Wisconsin Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

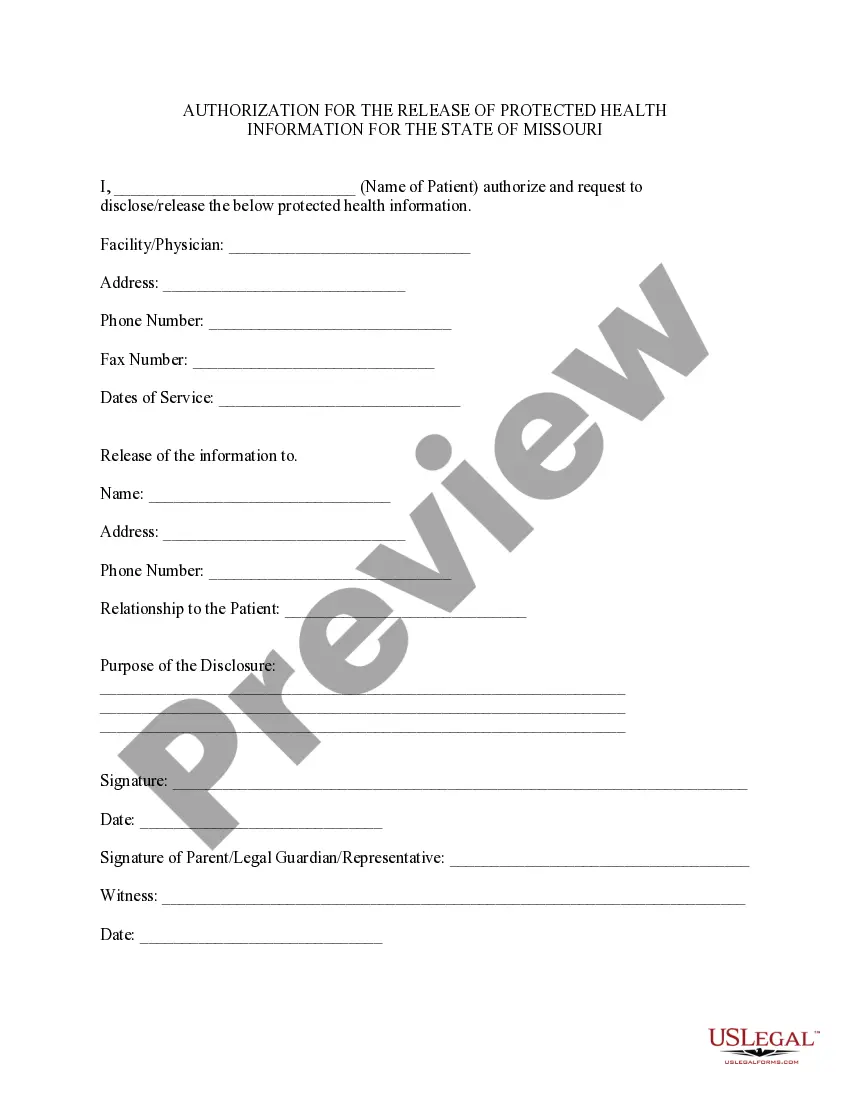

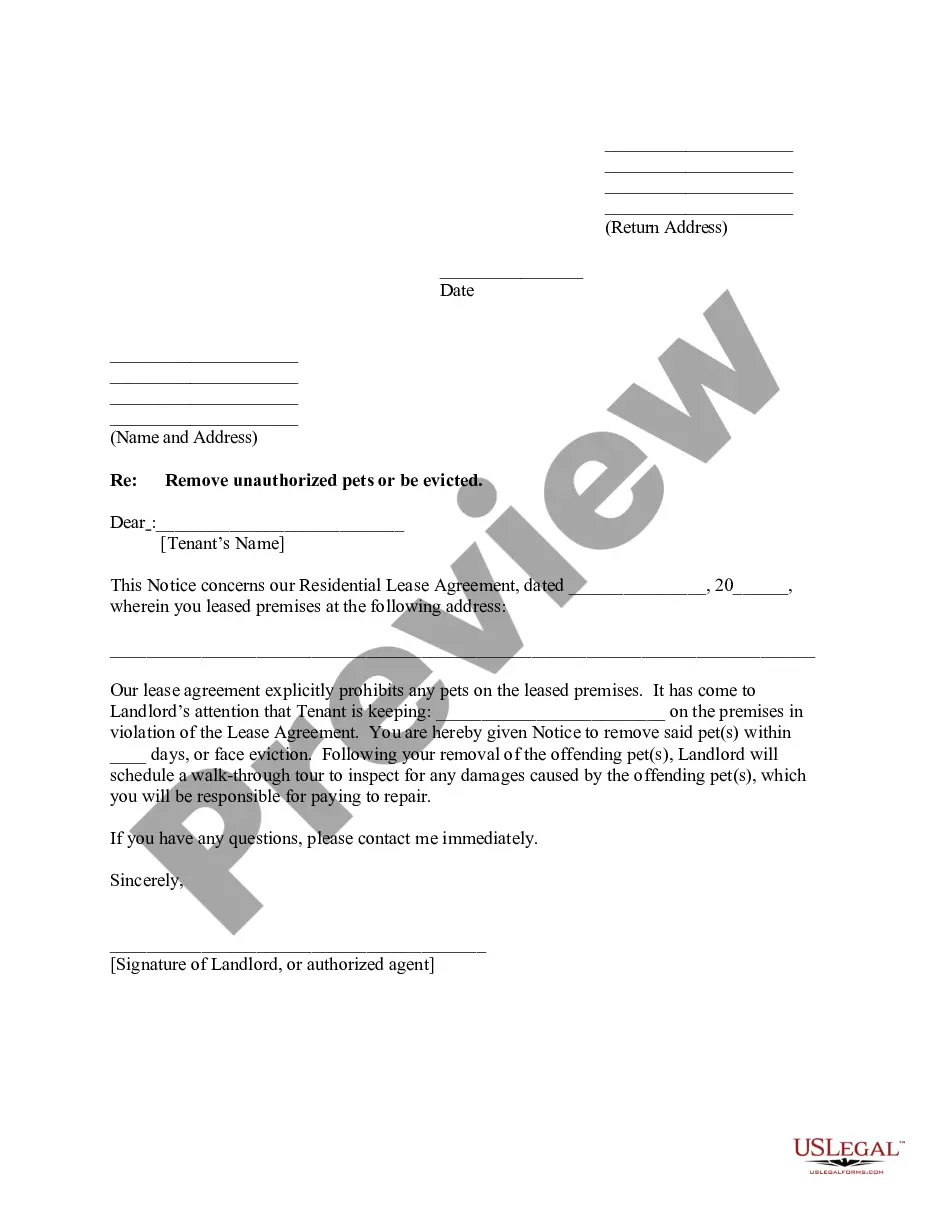

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

If you wish to complete, download, or produce legitimate record templates, use US Legal Forms, the most important selection of legitimate kinds, which can be found on the web. Take advantage of the site`s easy and handy research to discover the paperwork you want. A variety of templates for organization and person purposes are categorized by types and suggests, or search phrases. Use US Legal Forms to discover the Wisconsin Gift Deed of Nonparticipating Royalty Interest with No Warranty in just a handful of mouse clicks.

Should you be presently a US Legal Forms consumer, log in for your bank account and click the Obtain switch to find the Wisconsin Gift Deed of Nonparticipating Royalty Interest with No Warranty. Also you can entry kinds you formerly delivered electronically from the My Forms tab of your respective bank account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the correct metropolis/nation.

- Step 2. Use the Review method to look through the form`s content material. Don`t overlook to learn the description.

- Step 3. Should you be not happy together with the develop, use the Research area near the top of the display to find other models of the legitimate develop web template.

- Step 4. Upon having discovered the form you want, click on the Get now switch. Opt for the rates prepare you choose and include your references to sign up for an bank account.

- Step 5. Method the deal. You may use your credit card or PayPal bank account to perform the deal.

- Step 6. Pick the structure of the legitimate develop and download it on the product.

- Step 7. Complete, change and produce or signal the Wisconsin Gift Deed of Nonparticipating Royalty Interest with No Warranty.

Every legitimate record web template you purchase is the one you have eternally. You have acces to each develop you delivered electronically within your acccount. Click on the My Forms section and choose a develop to produce or download yet again.

Be competitive and download, and produce the Wisconsin Gift Deed of Nonparticipating Royalty Interest with No Warranty with US Legal Forms. There are many specialist and express-distinct kinds you can use for your organization or person requirements.

Form popularity

FAQ

Under Texas law, a forged deed is void. However, a deed procured by fraud is voidable rather than void. The legal terms ?Void? and ?Voidable? sound alike, but they are vastly different. A void instrument passes no title, and is treated as a nullity.

Good to know: Beware that a Gift Deed cannot be revoked. Once the property is given away, you cannot get it back unless the person who received it transfers it back.