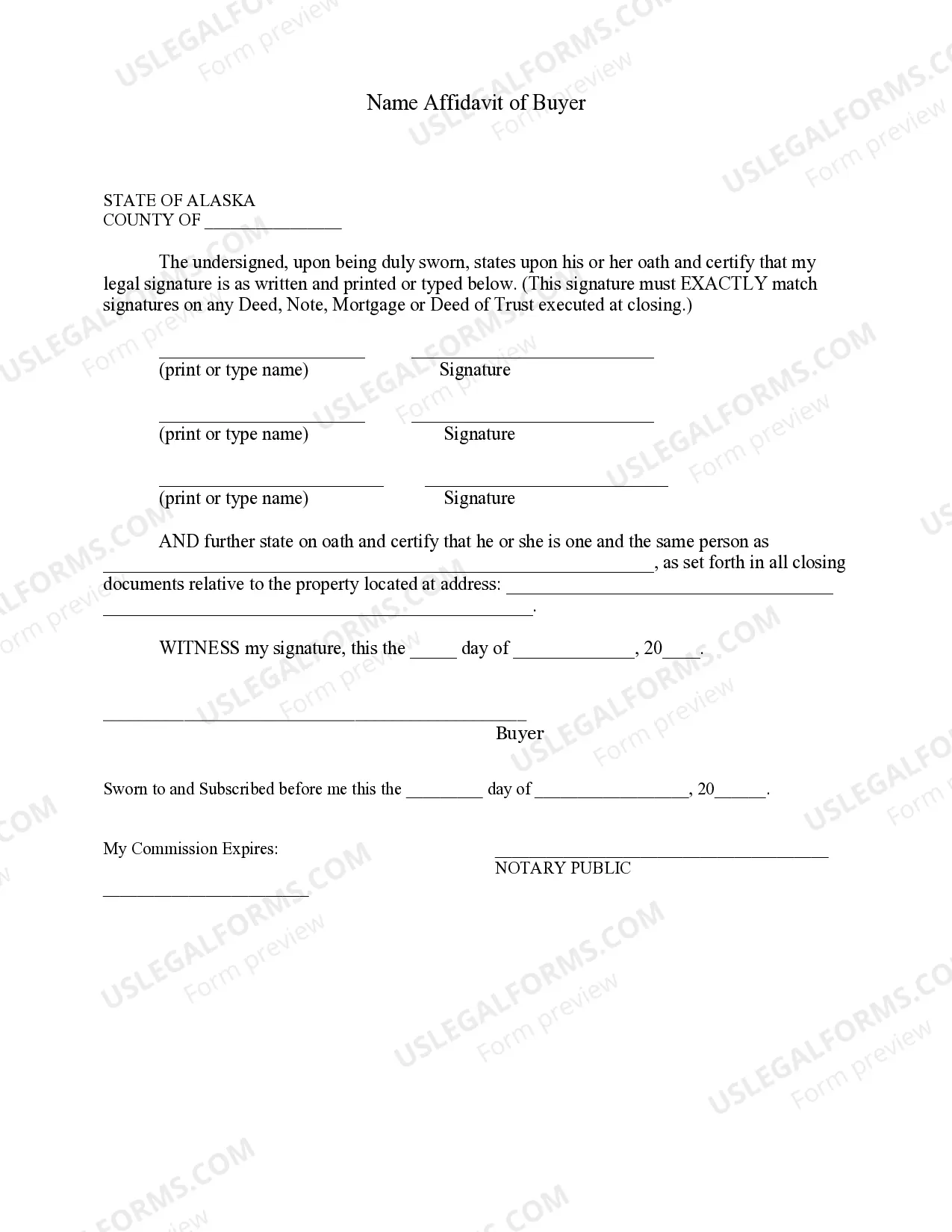

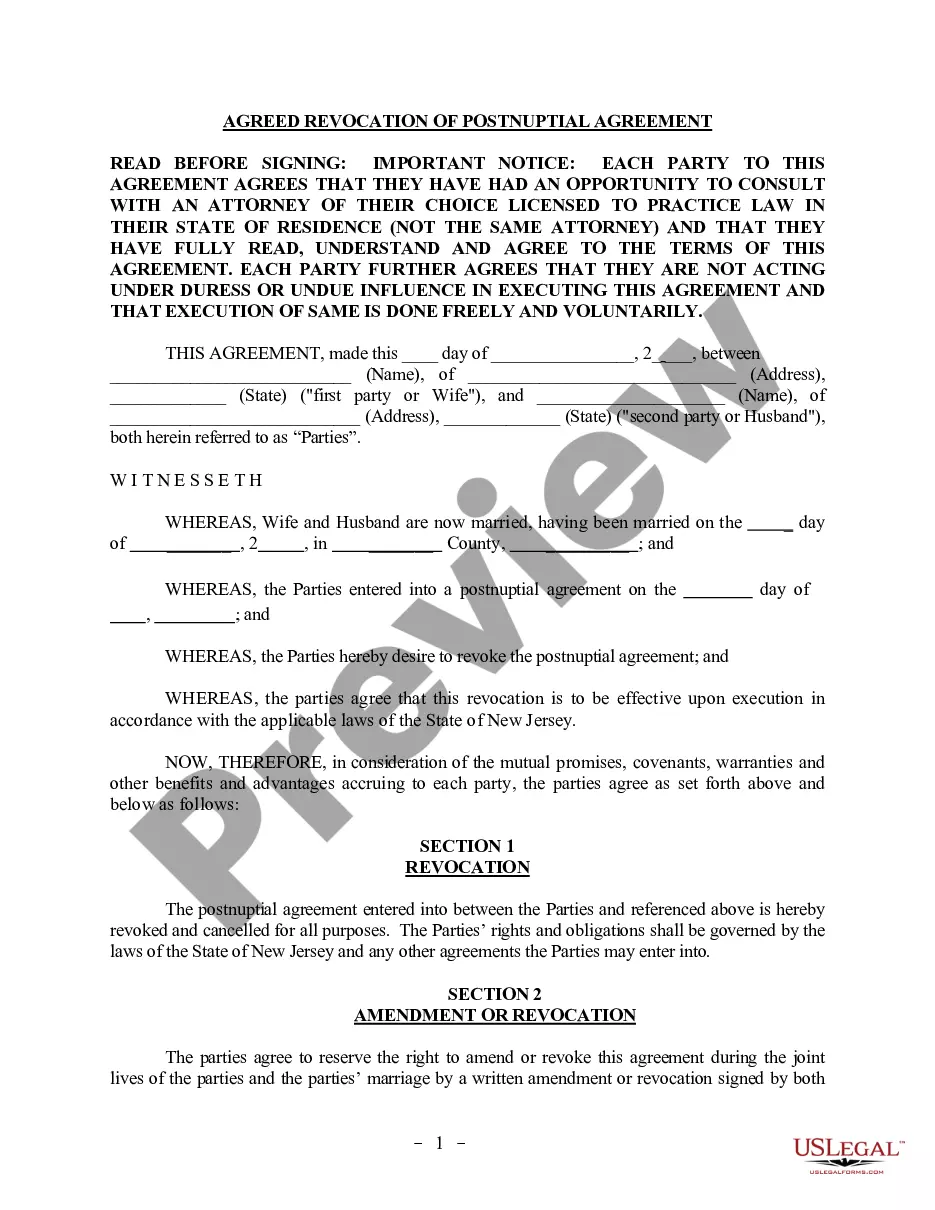

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act. It's shorter than the actual Trust document, and it can offer pertinent information without making every aspect of the Trust public.

Anyone can make a trust in Virginia as long as they follow the requirements as listed in the statute. The settlor must have the proper mental capacity and must intend to create the trust. Furthermore, the settlor must name a beneficiary for the trust and a trustee to manage it.

A certification of trust shall state that the trust has not been revoked, modified, or amended in any manner that would cause the representations contained in the certification of trust to be incorrect.

Declaration of Consideration of Value (This is the monetary amount for which the property is sold. If the property is being transferred without monetary value, it must state in the declaration paragraph 'why' it is exempt from transfer tax.)

A West Virginia deed of trust transfers a borrower's real estate to a trustee to secure their financial obligation to a lender. The borrower is returned their property title upon repaying their debt to the lender.

A credit line deed of trust shall be, from the time it is duly recorded as required by law, security for all indebtedness or other obligations secured thereby at the time of recording and for all future advances secured thereby in an aggregate principal amount outstanding at any time not to exceed the maximum amount ...

Beneficiaries have the legal right to copies of trust documents. This right emerges when the Trust becomes irrevocable or after the passing of a Trust creator, known as a ?Grantor.? It's vital for beneficiaries to know their rights for trust transparency and proper administration.