West Virginia Employment Application for Sole Trader

Description

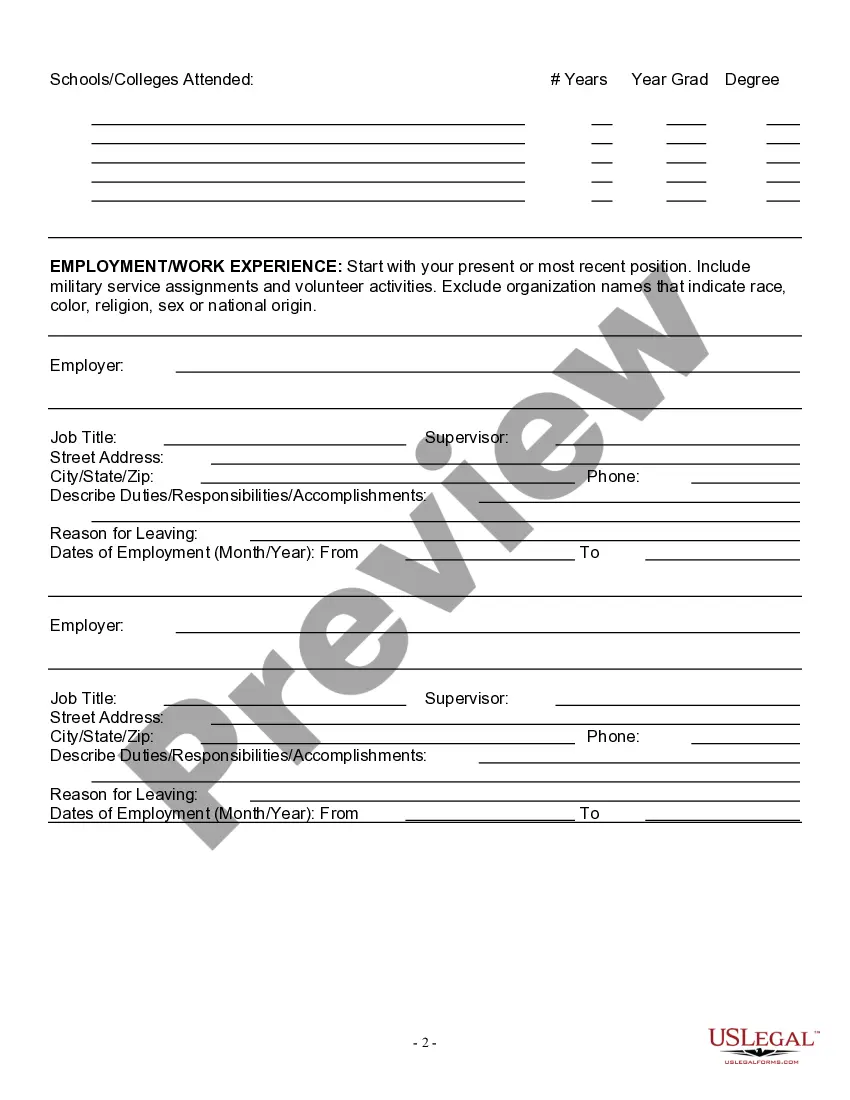

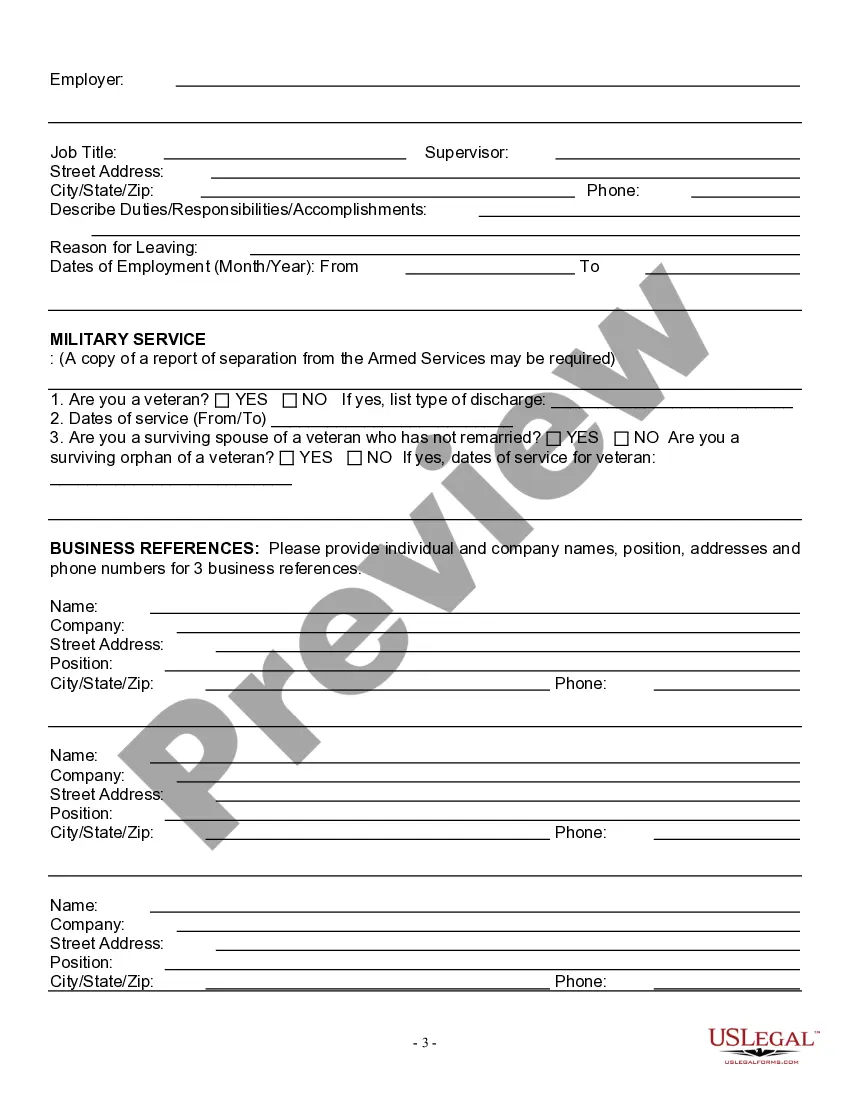

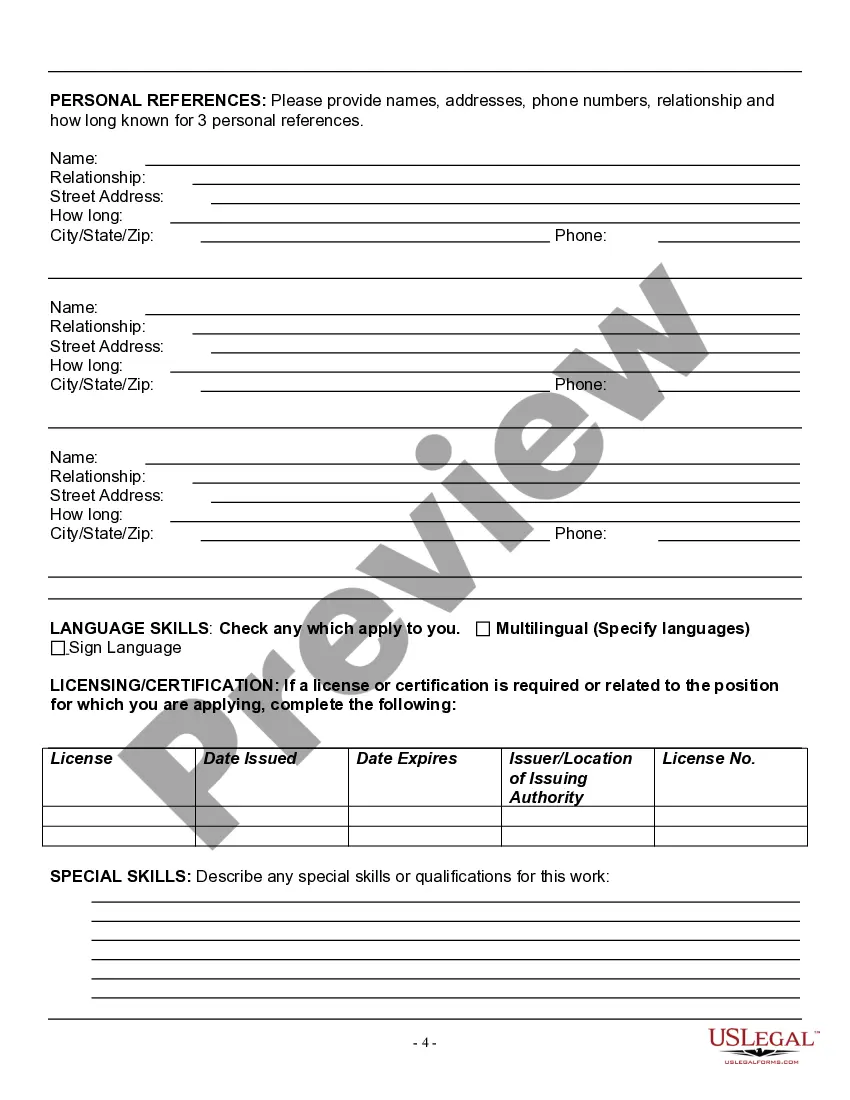

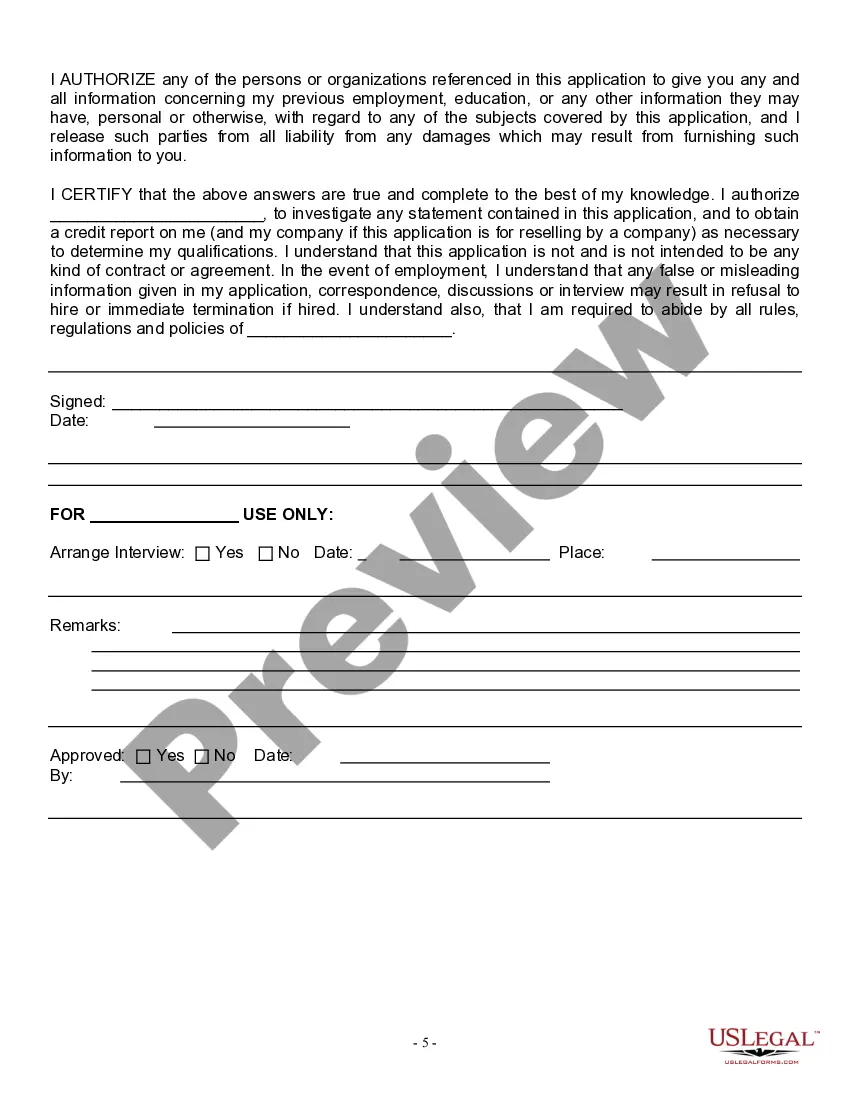

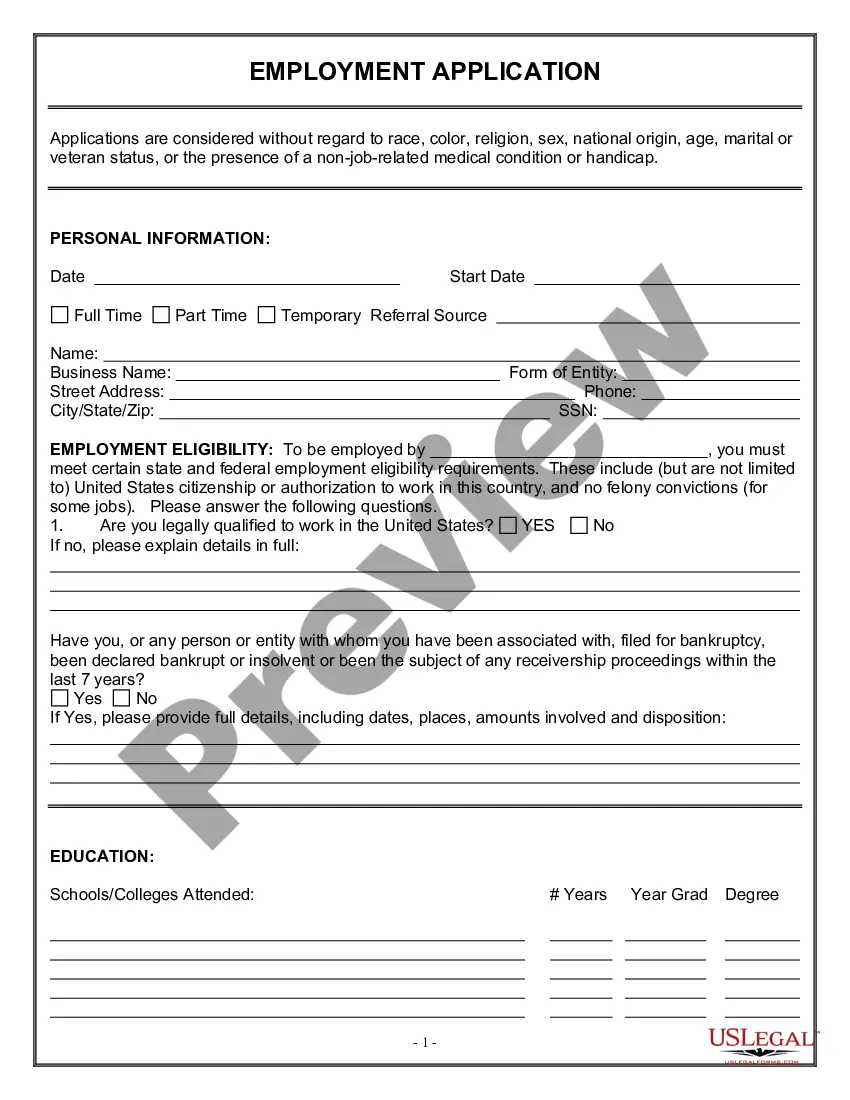

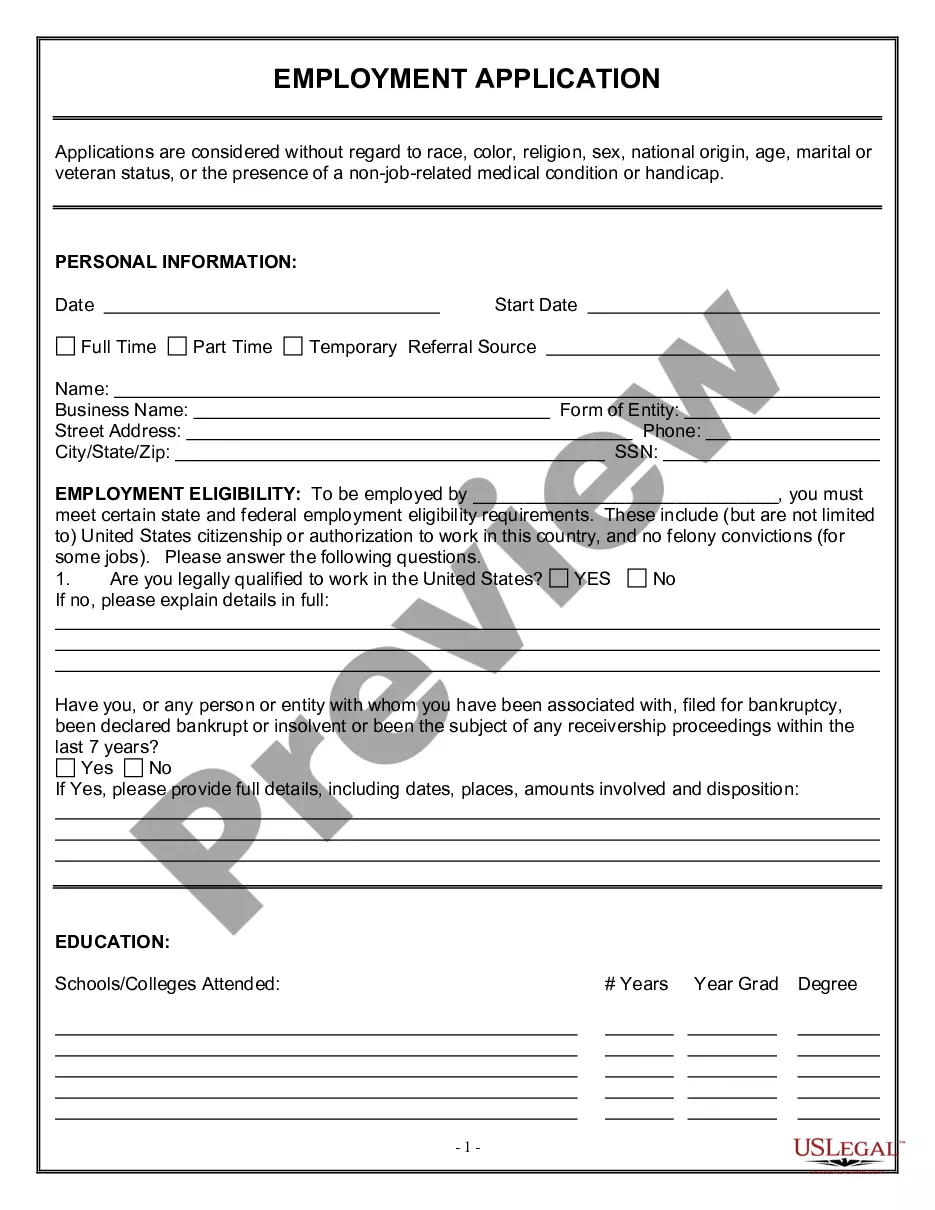

How to fill out Employment Application For Sole Trader?

If you require thorough, acquire, or create legal document templates, utilize US Legal Forms, the largest compilation of legal forms, which can be accessed online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are categorized by types and titles, or keywords.

Step 4. After you have found the form you require, click on the Download now option. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the West Virginia Employment Application for Sole Trader in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to locate the West Virginia Employment Application for Sole Trader.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure that you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The filing fee is $100. To form a corporation in West Virginia, you must file Articles of Incorporation with the West Virginia Secretary of State. You can file the articles online through the WV One Stop Business Portal, or by using postal mail. The filing fee is $100.

How to get a sales tax permit in West Virginia. You can complete the form WV/BUS-APP found in this booklet or register online at Business for West Virginia. You need this information to register for a sales tax permit in West Virginia: Personal identification info (SSN, address, etc.)

The total fees for registration of Sole Proprietorship Firm in India is 20b91,999 including government and professional fees. The main cost is mandatory registrations for existence of proprietorship firm like GST registration, MSME registration, etc.

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

Obtain Business Licenses and PermitsThere isn't a requirement in West Virginia for sole proprietors to acquire a general business license, but depending on the nature of your business you may need other licenses and/or permits to operate in a compliant fashion.

If you already have a WV Withholding Tax Account Number, you can find this on previous tax filings or correspondence from the WV State Tax Department. If you're unsure, contact the agency at 1-304-558-3333.

There are no costs to start a sole proprietorship, and it typically costs between $10 and $100 to register a DBA for a sole proprietorship. While that's the least expensive option, the cost of forming an LLC generally ranges between $100 and $800 still a reasonably affordable fee to start a new business.

As a sole proprietor you must report all business income or losses on your personal income tax return; the business itself is not taxed separately. (The IRS calls this "pass-through" taxation, because business profits pass through the business to be taxed on your personal tax return.)