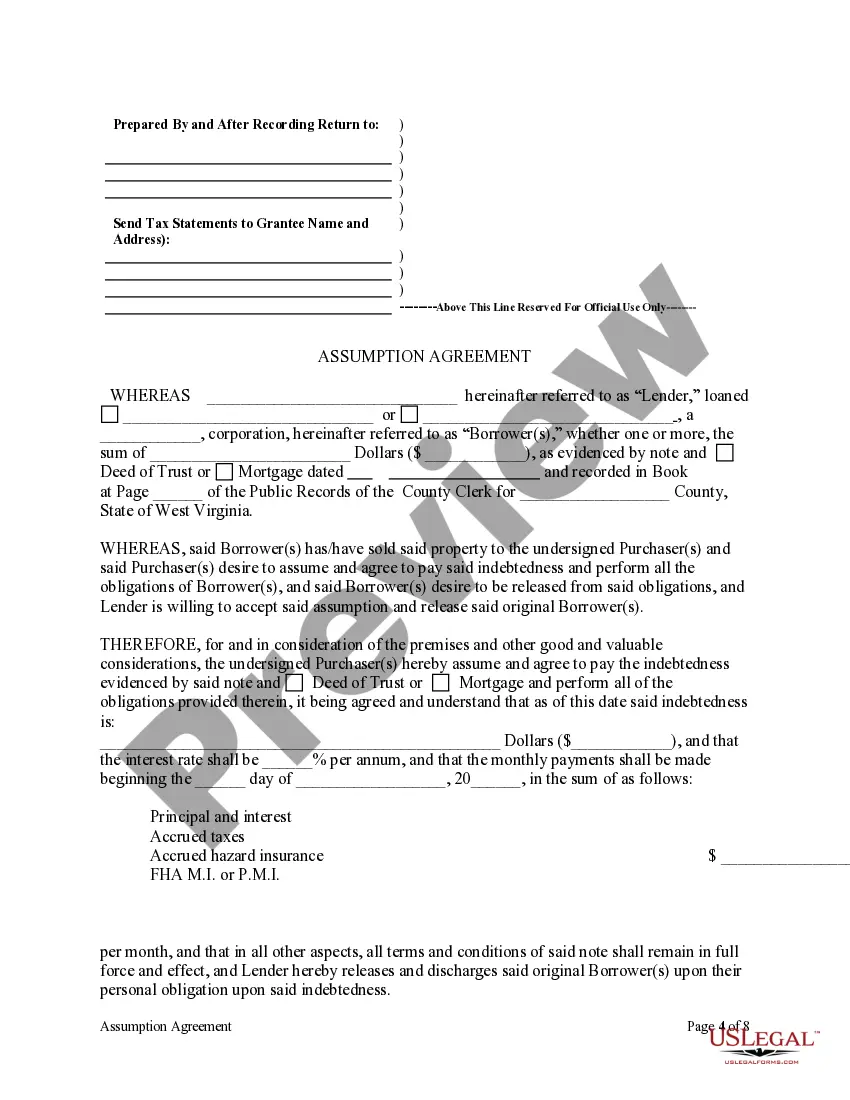

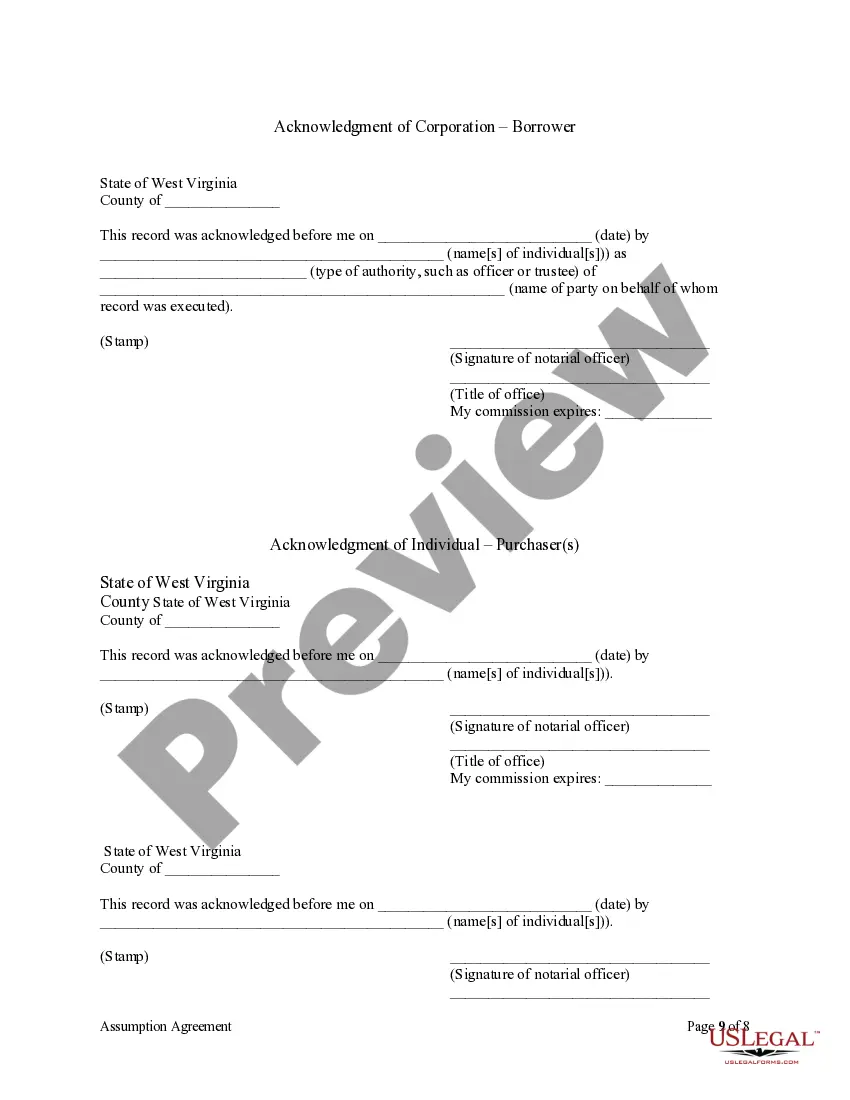

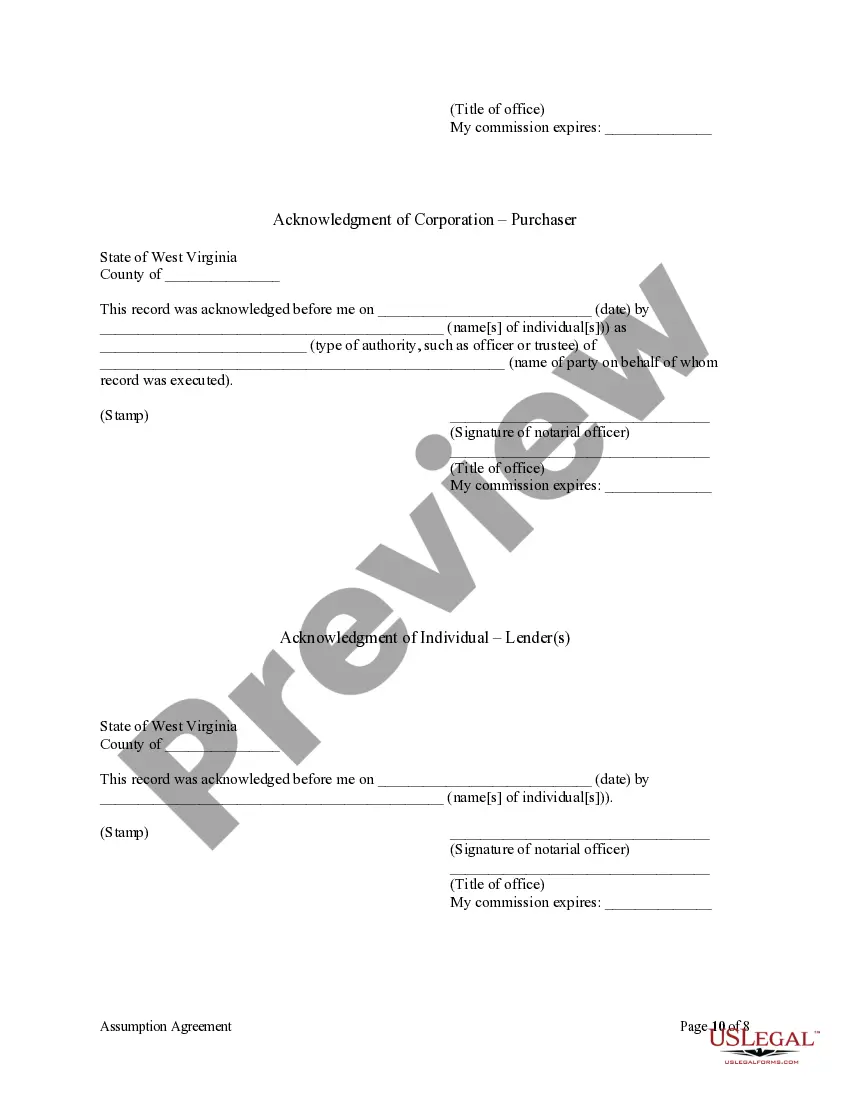

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

West Virginia Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out West Virginia Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Out of the great number of services that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms prior to buying them. Its comprehensive library of 85,000 samples is grouped by state and use for efficiency. All the documents available on the service have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, hit Download and access your Form name in the My Forms; the My Forms tab holds all your downloaded documents.

Follow the guidelines listed below to obtain the form:

- Once you see a Form name, make certain it is the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the template.

- Search for a new template using the Search engine in case the one you’ve already found is not appropriate.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

After you have downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it continues to be the most updated version in your state. Our platform offers easy and fast access to templates that suit both legal professionals and their clients.

Form popularity

FAQ

What is a mortgage assumption agreement?A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

Start with the Newspaper. Look in the newspaper. Utilize Online Resources. Search online for a mortgage loan to assume. Contact a Local Real Estate Agent. Talk to your real estate agent. Consider Short Sales.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

Although it's possible to change the names on title deeds yourself, we recommend that you seek professional help from a solicitor. The value of property is sufficiently high to make it worthwhile getting the transfer right.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

Assumable mortgages still exist, but it's hard to find them anymore, she adds. And the buyer must qualify for the mortgage they are trying to assume. Click to check today's mortgage rates.

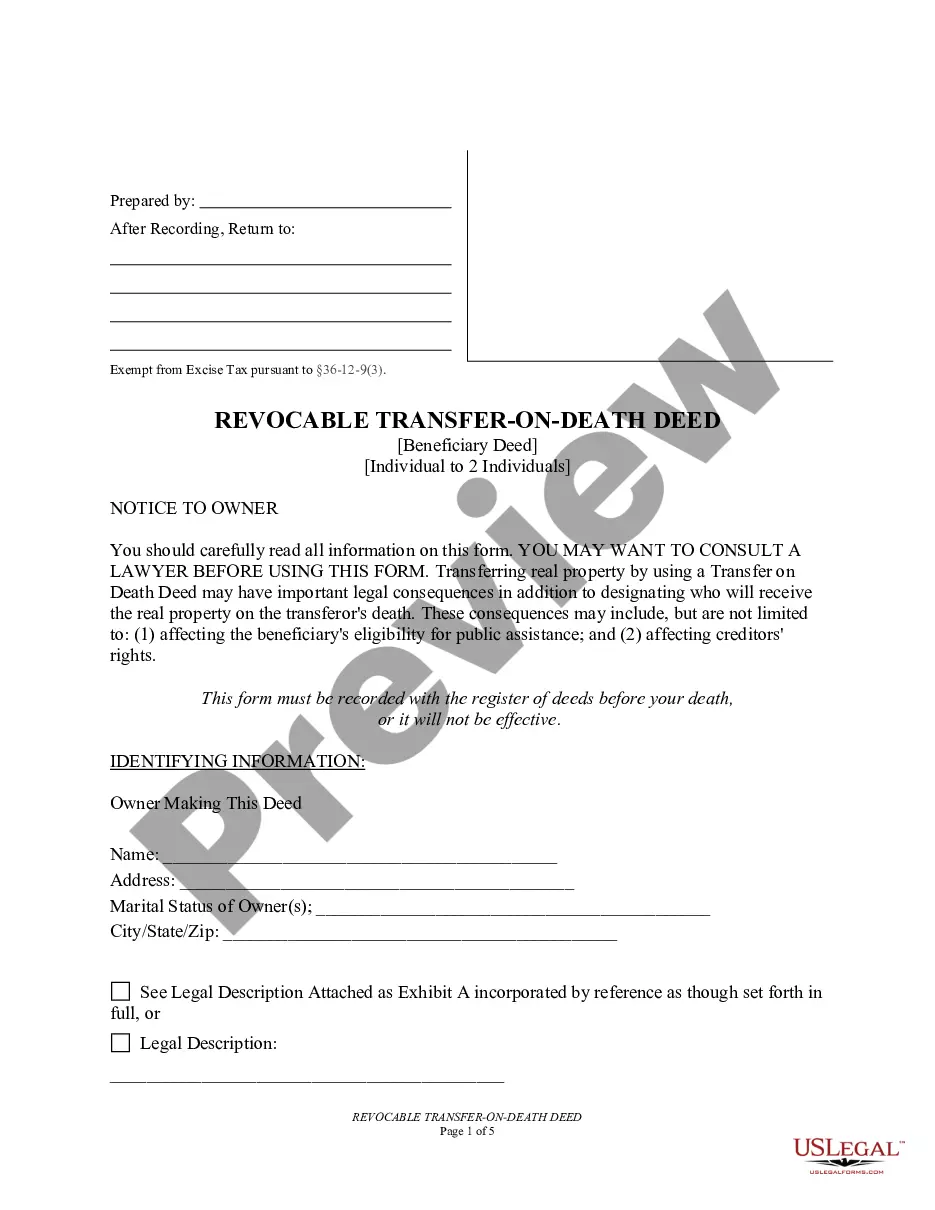

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Assumable mortgages still exist, but it's hard to find them anymore, she adds. And the buyer must qualify for the mortgage they are trying to assume. Click to check today's mortgage rates.