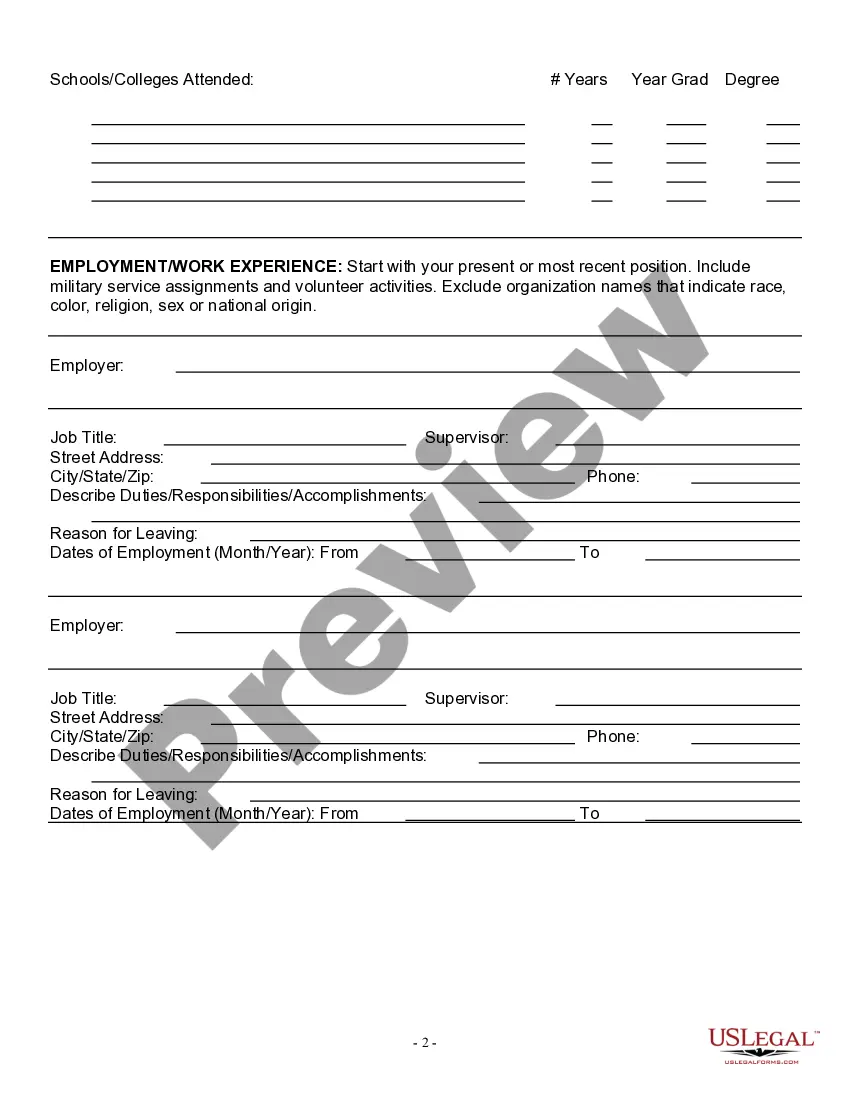

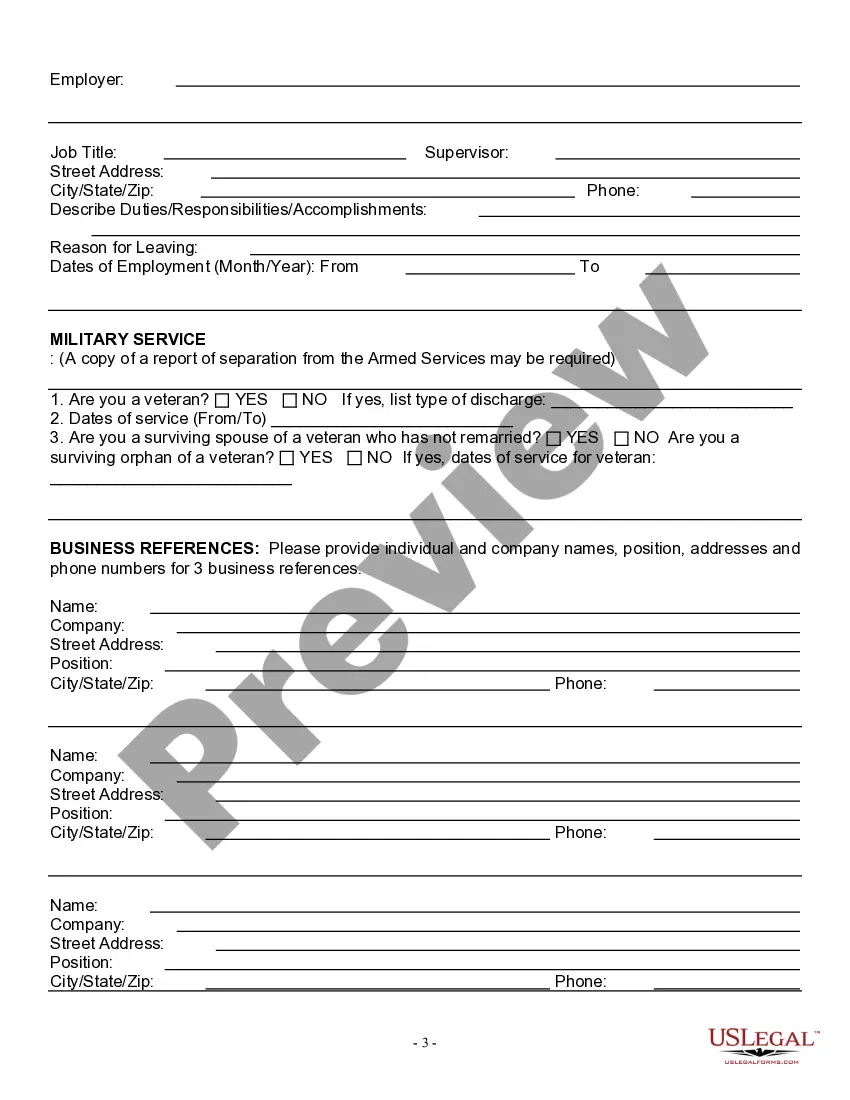

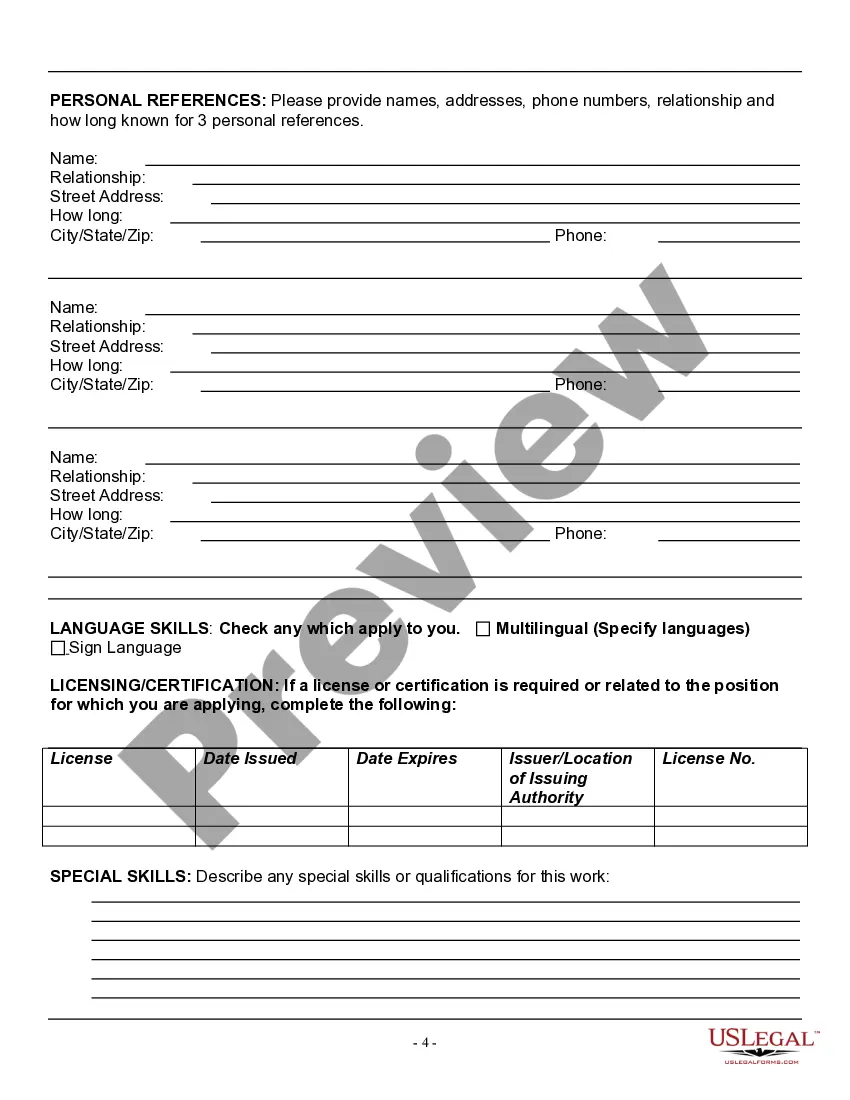

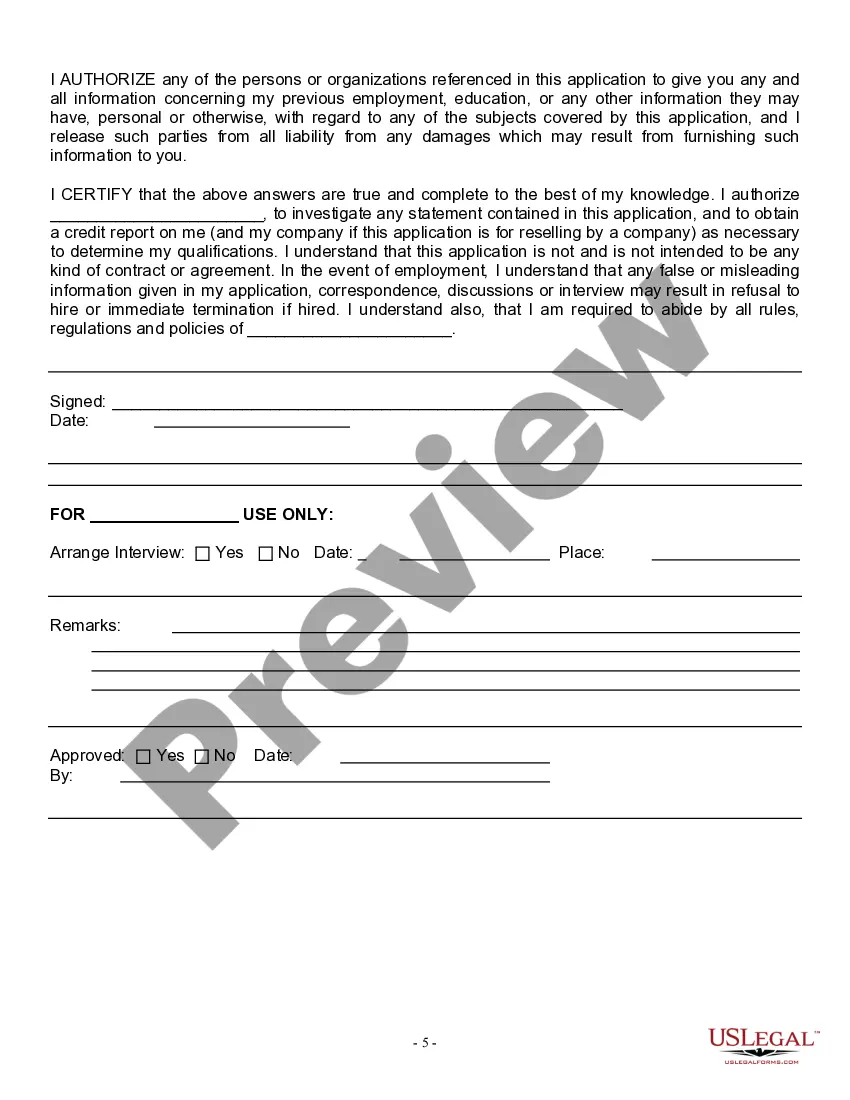

West Virginia Employment Application for Labourer

Description

How to fill out Employment Application For Labourer?

If you need to complete, obtain, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the website's straightforward and user-friendly search tool to find the documents you require.

Various templates for business and personal use are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click on the Buy now option. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the West Virginia Employment Application for Laborer in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to get the West Virginia Employment Application for Laborer.

- You can also access documents you previously saved in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow these instructions below.

- Step 1. Make sure you have chosen the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the document’s content. Don't forget to read through the description.

- Step 3. If you are not satisfied with the document, use the Search bar at the top of the screen to locate other types of legal document formats.

Form popularity

FAQ

You are required to issue a Low Earnings Report to any full-time employee whose earnings in a week are reduced because of lack of work. Do not issue a Low Earnings Report to a part-time employee.

W&H Contact Information1900 Kanawha Boulevard, 200bEast.State Capitol Complex - Building 3, Room 200.Charleston, WV 25305.Main - (304)558-7890.Fax - (304)558-3797.Child Labor.Jobs Act.Minimum Wage.More items...

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar.

How do I file a claim? You must file your Initial Unemployment Compensation Application online at uc.workforcewv.org and select the radio button To file a new/additional Initial Unemployment Claim.

West Virginia law distinguishes between simple and gross misconduct. You will be disqualified for a longer period of time for gross misconduct, which includes such serious offenses as intentional destruction of company property, theft, assault, or working under the influence of alcohol or drugs.

By government standards, "low-income" earners are men and women whose household income is less than double the Federal Poverty Level (FPL). For a single person household, the 2019 FPL was $12,490 a year. That means that a single person making less than $25,000 a year would be considered low income.

WorkForce West Virginia is a state government agency funded through the U.S. Department of Labor that oversees the state unemployment insurance program as well as a network of workforce development services designed to provide West Virginia's citizens and employers the opportunity to compete in today's competitive

West Virginia Withholding Tax Account Number If you already have a WV Withholding Tax Account Number, you can find this on previous tax filings or correspondence from the WV State Tax Department. If you're unsure, contact the agency at 1-304-558-3333.

How much can I earn and still be eligible to receive UC benefits? You may work and earn up to $60 per week and still receive your full weekly benefit amount. Wages of more than $60 are deducted from your weekly benefit amount on a dollar-for-dollar basis. Any amount of wages earned must be reported.

You may file your weekly claim certification either by going through our online web service by clicking or by calling 1-800-379-1032.