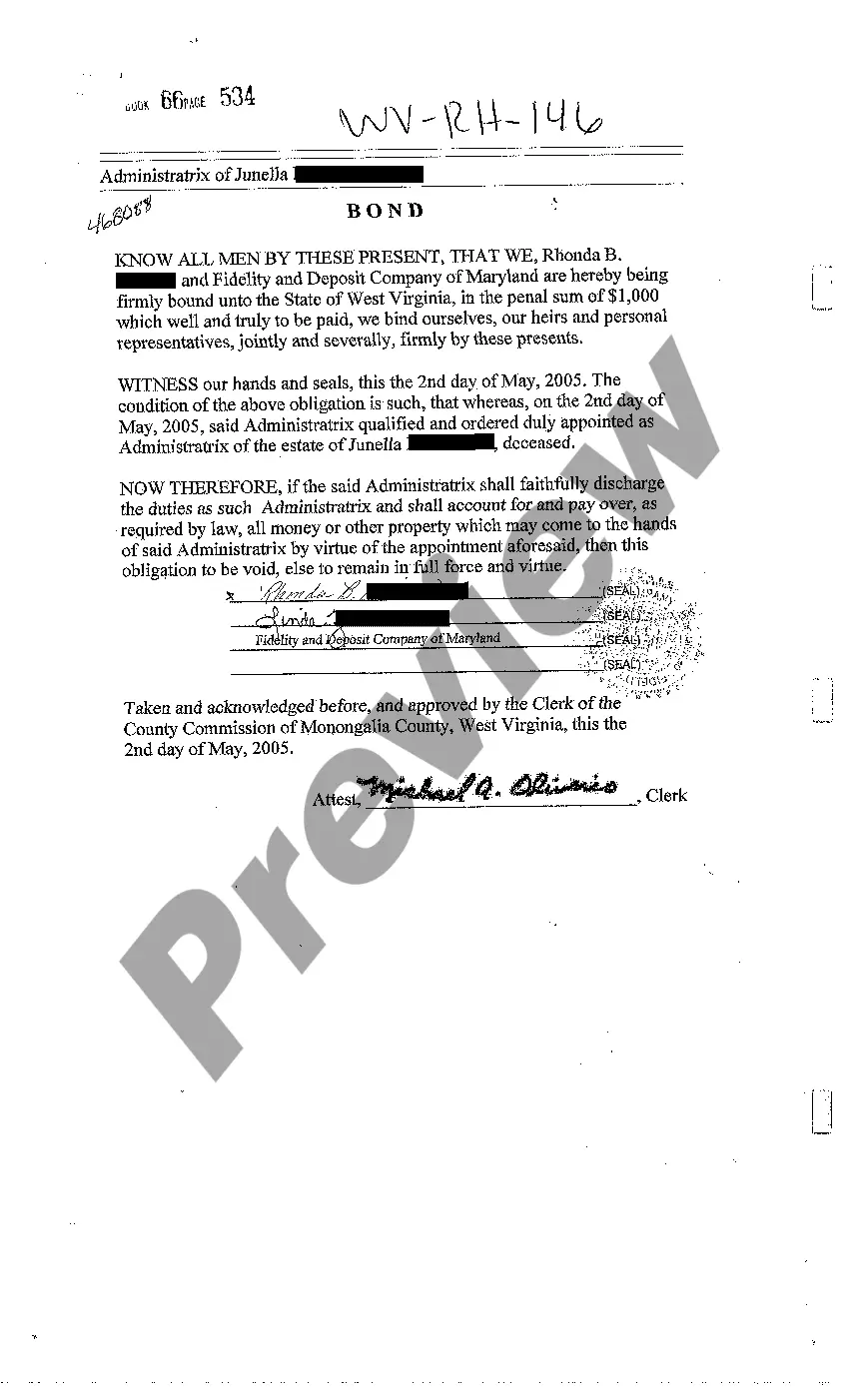

West Virginia Bond for Administration of Will

Description

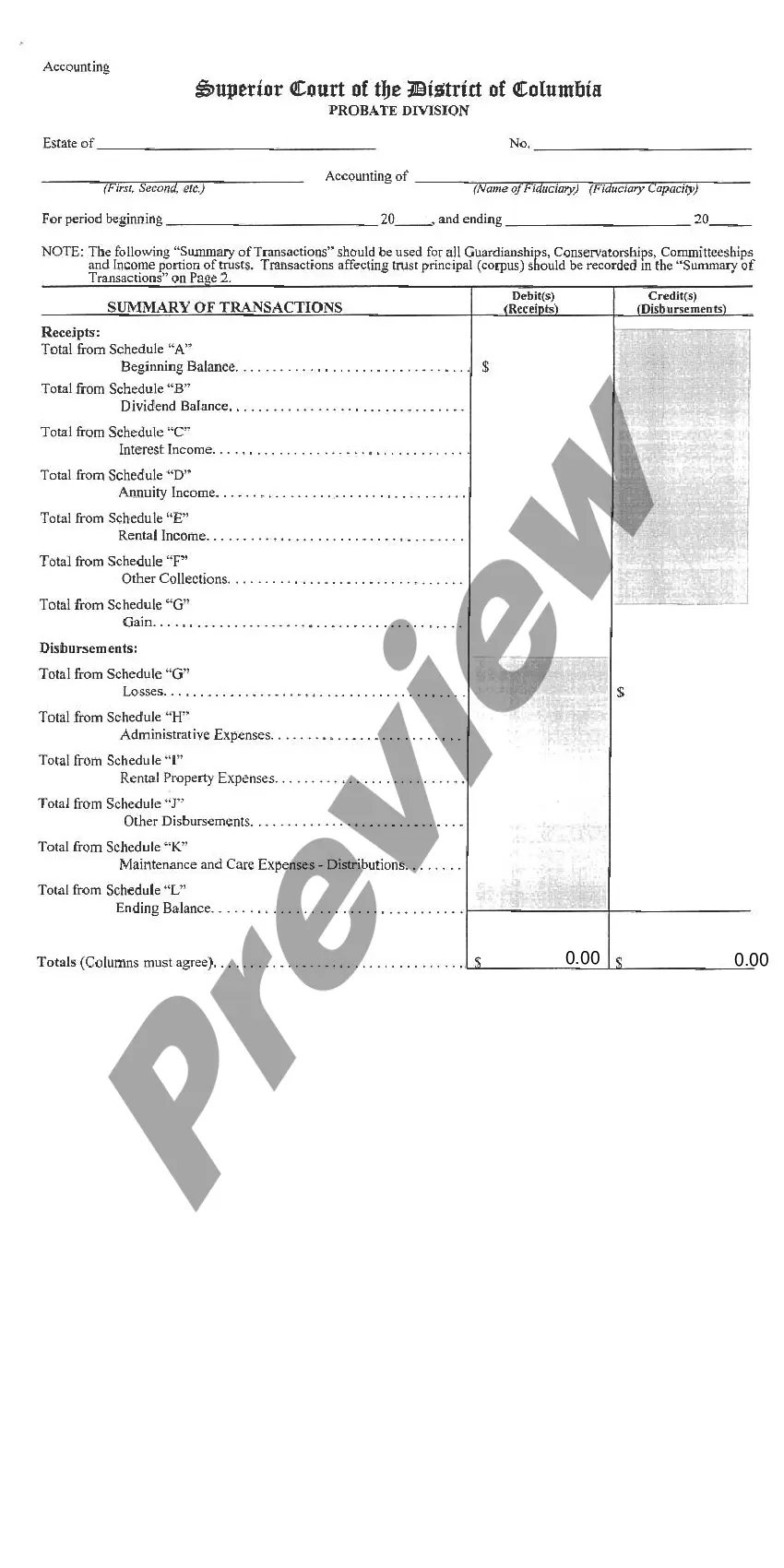

How to fill out West Virginia Bond For Administration Of Will?

Among numerous paid and free examples that you can get on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to take care of the thing you need them to. Always keep relaxed and make use of US Legal Forms! Find West Virginia Bond for Administration of Will templates developed by professional lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and then having to pay them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are seeking. You'll also be able to access all of your earlier acquired files in the My Forms menu.

If you’re making use of our platform the first time, follow the guidelines below to get your West Virginia Bond for Administration of Will quick:

- Ensure that the file you discover is valid in the state where you live.

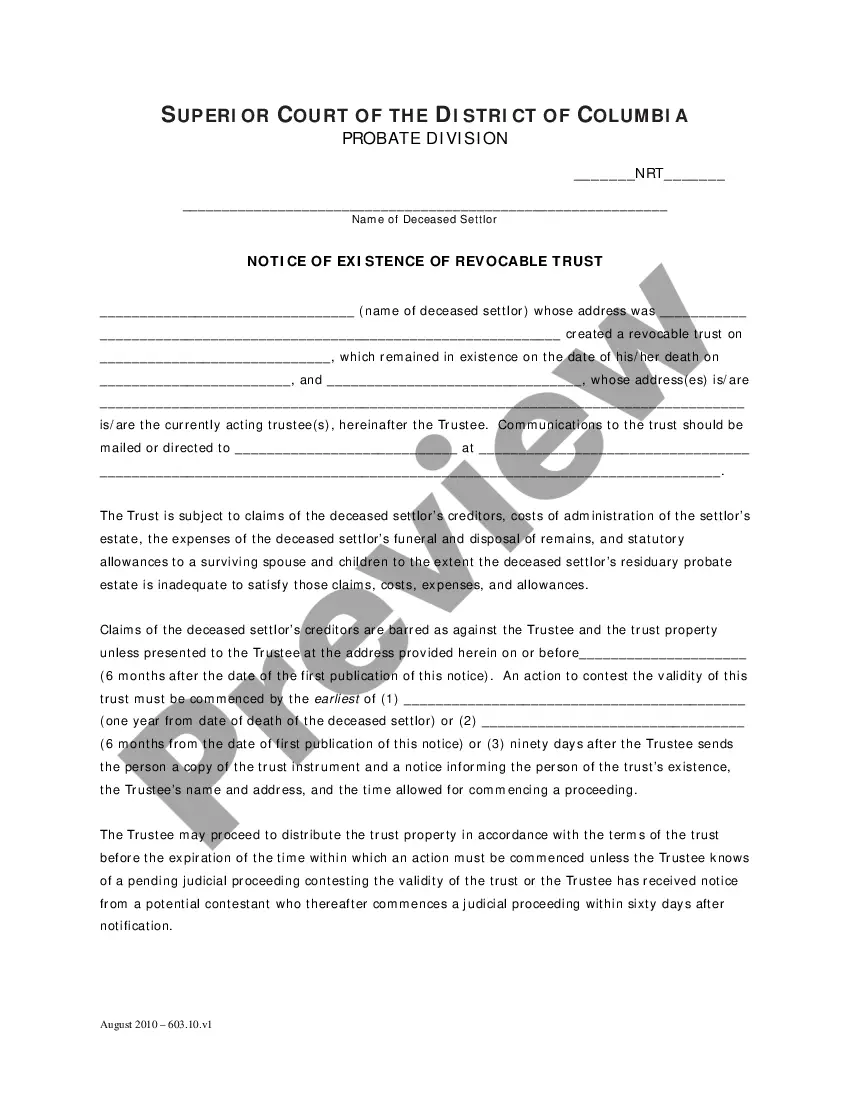

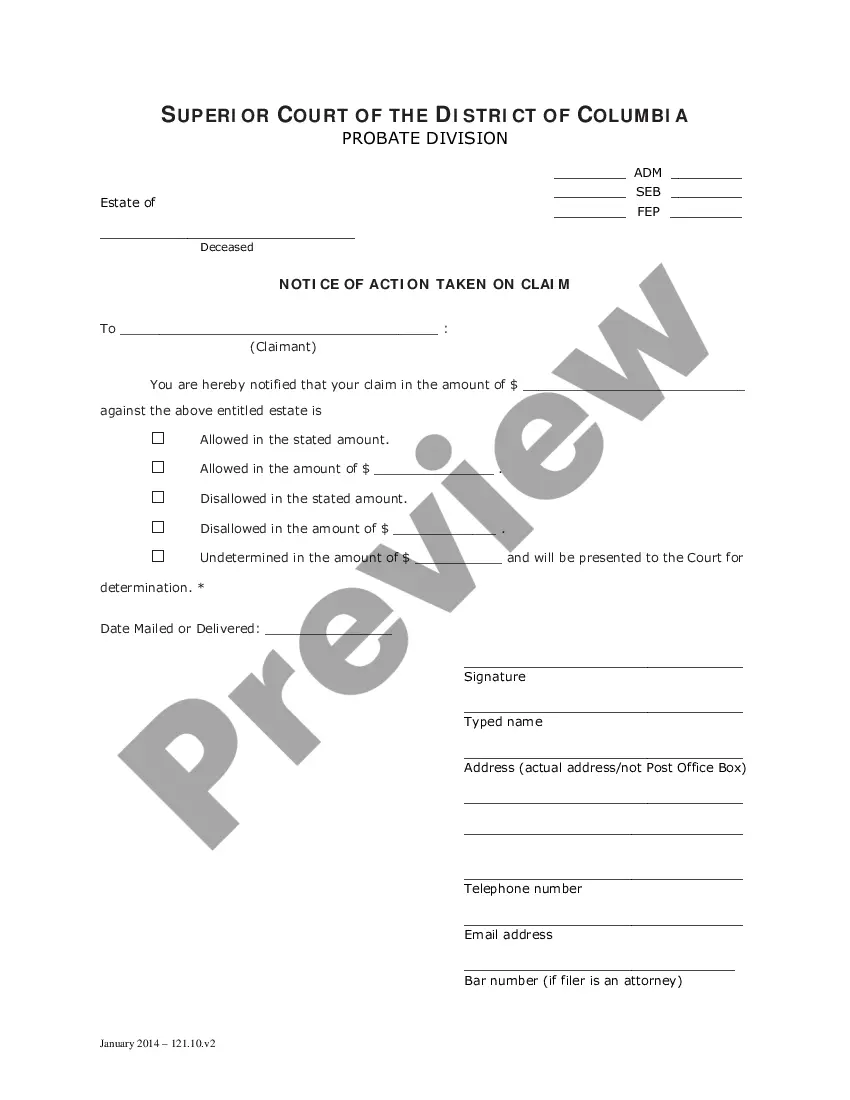

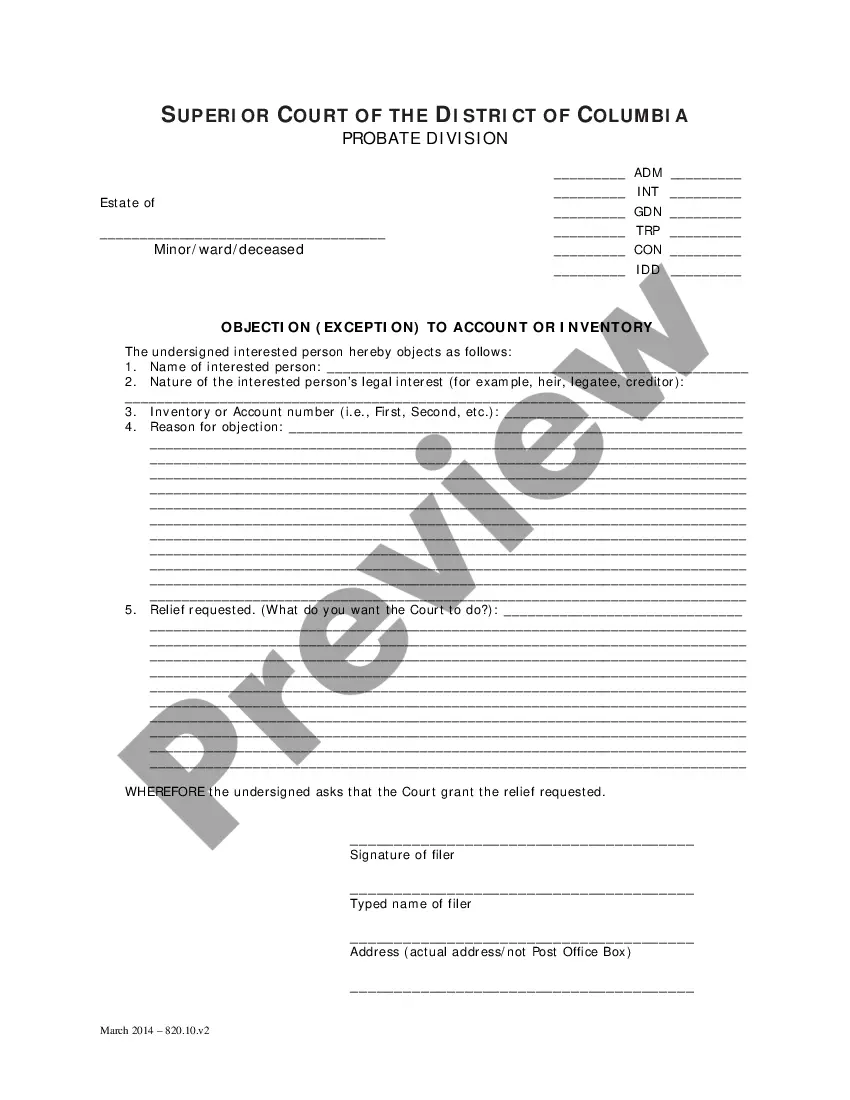

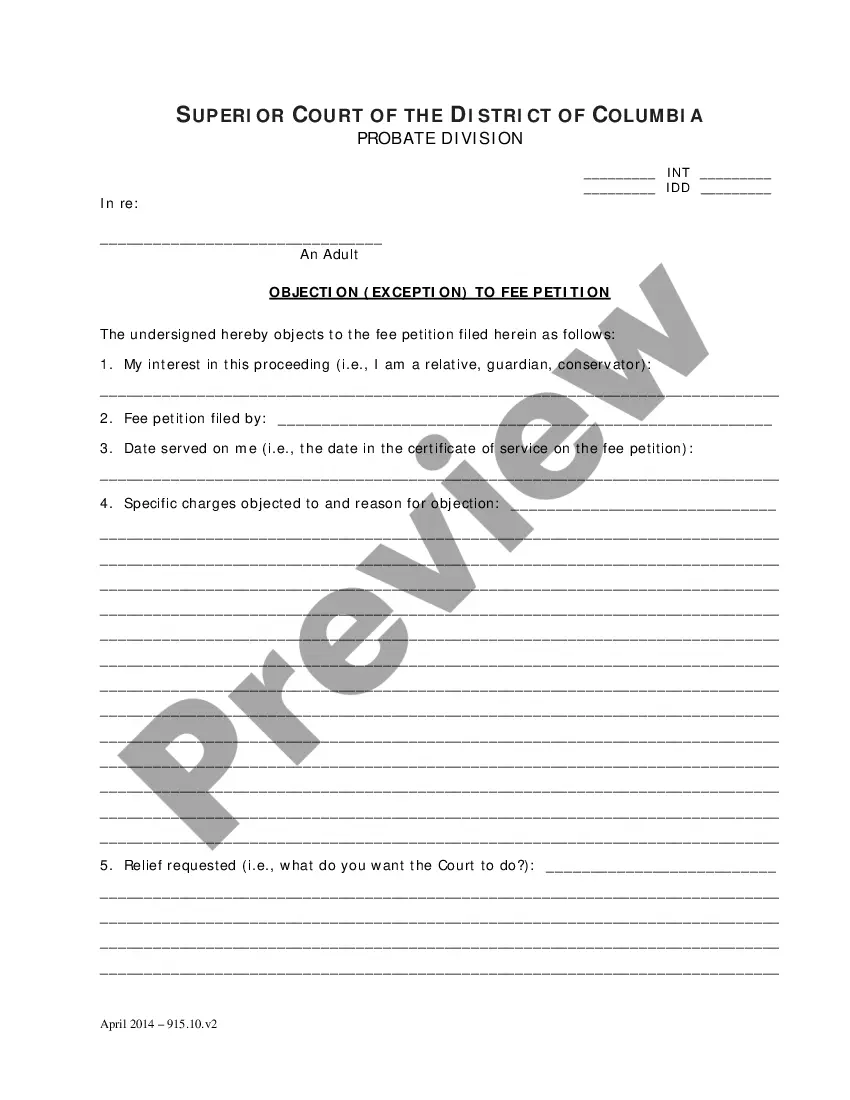

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and paid for your subscription, you can use your West Virginia Bond for Administration of Will as many times as you need or for as long as it continues to be active where you live. Change it with your favorite editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

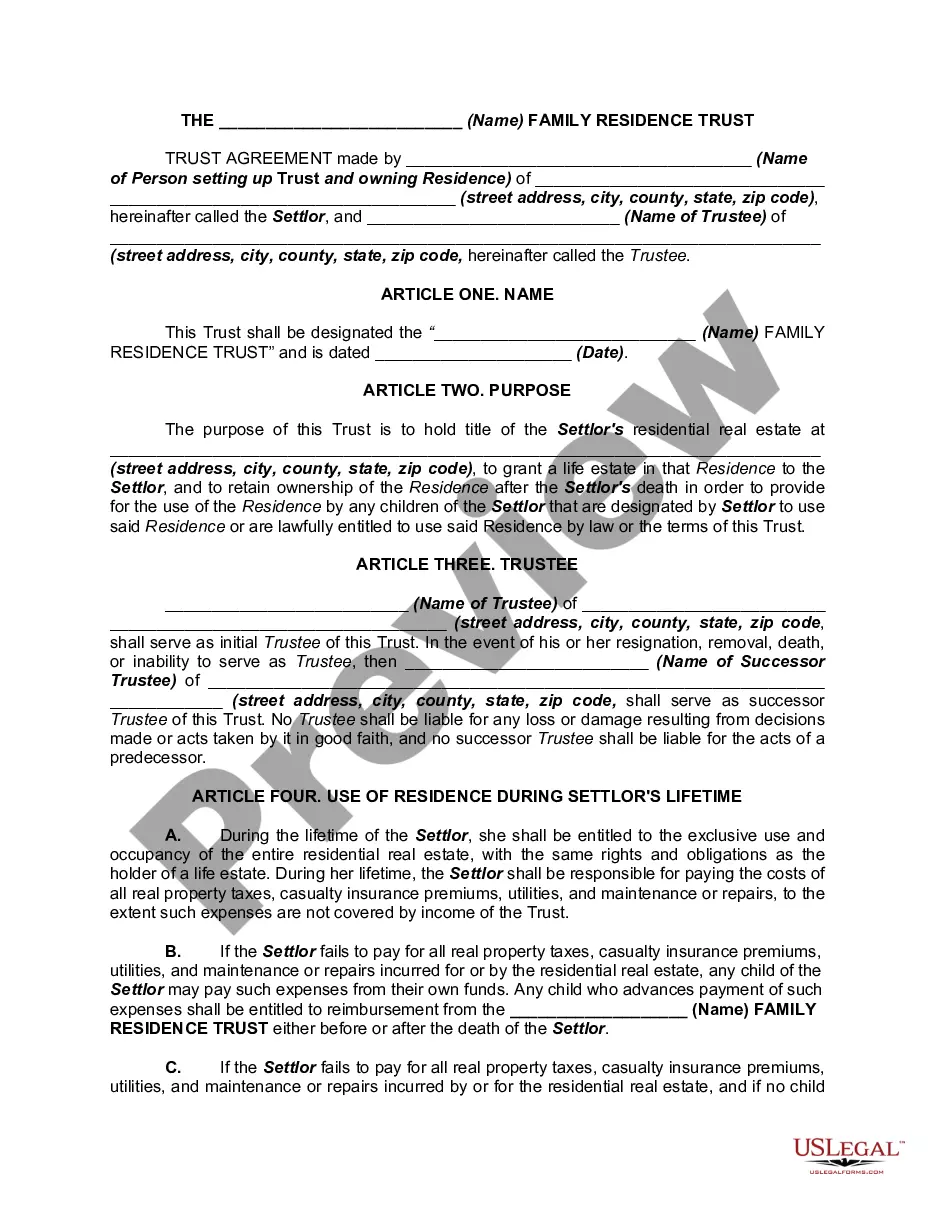

A grant of letters of administration is similar to a grant of probate, but is issued instead to the next of kin of someone who dies without a will. If the person who died did not made a will, this means they have not appointed a specific person as their executor.

An Executor Bond is a type of surety bond that guarantees the Executor will administer the estate according to law. An Executor Bond gives beneficiaries peace of mind, reassuring them that even if the Executor somehow loses or mishandles the estate's assets, the bond will protect them and they will be compensated.

An administration bond is a bond that is posted on behalf of an administrator of an estate to provide assurance that they will conduct their duties according to the provisions of the will and/or the legal requirements of the jurisdiction.

Executor bonds are a type of probate bond sometimes required of the person appointed to execute the wishes of a decedent's last will and testament.The executor bond protects the will's beneficiaries from fraud and illicit acts perpetrated by the executor by providing a recourse to recover funds.

In West Virginia, the estate executor is known as a "personal representative". If compensation is not specified in the will, West Virginia sets the executor fee as a percentage of the estate's assets (other than real estate) and any income generated by the estate: 5.0% for the first $100K. 4.0% for the next $300K.

No Problem. Administrator Bonds Guarantee Estate Distribution. When a decedent dies without a will, an administrator is appointed to administer an estate and the court requires that the administrator obtain an administration bond.

The creditors then have 3 months to make a claim. An inventory (called an Appraisement) of the estate's assets must be filed with the court listing the estate's assets within 90 days of the appointment of the executor.

The amount is typically based on the total estate value the fiduciary will be responsible for. Probate bond premiums are typically calculated at just . 5%, or $5/thousand for the first $250,000 of coverage. This means $100,000 of coverage would cost just $500.

The Surety. The party that guarantees the principal's obligation for a fee, is an insurance or surety bond company. A probate surety bond guarantees that the principal will fulfill their duties and obligations under the law and the testator's will.