West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

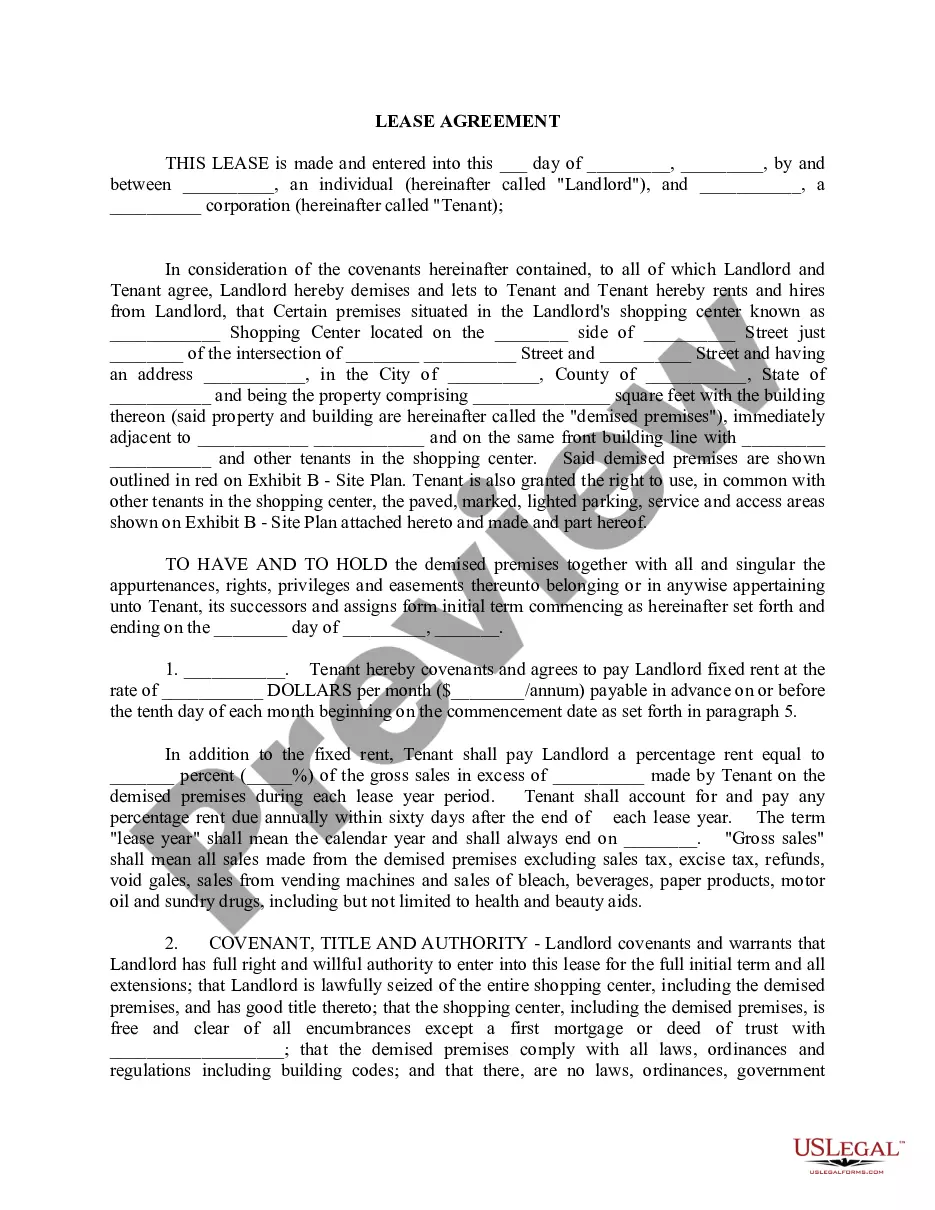

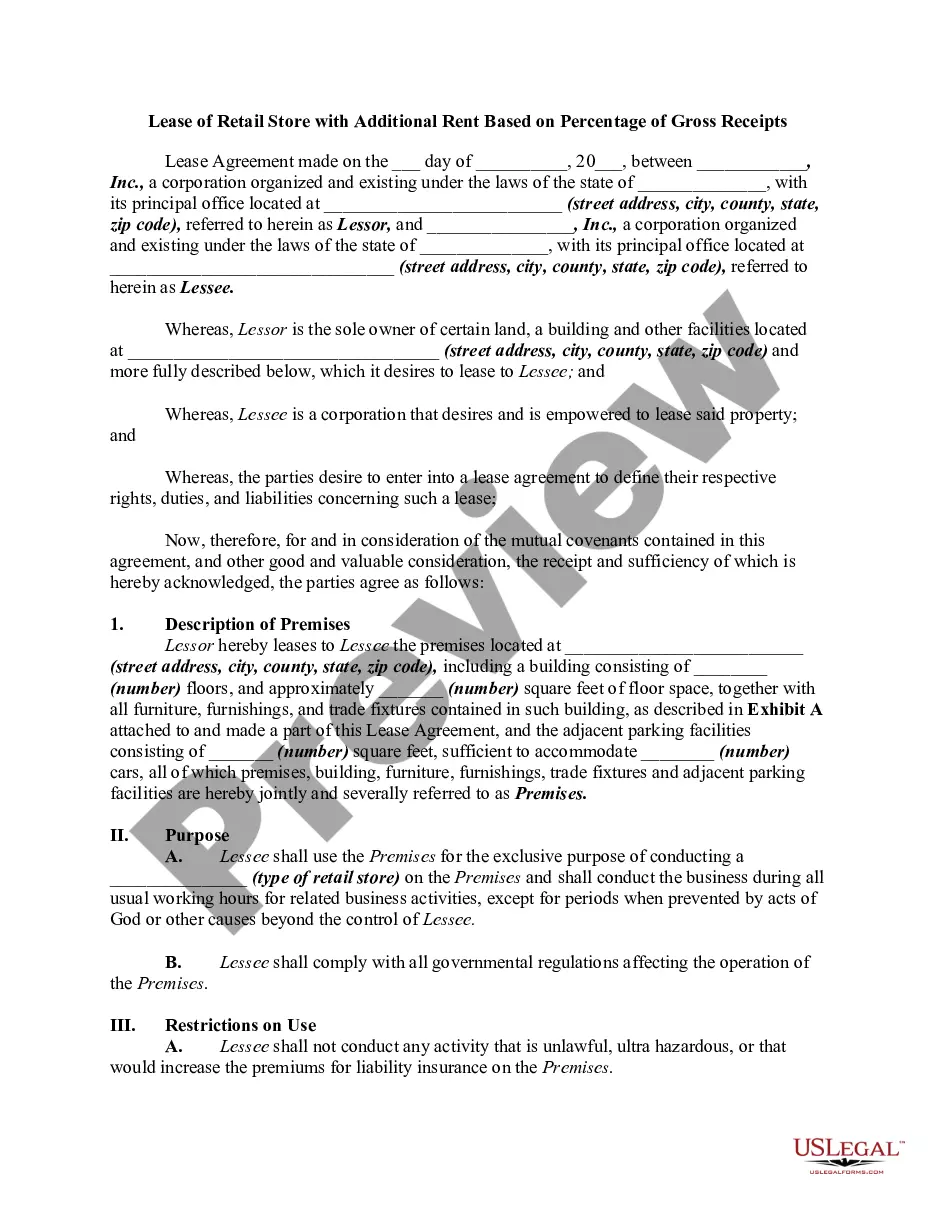

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

You can spend time online attempting to locate the valid document template that fulfills the federal and state criteria you require.

US Legal Forms offers thousands of valid forms that have been reviewed by experts.

You can download or create the West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate from the platform.

If available, use the Preview option to view the document template as well.

- If you have a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Every valid document template you obtain is yours permanently.

- To get an extra copy of a purchased form, proceed to the My documents section and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice. Check the form details to ensure you have chosen the right form.

Form popularity

FAQ

A breakpoint in a contract signifies the sales threshold that triggers additional rent payments in a percentage lease. Understanding this concept is vital for tenants and landlords alike in a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It establishes clear expectations regarding when and how much rent will increase based on performance.

Gross leases are typically used with commercial properties where the landlord covers the property's operating expenses. In a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this could encompass maintenance, property taxes, and utilities, providing tenants with a predictable expense model. This can be advantageous for new or small business owners.

Tenants with businesses that experience variable sales often opt for percentage leases. Retailers in the entertainment, food, or fashion sectors commonly benefit from this arrangement in a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Such leases allow them to manage costs while capitalizing on peak sales periods.

A percentage lease is particularly suitable for retail environments where sales fluctuations are common. Newer businesses or seasonal shops in a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate benefit greatly, as they align rental costs with actual sales growth. This arrangement allows flexibility during varying business climates.

To calculate a percentage lease, first determine your base rent and the agreed-upon percentage of gross receipts. Once you have those figures, you can apply the formula for total rent mentioned earlier. This approach is essential in a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate for effective financial planning.

The formula for a percentage lease generally incorporates the base rent and a percentage of sales over a specific breakpoint. For a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it can be expressed as: Total Rent = Base Rent + (Percentage x (Gross Receipts - Breakpoint)). Understanding this formula helps tenants forecast potential costs.

The breakpoint percentage is the rental percentage applied to a tenant's gross receipts that determines when additional rent is incurred. In a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this percentage is crucial as it helps calculate when a tenant exceeds their base rent obligation. A precise understanding of this percentage can significantly affect a business's budgeting.

The break-even point in percentage leases marks the sales level a tenant needs to achieve to cover the base rent. In the context of a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this point indicates where the revenue equals the fixed rent, without accruing additional charges. Knowing this helps in planning profitability.

To calculate a breakpoint in a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you first determine the base rent and the percentage of gross receipts that apply. Divide the annual base rent by the agreed percentage rate. This figure represents the sales threshold before any additional rent is charged.

W VA Code R 110 15 129 pertains to regulations related to sales tax and other transactional requirements in West Virginia. This code outlines how sales taxes apply to various business activities, including retail leases. If you are negotiating a West Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding this code can provide vital information on compliance and legal obligations.