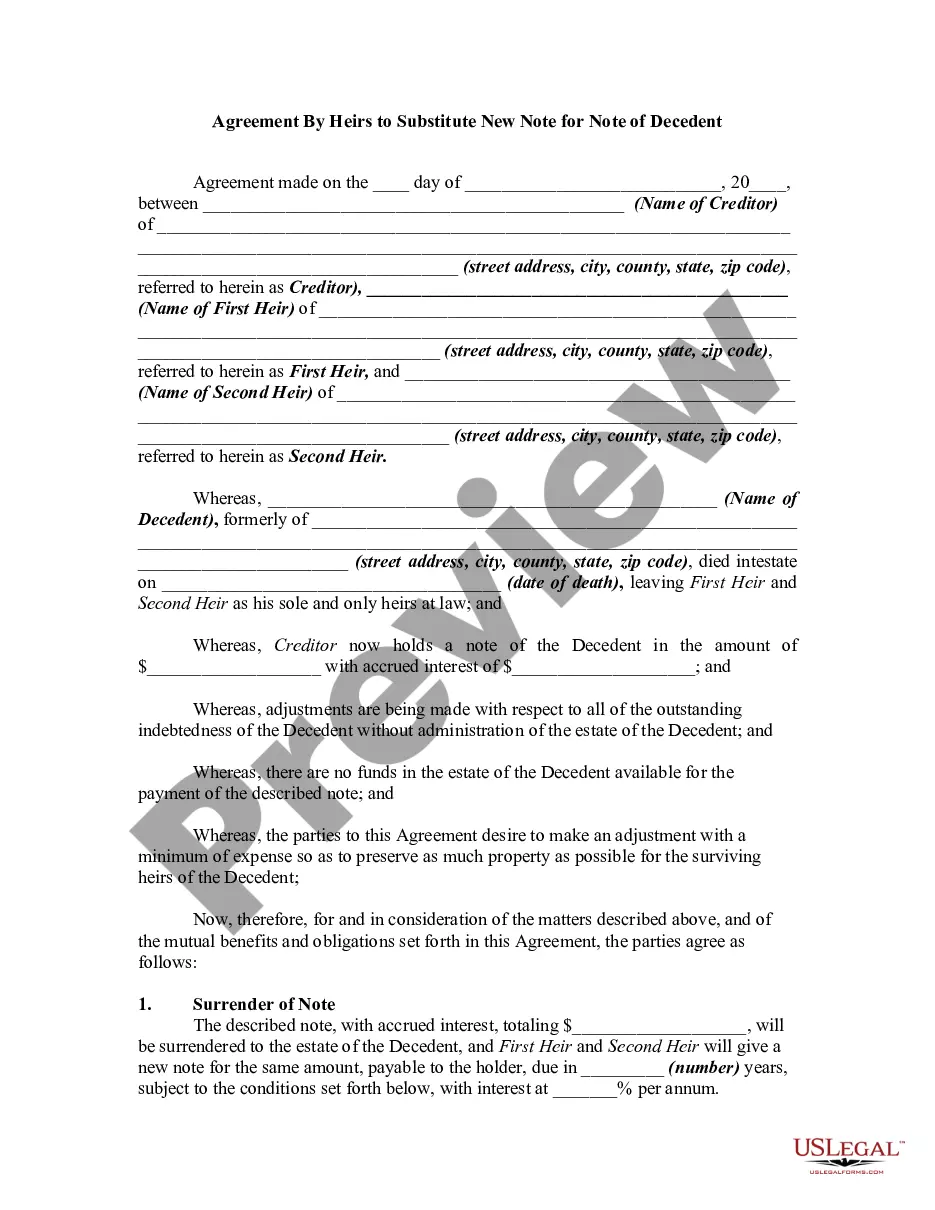

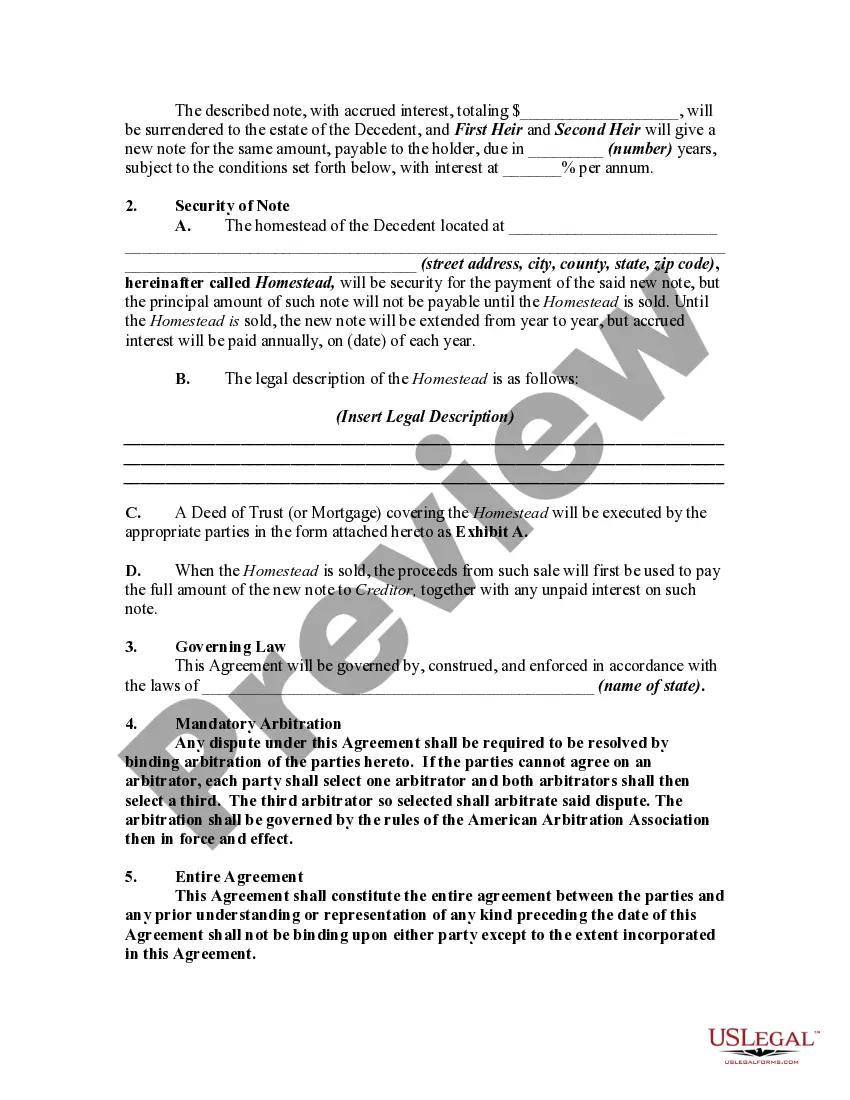

Are you currently in the position where you will need files for sometimes company or specific purposes nearly every day time? There are plenty of legal file templates available on the Internet, but finding kinds you can rely isn`t effortless. US Legal Forms delivers a large number of kind templates, like the West Virginia Agreement By Heirs to Substitute New Note for Note of Decedent, that happen to be published in order to meet state and federal demands.

Should you be previously acquainted with US Legal Forms web site and get a merchant account, merely log in. Following that, it is possible to obtain the West Virginia Agreement By Heirs to Substitute New Note for Note of Decedent web template.

If you do not offer an profile and wish to start using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for the appropriate metropolis/state.

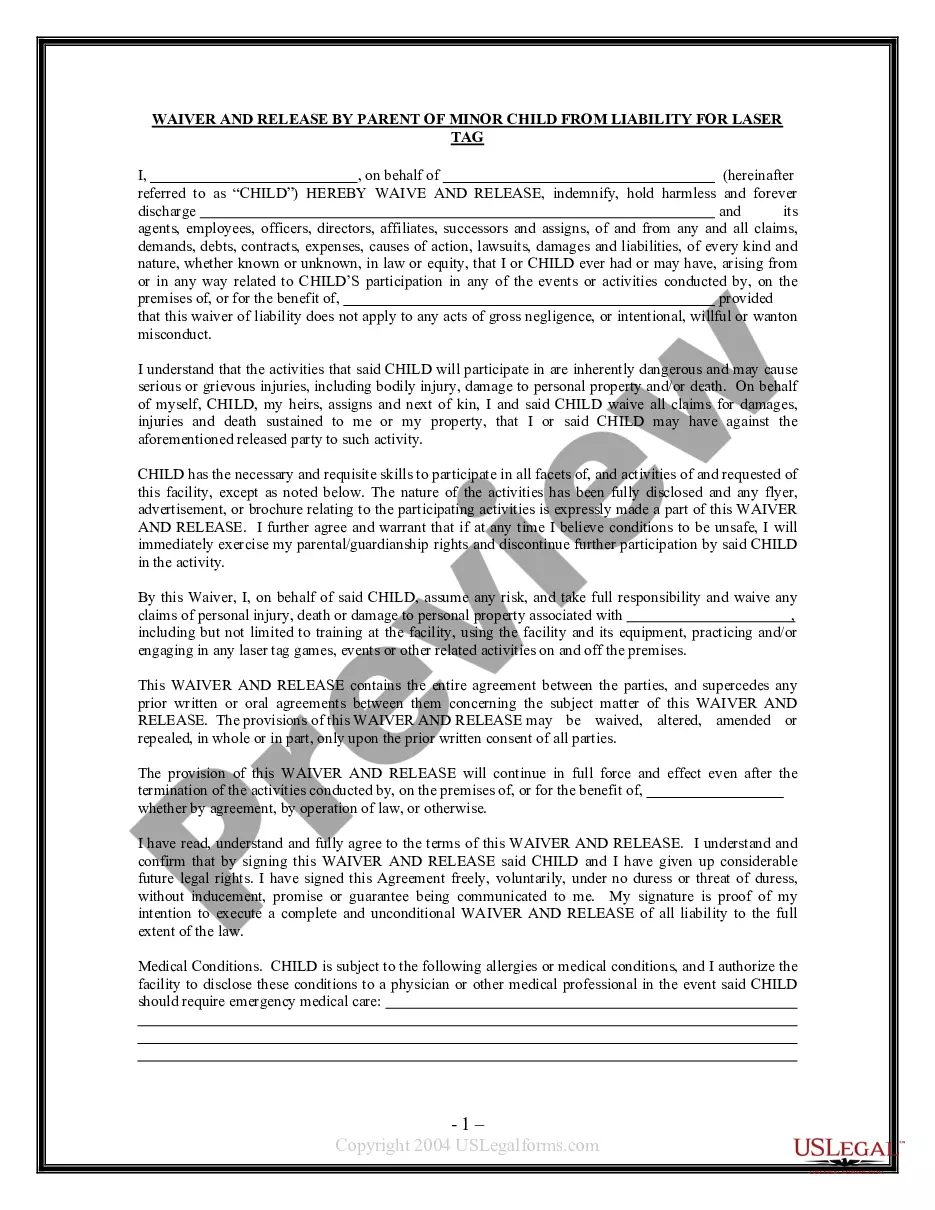

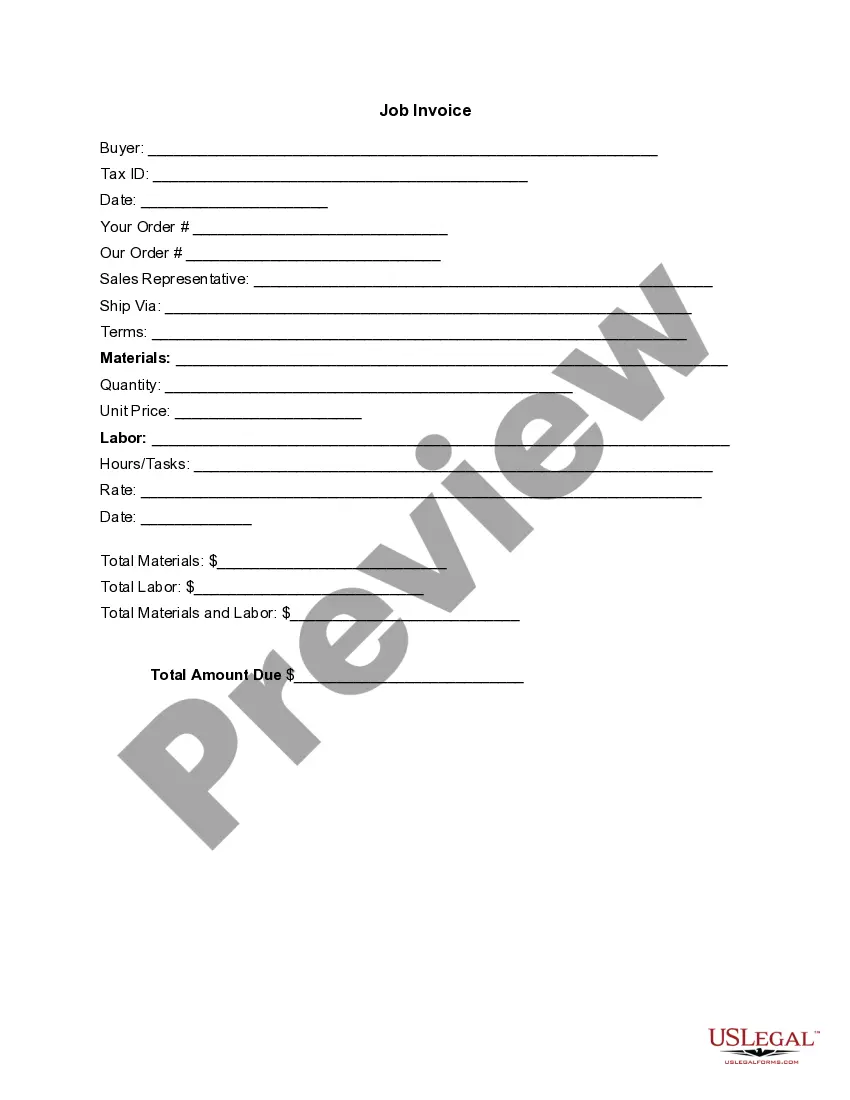

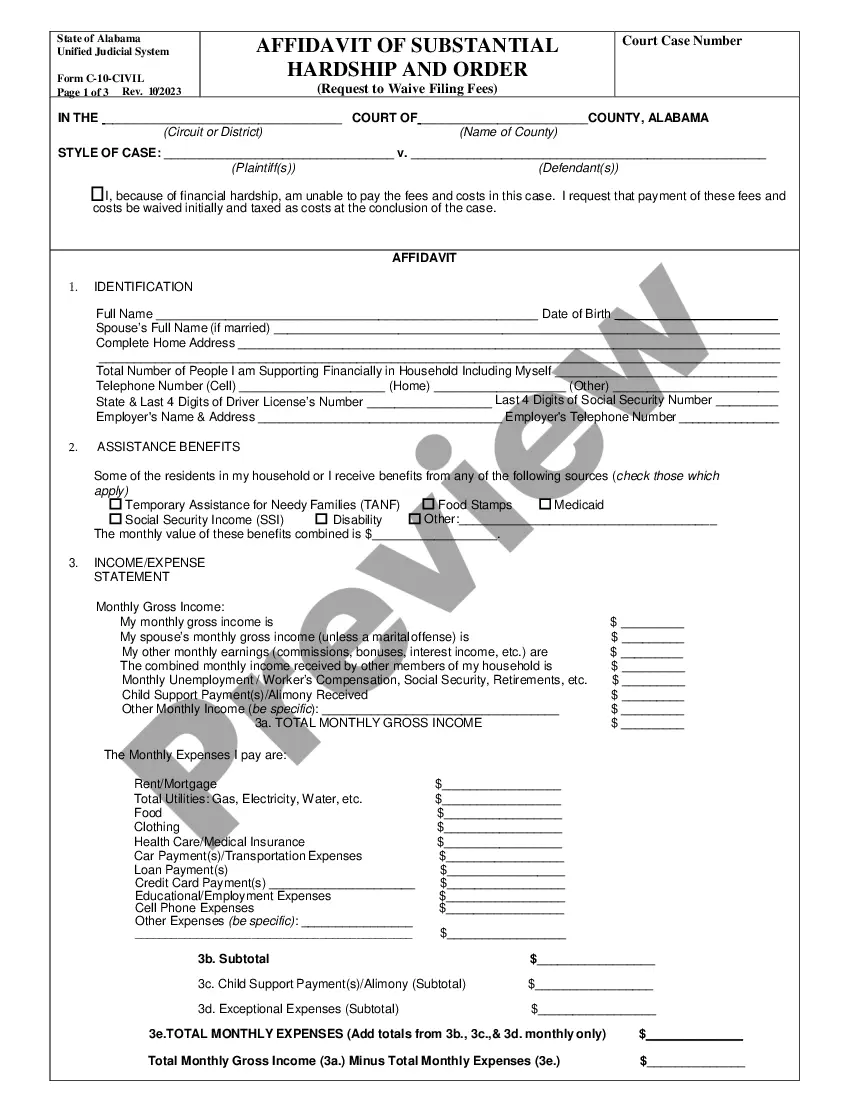

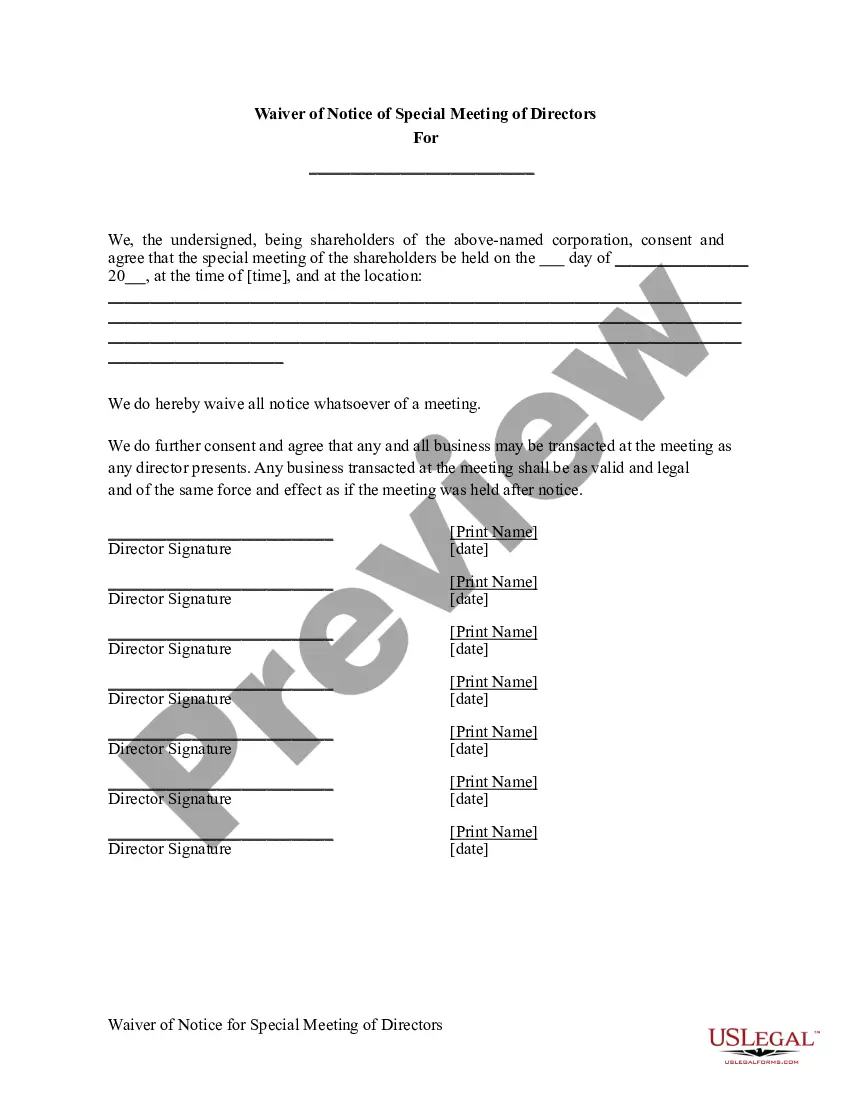

- Take advantage of the Review option to analyze the form.

- Browse the description to actually have chosen the correct kind.

- When the kind isn`t what you`re looking for, use the Search field to obtain the kind that meets your needs and demands.

- Once you get the appropriate kind, click Get now.

- Select the costs plan you would like, complete the desired info to make your bank account, and pay for an order using your PayPal or charge card.

- Select a hassle-free data file file format and obtain your copy.

Find all of the file templates you may have bought in the My Forms food list. You can get a additional copy of West Virginia Agreement By Heirs to Substitute New Note for Note of Decedent at any time, if required. Just click the needed kind to obtain or print out the file web template.

Use US Legal Forms, by far the most substantial variety of legal types, to save lots of some time and prevent blunders. The assistance delivers expertly made legal file templates which you can use for a range of purposes. Generate a merchant account on US Legal Forms and begin generating your way of life easier.