This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate

Description

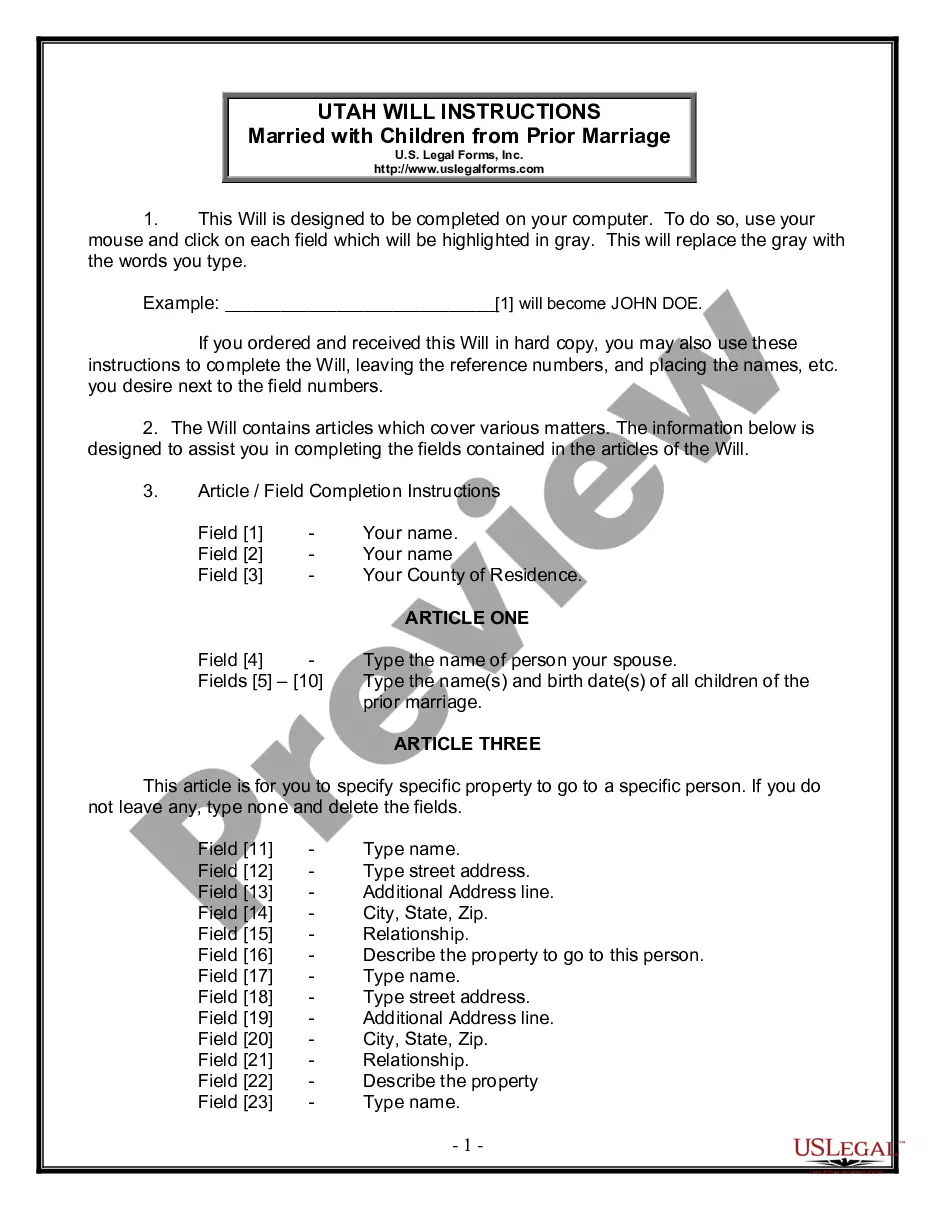

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

If you need to completely download or print authorized document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the website's simple and convenient search feature to find the forms you require. Numerous templates for business and personal use are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate in just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Act quickly to download and print the Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to find the Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse the form's content. Don't forget to check the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the payment plan you prefer and enter your information to create an account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate.

Form popularity

FAQ

Collecting on an unsecured promissory note involves first contacting the borrower to discuss the missed payments. If informal methods do not work, you may consider sending a formal demand letter or negotiating a repayment plan. If necessary, further action may involve filing a claim in small claims court. Utilizing a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate can streamline the collection process by providing clear terms and conditions.

A promissory note does not necessarily need to have an interest rate. However, including an interest rate can make the terms clearer and more beneficial for both the lender and the borrower. With a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate, you can specify a fixed interest rate, which simplifies repayment planning. This clarity helps avoid future misunderstandings.

An unsigned promissory note is generally not enforceable because it lacks the necessary agreement from both parties. For a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate to be valid, both parties must sign it to demonstrate their consent to the terms. Without signatures, you may face challenges if you seek to enforce the note in court.

To legally enforce a promissory note, you must first ensure that the note is properly completed and signed by both parties. If repayment is not made as agreed, you can take legal action by filing a claim in court. Using a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate can provide you with a solid foundation for pursuing this enforcement process.

To create a legally enforceable promissory note, you should clearly outline the terms, including the amount borrowed, payment schedule, and any interest rates. Utilizing a template for a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate can simplify this process. Additionally, both parties should sign the document and consider having it notarized to strengthen its enforceability.

Enforcing an unsecured promissory note involves taking specific legal steps to ensure repayment. First, you should document the terms of the Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate, ensuring both parties agreed to them. If the borrower defaults, you may need to pursue legal action, which could include filing a lawsuit in small claims court to recover your funds.

A promissory note does not necessarily need to include an interest rate, but having one can clarify the terms of repayment. If you choose to create a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate, specifying an interest rate will help both parties understand their financial obligations. This clarity can prevent misunderstandings and disputes down the line.

In Wisconsin, a promissory note does not have to be notarized to be legal, but having it notarized can add an extra layer of authenticity. Notarization can help prevent disputes by providing a record of the agreement and verifying the identities of the parties involved. Consider using US Legal Forms to create a notarized Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate to ensure clarity and compliance.

To write a Wisconsin Unsecured Installment Payment Promissory Note for Fixed Rate, start by including the date at the top, followed by the names of the borrower and lender. Clearly state the amount being borrowed, the repayment schedule, and any interest that will accrue. You can find detailed examples and templates on platforms like US Legal Forms, which can help you create a professional document.