Wisconsin Agreement for Sales of Data Processing Equipment

Description

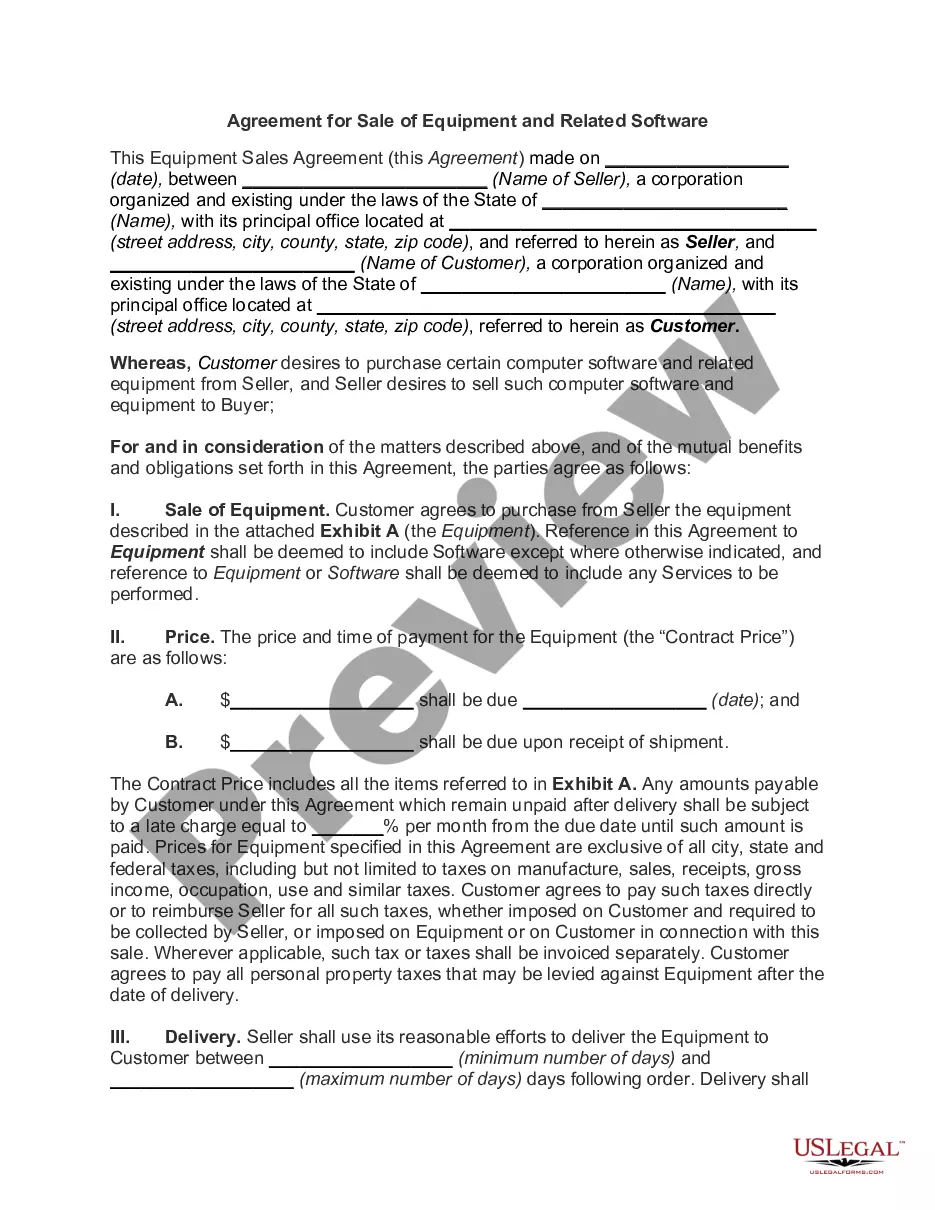

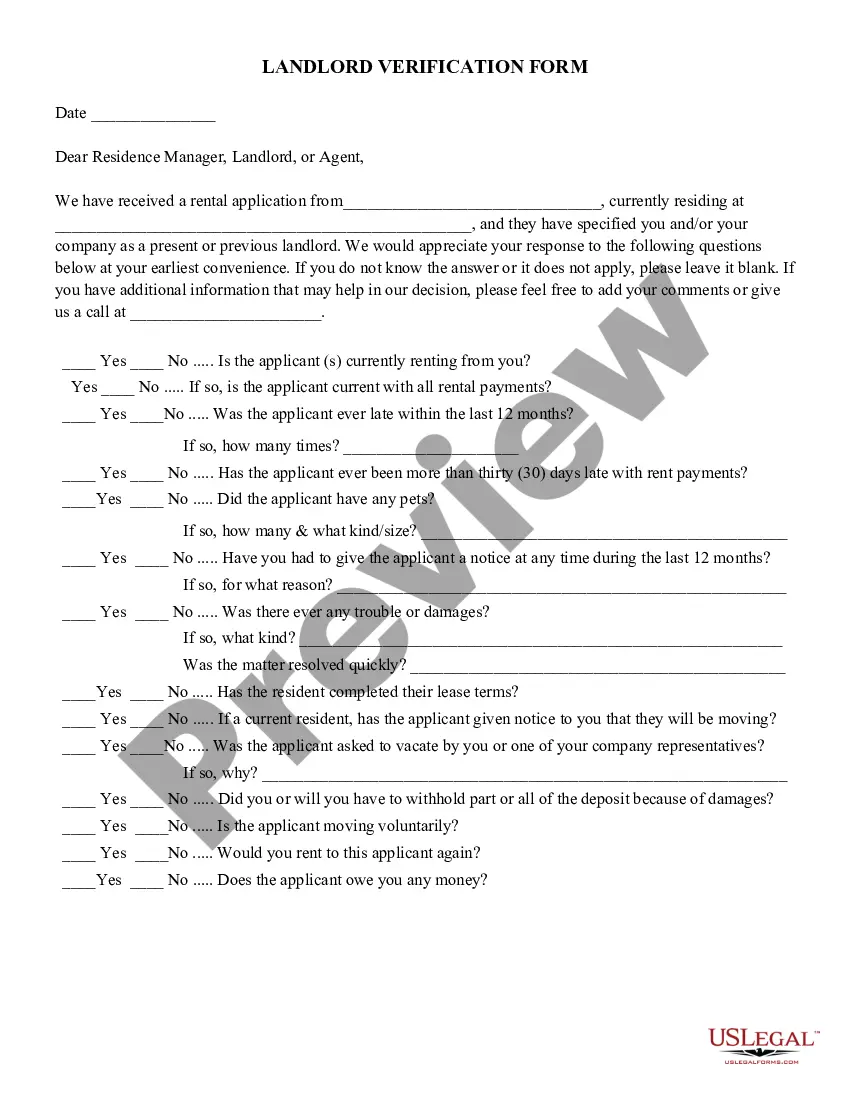

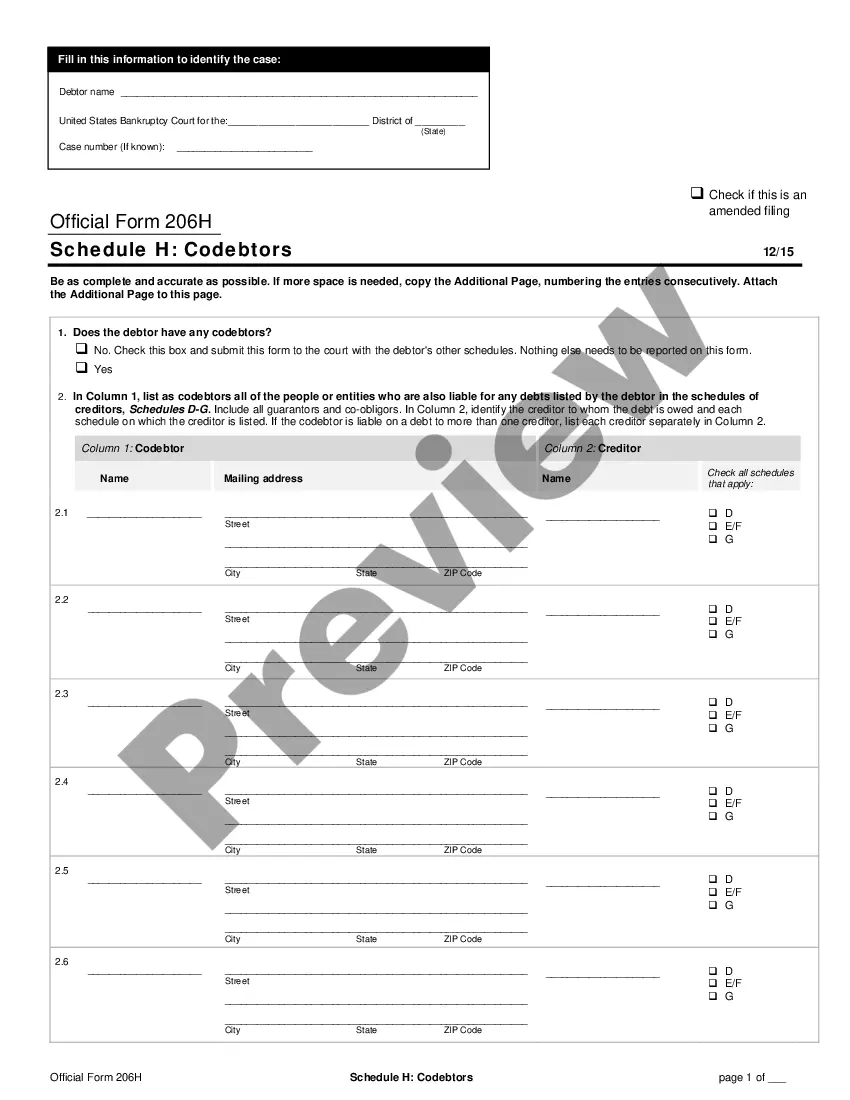

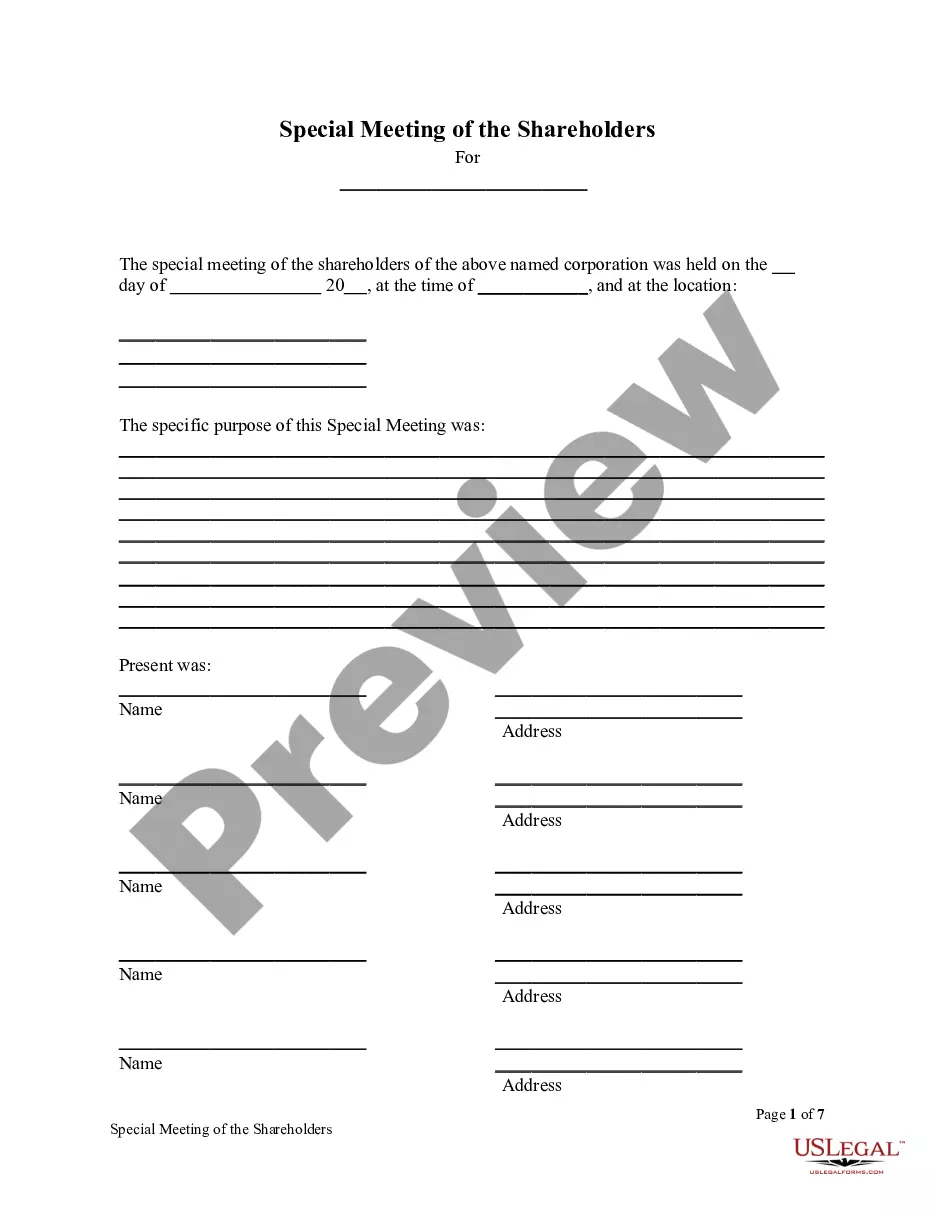

How to fill out Agreement For Sales Of Data Processing Equipment?

If you require extensive, obtain, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s simple and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Wisconsin Agreement for Sale of Data Processing Equipment with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Wisconsin Agreement for Sale of Data Processing Equipment.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your specific region/state.

- Step 2. Use the Preview feature to review the form’s content. Be sure to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

A vendor's license and a seller's permit are often used interchangeably, but they can serve different purposes. A seller's permit allows you to collect sales tax on sales, while a vendor's license may refer more broadly to a business's authorization to sell products and services in Wisconsin. For your activities related to a Wisconsin Agreement for Sales of Data Processing Equipment, securing a seller's permit ensures you are compliant with tax laws.

To get a Wisconsin seller's permit, you need to complete an application through the Wisconsin Department of Revenue. You can apply online or submit a paper application depending on your preference. Once you have your seller's permit, you can easily execute a Wisconsin Agreement for Sales of Data Processing Equipment and enjoy the benefits of tax exemptions.

To obtain a Wisconsin resale certificate, you must register for a seller's permit through the Wisconsin Department of Revenue. This certificate allows you to buy products, like data processing equipment, without paying sales tax, provided you intend to resell them. Once registered, you can fill out the appropriate forms and begin your process, thereby facilitating your agreement for sales of data processing equipment.

The Wisconsin sales and use tax exemption certificate S 211 allows buyers to make tax-exempt purchases of certain items when reselling them or using them in a way that does not incur sales tax. When purchasing data processing equipment under a Wisconsin Agreement for Sales of Data Processing Equipment, you may need this certificate if you qualify for tax exemption. Be sure to understand the specific uses allowed to avoid any compliance issues.

In Wisconsin, certain items are exempt from sales tax, including food, prescriptions, and some medical devices. Equipment and services directly associated with the Wisconsin Agreement for Sales of Data Processing Equipment may also qualify for exemption under specific circumstances. It’s important to understand these exemptions to avoid unnecessary tax charges. For more precise guidance, consult the Wisconsin Department of Revenue's website.

Software licenses are typically subject to sales tax in Wisconsin. This applies to licenses related to products described in the Wisconsin Agreement for Sales of Data Processing Equipment. However, the tax treatment may vary depending on the nature and use of the license. Review the state regulations to ensure compliance and understand any exceptions that might apply.

Yes, in Wisconsin, most software sales are subject to sales tax. This includes prewritten software, as well as software provided under the Wisconsin Agreement for Sales of Data Processing Equipment. However, custom software developed specifically for a customer may have different tax implications. Always consult state guidelines to confirm your software’s tax status.

A seller's permit in Wisconsin is required for any business that sells or leases tangible personal property or taxable services. If your business involves the sale of data processing equipment, complying with the Wisconsin Agreement for Sales of Data Processing Equipment, you’ll need this permit. Obtaining a seller's permit allows you to collect sales tax from customers legally. Review the eligibility criteria on the state revenue website to ensure you are compliant.

In Wisconsin, purchases made without paying sales tax at the time of sale are typically subject to use tax. This includes items such as equipment and software used in business settings, including those governed by the Wisconsin Agreement for Sales of Data Processing Equipment. When you buy products out of state for use in Wisconsin, be prepared to account for use tax. This ensures compliance with state tax laws.

In Wisconsin, certain services are exempt from sales tax. Notably, services related to the Wisconsin Agreement for Sales of Data Processing Equipment can fall under this category if they meet specific criteria. Additionally, services related to educational programs and healthcare services also enjoy this exemption. It's advisable to verify your specific service category with the state tax guidelines.