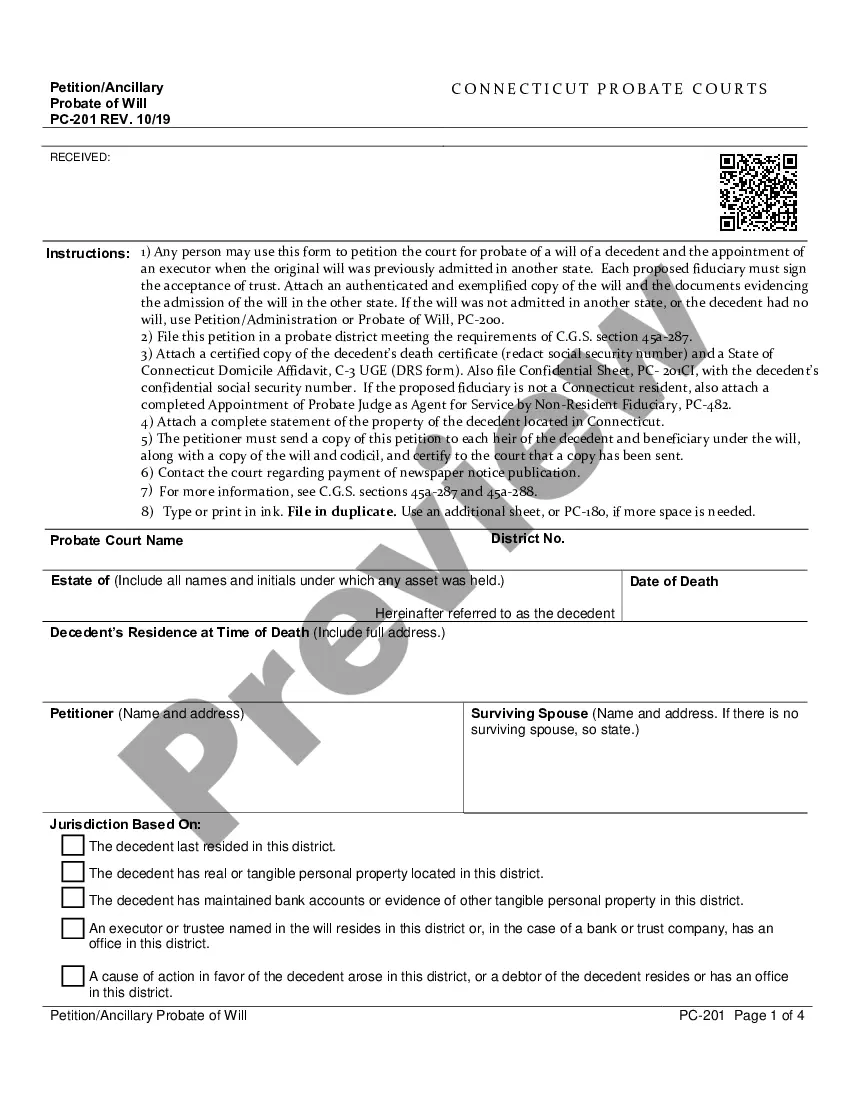

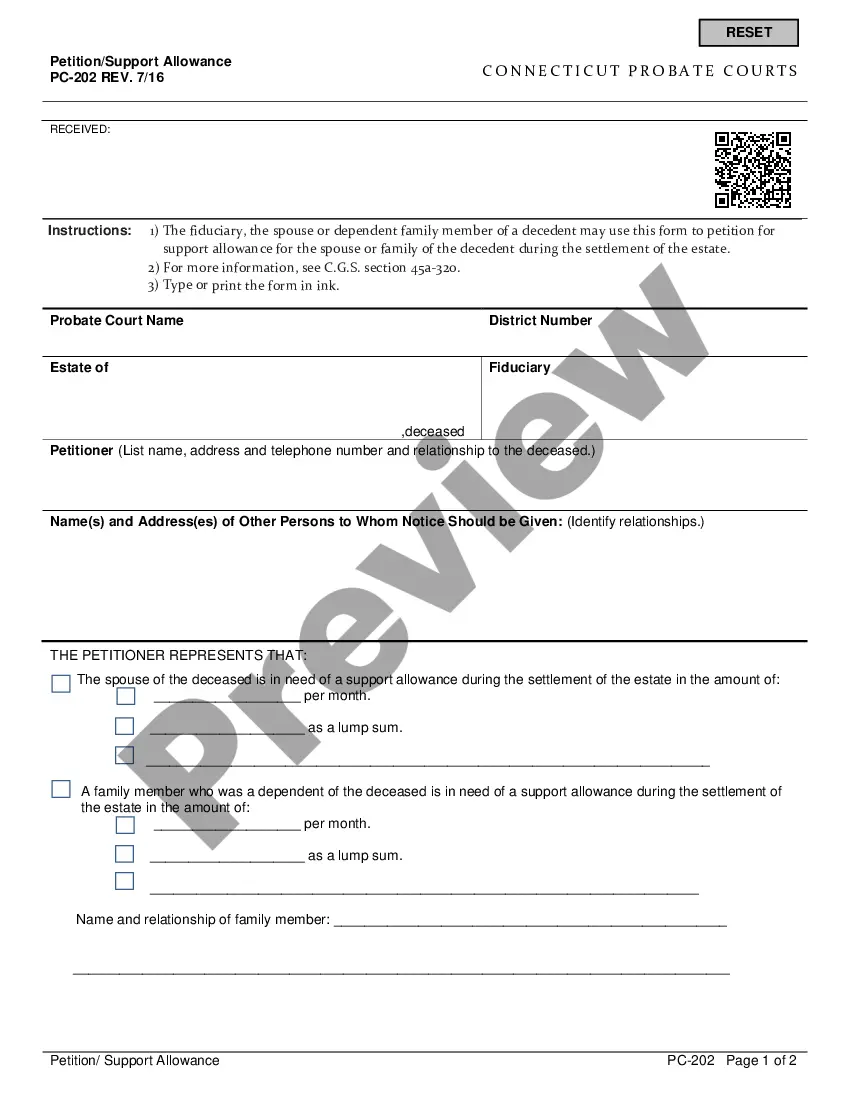

Connecticut Petition/Extension of Time to Pay Probate Fees (Rev. 4/16) is a document used by individuals in the state of Connecticut to request an extension of time to pay probate fees. This document is typically used when an individual is unable to pay the full amount of probate fees due on the original deadline. The document must be submitted to the Probate Court along with evidence of the applicant's financial hardship in order to be considered. Depending on the Court's decision, the applicant may be granted a partial or full extension of time to pay the fees. There are two types of Connecticut Petition/Extension of Time to Pay Probate Fees (Rev. 4/16): (1) Petition to Establish Extension of Time to Pay Probate Fees and (2) Petition for Extension of Time to Pay Probate Fees. The Petition to Establish Extension of Time to Pay Probate Fees must be used when the applicant is requesting an extension of time to pay the full amount of probate fees. The Petition for Extension of Time to Pay Probate Fees must be used when the applicant is requesting an extension of time to pay a portion of the probate fees.

Connecticut Petition/Extension of Time to Pay Probate Fees

Description

How to fill out Connecticut Petition/Extension Of Time To Pay Probate Fees?

If you’re looking for a method to suitably finalize the Connecticut Petition/Extension of Time to Pay Probate Fees (Rev. 4/16) without hiring a lawyer, you have come to the correct location. US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and business circumstance. Each document available through our online platform is crafted in alignment with national and state laws, ensuring your records are accurate.

Follow these simple instructions on how to obtain the ready-to-use Connecticut Petition/Extension of Time to Pay Probate Fees (Rev. 4/16).

Another excellent aspect of US Legal Forms is that you will never misplace the documents you have obtained – you can access any of your downloaded templates in the My documents tab of your profile whenever necessary.

- Verify that the document displayed on the page matches your legal circumstances and state laws by reviewing its text description or checking the Preview mode.

- Enter the document name in the Search tab located at the top of the page and select your state from the dropdown to find an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are assured about the paperwork adherence to all regulations.

- Log in to your account and click Download. Sign up for the service and choose a subscription plan if you do not have one yet.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available for download immediately after.

- Select the format in which you prefer to receive your Connecticut Petition/Extension of Time to Pay Probate Fees (Rev. 4/16) and download it by clicking the corresponding button.

- Add your template to an online editor for quick completion and signing or print it to prepare your physical copy manually.

Form popularity

FAQ

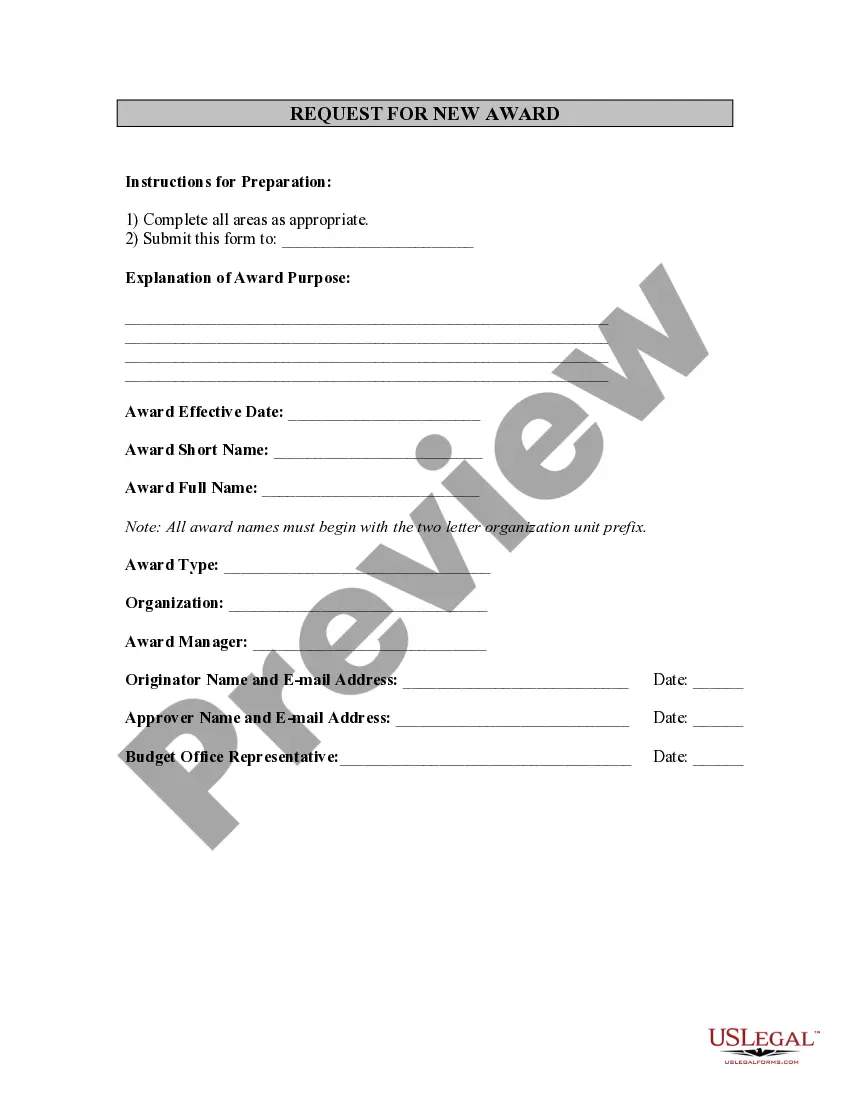

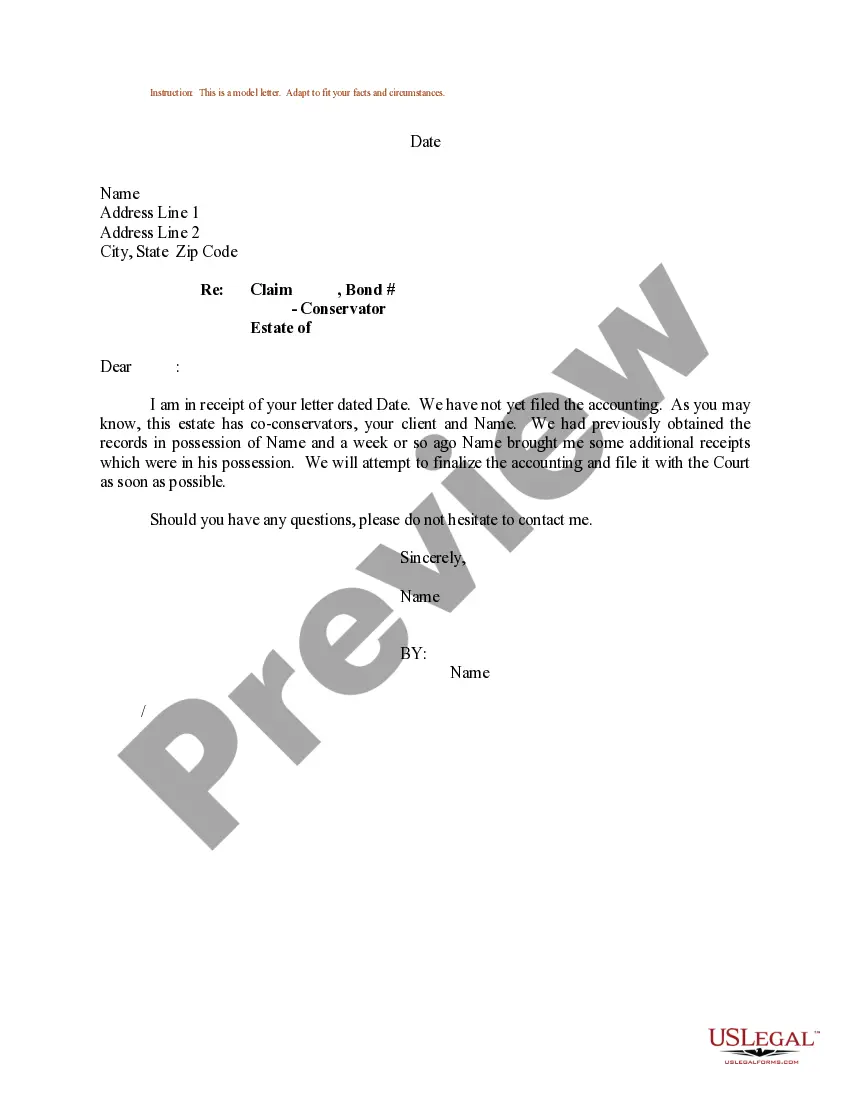

Section 30.12 Executor or administrator to send copy of inventory, status update, financial report or account and affidavit of closing to each party and attorney (a) Except as provided in subsection (c), the executor or administrator of an estate shall send a copy of the inventory, each supplemental or substitute

How Long Do You Have to File Probate After Death in Connecticut? ing to Title 45a-283, the executor must apply for probate of the deceased person's will within 30 days after the person's death. If they go beyond this timeline, they will be fined. There are exceptions, such as if a will isn't found until later.

The state of Connecticut, however, doesn't have any hard and fast rules about executor compensation. A rule of thumb used by many Connecticut probate judges is that a fiduciary's fee of less than 4% of the gross estate is presumed reasonable, and many people believe that anything on the order of 3-5% is okay.

In the state of Connecticut, you have up to 30 days to file for probate. If you go beyond the 30-day limit then you can expect to receive fines. There are exceptions to the rule however it's not worth the risk of meeting any of the little-known exceptions.

The short answer is yes, you have to show an accounting unless the heirs or beneficiaries of the estate waive the requirement.

In Connecticut, you can expect it to take a minimum or about six months to probate even a relatively simple estate if that estate is required to go through formal probate.

(Probate Court Rules, rules 37 and 38.) Section 36.3 When account is required instead of financial report (a) A fiduciary shall submit an account rather than a financial report if the fiduciary is required to account separately for principal and income under section 38.1.

An Estate Tax Return must be filed within six (6) months of death. Probate fees are calculated on the value of the estate of a decedent, whether or not the estate is administered in a Probate Court. 2) If an estate tax return is not filed within six (6) months of the date of death.